Smart beginning investors can often simplify their lives by using only a single fund that matches their needs for both risk and return. Investors should learn how these funds work so that they can evaluate whether a single fund, or a combination of a few funds, best fits their needs.

Summary of video: How Does a Target Date Fund Work?

A target date fund is a fund that gradually becomes less risky as you age. It’s generally a fund-of-funds so investors need to check whether this adds another layer of fund expense on top of the underlying fund expenses (called expense ratio). Vanguard is an example which primarily builds this from underlying index funds without adding any additional costs to integrate them into a single fund for your convenience.

The key challenge is to identify how much risk is important for you, and you need to think of this from the perspective of your total investments, not just a single fund or account. When you are totally unsure about this the old standby guidance of “own your age in bonds” is a worthy starting point. But that would suggest that your ownership of stocks decreases in a straight line and you will see that that these target date funds tweak that basic shape slightly. They refer to this shape as their glide path.

After you watch the video, you will find an excellent description of the Vanguard Target Date Funds on the Boglehead wiki and I suggest you compare any products you are considering against these.

Transcript of How Does a Target Date Fund Work?

Reduce Risk As You Approach Retirement

Christine: Hello and welcome to Target Date: Now. I’m Christine Rogers-Raetsch. Like any investment, target-date options are subject to risk. Markets go up, markets go down. When that happens, your balance in the investment will naturally change. It’s market risk and it’s just one type of risk that you’re exposed to when you’re invest.

There’s also interest rate risk, inflation risk, currency risk, I mean the list goes on. However, a Vanguard target-date investment will try to lessen the severity of some risk by gradually and automatically shifting its asset mix of stocks and bonds to a more conservative mix as you approach retirement. Which is a time when you’ll obviously need the money you’ve saved up.

In investment speak, we call this ongoing shift in the asset mix the glide path. Think of it as gliding into a more conservative stance as you get closer and closer to retirement. For more on the glide path, I’m please to be joined by the leader of Vanguard’s investment counseling and research group, John Americks. Welcome, John.

John: Thanks for having me.

Christine: John, you know that whenever we start talking about how target-date funds work, the glide path terms always pops up, so what is it exactly?

John: It’s a great question. I mean, the glide path sounds like a term out of aviation.

Christine: It does.

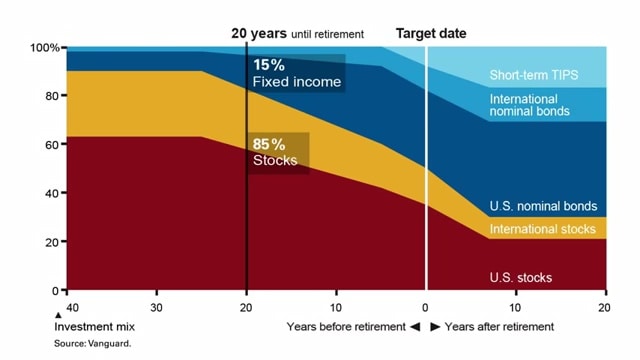

John: We’re talking about investments here, not aviation. It is really important to understand what a glide path is. It is on one page a description of what’s in a target-date fund and how it changes over time. We use the word glide path because in general what you’re going to see on this picture is that the equity allocation of a target-date fund continues to glide down as somebody approaches into retirement. That’s what the picture shows.

Glide Path Automatically Shifts Asset Allocation

It shows the asset allocation of the funds. It’ll show the different exposures that are there, the international piece of the equity markets, the domestic piece of the equity markets, the fixed income allocation, and it’ll depict how it changes over time.

Christine: Okay, so I think we have a graphic that shows hypothetically how glide paths work, so how exactly do they work?

John: Very important to understand as well, a lot of the value in target-date funds is in how this process works. As a target-date fund shareholder, it’s important to understand that you get all of these management services automatically by being invested in the fund.

The management includes both re-balancing the portfolio to its target allocations at any given point in time as well as moving the asset allocation, as I said earlier, gradually reducing the equity exposure over time, so very very important pieces of how it works on a daily basis.

In terms of specifics, the asset allocation does vary quite a bit over a lifetime and it’s important to understand that.

Christine: Okay.

John: Let’s start with what happens with a young person so someone let’s say that’s more than 40 years away from retirement and we could imagine that that person might retire at age 65. If they’re 40 years out, they’re going to get a portfolio that’s 90% in equities and 10% in fixed income, at least that’s the allocation within the Vanguard target-date funds.

Christine: Okay.

John: Roughly 20 years or so away from retirement, you’re down to about a 15% in bonds and 85% in equities again, a mix between international and U.S. equities, and then as you get closer to retirement, at the point of retirement you’re actually at 50/50. 50% stocks, 50% fixed income, again mixed between U.S. and international on the equity side, and then in between regular nominal bonds, international bonds and tips from the fixed income side.

Christine: At retirement, you’re at roughly a 50/50 allocation.

John: That’s correct, that’s right. In the Vanguard funds, that’s the way that it works. Now, there’s a point, this point at the point of retirement is where things can work differently for different target-date funds.

Christine: Okay.

John: In the Vanguard funds, the asset allocation’s going to continue to drop after the point of retirement.

Christine: Okay.

Glide Path Continues Beyond Retirement

John: It’s what we call a “through” version of the glide path. There are other providers that have what’s called a “to” version of the glide path, which just means that the asset allocation stops changing at the point of retirement.

Christine: All right. So for our through version, we keep changing through until about what? What’s the allocation look like?

John: That’s a great question and important to understand. It changes by another 20 percentage points. The asset allocation is going to decline from 50/50 to 30% in equities, 70% in fixed income. It’s going to hit that point about 7 years after the point of retirement, so 7 years after the target date, you get to that 30/70 mix.

Christine: So 30% equity, is that your most conservative, then, investment kind of mix?

John: That’s actually what we call the static asset allocation. It’s the asset allocation that lines up with Vanguard’s Target Retirement Income Fund, and it will stay that way, as long as there’s someone that continues to hold the funds.

Christine: I’m kind of surprised. I’m kind of surprised. That seems, it feels high to me.

John: Well, we still continue to believe that equities play a really important role for people in a long term portfolio, even as retirees. They’re still looking at needing many years of growth out of the portfolio, to keep up with some of the fastest rising expenses that they may see in their lifetime, some with medical care costs and other things rising.

They still need to get a little bit of extra return out of the portfolio. We think there’s the potential to do that with equities in the portfolio. Of course, it’s not guaranteed and there’s risk there but we think it’s well balanced by the 70% that’s in fixed income. As a portion of their overall assets, that asset allocation in the target-date fund really isn’t too aggressive.

Christine: All right. Just to be really really clear here, the stock portion of the Vanguard Target investment never really goes away.

John: That’s right. That’s really important to understand. It’s a balanced portfolio at all points in time. Relatively aggressive when you’re very young, as we said. You know, 40 years away from retirement, you’ve got a lot of time to go, many years to work and earn, so you can afford to take that risk, we believe.

Then as you get into retirement, you still have a long-term horizon. You still need some growth so having some equity still makes some sense.

Convenience

Christine: Let’s talk a minute about convenience. So you mentioned all this re-balancing going on. Is that one of the advantages of these funds?

John: It’s a huge advantage of these funds. When we’ve done surveys of target-date shareholders, one of the things that they find most attractive about the funds is the service aspect, this re-balancing and re-allocation that occurs over time.

Christine: That’s great. Well, thank you so much for breaking all this down for us, John.

John: You’re welcome. Thank you for having me.

Christine: Great. I’m Christine Rogers-Raetsch with John Ameriks, and you’ve been watching Target Date: Now. And by the way, if there’s something you’d like us to cover on a future episode or if you’ve seen something that you have a question about, let us know at vanguard.com/targetdatenow. Thanks for watching and we’ll see you next time.

Footnotes and Credits:

This video was produced by The Vanguard Group and was uploaded to their YouTube channel on May 31, 2013. I have created a summary and transcript to help you find spots that interest you and make the best use of your time.

The Vanguard Group is the largest provider of mutual funds in the world. Of high interest: Vanguard is owned by the funds themselves and, as a result, is owned by the investors in the funds. Founder and former chairman John C. Bogle is credited with the creation of the first index fund available to individual investors, the popularization of index funds generally, and driving costs down across the mutual fund industry.