A key point for beginners to learn to become smart investors is that before costs, trading stocks or other investments is a zero sum game. A ‘Zero–Sum Game‘ is a situation in which one person’s gain is equivalent to another’s loss, so the net change in wealth or benefit is zero. There may be as few as two players, or millions of participants. This is to a key point to learn how to invest because this is why index funds win in the long run. It’s simply arithmetic.

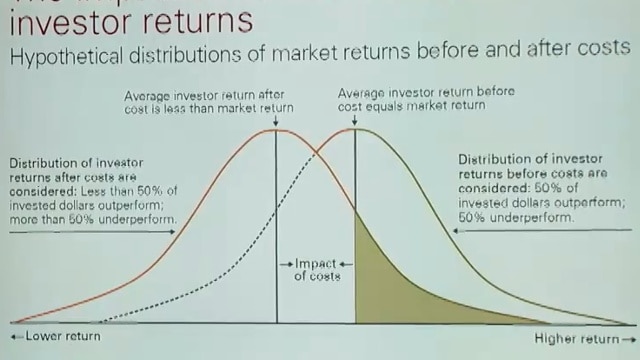

This video is a superb explanation of how mutual funds are a zero–sum game before costs are considered. A simple graphic shows how including costs shifts the outcome from equal winners and losers, to predominantly losers.

Summary of video: Why You Should Care About The Zero Sum Game

Every transaction in the stock market (or bond market) has a buyer and a seller. For every buyer that comes out above average there is a seller that comes out below average. Dollars that win have to be offset by dollars that lose. It’s a mathematical certainty. When no costs are considered we get a bell curve distribution of the returns of the stock market.

If you add in the costs, it shifts the distribution to the left. The higher the costs, the fewer fund managers that can beat the market average.

When you consider actively managed mutual funds over a period of 15-20 years, about 70% of the active managers have underperformed their market benchmark average return. This is largely explained by their costs which adds an additional hurdle to overcome.

Transcript of video: Why You Should Care About The Zero Sum Game

Elizabeth Tammaro, Moderator: Our next question is from Bob. Bob, thank you so much for sending in a question. Bob would like to know how the stock market is a zero-sum game. Scott, I believe you have some information to provide an answer there.

Scott Donaldson, Vanguard Investment Strategy Group: Well, great, and that’s really an important question, I think, in light of certainly the overview that Walter just gave about indexing in general, and how it works, and why some of the success factors are there. Generally, the zero-sum game is very, very important from an indexing standpoint because really, I think the success of indexing is grounded in that theory for a few reasons. One, if you think about starting from the premise or the understanding that every day or every minute the market, or all the holdings in a particular market that are being held by investors, aggregate up to become that market and create a return for that market, is basically the concept of a zero-sum game.

If you think about it simply, every transaction in the stock market or the bond market has a buy and a sell transaction. Somebody thinks that they’re going to buy a stock or a security because the forward looking performance in their mind looks to be good. At the same time, you have somebody deciding to sell that at a particular price, meaning they think there are better opportunities out there, right, so a buy and a sell. From a performance standpoint, is every dollar weighted part, or every dollar weighted excess return that outperforms the stock market there has to be a corresponding dollar weighted excess negative return. Dollars that win have to be offset have to be offset by dollars that lose. It’s a mathematical certainty in just the way that the market operates.

All of the active managers out there that say in their marketing literature, “I’m going to outperform or we’re going to try to outperform the market,” everybody cannot outperform the market. It’s an impossibility based on the zero-sum game theory. I actually have a chart I think I’d like to go to that might help explain this just a little bit better.

Here you see a chart, basically two hypothetical bell curve distributions, okay, of the returns of the stock market. This curve on the right is the before cost distribution of the market returns. if you’ll see the market return here in the middle is the average return for an investor before cost. You have 50% of the dollars outperforming and you have 50% of the dollars under-performing the market that achieves that return. However, in reality, okay, we all know that investors have costs associated with investing. There’s expense ratios when investing in mutual funds. In trading individual securities, there’s potentially commissions. There’s bid-ask spreads. Actually, one type of cost that a lot of people forget about is actually taxes, which can be a very, very huge cost.

If you think about equal dollars outperforming before and equal dollars under-performing the market from the zero-sum game frame point, if you add cost in, what it does is shift the distribution of market returns to the left. Now you have the average investor return after cost here, which is significantly less than the original, okay? Now you have only this portion, this shaded portion of investors, who have actually outperformed the market after cost. Before, it was all of this, now it’s only this. Now you have a significantly more than half of investor’s dollars under-performing the market on an after cost basis. That is why indexing works, because indexing seeks to keep your return as close to this line as possible by keeping costs and transactions low. The closer you stay to that before cost market return line, the more individual investors you’re going to outperform.

Elizabeth: Yeah, I think that’s a helpful visual, thanks.

Scott: It’s interesting. How does that translate to the real world?

Elizabeth: Mm-hmm (affirmative).

Scott: If you try to take this theory and apply it, if you look at the returns of active managers versus their corresponding benchmarks or index funds over the last, say 15 to 20 years, about 70% of active managers have underperformed their benchmark over 15 and 20 years. That’s a significant percentage. Certainly, there are some that have outperformed but it’s a much, much smaller percentage and a very, very difficult type of an outperformance to continually do and get right on a regular basis.

Footnotes and Credits:

This video was made October 23, 2014 at The Vanguard Group and published on their YouTube Channel with the title, Why You Should Care About The Zero Sum Game.

The Vanguard Group is the largest provider of mutual funds in the world. Of high interest: Vanguard is owned by the funds themselves and, as a result, is owned by the investors in the funds. Founder and former chairman John C. Bogle is credited with the creation of the first index fund available to individual investors, the popularization of index funds generally, and driving costs down across the mutual fund industry.