Continue reading from previous page …

Smart Investing for Beginners — Ten Simple Rules

#8: Maximize after-tax returns

Two things every investor should know to be a smart taxpayer are that:

- Not all income is taxed the same, so

- You generally want to hold bonds in a retirement account and stocks in a taxable account.

To understand this, let’s consider Sharon and Mark’s retirement account. We always start with a long-term plan which includes choosing risk and asset allocation before worrying about taxes. They have decided that the correct risk level for their retirement portfolio is 60% stocks and 40% bonds, increasing the allocation to bonds by 1% every year.

Their preference is to own total stock market index funds, with 2/3 from US companies and 1/3 from international companies. For bonds, they chose a total US bond market index fund.

Later in this chapter, we will learn how it is advantageous to hold these funds in different types of accounts. But first, we need to learn about the major types of accounts and their tax implications.

Taxable, tax-free, and tax-deferred accounts

You can have taxable, tax-free, and tax-deferred accounts. Tax-advantaged accounts are the most tax-efficient place to invest, so you’ll want to take maximum advantage of these.

Sharon’s been contributing to a Roth IRA with some of their after-tax earnings every year. Her contributions are with income that she has already paid taxes on. But the account’s growth will never be taxed, so the ultimate earnings are much larger—a big advantage!

Mark has a 401(k) retirement program with his employer. This, like traditional IRA Accounts, is all tax-deferred. They pay no taxes on income he invests here, or on any growth of these investments until he uses it during retirement when it all gets taxed as ordinary income. Best of all, his company matches some of his contributions.

Let’s consider their tax situation. As they earn more income, the last dollars they earn get taxed at higher levels. Say they are in the 25% marginal tax bracket. While they pay less than 10% of their total gross income on federal income taxes, the important thing is that 25% of the last dollar they earn in wages goes to these taxes.

Now to the first point of this chapter: not all income is taxed the same.

Not all income is taxed the same

Let’s consider how investments get taxed. It turns out that the interest and dividends that you earn from your bonds, bank CDs, and savings accounts are all taxed like ordinary income—or 25% for the investor in this example.

Now with stocks, you own a portion of these companies and they distribute some of their profits to you as dividends. Second, as the company grows, the value of the shares appreciates. So you hope to sell them for a higher price in the future. If you hold the stock for a long time and the price goes up, not only do you get to defer paying taxes on the appreciation until you sell it, but this long-term-capital-gains tax is at a lower rate. The next chart shows that there is a big difference between these tax rates! (Remember: actual rates change frequently. What you are learning here are the key concepts.)

There’s more good news. Currently, the earnings that are distributed every year as qualified dividends are also taxed at this lower rate!

Some actively-managed mutual funds do lots of buying and selling, trying to beat the market. This turnover creates extra capital gains that you have to declare and pay taxes on now, instead of deferring these into the future as you would prefer. The best mutual funds are going to have low-turnover in addition to being low-cost and widely diversified. The best choices are usually index funds, but they aren’t always. It’s these attributes that are important.

Five steps to tax-efficient asset locations

We saw that not all income is taxed the same. The next chart ranks different kinds of mutual funds by tax efficiency. This is not sorting good funds from the bad. Rather, it is to guide us to which account to hold each investment in. It makes a big difference.8-1, 8-2

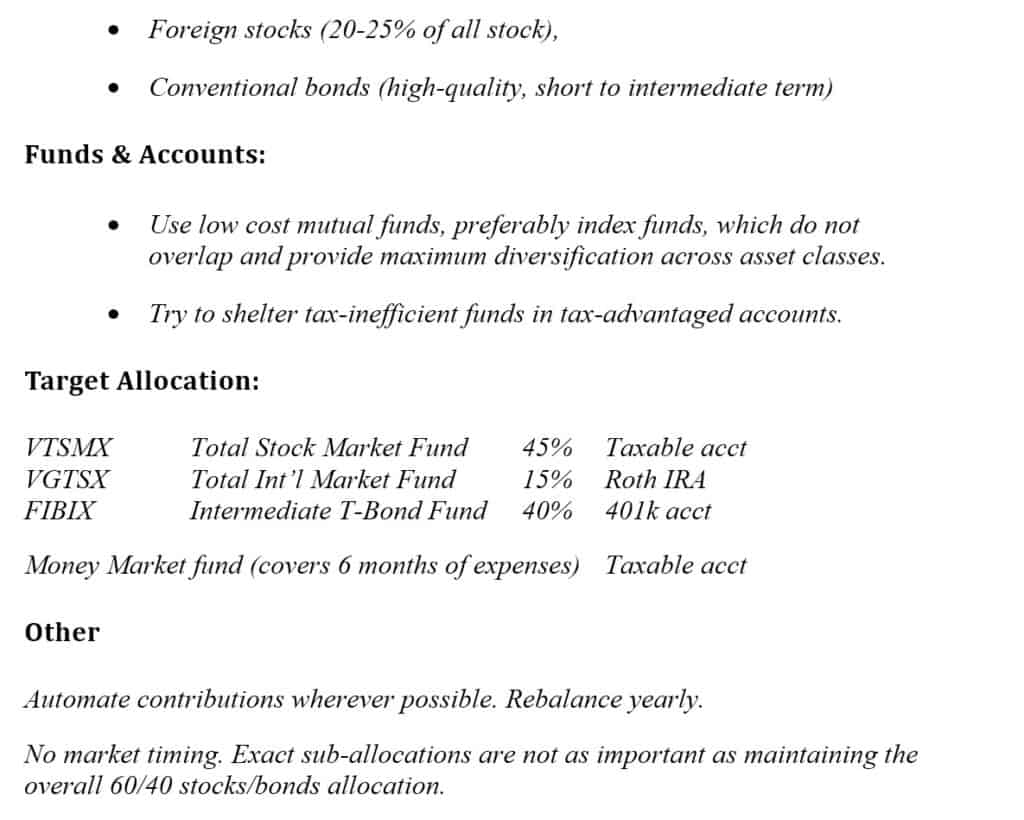

Getting back to our example: after they’ve considered the risk and asset allocation, Sharon and Mark determine the tax efficiency of each of their investment assets. We want to place the bonds in their tax-deferred retirement account, or more precisely, those investments that have the highest tax cost. This is the main point. So if you only remember one thing, remember this.

Sometimes the limited fund selection in a 401(k) does not include a good low-cost bond fund. If not, bonds can be allocated to a Roth account if there is “space” —meaning, it has grown large enough over time from regular contributions.

The next steps illustrate how to locate funds for tax efficiency by considering the three funds owned in this chapter’s example.

Other recommendations: generally keep your foreign stocks in your taxable account where you can get a foreign tax credit.

And usually, put the fund with the highest expected return into a tax-free Roth IRA.

Fill up the remaining space in your tax-advantaged accounts with tax-efficient stock funds, and then hold the rest in a taxable account. For this example, here is how it ends up looking.

There are many other benefits to having stock funds in a taxable account, so I’ll provide you links to these topics if you want to explore them.

Advanced strategies

- Tax Loss Harvesting

- Whether to Reinvest Dividends in a Taxable Account

- Cost Basis Methods

- Specific Identification of Shares

- Placing Cash Needs in a Tax-Advantaged Account

Other resources for Rule #8: Maximize after-tax returns

- This overview video is an introduction to using tax-advantaged accounts in order to maximize your after-tax returns.

▶ Watch this video overview: Rule 8: Maximize after-tax returns. Everyone should use tax-advantaged accounts such as an IRA or 401(k). Get familiar with tax costs because you can control them. When we talk about risk and return, we specifically mean your after-tax returns. Taxes are a big cost.

Never underrate either the majesty of simplicity or its proven effectiveness as a long-term strategy for productive investing. Simplicity, indeed, is the master key to financial success.

—John C. Bogle, Common Sense On Mutual Funds

Smart Investing Tips For Beginners:

- Costs matter and taxes are a significant cost.

- Smart investors use tax-advantaged accounts and know that people are generally in lower tax brackets after they retire.

Smart Investing for Beginners — Ten Simple Rules

#9: Keep it simple

Hearing the truth about investing is empowering. Yes! You can do this! But it’s imperative that you create a plan that you can stick to. Keeping it as simple as you can help.

The magic that makes a plan work is to put something in writing. Something that you will look at and review every year. It forces you to write down what you are actually doing and makes you realize what assumptions you are making.

Start wherever you are! Don’t strive for perfection.

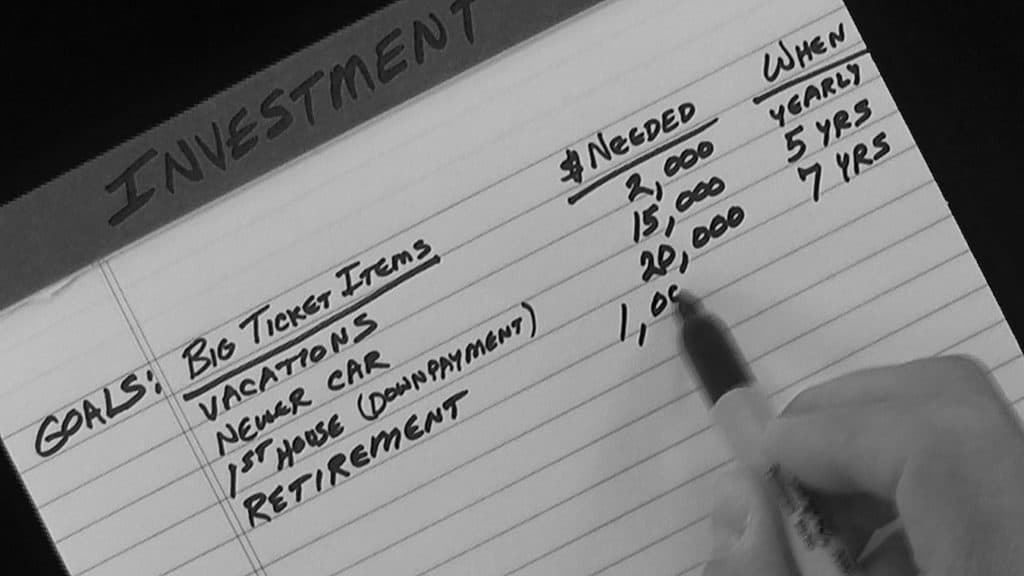

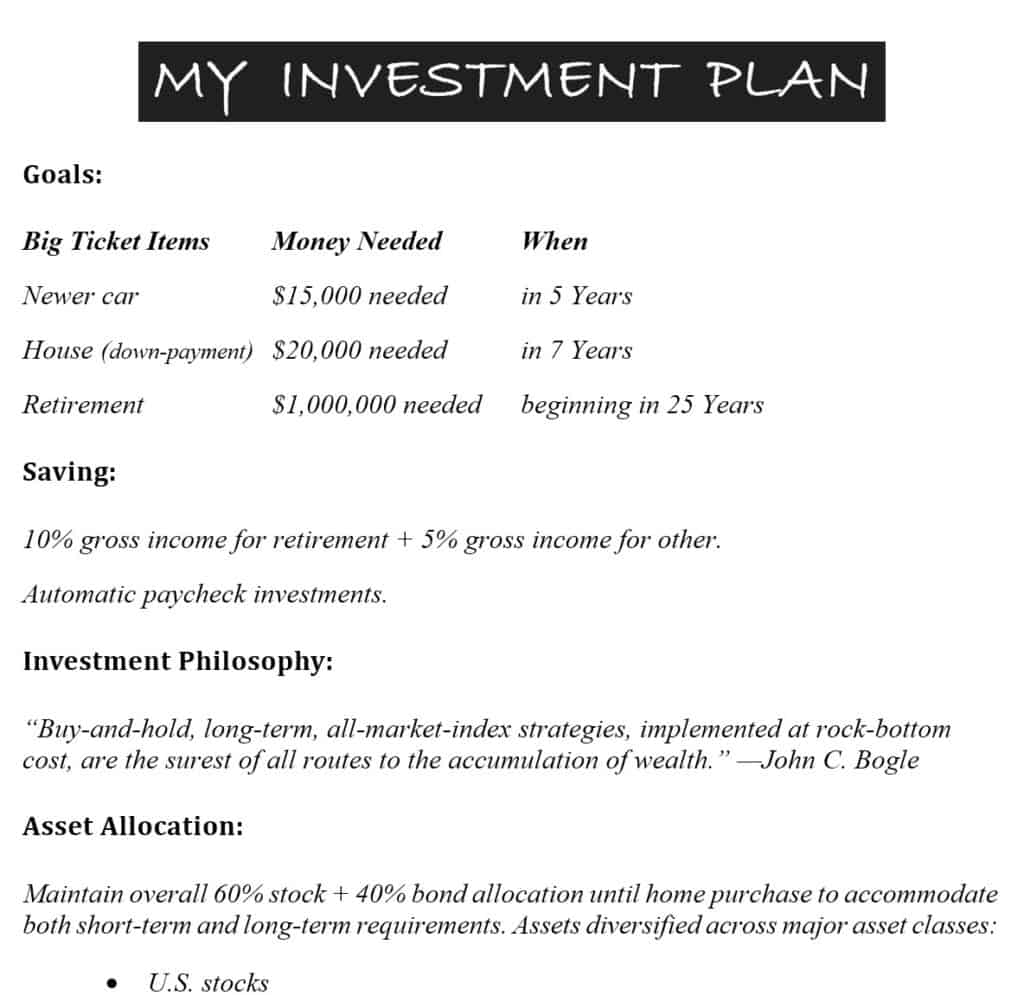

Write down what you can about the big-ticket items you can envision. You can always change these later. In a month, or a year, or two, or five, your goals will take shape and look something like this. Everybody’s objectives are different. What we’ll eventually need for retirement often dwarfs the size of our near-term goals. These are what motivate your most important habit: starting now and saving regularly. For instance: maybe you will decide to save by automatic paycheck investments; 5% of your gross income for short-term goals plus another 10% for retirement.

Your most important decision (stocks/bonds ratio)

Next is the most important decision—how much risk is appropriate for you to take on these investments. For your mid- to long-term goals, it’s simply the ratio of stocks and bonds you own. It is essential that you own both. You need to be at a level that’s appropriate for you.

The following chart is a little simplistic but it will remind you (1) that this is your most important decision, (2) the closer you are to needing money, the less risky it should be invested, and (3) keep your long-term allocation very stable over time. Again, consider ability, willingness, and need to refine your plan.

It is common for investors to gradually make their portfolios more conservative as they approach their retirement when they will rely on those savings. But not always. The following example is also an excellent plan. These investors (man and wife) have identified their appropriate level of risk, and the plan is both solid and simple.9-1

Example: Investment Policy Statement

This couple views all their investments together for both their short and long-term goals, and have decided to own a constant 60% stocks and 40% bonds every year until they purchase a home. They further allocate their stocks: 3/4 US stocks and 1/4 foreign stocks. Any good-quality low-cost bond fund works fine. The type of bonds is less important than the amount you allocate to bonds.

You’ll want to take maximum advantage of taxable and tax-advantaged accounts. These are for everybody.

When it comes to selecting specific funds, it is helpful to remind yourself of the investment philosophy you believe in. This couple included this quote in their plan to help ground them in common sense. I liked it so this quote is in my own plan too.

“Buy-and-hold, long-term, all-market-index strategies, implemented at rock-bottom cost, are the surest of all routes to the accumulation of wealth.”

—John C. Bogle

We talked a lot about what makes a good fund and which account you want to hold them in. This couple lists their fund selections and target allocations and adds these final comments: “Automate future contributions wherever possible. Rebalance yearly. No market timing. Exact sub-allocations are not as important as maintaining the overall 60/40 stocks/bonds allocation.”

Revisit plans annually. Keep them simple.

Every year they look at this Investment Plan and compare it with their actual investments. If stocks grew faster that year, they change their future automatic monthly investments to buy more bonds. Maintaining the 60/40 allocation keeps the risk at their desired level.

In years when the stock market plummets, re-balancing means buying more stocks. Appendix E shows an example. It is psychologically hard to re-balance in a drop—another reason a simple written Investment Policy Statement is very helpful. You can do this if you have confidence that stocks will go up in the long run. Stocks are a long-term investment. There will be many bumps in the road: wars, recessions, high inflation, and stuff we haven’t even thought of.

Find links to other plans in the footnotes below. You can do this! And most likely, you must invest wisely to accomplish your life dreams.

It doesn’t need to be more complicated than this. Successful investing involves doing just a few things right and avoiding serious mistakes.

Strive for a rough draft now

Just strive for a rough draft in your first year, but make sure it is written. As you review it every year it will improve in a natural way as you continue to learn. Resist the temptation to gussy up your plan with needless bells and whistles. Pretty soon you’ll have a robust plan and you’ll be accomplishing your objectives—and financing your dreams. After all, that’s why we do this, right?

Other resources for Rule #9: Keep it simple

- I’ve become a believer in the majesty of simplicity. That means not spreading investments unnecessarily all over the place. A three-fund-portfolio can work extremely well. Life is short. Aim for as simple as possible (but not more) and give your time to more fulfilling things.

- See if your library has this 2018 book by Taylor Larimore: The Bogleheads’ Guide to the Three-fund Portfolio.

▶ Watch this video overview: Rule 9: Keep it simple. Keep it simple by using a three-fund portfolio. Some people call this a Boglehead Lazy Portfolio and it simply accomplishes your diversification objectives at the lowest possible cost with only three funds. Why stop there? You can even do it with two funds! And with one fund! Life is short. Keep it simple. Give your time to more fulfilling things.

Smart Investing Tips For Beginners:

- Smart investors keep it simple. Life is short. Give your time to more fulfilling things.

- Everyone gets older, some more gracefully than others. But there is a very strong chance that you’ll need someone to help or handle your finances in the future. Make it easy for them to enjoy more quality time with you.

Smart Investing for Beginners — Ten Simple Rules

#10: Stay the course

Here’s where it gets difficult for most of us—in fact, very difficult. Mike Piper nails this in his book, Investing Made Simple, where he says:

Tune out the noise

Intuitively, we understand the importance of sticking to our plan. Yet we’re constantly receiving conflicting messages10-1 about how to be successful investors. For example, the mutual fund industry tells us that:

- Professionals have the best chance of picking stocks that will outperform, and

- A mutual fund that has outperformed the market in the past is likely to outperform the market in the future.

At the same time, the discount brokerage firms are telling us:

- Picking stocks on your own is easy!

- You can time the market successfully with up-to-the-minute information.

Meanwhile, the mainstream financial media is bombarding us with a third group of messages, like:

- You can improve your performance by picking hot funds (particularly those mentioned in their show or magazine).

- If you watch the news enough and listen to enough economists/market analysts, you have a good chance of predicting the next market move.

Whom should we believe?

Each of those sources seems like they should know what they’re talking about.

The reality is that the primary goal of each of those parties is not to provide us with quality information, but rather to persuade us to consume their products (just like any other business). So we must tune them out and turn instead to unbiased sources of information (like academic studies). When we do, we encounter a few findings that have been confirmed time and again:

- Within each category of mutual funds, expenses are the best predictor of future performance.

- Any investor–even a full-time professional–is unlikely to be able to reliably outperform the market. And,

- Reliably predicting short-term market moves is impossible.

And those facts lead us to this simple common-sense investment strategy.

Smart investing is a common-sense strategy

- Develop a workable plan.

- Start saving now, not later. Time is your friend when you use the wondrous growth power of compound interest.

- Own the appropriate amount of bonds. It is the ratio of stocks to bonds that controls your risk. This is far more important than which specific funds you choose.

- Diversify, and hold on to your investments for as long as you possibly can before selling them.

- Never try to time the market.

- Use index funds when possible.

- Keep all costs low, not just sales costs, but the recurring expense ratio, and hidden tax consequences.

- Taxes are a very big cost that you can minimize, or defer.

- Keep it simple.

- And hardest of all: Stick To Your Plan!

“Stay the course” means that once you’ve chosen your portfolio, only sell to rebalance and maintain your risk level. Never sell based on greed or fear.

Imagine that you wake up tomorrow morning and the stock market is down 50% due to some huge global problem, like a nuclear war in the middle east, what will you do? If the answer is ―sell‖ when it is down 50%, then you have too much in stocks. You are carrying more risk than you can live with.

A written plan helps immensely

A written Investment Policy Statement helps you rebalance in a market drop. Everyone is different. Not everyone can be cool in the line of fire. But knowing your limitations ahead of time and being able to admit them and select an appropriate level of risk and a plan that you can stick with is a wonderful pursuit of self-knowledge.4

You can do this!

You can do this! Now when you get a question, and you will, you can turn to the Bogleheads wiki for reliable advice supported by a large number of savvy volunteers trying to help ordinary investors.

The Bogleheads have endearingly named themselves after John C. Bogle, the great champion of common sense investing. Join them online. You can find answers to common questions or books that are worth reading. And if you can’t find your answer, you can always anonymously ask the Bogleheads discussion board—a group of friendly people that are amazingly generous with helpful feedback (to people with genuine questions).

Tune out the noise. Stick to these ten simple guidelines. Investing is just a small piece of fully living your life, but it’s an important piece. It enables you to reach some of your most valued dreams.

Other resources for Rule #10: Stay the course

- This is the last overview video. John Bogle loves to say “Stay the course”, meaning: choose an investment strategy that you can stick with for the long-term, though inevitable periods of market volatility. This has to do with asset allocation, and inevitably is a strategy built with low-cost index funds.

▶ Watch this video overview: Rule 10: Stay the course. John C. Bogle is famous for saying “Stay The Course!”. The stay the course meaning is to invest for the long term, and then not second-guess your decisions. This strategy leads to great success. This requires building an all-weather portfolio that you can stick with come hell or high water.

▶ Watch a fun video: The ABCs of Common Sense Investing Here is a fun video that pulls it all together. If you are a Boglehead investor, you’ll recognize this as common sense investing.

Smart Investing Tips For Beginners:

- It’s important that you stick to your plan. This keeps emotions out–they are the common source for bad decisions.

- Smart investors know that emotions and human nature are working against them.

- It’s tempting to buy last year’s winners, but looking backward is not a helpful approach.

- It’s tempting to sell during a stock market plunge. Avoid taking such losses by having a plan and by not bearing too much or too little investment risk.

- Smart investors know that they are bombarded with noise all day long. Tune out the noise. Someone is always trying to sell you something.

- The mutual fund industry wants you to buy its managed products.

- The discount brokerage firms want you to pick and trade individual stocks.

- And the mainstream media want your attention so your eyeballs see their advertising.

Footnotes to Smart Investing For Beginners

Smart Investing for Beginners Rule #1: Develop a workable plan

1-1. This series of ten rules is also endearingly called the Bogleheads investment philosophy — investing advice inspired by John C. Bogle. I prefer to call it Common Sense Investing as a nod to one of my favorite books by John C. Bogle↩

1-2. How much income do you need in retirement? a short video by Dimensional Fund Advisors.↩

Smart Investing for Beginners Rule #2: Invest early and often

2-2. https://www.uninflationcalculator.com/inflation/historical-inflation-rates/↩

2-3. Explore TIPS: A Practical Guide to Investing in Treasury Inflation-Protected Securities, by The Finance Buff, 2010(Available at Amazon.com)↩

2-4. Andrew Tobias, The Only Investment Guide You’ll Ever Need, 2010, pg.13.↩

2-5. Vicki Robin and Joe Dominguez, Your Money or Your Life: 9 steps to transforming your relationship with money and achieving financial independence, updated 2018. (Available at amazon.com)↩

Smart Investing for Beginners Rule #3: Never bear too much or too little risk

3-2. Burton G. Malkiel, A Random Walk down Wall Street: The Time-Tested Strategy for Successful Investing, Rev. and updated ed (New York: W.W. Norton & Co, 2011), 305.↩

3-3. tradingeconomics.com/japan/stock-market↩

3-4. Walk down Wall Street, p. 363.↩

3-5. https://www.nhc.noaa.gov/aboutcone.shtml↩

3-6. Risk and Time, John Norstad, Northwestern University, https://web.archive.org/web/20170911171611/http://www.norstad.org/finance/risk-and-time.html↩

3-7. Risk and Time, John Norstad, Northwestern University, https://web.archive.org/web/20170911171611/http://www.norstad.org/finance/risk-and-time.html↩

3-8. Risk and Time, John Norstad, Northwestern University, https://web.archive.org/web/20170911171611/http://www.norstad.org/finance/risk-and-time.html↩

3-9. annimated gif https://themeasureofaplan.com/us-stock-market-returns-1870s-to-present/↩

3-10. Risk and Time, John Norstad, Northwestern University, https://web.archive.org/web/20170911171611/http://www.norstad.org/finance/risk-and-time.html↩

3-11. The Riskiness of Stocks: Readers Protest—and the Authors Respond, https://www.wsj.com/articles/SB10000872396390443324404577595483877996626↩

3-12. Zvi Bodie and Rachelle Taqqu, Risk Less and Prosper: Your Guide to Safer Investing (Hoboken, N.J: Wiley, 2012).↩

3-13. The Riskiness of Stocks: Readers Protest—and the Authors Respond, https://www.wsj.com/articles/SB10000872396390443324404577595483877996626↩

3-14. Interview in WhiteCoatInvestor podcase, https://www.whitecoatinvestor.com/bernstein-says-stop-when-you-win-the-game/↩

Smart Investing for Beginners Rule #4: Diversify!

4-1. The benefit of poorly correlated assets is a small portion of the Modern Portfolio Theory for which several economists won the Nobel Prize. This particular chart of stocks and bonds is a simplification of one that appears in All About Asset Allocation: The Easy Way to Get Started, by Richard A. Ferri, 2006, p.45. ↩

4-2. The importance of company size and style (growth vs value) for explaining the differences in returns of diversified portfolios is known today as the Fama-French Three-Factor Model. ↩

4-3. The correlation of various asset classes to the S&P 500 Index is listed in The Only Guide To A Winning Investment Strategy You’ll Ever Need, 2005, by Larry E. Swedroe, p 144. ↩

Smart Investing for Beginners Rule #5: Never try to time the market

5-1. Yes, during the past 25 years, while the stock market index fund was providing an annual return of 12.3 percent and the average equity fund was earning an annual return of 10.0 percent, the average fund investor was earning only 7.3 percent a year. The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns, by John C. Bogle, 2007, p.51. ↩

5-2. Find two alternative views of a periodic table of investment returns in color, more detail, and over 15-20 year timeframes:

www.callan.com/research/download/?file=periodic%2Ffree%2F457.pdf

www.russell.com/us/documents/syndication/value_of_diversification_004000579.pdf

↩

5-3. John C. Bogle, Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor, 1999. ↩

5-4 John C. Bogle, The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns, p.xi. ↩

Smart Investing for Beginners Rule #6: Use index funds when possible

6-1. It is investors who misuse the fund rankings. Morningstar® clearly describes what the rankings are based on and explains that they “shouldn’t be considered as buy or sell signals.” And yet we do. http://corporate.morningstar.com/us/documents/methodologydocuments/factsheets/morningstarratingforfunds_factsheet.pdf ↩

6-2. The Arithmetic of Active Management, William F. Sharpe http://www.stanford.edu/~wfsharpe/art/active/active.htm ↩

6-3. All About Index Funds, by Richard A Ferri, 2nd Edition, McGraw-Hill, 2007, p.26. Used with permission. ↩

6-4. All About Index Funds, by Richard A Ferri, 2nd Edition, McGraw-Hill, 2007, p.25. Used with permission ↩

6-5. The Case for Indexing, Vanguard, February 2011 https://institutional.vanguard.com/iwe/pdf/ICRPI.pdf ↩

6-6. The Coffeehouse Investor: How to Build Wealth, Ignore Wall Street, And Get On With Your Life by Bill Schultheis, p.65. ↩

6-7. This “outfox the box” game was originally presented by Bill Schultheis in his delightful little book, The Coffeehouse Investor: How to Build Wealth, Ignore Wall Street, And Get On With Your Life (Palouse Press, 2005). I added details to make this example consistent with typical fund expenses, and consistent with the odds of beating the market in five years. Used with permission. ↩

6-8. The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns, by John C. Bogle, John Wiley & Sons, Inc., 2007, p. 189. ↩

Smart Investing for Beginners Rule #7: Keep costs low

7-1. The stock market index fund was providing an annual return of 12.3 percent and the average equity fund was earning an annual return of 10.0 percent, the average fund investor was earning only 7.3 percent a year. The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns, by John C. Bogle, 2007, p.51. ↩

7-2. All About Index Funds, by Richard A Ferri, 2nd Edition, McGraw-Hill, 2007, p.25. ↩

7-3. Unfortunately, there is no persistence to the funds or fund managers that recently outperformed the market average, and ultimately cost (expense ratio) becomes the best predictor of future success. The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns, by John C. Bogle, 2007, p.189. ↩

7-4. The Bogleheads’ Guide to Investing, by Larimore, Lindauer, and LeBoeuf, 2007, pp 110-116. ↩

7-5. John C. Bogle, The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns, 2007, p. 51. ↩

7-6. Ibid. , p.37. ↩

7-7. In Investing, You Get What You Don’t Pay For, 2005 Keynote Speech by John C. Bogle, http://johncbogle.com/speeches/JCB_MS0205.pdf ↩

7-8. This is a screenshot from Vanguard Total Stock Market Index Fund Admiral Shares which had an expense ratio of 0.07% (subject to change). The minimum investment is $10,000, and the ticker symbol is VTSAX. This fund is also available in another class called Investor Shares with an expense ratio of 0.18%, a minimum investment of $3,000, and a ticker symbol VTSMX. ↩

7-9. This example uses cost figures that are LESS than the Total Annual Costs of U.S. Equity Market Funds (3.3%) that were prepared by Jack Bogle and the Bogle Research Center and then presented in The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns p. 115. Higher costs produce worse results. ↩

7-10. John C. Bogle, The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns, 2007, p. 37. ↩

Smart Investing for Beginners Rule #8: Minimize taxes

8-1. This topic is discussed more completely in this wiki article: Principles of Tax-Efficient Fund Placement

http://www.bogleheads.org/wiki/Principles_of_Tax-Efficient_Fund_Placement

↩

8-2. Another good discussion of this topic is in The Only Guide to a Winning Investment Strategy You’ll Ever Need, by Larry Swedroe, 2005, pp 179-183. ↩

Smart Investing for Beginners Rule #9: Keep it simple

9-1. While I favor plans that fit on one side of one sheet of paper, in practice they vary widely. You might find it constructive to look at some other plans here: https://www.bogleheads.org/wiki/IPS#Real-World_IPS and here: https://www.bogleheads.org/forum/viewtopic.php?p=852539#852539 ↩

Smart Investing for Beginners Rule#10: Stay the course

10-1. Most of this chapter is from chapter 12 (pp. 98-100) of Investing Made Simple by Mike Piper and used with permission. He is a great writer. I recommend his books! ↩