Please watch the updated version of this investing for beginners video here: Rule#1: Develop a workable plan.

This is first of the Ten Rules of Investing For Beginners: Develop a plan — preferably a written plan, although it doesn’t have to be fancy! Sometimes these are called Investment Policy Statements, or Personal Investing Statements. Put it in writing. Review it annually, and it will improve! We’ll start one here and develop it over these ten videos.

Next steps:

- Watch next video in this series: Rule #2: Start saving early.

- Download cheat sheet Ten Simple Rules to Common Sense Investing,

a printable 1-page PDF summarizes Boglehead Investing. - Take a free course: Common Sense Investing,

or Where Should I Put Money?

Read the transcript for Develop A Plan (investment policy statement)

Some of our dreams need a little money. This list is where we begin.

We need to have some idea of how much we need to save and how we will save that.

There may be part of you rebelling already. Relax! Of course you don’t know the future! But it will serve you to imagine one scenario. The enemy of a good plan is the search for a perfect plan.

The enemy of a good plan is the search for a perfect plan.

Carl von Clausewitz (and others)

Make assumptions, and then change them when you get better ideas, or better information. Our goal is to enable these possibilities.

Let’s pause here and consider some simple arithmetic. This set of videos is not about retirement, but for most of you, saving for retirement will be the biggest item — by far!

Hopefully you have a long time to save for retirement so I want to share two guidelines so that you can choose an appropriate goal for our investment plan.

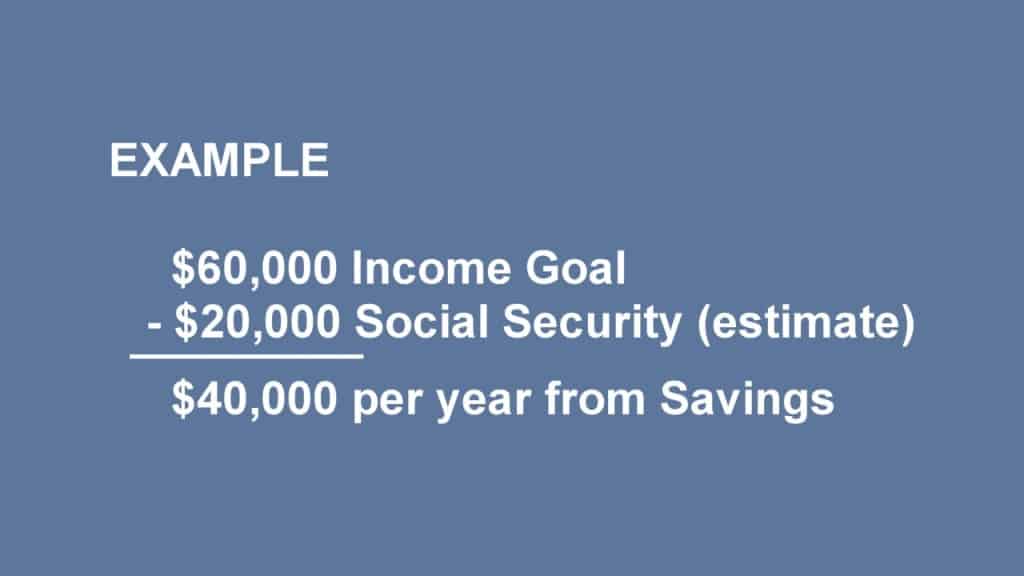

If you reach retirement age in good health, there’s a very good chance you, your spouse, or both of you, will enjoy 30 years of retirement. A good rule-of-thumb is that you’ll need 25 times what you’ll draw from your savings for 30 years of retirement. For example: someone may wish to retire at age 65 on $60,000 a year. If they expect $20,000 a year from Social Security then they’ll need $40,000 a year from their savings. That means you’ll need to save 25 x $40,000, or $1 million to be fairly confident you won’t run out of money if you live to age95.

You might want half this; or twice this. It’s a personal choice. This guideline does account for inflation and most stock market scenarios, but assumes your money is invested wisely, like we’ll describe in later videos.

Invest money you’ll need soon very conservatively, like in a MoneyMarket or a Bank CD; definitely not the stock market. On the other hand, money you need beyond 10 years really must be invested in a portfolio of stocks and bonds, and that is what most of my videos will help you understand how to do correctly.

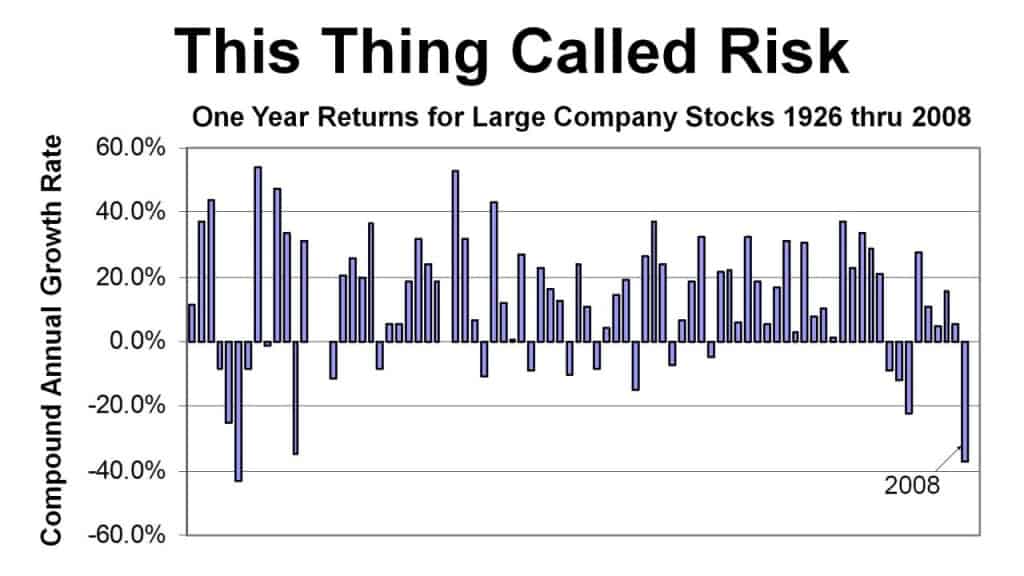

But Rick, you say, the stock market is WAY too volatile.

Correct! This is a history of annual returns of Large Company Stocks.

In any given year the value might fall by half! Look what happened in 2008.

Now let’s look at the historical outcomes for holding stocks still longer. Each bar represents the return after holding for 10 years.

Sometimes people lose money after holding 10 years! (like 2008!)

But, most of the time stocks outperform an even bigger risk: inflation.

Your risk of losing your investment in the stock market is small over a long holding period. Your risk of losing the value of your investment due to inflation is much larger! This is why YOU MUST INVEST: and you need an investment return bigger than inflation.

Suppose you plan to retire in 30 years and inflation is just average — every $1000 you save today will be worth only $410!

But wait, does this chart suggest we should own only stocks and hold them for a very long time–until when you need that money? It’s true our investments would grow, but we can’t change the volatility of the stock market.

Remember, we saw that any given year your stock holdings might lose half of their value. We’ll see in Rule#3 that each year we will want to gradually convert some of our stocks to bonds so that we don’t hold too much risk by the time we need the money. One popular guideline we’ll discuss later is to “own your age in bonds”.

We’re going to continue working on this plan all the way through Rule#10. Right now it probably looks like you are going to need a lot of money.

OK. So how much do you need to save? Here a short answer that works for most young adults: 5% of your gross paycheck for those big ticket items, and another 10% for your retirement.

And if you haven’t already, you should use the very first money you save to establish a sound financial lifestyle before investing for the future. I have a separate video about this.

If you get a paycheck, you already get a large slice withheld for various taxes. These are just guidelines–it will vary state-to-state, individual-to-individual.

Our human behavior is that if we don’t see it, we don’t miss it. So a time-proven strategy for saving is to pay yourself first with that 15% automatically deposited.

Here’s a balanced budget that works for many people. See how this works for you. It applies 45% of your gross income to your essential expenses that you NEED, and 15% to discretionary, or fun stuff.

Initially you might be thinking that you need everything you spend money on. Use these questions to get at your true foundation expenses:

1. Could you live in safety and dignity without this purchase?

2. If you lost your job, would you keep spending money on this?

3. Could you live without this purchase for six months?

If you withhold money from your paycheck to pay your taxes, and you pay yourself first with an automatic deposit for your long-term savings, then you don’t need a complicated budget. You simply spend what you have left: one dollar for fun expenses for every three dollars you spend on the essentials you need.

Some of you might be thinking, “Hey, you’re only young once. Maybe I should save 10% for big-ticket items, and only 5% for retirement.” This is a tradeoff that only you can make.

Time is your friend. You’ll see in this next very short video example how you can harness the power of compound interest by starting to save early.

Find other explanatory videos, smart tips, and links to useful resources at FinancingLife.org.

Related articles:

- Must-read guide: Smart Investing for Beginners

- Video overview of Intro: Ten Rules of Investing for Beginners

- Step 1: Develop a workable plan.

- Step 2: Start saving early.

- Step 3: Choose appropriate investment risk.

- Video overview of Step 4: Diversify.

- Video overview of Step 5: Never try to time the market.

- Video overview of Step 6: Use index funds when possible.

- Video overview of Step 7: Keep costs low.

- Video overview of Step 8: Maximize after-tax returns.

- Video overview of Step 9: Keep it simple.

- Video overview of Step 10: Stay the course.

- Video overview of The ABCs of Common Sense Investing

- Must-read guide: How To Build An All Weather Portfolio With Stocks and Bonds

- Courses at: FinancingLife Academy

Footnotes and Video Production Credits for Rule #1: Develop a plan (investment policy statement)

The story about risk and inflation is adapted from The New Coffeehouse Investor by Bill Schultheis, 2009.

The budgeting basics are adapted from On My Own Two Feet by Manisha Thakor and Sharon Kedar, 2007.

Photo “Contemplation au sommet de la Fache” is by Vinvin F. via www.flickr.com with this Creative Commons license BY-NC-SA 2.0 .

This video may be freely shared under the terms of this Creative Commons License BY-NC-SA 3.0.

Video copyright 2009-2019 Rick Van Ness. Some rights reserved.

————————————————————————–

What’s your learning style? Would you prefer a book?

- to learn at your own pace?

- to mark with notes?

- to use as reference?

- to give as a gift?

- or, even just to support this non-profit educational website (thanks!)

Take a closer look at the paperback book.