Hi, I’m Rick Van Ness and this is Rule #4: Diversify. …

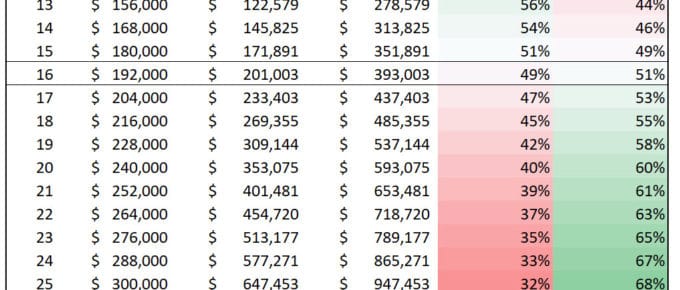

What’s more important: Saving or Investing?

What matters more — your personal savings rate or your investing rate of return? Saving is far more important for the majority of Americans. But that is because most people don't save very much at …

Continue Reading about What’s more important: Saving or Investing? →

Control investment risk and return | Stock market risk for beginners video

It's important to choose an appropriate level of investment risk and return. This video will help you understand stock market risk and whether stocks get safer with time. They don't. Use …

Continue Reading about Control investment risk and return | Stock market risk for beginners video →

How to save money automatically | Start saving early | How to invest video

Last updated June 24, 2020 in Learn How To Invest, part of Investing for Beginners series. Start saving money early. Learn how to save money first; then learn how to invest. We'll use risk-free …

Continue Reading about How to save money automatically | Start saving early | How to invest video →

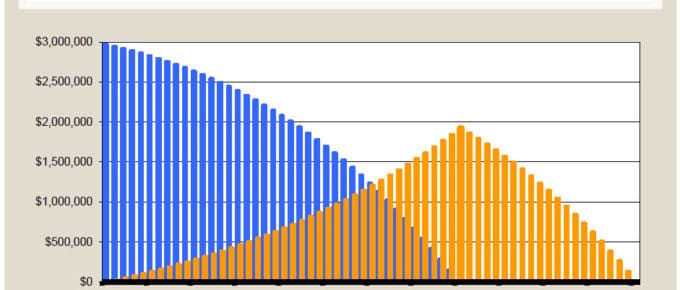

Goal-based investment planning | Retirement planning example and video

Last updated June 24, 2020 in Learn How To Invest, part of Investing for Beginners series. Goal-based investment planning starts with your imagination and then creates a simple plan to finance your …

Continue Reading about Goal-based investment planning | Retirement planning example and video →

Retirement Income Planning & Life Cycle Finance

{Editor: retirement income is a specific instance of financial planning, but one that should be a high priority goal for everybody. Investing for retirement suffers from some pervasive …

Continue Reading about Retirement Income Planning & Life Cycle Finance →