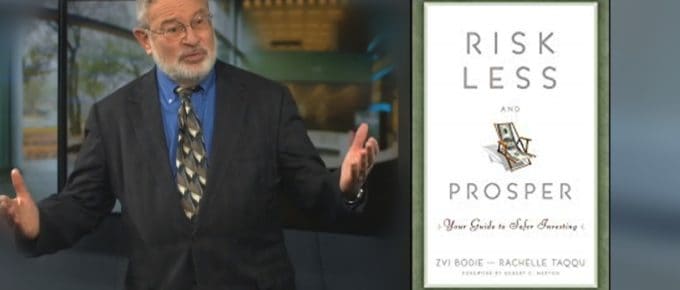

I wasn’t ready for this book when it was published in 2012. Shame on me. This is a better approach to goal-based investing than blindly focusing on accumulating a pot of money. It’s better because the …

Continue Reading about Investing Book Review: Risk Less and Prosper →