Please watch the updated version of this investing for beginners video here: Rule#2: Start saving early.

The second of the Ten Rules of Investing For Beginners is: invest early and often! Start investing early. Start investing now. Automatic payroll investing is a secret that works for many. And then the power of compound interest is the reason this rule is so valuable for investors to earn the large amounts they’ll need to finance their retirements.

Next steps:

- Watch next video in this series: Rule #3: Choose appropriate investment risk.

- Download cheat sheet Ten Simple Rules to Common Sense Investing,

a printable 1-page PDF summarizes Boglehead Investing. - Take a free course: Common Sense Investing,

or Where Should I Put Money?

Read the transcript for Start Investing Early. Start Investing Now.

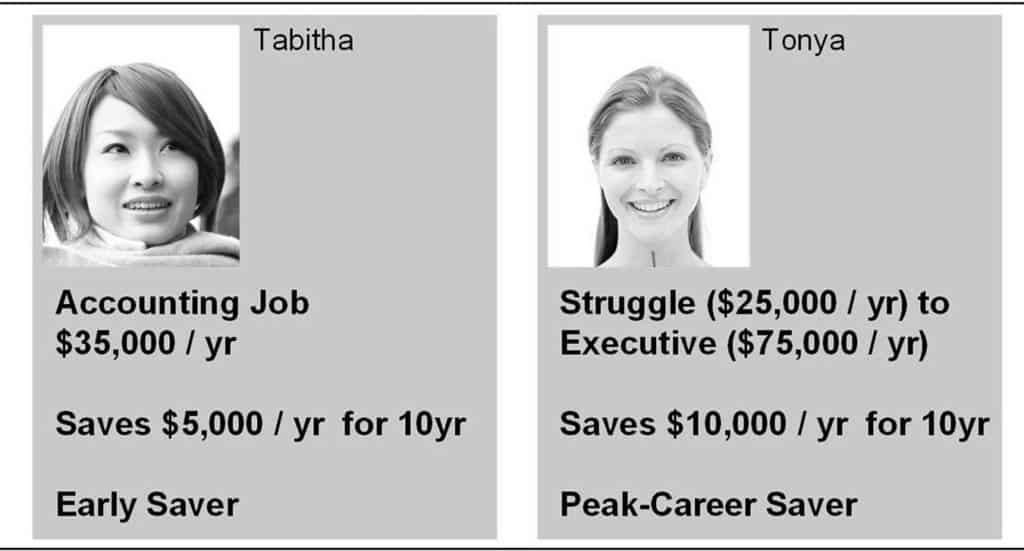

Hi, I’m Rick. To illustrate the miracle of compound interest and the importance of starting to save early, and starting to invest early. I’d like you to consider two women, Tabitha and Tonya.

Tabitha graduated from college at age 22 and took a job with a starting salary of $35,000. Right away she began saving $5,000 a year for her retirement. She kept up this routine for ten years, saving a total of $50,000 out of her own pocket. Then, at age 32, she decided to quit her job and become a full-time mother. While she did not contribute another dollar to her savings, her existing savings continued to grow until she retired at age 65.

Tonya, by contrast, took a lower paying job in an expensive part of the country. Her early years were a struggle and she saved nothing. But her career advanced with constant promotions. At age 40, she was a vice president making $75,000 a year. She finally felt like she was able to start saving for retirement, so she began putting away $10,000 a year. Tonya did this for ten years, saving a total of $100,000 out of her own pocket. At age 50, when her parents became very ill, she decided to quit her job to help take care of them so she stopped saving. Tonya’s existing nest egg only got to grow for fifteen more years before she turned age 65.

While both women’s investments grew at 10 percent per year, their nest eggs at age 65 were very different sizes. While Tabitha saved only half as much as Tonya out of her own pocket, she ended up with over $1 million more in her retirement.

The benefits of starting to save and invest early are simply enormous. Having time on your side and investing your hard-earned savings in a smart manner is the classic recipe for financial success.

Find other explanatory videos, smart tips and links to useful resources at FinancingLife.org.

Related articles:

- Must-read guide: Smart Investing for Beginners

- Video overview of Intro: Ten Rules of Investing for Beginners

- Step 1: Develop a workable plan.

- Step 2: Start saving early.

- Step 3: Choose appropriate investment risk.

- Video overview of Step 4: Diversify.

- Video overview of Step 5: Never try to time the market.

- Video overview of Step 6: Use index funds when possible.

- Video overview of Step 7: Keep costs low.

- Video overview of Step 8: Maximize after-tax returns.

- Video overview of Step 9: Keep it simple.

- Video overview of Step 10: Stay the course.

- Video overview of The ABCs of Common Sense Investing

- Must-read guide: How To Build An All Weather Portfolio With Stocks and Bonds

- Courses at: FinancingLife Academy

Footnotes and Video Production Credits for Rule #2: Start Investing Early; Start Investing Now.

This story is adapted from one written in On My Own Two Feet, by Manisha Thakor and Sharon Kedar, 2007, www.adamsmedia.com , pp 6-7. Used with permission.

The music is by Daniel Ben Pienaar. The audio segments are tracks from the “Prelude and Fugue No. 1 in C Major” on the album “Book 1 CD 1 Well-Tempered Clavier” published and licensed by www.Magnatune.com .

This video may be freely shared under the terms of this Creative Commons License BY-NC-SA 3.0.

Video copyright 2009-2019 Rick Van Ness. Some rights reserved.

————————————————————————–

What’s your learning style? Would you prefer a book?

- to learn at your own pace?

- to mark with notes?

- to use as reference?

- to give as a gift?

- or, even just to support this non-profit educational website (thanks!)

Take a closer look at the paperback book.