Keep it simple. That’s the mantra of many happy and successful investors, and the ninth of the Ten Rules of Investing For Beginners. A three-fund-portfolio will work just fine! Or, even a good one-fund portfolio if it has your desired allocation.

Next steps:

- Watch next video in this series: Rule #10: Stay the course.

- Download cheat sheet Ten Simple Rules to Common Sense Investing,

a printable 1-page PDF summarizes Boglehead Investing. - Take a free course: Common Sense Investing,

or Where Should I Put Money?

Read the transcript to Keep It Simple

Hearing the truth about investing is empowering. Yes! You can do this! But it’s imperative that you create a plan that you can stick to. Keeping it as simple as you can will help.

The magic that makes a plan work is to put something in writing. Something that you will look at and review every year. It forces you to write down what you are actually doing, and makes you realize what assumptions you are making.

Start with wherever you are! Don’t strive for perfection.

Successful investing involves doing just a few things right, and avoiding serious mistakes.

John C. Bogle

Write what you can about the big ticket items you can envision. You can always change these later. In a month, or a year, or two, or five, your goals will take shape and look something like this. Everybody’s objectives are different. Most of us have near term goals that get dwarfed by what we’ll eventually need for retirement. These are what motivate your most important habit: starting now and saving regularly. For instance: maybe we will decide to save by automatic paycheck investments; 5% of our gross income for short-term goals plus another 10% for retirement.

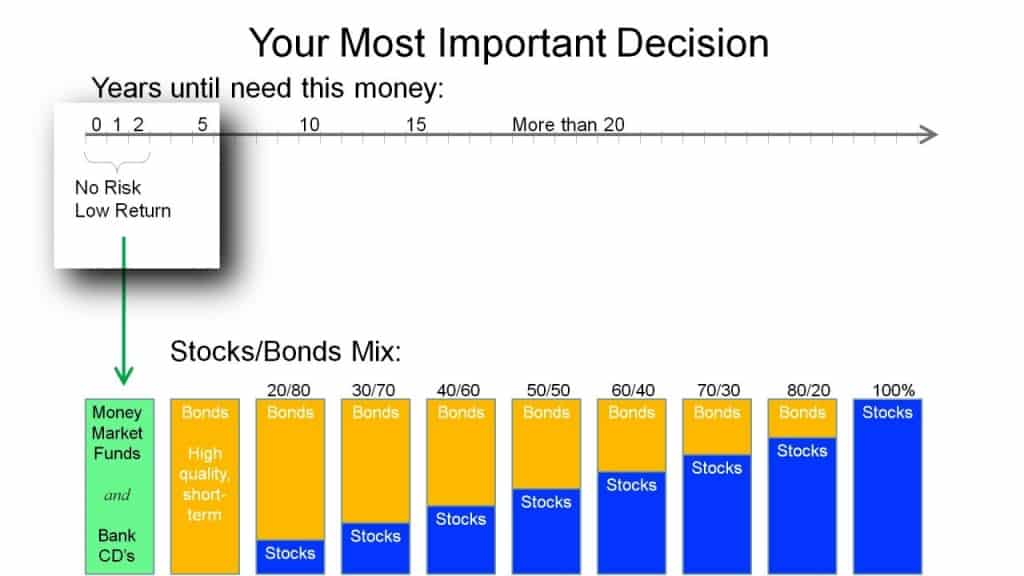

Next, is the most important decision, how much risk is appropriate for you to take on these investments. For your mid- to long-term goals, it’s simply the ratio of stocks and bonds you own. It is essential that you own both. You need to be at a level that’s appropriate for YOU. This asset allocation needs to be very stable. Many people become more conservative by increasing their bond percentage by 1% per year.

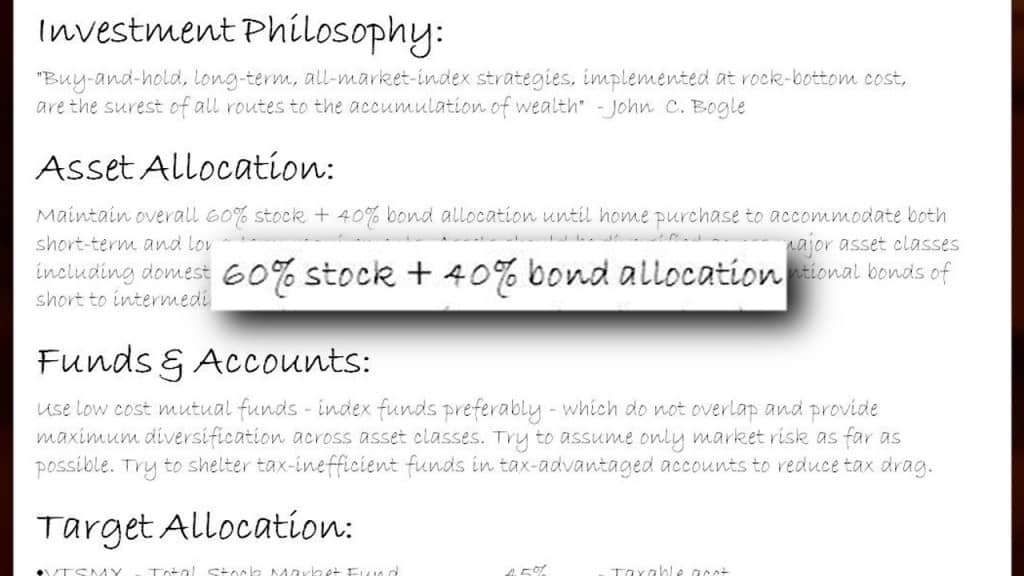

Although this(1) is also an excellent plan. Here they view all their investments together for both their short and long-term goals, and have decided to own a constant 60% stocks and 40% bonds every year until they purchase a home. Their stocks are further divided 3/4 US stocks, and 1/4 foreign stocks. Any good-quality low-cost bond fund works fine. The type of bonds is far less important than the amount of bonds.

You’ll want to take maximum advantage of taxable and tax-advantaged accounts. These are for everybody.

When it comes to selecting specific funds it is helpful to remind yourself what investment philosophy you believe in. He has this quote to help ground him in common sense. I liked it so this quote is in my own plan too.

“Buy-and-hold, long-term, all-market-index strategies, implemented at rock-bottom cost, are the surest of all routes to the accumulation of wealth.” – John C. Bogle

Buy-and-hold, long-term, all-market-index straegies, implemented at rock-bottom cost, are the surest of all routes to … wealth.

John C. Bogle

We talked a lot about what makes a good fund and which account you want to hold them in. Here are their fund selections and target allocations. He adds these final comments: ” Automate future contributions wherever possible. Rebalance yearly. No market timing. Exact sub-allocations are not as important as maintaining the overall 60/40 stocks/bonds allocation.”

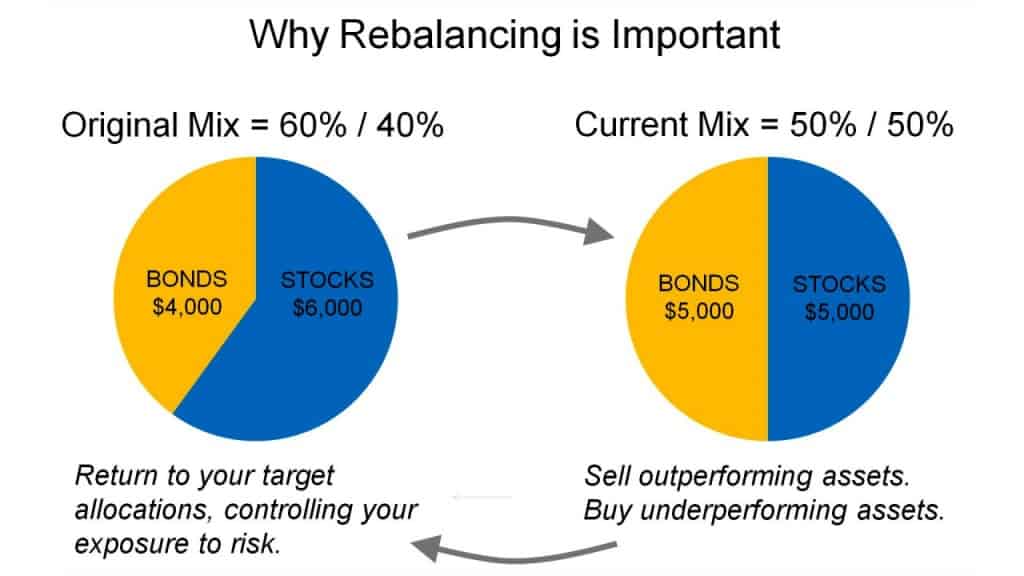

Every year he looks at this Investment Plan and compares with his actual investments. If stocks grew faster that year, he changes his future automatic monthly investments to buy more bonds. Maintaining the 60/40 allocation keeps his risk at his desired level.

In years when the stock market plummets, rebalancing means buying more stocks. It is psychologically hard to rebalance in a drop, and you’ll find a simple written Investment Policy Statement to be very helpful. You can do this if you have confidence that stocks will go up in the long run. Stocks are a long-term investment. There will be many bumps in the road: wars, recessions, high inflation, and stuff we haven’t even thought of.

I’ll post links to this(1) plan and others(2) in the transcript to this video. You can do this! And most likely, you MUST invest wisely to accomplish your life dreams.

It doesn’t need to be more complicated than this. Successful investing involves doing just a few things right, and avoiding serious mistakes.

Just strive for a rough draft your first year, but make sure it is written. As you review it every year it will improve in a natural way as you continue to learn. Resist the temptation to gussy it up with needless bells and whistles. Pretty soon you’ll have a robust plan and you’ll be accomplishing your objectives — and financing your dreams. After all, that’s why we do this, right?

Find other explanatory videos, smart tips, and links to useful resources at FinancingLife.org.

Related articles:

- Must-read guide: Smart Investing for Beginners

- Video overview of Intro: Ten Rules of Investing for Beginners

- Step 1: Develop a workable plan.

- Step 2: Start saving early.

- Step 3: Choose appropriate investment risk.

- Video overview of Step 4: Diversify.

- Video overview of Step 5: Never try to time the market.

- Video overview of Step 6: Use index funds when possible.

- Video overview of Step 7: Keep costs low.

- Video overview of Step 8: Maximize after-tax returns.

- Video overview of Step 9: Keep it simple.

- Video overview of Step 10: Stay the course.

- Video overview of The ABCs of Common Sense Investing

- Must-read guide: How To Build An All Weather Portfolio With Stocks and Bonds

- Courses at: FinancingLife Academy

Footnotes and Video Production Credits for Rule #9: Keep It Simple, consider a three-fund portfolio

(1) The plan in this video My-Investment-Plan is nearly identical to this plan

http://www.bogleheads.org/wiki/IPS#Real-World_IPS

(2) Here are other plans

http://www.bogleheads.org/forum/viewtopic.php?p=852539#852539

The opening photo is “View of Connecticut River Valley from Whately Massachusetts” by photographer John Phelan under the terms of the Creative Commons Attribution 3.0 license.

The opening/closing music “Because” is by David Modica from his Stillness and Movement album, published and licensed by www.Magnatune.com.

The closing photo “Trees in the Fog” is by Yann Richard under the terms of the Creative Commons BY 2.5 license.

This video may be freely shared under the terms of this Creative Commons License BY-NC-SA 3.0.

Video copyright 2009-2019 Rick Van Ness. Some rights reserved.

————————————————————————–

What’s your learning style? Would you prefer a book?

- to learn at your own pace?

- to mark with notes?

- to use as reference?

- to give as a gift?

- or, even just to support this non-profit educational website (thanks!)

Take a closer look at the paperback book.