What matters more — your personal savings rate or your investing rate of return?

Saving is far more important for the majority of Americans. But that is because most people don’t save very much at all, and without savings you cannot invest.

But this article is for people with goals, and the full answer is much more interesting. And this is true, whether you make $25,000 a year or $250,000 a year…

Investment returns are always important, but in the initial years savings rate is more important than your investment returns. The real impact of returns (the miracle of how they compound) is realized when the portfolio has become a reasonable size. Until then, it’s more about your saving rate.

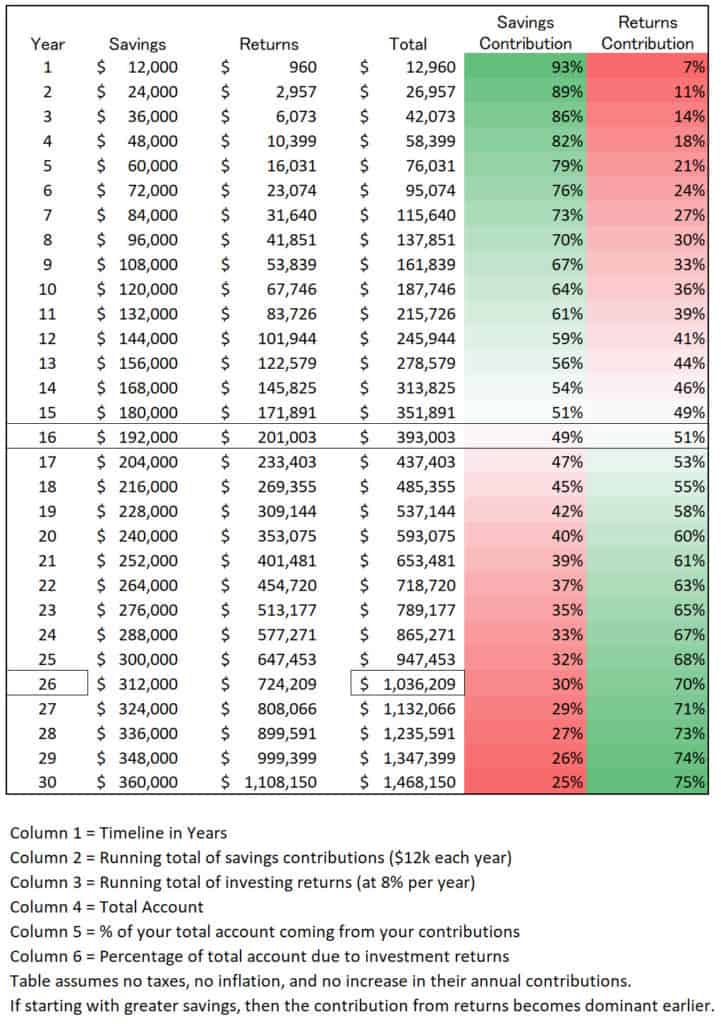

Example: This couple’s goal is to retire with a million dollars. This is because need $80,000 per year for living expenses, expect half of this to come from Social Security, and will draw down their million-dollar nest egg at 4% per year for the other half. Together they are contributing $12,000 per year into a total stock market index fund. The table below shows this numerically assuming a constant 8% total return.

Column 2 shows what they save (your contributions) and column 3 the investment returns generated. In the initial years, the savings contribute more to the total value than compared to investment returns.

Beginning year 17, before the total is half way to the million dollar goal, the rate of return on the investments become dominant. By year 27 they have reached their $million goal.

Conclusions

If you still haven’t got a large portfolio, or it is still early days of saving for you, then focus more on increasing your savings rate than worrying unnecessarily about the market returns.

For a diversified investor, returns will be what they’ll be. The best you can do is to accept that and don’t let your emotions get in the way. A far better use of your time and energy is to focus on what you can control: moving forward in your career, living within your means and saving more.

Your savings rate matters much more than you think.

Moreover, your savings rate is a factor that you can actually control whereas you can’t control market returns. And this reminds me of the artful book chapter by Andrew Tobias called

“A Penny Saved in Two Pennies Earned”

Andrew Tobias

For retiring investors, remember that this remains true even after you’ve reached your goal. Your prudent move is to remove unnecessary risk, or more eloquently:

Once you’ve won the game, stop playing.

William J. Bernstein

In other words, once the game has been won by accumulating enough safe assets to retire on, it makes little sense to keep playing it, at least with the “number”: the pile of safe assets sufficient to directly provide or indirectly purchase an adequate lifetime income stream.

William J. Bernstein

Bernstein, William J (2012-06-18). The Ages of the Investor: A Critical Look at Life-cycle Investing (Investing for Adults) (Kindle Locations 51-52). Efficient Frontier Publications. Kindle Edition.