A simple planning tool can help you create a better personal financial plan. Here’s an example. This is a video demonstration of a free, simple-to-use, online planning tool. It can be useful for working Americans of all ages who are beginning to think about their personal investment plans.

This video reinforces these important principles:

* Start Saving Now; Not Later

* Make a Simple Plan

* Stick to Your Plan

* Use Passive Strategy (low-cost, broadly diversified)

* Use Bonds to Reduce Risk

It is not my intent to endorse or promote any particular software tool because I have not made such an evaluation. Rather, I think it is useful to try these simulators—with your eyes wide open to all their limitations—to help make decisions that you are facing today: like, “Am I saving enough?” They are not a substitute for making a personal investment plan and should not be relied on for long-term precision and predictions.

Video Transcript: On Track? Here’s a Simple Planning Tool

Hi, I’m Rick. Today I’m going to show you a great tool that gives you a quick big-picture view of Financing your Life. This is free on the internet—I’ll tell you more about that at the end. I like this because it is simple to use and shows you the consequences of alternatives. It helps you make informed choices.

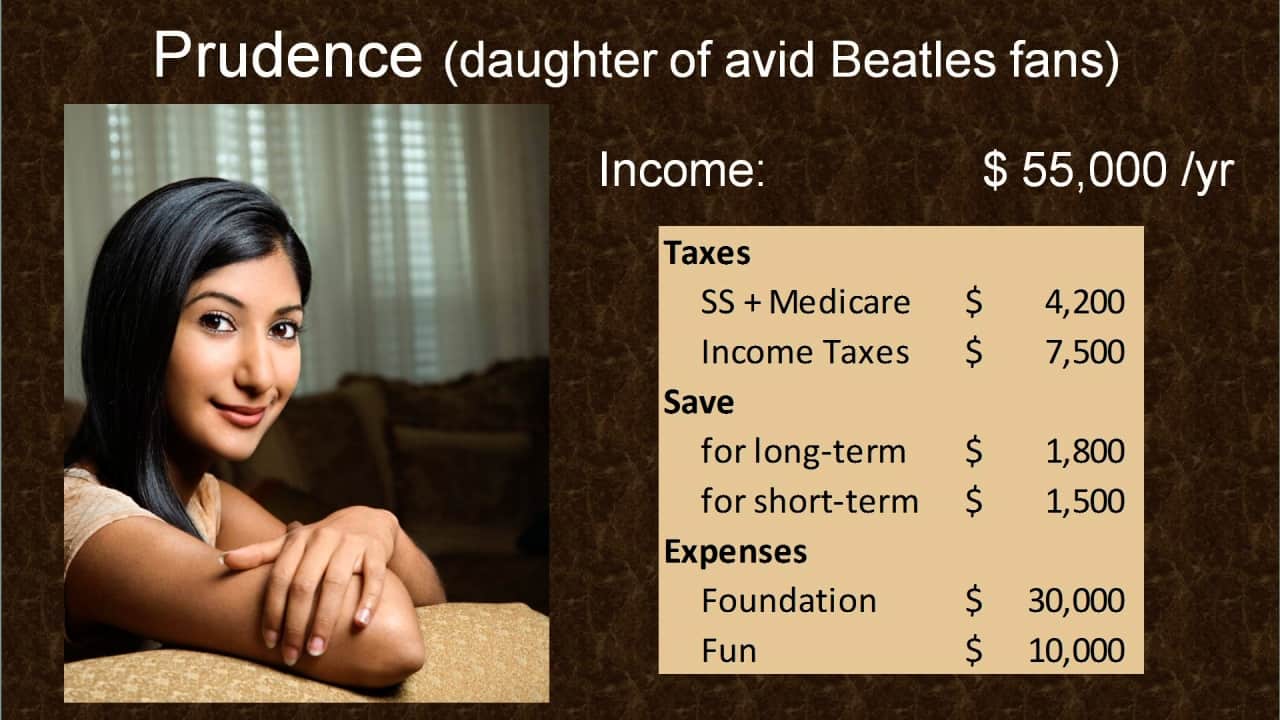

Everybody’s situation will be different, but just to get real let’s consider somebody. Here’s Prudence. She’s single, 30 years old, she asks whether she’s on track.

It’s never too early to create a simple plan, because you can always change and improve it. You don’t need special tools to make a plan. But sometimes tools like this can help you make your plan better.

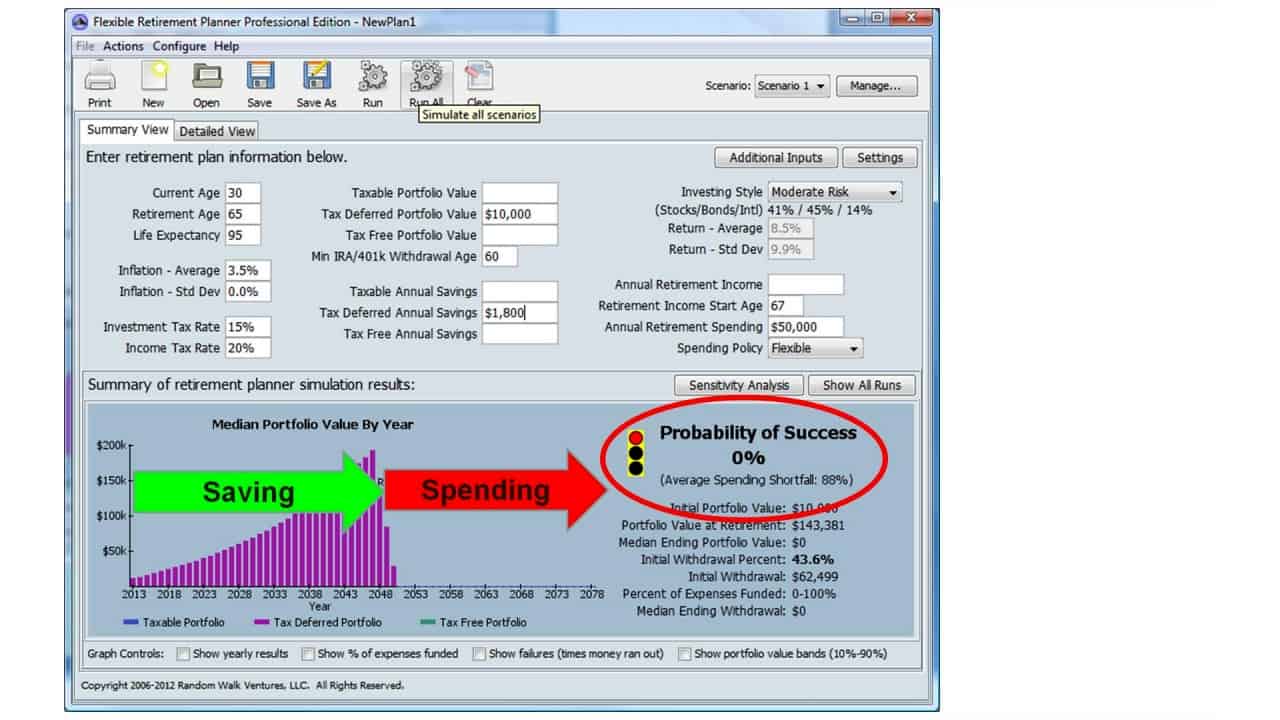

Here’s the input page. We can put in what we know about her: she’s 30, has $10,000 in some kind of retirement account like a 401k or an IRA, and she’s contributing $1,800 a year to that. Let’s click Run.

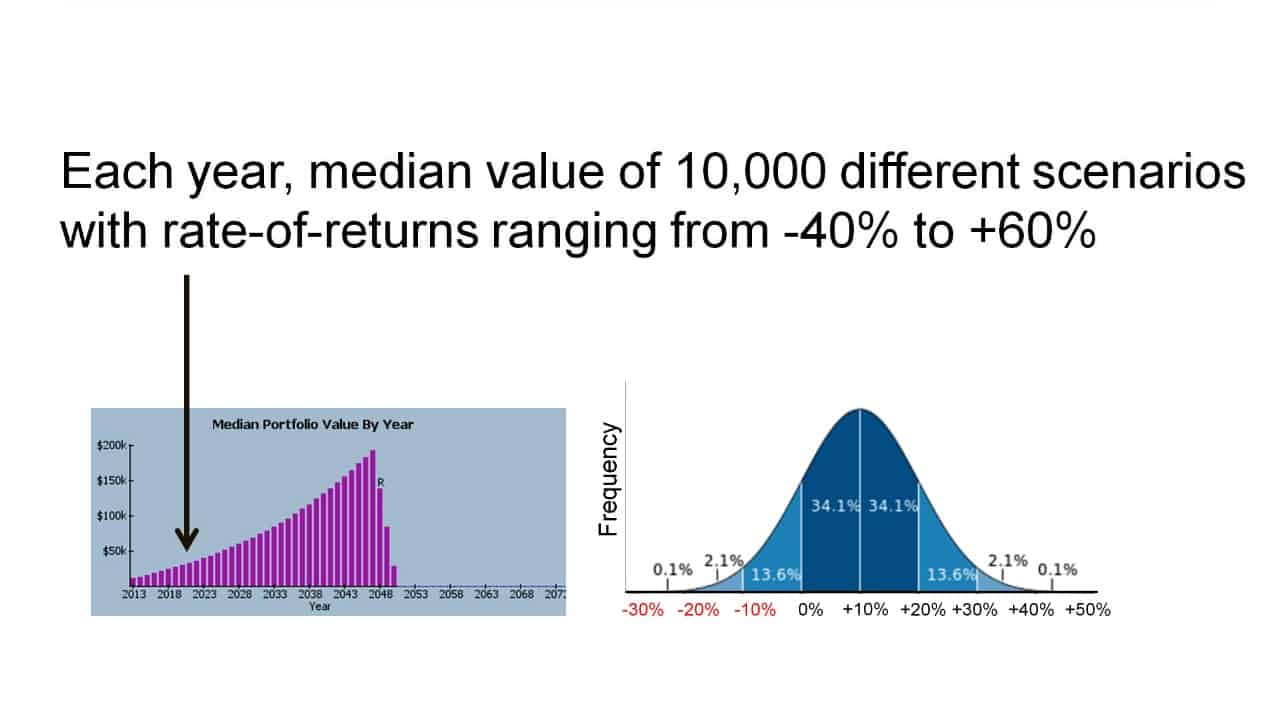

The result is the median value of her portfolio every year after 10,000 different scenarios. If we look behind the numbers we find the 10,000 rates of return are randomly considered for every year with about 2/3 of these within one standard deviation of a median value.

These years she’s accumulating wealth for retirement, these are spending during retirement, and this the probability of not running out of money.

We can change all these inputs, but the important one that we’ve left blank is any retirement income. Prudence expects to get Social Security. She can go online and find an estimate of what she might expect if she stays employed.

You know, if you’re a couple there’s a pretty good chance that one of you will live to age 95 and need savings to handle that. So let’s leave this.

Right now inflation is less than two percent. Three percent would be more typical. The important thing to know about this model is that all of your income and expenses will inflate by this number. But all the inputs and outputs to the model are in today’s dollars, which is the easiest way to think about it.

One choice she does have is to plan to work longer. Let’s add two more years here.

Well, that was helpful. We’ll leave that for now. But careful about leaning too heavily on this factor because many people get unwillingly downsized or are unable to maintain their careers.

Prudence, of course, would have no idea what her lifestyle will cost when she retires, so let’s assume the same type of lifestyle as she enjoys today, which we saw earlier was $40,000.

As we make these adjustments we also see an opportunity to choose whether we’re willing to be flexible or conservative in our retirement spending, but let’s keep it simple and choose Stable, where every year we need to fund exactly the same amount.

One rule-of-thumb is to save 10% of gross income for retirement, plus additional for short term goals. For Prudence this would require saving substantially more. That would make a big difference just like you’d expect.

Now some of you are wondering why this isn’t a terrific plan because it doesn’t look like it runs out of money. Remember, we’re looking at the median results. Half of the 10,000 scenarios were worse than this. For insight about that we’ll check the box to Show Failures. For many, the worst case is a recession right after you stop working. The way we reduce this risk is gradually own more bonds.

So, instead of owning a constant allocation of stocks and bonds, many use a rule-of-thumb to gradually reduce their portfolio risk as they age—from more risk than this when they are young, to less risk than this when they retire. The formula you choose is less important than sticking to it.

With this savings rate, any of these strategies have a good chance of achieving another popular rule-of-thumb: Save 25 times your annual need (before taxes) to support 30 years of retirement. You might also know this as the 4% safe withdraw rate.

Here’s her probability of success if she achieves that goal as she retires, with high-quality bonds making her risk below average, and slightly lower income taxes. The output of any planning model is only as good as the assumptions you use.

It’s worth pointing out that the average investor doesn’t achieve the market returns because of adviser fees, costs associated with the funds they choose, and poor investor discipline. It’s also very possible that the markets won’t be as attractive as they were in the last century. (See note 3 in footnotes below).

Prudence should be congratulated for working on her plan, but this tool indicates that she’ll need to substantially increase her saving rate to be on a solid path forward.

Get links to more information about this and other tools, a copy of her final plan, and other useful resources at FinancingLife.org/Prudence.

Resources

The Flexible Retirement Planner is free online with nice documentation and a support forum.

Here’s a list of other retirement calculators in the Boglehead Wiki.

Links to Social Security Administration in the Boglehead Wiki. If you create a (free) account you’ll be able to see exactly what you’ve paid in payroll taxes and what you can expect in future benefits.

Prudence’s one page Personal Investment Plan (often called Investment Policy Statement). (*.doc version)

Footnotes and Credits:

(1) is a Beatles song recorded on the White Album in 1968.

(2) Graphic of a standard deviation from Wikipedia.

(3) “Yes, during the past 25 years, while the stock market index fund was providing an annual return of 12.3 percent and the average equity fund was earning an annual return of 10.0 percent, the average investor was earning only 7.3 percent a year.” — John C. Bogle, The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns, 2007, p51.

This video may be freely shared under the terms of this Creative Commons License BY-NC-SA 3.0.

Hello There. I discovered your blog using msn. This is an extremely neatly written article.

I’ll be sure to bookmark it and come back to read extra of your useful info.

Thank you for the post. I’ll definitely return.

Hey I am so happy I found your site, I really found you

by accident, while I was searching on Digg for something else, Regardless I am here now and would just like to say many thanks for a

incredible post and a all round enjoyable blog (I also love the theme/design), I don’t have time

to browse it all at the minute but I have saved it

and also added in your RSS feeds, so when I have time I will be back to read a great deal more, Please do

keep up the fantastic work.

Excellent article. I certainly appreciate this site.

Stick with it!

Cora,

What a wonderful comment to come back to! Thank you so much. And please do return to the website—you can learn at your own pace. Consider becoming a subscriber and get the short article “Why Bother With Bonds”. It’s particularly relevant with the stock market setting new record highs and the bonds still at miserable lows. But they are important. Learn why. All the best to you! -Rick

Sweet internet web site , super layout, real clean

and utilize pleasant.

Thanks! Tell you friends. Seriously, you’ll not only help your friends but hopefully help others to discover us. Our whole mission is to help teach the common sense investing principles that should be taught in schools, but isn’t.

Thank you for the informative video Rick. I really appreciate your insights and resources.

Thank YOU for the kind comment Meredith! 🙂