Learn about money matters that everyone needs to know—but too few ever learn.

Click on any area of interest:

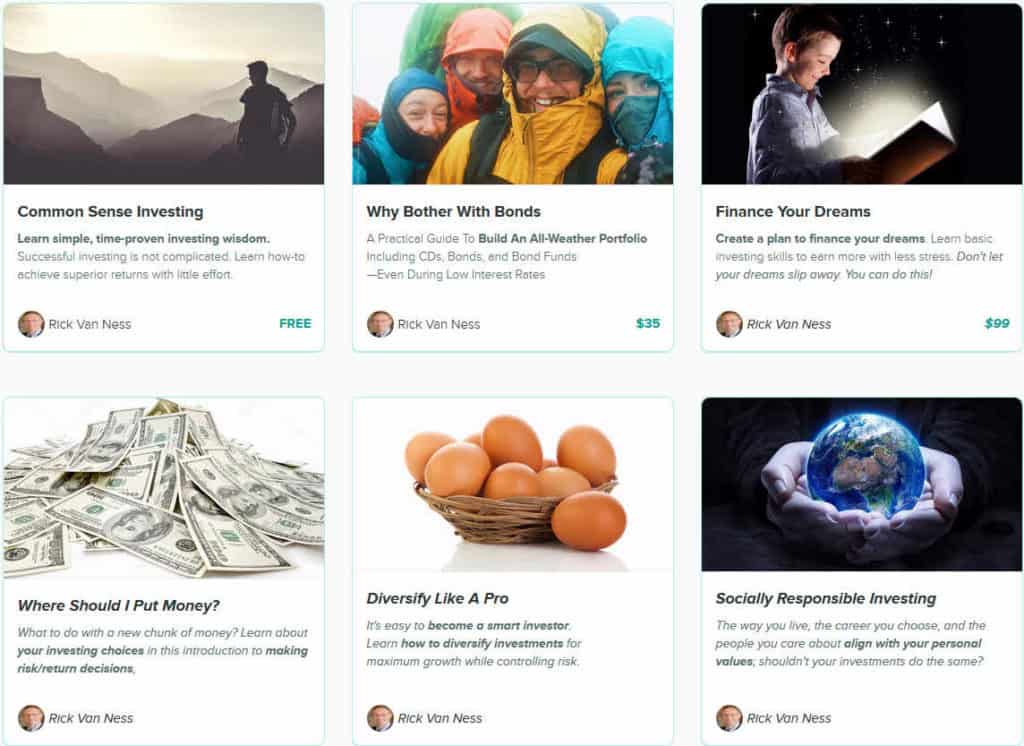

![]() Courses — The FinancingLife Academy has both free and low-cost courses

Courses — The FinancingLife Academy has both free and low-cost courses

![]() Video Tutorials — Find short video tutorials about specific topics

Video Tutorials — Find short video tutorials about specific topics

- Why Bother With Bonds? — 5 short videos

- Learn Bond Basics in minutes — 4 short videos

- Lessons From Stock Market History — 8 short videos

- Ten Rules for Common Sense Investing — 11 short videos

![]() Books — There is a lot of junk out there, but these are some gems that I recommend.

Books — There is a lot of junk out there, but these are some gems that I recommend.

- Books About Investing (by experience level) — Books recommended by the Bogleheads and rated by Rick Van Ness

- Discover What You Need To Learn Next — helpful because it may not be what you think.

Find individual videos and articles by category:

![]() Why Invest? — To achieve Freedom. So you can spend your time the way YOU want.

Why Invest? — To achieve Freedom. So you can spend your time the way YOU want.

- Financial Independence — Work because you want to, not because you have to. It is your time that is important.

- Preparing For Retirement

- Saving For Major Purchases

![]() How To Invest? — insert an ID+ and: You may think you know, but most people do not.

How To Invest? — insert an ID+ and: You may think you know, but most people do not.

- Start with a Sound Lifestyle insert an ID+ and: Start by becoming aware and making conscious lifestyle choices. You need to save money before you can invest.

- Investing For Beginners —

- Learn how time is your friend because of the miracle of compound interest.

- Start with a sound lifestyle. Become aware of money and make conscious lifestyle choices. You need to save money before you can invest.

- Learn the ten rules of investing, and they’ll seem like common sense.

![]() What To Buy? — the things you invest your money in are called assets

What To Buy? — the things you invest your money in are called assets

- Asset Classes — Video tutorials. At the highest level it is choosing between things like stocks, bonds, gold, real-estate, and then things like U.S. stocks, International stocks, “Value stocks”, etc.

- Asset Allocation insert an ID+ and: Learn why the most important decision is determining how much stock to own; how much bonds; and how this changes over time.

- Investing in Bonds insert an ID+ and: Bonds are as simple as bank CDs, but people trip on some basic concepts. Let me explain how they work and how to use them.

- Investing in Stocks insert an ID+ and: Stocks are volatile. Own an appropriate amount of them, learn why to avoid owning individual stocks.

![]() Types of Funds — insert an ID+ and: You just need to know what index mutual funds are. But you may want to learn a few others in order to recognize them with confidence.

Types of Funds — insert an ID+ and: You just need to know what index mutual funds are. But you may want to learn a few others in order to recognize them with confidence.

- Mutual Funds — A traditional mutual funds is the easy way to own a large collection of stocks.

- Avoid actively managed funds. They under-perform in the long run because of their costs.

- Choose passively managed funds. They are hard to beat in the long run because they are inexpensive.

- Index Funds — Ultimately, this is what you want because it is lowest cost and outperforms all others in the long-run.

- Target Date Funds: the good ones are a combination of a few index funds.

- Exchange Traded Funds (ETFs) — this is simply a mutual fund that is purchased and traded differently

![]() Managing Your Money — Taxation is the biggest cost. Some tax laws are designed to help you save. Be sure to use these advantages that are designed for you.

Managing Your Money — Taxation is the biggest cost. Some tax laws are designed to help you save. Be sure to use these advantages that are designed for you.

- Important Tax Concepts

- Types of Investment Accounts

- Managing a Portfolio

![]() Additional Resources

Additional Resources

You are here because you know that your money matters, but that there are more important things in life.

Your best chance to make many of your dreams come true is to learn the simple investing basics and control your own finances. The videos at this Investor Learning Center are a combination of ones that I have created for you and ones that I have carefully selected (curated) because they are exceptional. I try to create transcripts for each so you can quickly decide how to best spend your time.

The videos teach you how to save and invest wisely. They intend to build your confidence to regard yourself as a do-it-yourself investor. The money you save will accumulate and you will make much better decisions about all your money matters. You’ll find it is straight-forward, and that it is usually our emotions that make it difficult. But it’s worth it. Don’t let your dreams slip away!

Prefer to read? Click here for a list of helpful books.

Why Invest?

Learn the importance of financial freedom and achieving financial independence—and most importantly, how this is within your reach!

Financial Independence—easier than you might think

Article: Your Money or Your Life (book summary)

How to Invest?

This includes answers to frequently asked questions about how to start investing for beginners, common sense investing rules, and your other money matters.

What is Common Sense Investing?

Ten Simple Rules To Finance Your Dreams

Other Video Tutorials

What To Buy?

This includes answers to frequently asked questions about asset classes, asset allocation, investing in bonds, and other money matters.

Historic Ranking of Asset Classes

Why Bother With Bonds?

Learn Bond Basics in Minutes

Six Key Lessons From Stock Market History

Types of Funds?

This includes answers to frequently asked questions about mutual funds, index funds, exchange-traded funds, and other money matters.

Mutual Funds

Index Funds

Exchange Traded Funds

Click here to view a list of other helpful websites.

Leave a Reply