Continue reading from previous page …

Smart Investing for Beginners — Ten Simple Rules

#5: Never try to time the market.

Imagine this: You’ve invested in a stock, or a fund and its value has plummeted to half of what it was worth a year ago, with no end in sight. You hate to lose money! Should you sell to prevent further loss?

Focus on time in the market, not timing the market

Or, perhaps the market’s been rising and you are wondering whether you are missing the boat and should be owning the current winner?

These are examples of trying to beat the market using timing. It’s a loser’s game. It is at least very difficult, if not impossible, to succeed at market timing over the long-run.

It turns out that investor money flows into stock funds after a good performance, and goes out when bad performance follows. Investors chasing performance are typically too late.

Expenses and emotion-driven selling

For a recent 25-year period, John Bogle found that the vast majority of investors earned 5% less than the overall stock market return. Over half of this gap was from market timing, the rest unnecessary costs.5-1

It’s simple to achieve the market return because you can buy a single mutual fund that owns all publicly held companies for a low cost. But, it’s only easy if you have a plan that matches your ability, willingness, and need to take the risk, then you stick to it and weather through all the sales efforts targeting you.

Collectively, we all earn the Market Return

To make money from stocks and bonds, it is important to acknowledge that you are investing in companies, either by becoming a lender to them, through holding a company’s bond or by becoming a partner with them, through buying a company’s stock. We collectively buy and hold these shares for the long term, sharing the wealth all these companies generate through their growth, resourcefulness, and innovation. And we, collectively, all earn the market return.

Before expenses, the winners equal the losers

But within this pool of shareholders, there is short-term trading between investors. And for every dollar that outperforms the market return, there is a dollar of under-performance. The huge financial services industry is very adept at convincing you that they can help you get better returns than the market so that you’ll watch their channel, purchase their newsletter, or invest in their fund. But in the end, the amount of over-performance (which you’ll hear a lot about) must equal the amount of underperformance (which you won’t hear about) because the market return is the average.

Larry Swedroe points out that most investors think they are competing against you and me. But about 90% of stock trades are by institutional investors. You are not buying from, or selling to, your neighbor next door whom you may be smarter than, but these institutional investors who are focused on this full-time with great resources. Do you think you are going to outperform institutional investors? Do you think this is Lake Wobegon where everybody is above average?

The next chapter will help you distinguish a good fund from a lousy one.

Attempting to predict the future direction of the market is only the first of the two common timing mistakes.

The strong lure to buy recent performance

It’s also incredibly tempting to invest in the most recent, top-performing categories of stocks and bonds.

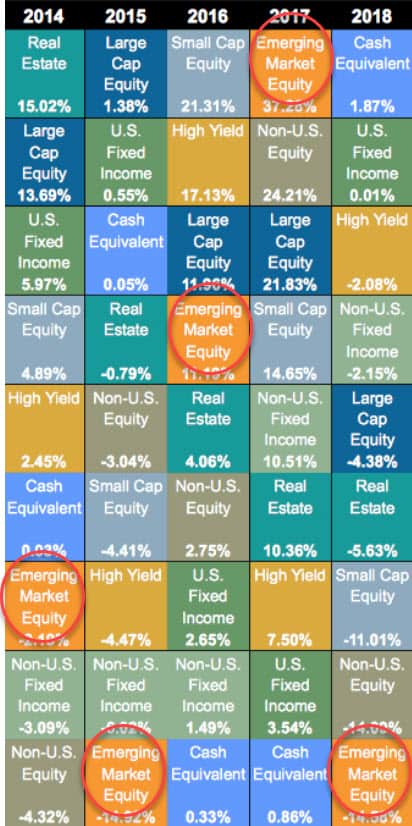

Individual asset categories, like small-cap growth companies or real estate companies, are constantly moving between being the year’s top performer to being the year’s worst performer. This is particularly obvious when you look at it graphically. View this in color in what we call the periodic table of investment returns. The following picture is an excerpt of what you’ll see if you follow the footnote link to Russell Investments.5-2

Are last year’s winners next year’s losers?

Smart investing tip for beginners. Download free PDF depicting annual returns for 10 asset classes, ranked from best to worst performance for each of the last 20 calendar years.

I circled ―small-cap growth performance. Do you see how yesterday’s winners are often tomorrow’s losers? Predictions here are futile. Now you circle ―real estate for each year. Do you see the mistake of investing in yesterday’s top performers?

John Bogle warns, “Don’t think you know more than the market. Nobody does.”5-3 Winning strategies buy and hold a portion of all of the nation’s publicly held businesses at a very low cost. By doing so, you capture almost the entire return that they generate in the form of dividends and earnings growth—guaranteed!5-4

Example: scheduled investments and rebalancing

Here’s a short example. Henry is saving for his retirement in 30 years. He chooses to own his age in bonds which means, this year, he allocates 35% of his retirement savings to bonds and allocated 65% to a fund that owns the entire stock market. He re-balances every birthday so very gradually his percentage of bonds increases. Appendix E shows an example of re-balancing.

Now, does he hesitate after every paycheck and consider whether stocks might be cheaper to buy tomorrow? No. He set up his purchases to occur automatically and avoids that first timing mistake.

Does he ever consider which companies (or mutual funds) are doing best this month? Nope. By simply buying a small piece of the whole market, he gets to own them all and avoids that second timing mistake.

How ’bout re-balancing every birthday: is that ―market timing‖? No again. It’s an example of having a plan and sticking to it.

Resources for Rule #5: Never try to time the market

- Don’t try to guess short-term market directions. Nobody can. Here’s an overview video encouraging you to focus on time in the market, not market timing.

Focus on time in the market, not timing the market.

▶ Watch this video overview: Rule 5: Never try to time the market. It’s time in the market that reliably gives you your fair share of the Market’s Returns. Timing the market is for fools. It’s tempting to think that the best investment managers can do this, but their long-term track records don’t distinguish them from simple luck. And the costs involved make this a fool’s game. However, time in the market is the way to capitalize on the miracle of compound interest.

Smart Investing Tips For Beginners:

- Smart investing is not about speculating (think gambling, forecasting, predicting), but rather about owning a piece of all businesses producing something of value.

- Passive management is a bulletproof argument when the assets in your portfolio are stocks and bonds.

- An active management approach means an investor tries to pick good investments and avoid bad investments.

- A passive management approach means an investor buys everything and accepts their share of the total.

- Active management costs lots of money as compared to passive management, unfortunately. And those extra costs almost always destroy an investor’s long-run returns.

- Smart investors know that it is foolish to consider the market return as merely “average”. Even getting the Market Return is incredibly difficult because it involves eliminating all costs.

- Trying to beat the market is a loser’s game.

Smart Investing for Beginners — Ten Simple Rules

#6: Use index funds when possible

In prior chapters, we’ve established that you’ll want both stocks and bonds, from many, diversified companies, and that you need to avoid market timing.

Mutual funds are a convenient way to invest in hundreds, or even thousands, of diverse companies. So, how do we recognize a good mutual fund from a bad one?

Misleading rankings based on recent performance

This is where our instincts get us in trouble. We are comfortable using rating systems to guide our other purchases. Would you like a mutual fund rated four or five stars by Morningstar®?

Here’s an actively-managed fund that tries to beat the market return (and recently did), and a passively-managed fund that attempts to match the market return.

A key point that I want you to understand is that these rankings are

based on past performance so have very little relevance!6-1

Here’s why. Remember, ―the Market is the collection of all stocks, all investors. So for every active manager who beats the average market return, another loses by the same amount. Unfortunately, the only way to profit from those winning funds is to know the winners in advance, which is impossible to know.6-2

There are a variety of reasons why the winners don’t enjoy persistent success. Sometimes success attracts an overwhelming amount of new money to a fund. Sometimes the manager’s style of investing goes out of favor. And sometimes the managers were never good, just lucky, and their luck runs out.6-3

Why index funds must beat active funds

In contrast, index funds don’t have active management (trying to beat the market) so they can be very low cost. An index fund simply owns all the stocks that make up an asset category, or in this case, all asset categories. The goal is not to beat the market, but to match the market return as measured by a benchmark index. For instance, the S&P 500 is a benchmark index for the 500 largest companies in the United States. A different, broader index benchmarks the entire stock market.

Active funds require a talented staff and excellent insightful research to try to predict which companies will outperform tomorrow. Frequent trading is normal. First, subtract these expenses. Investors get what is left.

So, to beat the market after subtracting these costs is very challenging.

Probability of an active equity fund beating the market

Only 37% of active funds beat the market every year.6-4, 6-5 But there is little persistence, and within five years, the number of winners has dropped to 25%. Over 10 years, a mere 15% of the actively managed funds beat the ―market return, which is what you would get if you had invested in a low-cost, highly-diversified index fund.

Bill Schultheis calls this dismal performance “Wall Street’s Best Kept Secret.”6-6 It illustrates that you have a low probability of beating the market, and the odds get worse with time. Plus remember, it is impossible to choose the winners in advance. Bill also invented an instructive game called Outfox-the-Box in his book The New Coffeehouse Investor.

Outfox-the-Box (with clairvoyance)

Imagine that you want to invest $10,000 and there are only nine mutual funds in the world.6-7 Eight of them are active funds with an annual cost of 2%. One of them is a low-cost index fund that closely tracks the overall market return.

You are clairvoyant and can foresee that you have two out of eight chances of outperforming the market over the next five years (recall the 25% probability), and you know the odds will decline further with time.

Collectively, all stocks earn the Market Return (before costs)

The next picture illustrates this with numbers. Four active funds beat the market before expenses—highlighted in green. Only two active funds beat the market after expenses—the two shaded in the right-hand column. The reward for such long odds is an extra $2,000 or $4,000. But the average investor return from all the active funds is less than the market return by $1,300—the amount of the expenses.

Before costs, odds of winning are 50/50

After costs, the odds of beating the market drop dramatically

Before costs, odds of winning are 50/50. Some active funds will beat the market average, but the returns of the other active funds will be lower by the same amount. That’s the definition of the market average—which index funds seek to match. After costs, the odds of beating the market drop dramatically:

- The odds after 5 years drop to roughly two of eight active funds (25%)

- After 10 years drop to about one of seven active funds (15%)

- The odds after 25 years drop to one of twenty active funds (5%)

- The odds after 50 years drop to one of a hundred active funds (1%)

You have this information, so you further notice that if it wasn’t for those expenses, four of the active funds would beat the market, and four would not. And, averaged together, the eight active funds would have achieved the market return. After all, that’s what the market return is, by definition.

Will you choose an active fund or index fund?

You can know the odds. You can know the arithmetic. But you can’t know in advance which funds are going to outperform so cover them up. You are going to have to guess.

Do you want to invest in the index fund and get the average market return, or do you want to try to beat the market with one of the active funds? And, if so which one?

Congratulations if you chose the index fund. It shows that you are a rational, risk-averse investor.

Now, do you agree with me that rankings based on past performance might be a little misleading? Five stars for a fund that outperformed recently, but has a very low chance of outperforming over the next ten years? And, of course, the index fund is only rated mid-pack: It can’t outperform the market; it tracks the market!

The best predictive measures of a fund’s future performance are its costs and how closely it tracks the market.6-8 Now, do you think that you don’t have costs because you only buy ― no-load funds? If so, don’t miss the next chapter.

Resources for Rule #6: Use index funds when possible

- Index funds give you broad diversification at the lowest possible cost. Here’s an overview video encouraging you to use index funds when possible—especially on the stock side of your portfolio.

- Link to future article ETF vs Index Funds (Coming Soon!)

▶ Watch this video overview: Rule 6: Use index funds when possible. Index funds are for beginners. Index funds are for all investors, every age, every skill level. The reason why you should use index funds whenever possible is that this is the way to get diversification at the lowest possible cost.

Smart Investing Tips For Beginners:

- Smart investing uses index funds when possible. Index funds are the tactic designed to capture the market returns at the lowest cost.

- Buy shares in the whole market at the lowest possible cost by purchasing just one to three total market index mutual funds. That’s easy!

- Smart investors know that very few actively managed funds can beat the market return in the long-term, and it is impossible to know which ones to choose in advance.

- This is because when ALL the costs of actively managed funds are included, the net returns that investors earn is below the market’s return.

- Smart investors know that index funds approximate the market return because their costs are so low.

Smart Investing for Beginners — Ten Simple Rules

#7: Keep costs low

The return-on-investment for the vast majority of investors is substantially worse than the stock market as a whole.

Two chapters ago we looked at how the behavior of market timing, or trying to pick specific stocks or funds, accounts for about half of this gap. The rest we give away as costs.7-1

In the last chapter, we introduced the idea that the best and least expensive way to buy the whole stock market is with index funds. This is because actively managed funds are very unlikely to beat the total market index funds in the long run because of their costs.

Only a small percentage of active funds outperform the total stock market index funds, and you can’t choose them in advance. Moreover, that probability gets lower every year.7-2

Three flavors of mutual fund costs

Three costs that I want you to be very aware of are sales charges, operating expenses, and taxes.

Sales charges

A sales charge (or, load) on purchases is exactly what you’d expect. If there’s a 5% sales charge, you write a check for $10,000 but only $9,500 gets invested because $500 goes to the salesman. Sometimes a back-end sales load is deducted from the redemption proceeds instead.

Too often, brokers or commissioned agents think they are helping you by recommending to you recent top-performing actively-managed funds. This is bad advice! It makes other people wealthy instead of you.

When you can, buy from one of the big discount brokerage houses and look for low-cost, highly-diversified index funds without these sales fees. These kind of funds are no-load funds, or marked NTF for “No Transaction Fee”. Sometimes, the fee exemption requires you to purchase online and hold the fund longer than some number of months.

Operating expenses

Now here is the important number that I want you to remember. The expense ratio is the annual recurring management fee. It’s a funny term that you need to remember. It is the percentage of a mutual fund’s assets that the investment firm incurs for all of its regular operating costs.

The expense ratio7-3 is only part of the cost of owning mutual funds. Transaction costs and market spreads are examples of additional costs a fund incurs every time it buys or sells a security. Frequent trading is part of the reason that actively managed mutual funds underperform the total stock market.7-4

Here’s an example: the Total Stock Market Index Fund offered by Vanguard. We can click on the Fees tab to find the expense ratio is 0.07% for this particular fund. All funds must publish this. If our total investment was only $10,000 then we would pay only $7 per year. This is excellent. They subtract that first. Investors get what is left.

Income Taxes

Income taxes are the third tax cost to be aware of. Funds that do a lot of trading generate a lot of taxable events that get passed to investors. But funds that merely track an index have low turnover and fewer tax consequences for investors. More about this in the next chapter: Rule #8.

Why investors underperform the Market

Earlier we saw how ill-timed market decisions cause undisciplined buying and selling. This keeps individuals from even achieving the returns of average funds. Now, observe how costs keep these active funds from achieving the returns of index funds—which closely approximate the average returns of the whole market without any fund expenses.

Surprise! The returns earned by average investors are far less than the Market return. I drew this from data in John Bogle’s book.7-5

With mutual funds, it’s not: “You get what you pay for.”

“The grim irony of investing, then, is that we investors as a group not only don’t get what we pay for. We get precisely what we don’t pay for. So if we pay nothing, we get everything. It’s only common sense.”7-6, 7-7

John Bogle

What you pay as expenses come directly out of your pocket. The fund in this example, the Total Stock Market Index Fund (VTSAX), has no sales charges. There is an annual fee for the account, but they point out ways to avoid these as well.

Little percentages make a BIG difference

These little percentages make a big difference! This portion of a screenshot from the Vanguard website for that mutual fund shows show how their expense ratio compares with the industry and how, if reinvested, that could be worth nearly $2,600 after ten years.7-8

Example: the index fund advantage

To understand the devastating impact of these costs, consider a 25-year old, Paul, who invests $100 per month in a Roth IRA until he is 65. In the next table, one column shows the amount he would earn using a historic stock market average captured with a low-cost index fund. The right column shows the amount Paul would earn with the same gross returns, but with a sales charge of 60 cents for each $100 investment and actively managed fund costs of 2% per year. At age 65 he would have earned $210,000 less, and that difference would continue to get worse.

Now if future returns are lower, then these costs take an even bigger bite out of what he would earn. Costs matter! Keep them low.7-9, 7-10

Unfortunately, some 401(k) plans do not offer any index funds at all. In that case, look for the largest, most diversified funds with the lowest fees.

Now, some of your savings will be in a taxable account where (guess what!) taxes are the third big cost that dramatically affects your return. We’ll look at this in the next chapter.

Resources for Rule #7: Keep costs low

- The goal is to keep investing costs low. This overview video focuses on the “expense ratio” as the biggest factor in index fund returns.

▶ Watch this video overview: Rule 7: Keep costs low. Index funds returns very nearly match the Market’s Return. This is what every investor should strive for. It is difficult. It requires the lowest possible costs. Most investors don’t achieve index fund returns because (1) they succumb to letting their emotions guide their buying and selling, and (2) they get talked into actively-managed funds.

Smart Investing Tips For Beginners:

- The smart way to invest is to keep costs low. You get to keep what you don’t give away. Costs matter!

- Astute investors are turned-off by seeing lavish offices and advertising where they invest because they know they are paying for it.

Read these simple rules in order, or click on the page buttons below …