I highly recommend this compelling video that shows how top asset classes change.

Answer:

The simple definition of an asset class is a group of securities that are similar in fundamental ways. The three main asset classes are equities (stocks), fixed income (bonds), and cash equivalents. All other types of investments are designated alternative investments, and often involve owning various forms of physical property.

- Equities (stocks), owning a piece of a company

- Fixed Income (debt), lending money to a company or government for interest (bonds and certificates of deposit, for example)

- Cash equivalents, the money in your savings account or money market funds

- Alternative Investments, which included real-estate, commodities, hedge funds, private equity, and art.

Investments in different asset classes react differently to news—and that’s a good thing. A given piece of news might be positive for stocks, negative for bonds, indifferent for cash equivalents, and mixed for alternatives.

Equities are shares in the ownership of publicly-owned businesses. Their value goes up and down on investors perceptions of the firms performance. Historically, this asset class provides the highest return but is the most volatile.

Fixed income is more stable than stocks, but does fluctuate in response to market interest rates.

Cash equivalents are considered the safest, although their risk is that they may not keep up with inflation.

Real Estate includes homes and investment properties and funds that hold groups of them. While these tend to be more stable than stocks, their value can still rise or fall sharply.

Commodities are investments in other physical things or natural resources like livestock, agriculture, metals, or energy.

It is commonly accepted that owning investments from different asset classes, which is called diversification, can reduce a portfolio’s overall volatility.

From here, we can categorize each asset class in even greater detail.

Stocks as an asset class

Stocks can be American or foreign, startups or multinationals, value or growth, and so forth. Below are some of the most common ways of breaking down the Equity asset class.

Location

This is where a company is based. Hopefully that does not require further explanation.

- U.S.: companies based in the United States

- Foreign Developed: companies based elsewhere with developed economies and generally accepted currencies

- Foreign Emerging: companies in countries with relatively undeveloped economies, generally thought to be a more volatile, riskier class, but with higher expected returns; the BRIC countries (Brazil, Russia, India, and China) are the largest emerging stock markets

Most investors own between 25 – 50% of their stock allocation in Foreign companies and the balance in American companies. Foreign stocks have higher expenses, so some investors hold even less. This is constantly debated. The main thing is to choose a US/foreign mix that you can be comfortable with—and then stick to it!

Growth Versus Value

Each stock, regardless of its company’s size or geographic location, can be identified as either a growth or value stock. Nerdwallet suggests this easy way to differentiate the two:

- Growth stock: Think ‘The iPhone 5!’ It’s a stock that is expensive relative to earnings but investors think the price is justified by high potential for future growth; startups with negative earnings, but huge potential upside are growth stocks

- Value stock: Think ‘It’s on sale!’ It’s a stock that is low priced relative to earnings, dividends, or book value; there’s usually not much expectation this company’s stock price will skyrocket anytime soon, but investors are happy to hold it because there’s low downside risk and a high dividend yield (dividends paid per dollar invested)

- Blend: A mix of the two.

Company Size (small-cap, mid-cap, large-cap)

Market capitalization is just a fancy way of saying “How big is this company?” Market cap is defined as the total value of a company’s tradable stock (the number of outstanding shares times the price of a share). The breakdown is:

- Large-Cap: A company whose value exceeds about five billion. Think Wal-Mart;

- Mid-Cap: A company whose market value is in the middle, usually around one to five billion;

- Small-Cap: A company whose market value is smaller, typically less than one billion

- Micro-Cap: A very small company, often less than $300 million

This is important when it comes to diversifying your portfolio, since larger companies tend to be more stable and less risky than younger, smaller ones. Then again, smaller companies can have a lot more growth potential along with that risk. A diverse portfolio includes all company sizes.

So what?

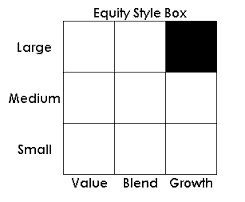

Now you can be comfortable looking at Morningstar’s famous style box for domestic equity (stock)—you’ve probably seen it before. It’s just a visual way of showing all your asset class options.

Industry or Sector?

Did you notice that the Morningstar style chart does not distinguish businesses that share the same or a related product or service. Does this surprise you? Perhaps you were expecting a US oil company stock and a US healthcare stock to be different asset classes? Segregation by industry, or sector, can lead to differences in investment strategy and hence differences in return. But these variations are not considered separate asset classes — the asset class remains US Equities.

Which asset classes will work best for my portfolio?

Well that’s the million dollar question! It’s easy to tell in hindsight. It’s impossible to predict for the future. But your starting point should be to own the total market.

Don’t look for a needle in the haystack. Own the whole haystack!

— John Bogle

It’s easy to own a slice of the whole thing with an index fund. From that solid foundation you can make adjustments if you wish to. For instance, you might choose to own some of a small-cap index fund if you seek higher risk and reward, or a small-value index fund with the same reasoning.

Confused? It may seem overwhelming, but all you really need to remember is to include a broad mix of asset classes in your portfolio. Strive for maximum diversification at the lowest possible cost.

Bonds as an asset class

Bonds are the safe side of your investment portfolio. Everybody should own some bonds. Unless you have a clear reason to do differently, a good rule of thumb is to “Own Your Age In Bonds”. So, a 20 year old investor might own 20% bonds and 80% stocks for their long-term investment portfolio. But a 60 year old approaching retirement would normally be much safer to have more than half of their investments in bonds. Choose a stock/bond allocation that works for your situation, but try not to change it more than 1% a year. (Resist the temptation to continuously tinker with your investing!)

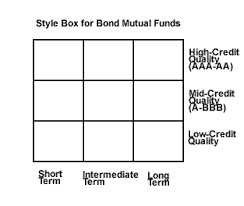

Don’t take risks with your bond investments. Choose only the highest level credit ratings. You’ll get better overall returns if you take your risk on the stock side of your portfolio.

That leaves the biggest decision to be the term of your bonds. But since bonds are your safety, you might want to consider an allocation to short-term bonds for your short-term money reserve and total bond (or even long-term TIPS) for your long-term needs.

A three-fund portfolio

This wonderful Boglehead forum discussion about a three-fund portfolio illustrates how perfectly wonderful a simple portfolio can be with just a stock fund and a bond fund. Except, instead of choosing a single index fund for all the stocks in the world, they use two funds for some practical reasons. Author Taylor Larimore says,

I have considered simplifying The Three Fund Portfolio to a Two Fund Portfolio (Total World + Total Bond Market). However, keeping Total U.S. Stock Market and Total International Stock Market separate has several advantages:

Lower Expense Ratio: Total Stock Market (VTSAX) = .05%; Total International (VTIAX) = .14%; Total World (VTWSX) = .30%

Lower Turnover (hidden cost): Total Stock Market = 4.3%; Total International = 4.9%; Total World = 11.8%

Better Tax Efficiency (5 years): Total Stock Market =.40; Total International = .67; Total World = .72

Better diversification (lower risk): Total U.S. Stock Market and Total International (combined) hold 9,388 stocks. Total World holds 7436 (3/31/14).

More U.S. stocks: Total World contains approximately 50% U.S. stocks. Many authorities, including Mr. Bogle, believe this is inadequate U.S. exposure for U.S. investors.

Flexibility: The ratio between U.S. Total Stock Market and Total International is flexible for investors wherever they live in the world or whatever their desire.