Maximize after-tax returns! That is the eighth rule of Investing For Beginners. We could have lumped this into the last rule which was to keep costs low, but tax costs are so important that we made a special rule to minimize taxes. Use tax-advantaged accounts. Defer taxable gains to minimize taxes. Avoid funds with high turnover, and become a long-term investor.

Next steps:

- Watch next video in this series: Rule #9: Keep it simple.

- Download cheat sheet Ten Simple Rules to Common Sense Investing,

a printable 1-page PDF summarizes Boglehead Investing. - Take a free course: Common Sense Investing,

or Where Should I Put Money?

Read the transcript for Use Tax-Advantaged Accounts

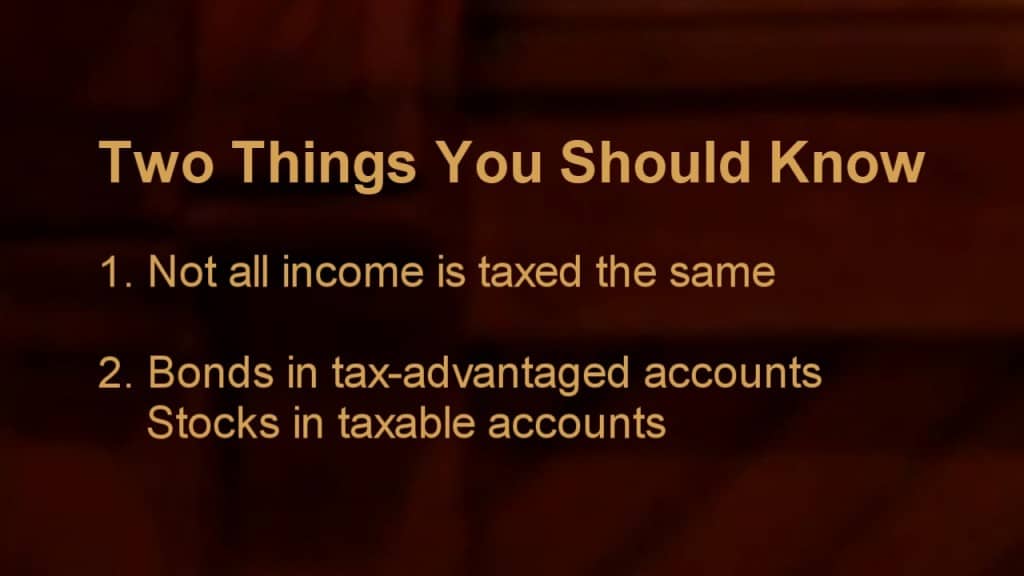

Two things every investor should know to be a smart taxpayer are that:

• not all income is taxed the same, so

• you generally want to hold bonds in a retirement account and stocks in a taxable account.

To understand this, let’s consider Sharon and Mark’s retirement account. We always start with a long-term plan which includes choosing risk and asset allocation BEFORE worrying about taxes. They have decided that the correct risk level for their retirement portfolio is 60% stocks and 40% bonds, increasing the allocation to bonds by 1% every year.

Their preference is own total stock market index funds, with 2/3 from US companies and 1/3 from international companies. For bonds, they chose a total US bond market index fund.

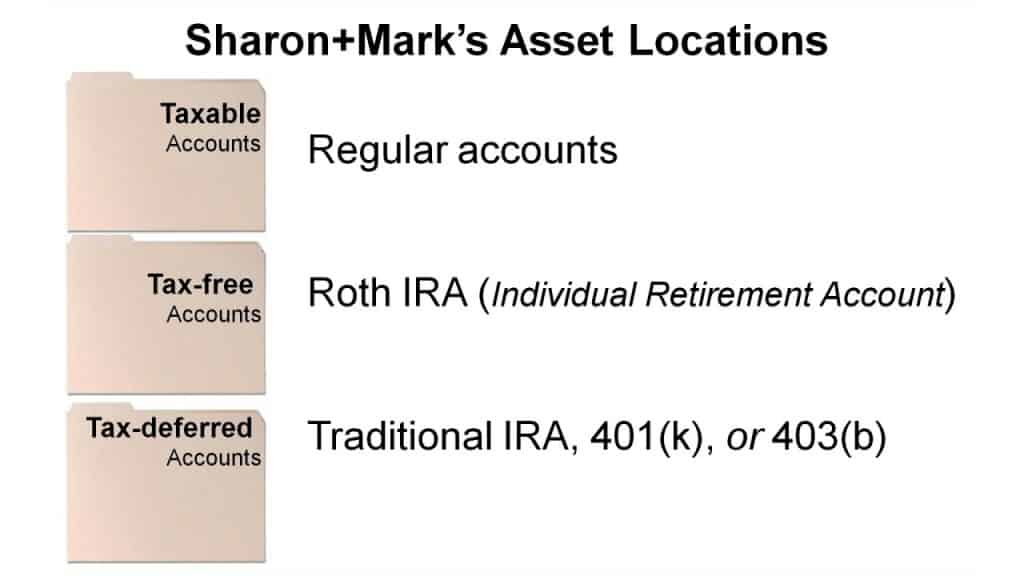

They’ve got taxable, tax-free, and tax-deferred accounts. Tax-advantaged accounts are the most tax-efficient place to invest so you’ll want to take maximum advantage of these.

Sharon’s been contributing to a Roth IRA with some of their after-tax earnings every year. All the growth in this account will forever be tax-free.

Mark has a 401(k) retirement program with his employer. This, like traditional IRA Accounts, is all tax deferred. They pays no taxes on income he invests here, or on any growth of these investments, until he uses it during retirement when it all gets taxed as ordinary income. Best of all, his company matches some of his contributions.

Let’s consider their tax situation. As they earn more income, the last dollars they earn get taxed at higher levels. Say they are in the 25% marginal tax bracket. While they pay less than 10% of their total gross income on federal income taxes, the important thing is that of the last dollar they earned in wages, 25% went to these taxes.

Now to the first point of this video. Let’s consider how their investments get taxed. It turns out that the interest and dividends that you earn from your bonds, bank CDs, and savings accounts are all taxed like ordinary income.

Now with stocks, you own a portion of these companies and they distribute some of their profits with you as dividends. Secondly, as the company grows, the value of the shares appreciate. So you hope to sell it for a higher price in the future. If hold the stock for a long time and the price goes up, not only do you get to defer paying taxes on the appreciation until you sell it, but this long-term-capital-gains tax is at a lower rate.

There’s more good news. Currently the earnings that are distributed every year as qualified dividends are also taxed at this lower rate!

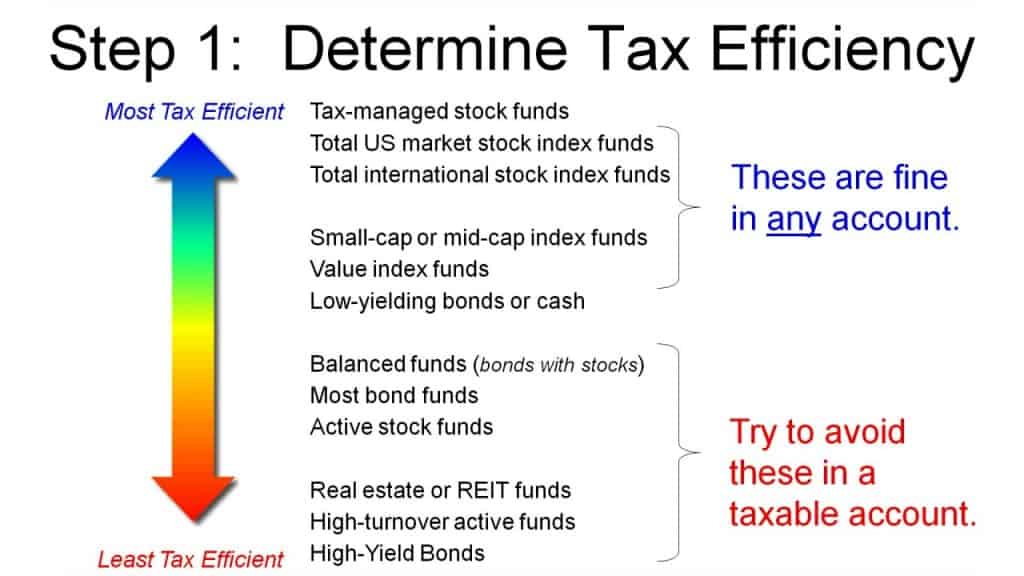

Now some mutual funds that are actively managed do lots of buying and selling, trying to beat the market. This turnover creates extra capital gains that we have to declare and pay taxes on now, instead of deferring these into the future like we would prefer. The best mutual funds are going to have low-turnover in addition to being low-cost and widely diversified. The best choices are usually index funds, but they aren’t always. It’s these attributes that are important.

Getting back to our example: after they’ve considered risk and asset allocation, Sharon and Mark determine the tax efficiency of each of their investment assets. We want to place the bonds in their tax-deferred retirement account, or more precisely, those investments that have the highest tax cost. This is the main point. So if you only remember one thing, remember this.

Other recommendations: generally keep your foreign stocks in your taxable account where you can get a foreign tax credit.

And usually put the fund with the highest expected return into a tax-free Roth IRA.

Fill up the remaining space in your tax-advantaged accounts with tax-efficient stock funds, and then hold the rest in a taxable account. For this example, here is how it ends up looking.

There are many other benefits to having stock funds in a taxable account, so I’ll provide you links to these topics if you want to explore them.

Tax Loss Harvesting

http://www.bogleheads.org/wiki/Tax_Loss_Harvesting

Whether to Reinvest Dividends in a Taxable Account

http://www.bogleheads.org/wiki/Whether_to_Reinvest_Dividends_in_a_Taxable_Account

Cost Basis Methods

http://www.bogleheads.org/wiki/Cost_basis_methods

Specific Identification of Shares

http://www.bogleheads.org/wiki/Specific_Identification_of_Shares

Placing Cash Needs in a Tax-Advantaged Account

http://www.bogleheads.org/wiki/Placing_Cash_Needs_in_a_Tax-Advantaged_Account

One topic that will impact all of you is record-keeping for your taxable account, since you usually want to keep track of the cost of every share that you buy so that when you sell it you can sell the highest cost shares first. I’ve got a link to tips for this as well in the transcript to this video.

Find other explanatory videos, smart tips, and links to useful resources at FinancingLife.org.

Related articles:

- Must-read guide: Smart Investing for Beginners

- Video overview of Intro: Ten Rules of Investing for Beginners

- Step 1: Develop a workable plan.

- Step 2: Start saving early.

- Step 3: Choose appropriate investment risk.

- Video overview of Step 4: Diversify.

- Video overview of Step 5: Never try to time the market.

- Video overview of Step 6: Use index funds when possible.

- Video overview of Step 7: Keep costs low.

- Video overview of Step 8: Maximize after-tax returns.

- Video overview of Step 9: Keep it simple.

- Video overview of Step 10: Stay the course.

- Video overview of The ABCs of Common Sense Investing

- Must-read guide: How To Build An All Weather Portfolio With Stocks and Bonds

- Courses at: FinancingLife Academy

Footnotes and Video Production Credits for Rule #8: Use Tax-advantaged Accounts

This topic is discussed more completely in this wiki article: Principles of Tax-Efficient Fund Placement

http://www.bogleheads.org/wiki/Principles_of_Tax-Efficient_Fund_Placement

Another good discussion of this topic is in The Only Guide to a Winning Investment Strategy You’ll Ever Need, by Larry Swedroe, pp 179-183.

The opening/closing music “Because” is by David Modica from his Stillness and Movement album, published and licensed by www.Magnatune.com.

The closing photo “Trees in the Fog” is by Yann Richard under the terms of the Creative Commons BY 2.5 license.

This video may be freely shared under the terms of this Creative Commons License BY-NC-SA 3.0.

Video copyright 2009-2019 Rick Van Ness. Some rights reserved.

————————————————————————–

What’s your learning style? Would you prefer a book?

- to learn at your own pace?

- to mark with notes?

- to use as reference?

- to give as a gift?

- or, even just to support this non-profit educational website (thanks!)

Take a closer look at the paperback book.