Please watch the updated version of this investing for beginners video here: Rule#3: Control investment risk and return.

The third of the Ten Rules of Investing For Beginners is to never bear too much risk, or too little. Control investment risk and return with asset allocation! Too often, investors that are holding too much risk (too much stock, too little bonds) sell when the market falls (or, exactly the wrong time).

Next steps:

- Watch next video in this series: Rule #4: Diversify.

- Download cheat sheet Ten Simple Rules to Common Sense Investing,

a printable 1-page PDF summarizes Boglehead Investing. - Take a free course: Common Sense Investing,

or Where Should I Put Money?

Read the transcript for Choose Appropriate Risk and Return with Asset Allocation

This video is about your most important decision: asset allocation. How much of your investment should be in stocks, and how much should be in bonds. This is all about managing risk. How much risk should you take? And how, exactly, do you go about that?

There are safe places to put your money and it might grow like this. After-taxes, it’s not likely to keep up with inflation. You have many choices to earn a higher return but all are less predictable, which means that the money might not be there when you need it. So variability of the return is one good measure of risk.

If we plot that risk, or variability, with the return on investment, our risk-free alternatives go here. Treasury bonds are not risk-free because their value varies with the current interest rate. Stocks have a high risk and return.

Distilled to its essence, investing is about earning a return in exchange for shouldering risk. Here’s the catch that many investors miss: this is only true for diversified portfolios. For instance, you could buy the S&P500 which is a low-cost benchmark index of the 500 largest companies.

But if you were to pick any one of them your risk would be far greater. Even any five of them, or ten, or twenty. Examples of this specific company risk that can be diversified away might be the departure of a key executive, the outcome of an important court case, or employees going on strike.

Don’t put all your eggs in one basket is the popular cliche. You simply don’t get rewarded for the risk you are taking. It moves you from investing, to speculating. “Concentrating your portfolio in a few stocks maximizes your chances of getting rich. Unfortunately, it also maximizes your chance of becoming poor.”1

Bonds are the other essential ingredient because they behave differently than stocks. So you need to learn about both of these. The ratio of stocks to bonds you own is your key lever that controls your risk.

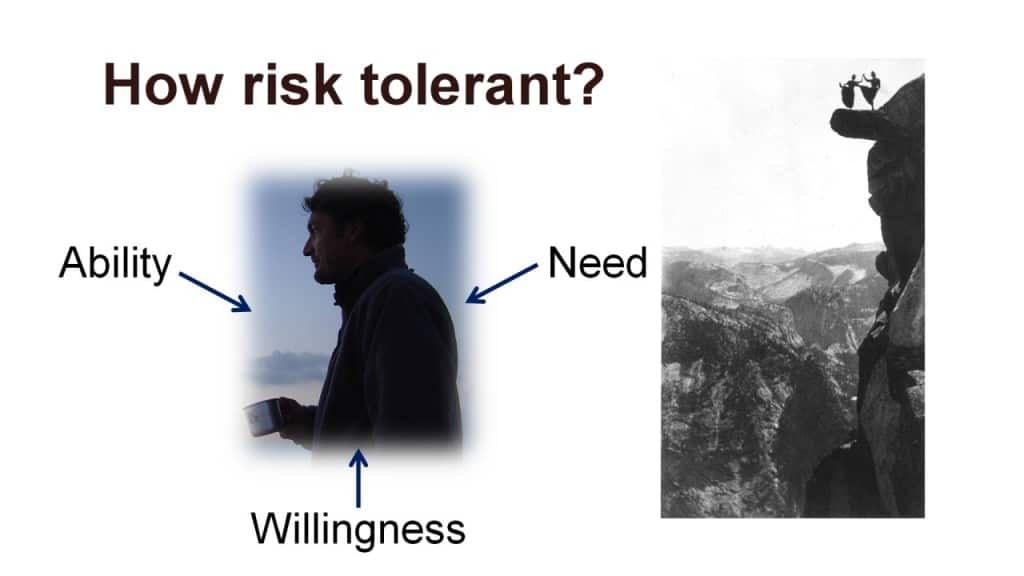

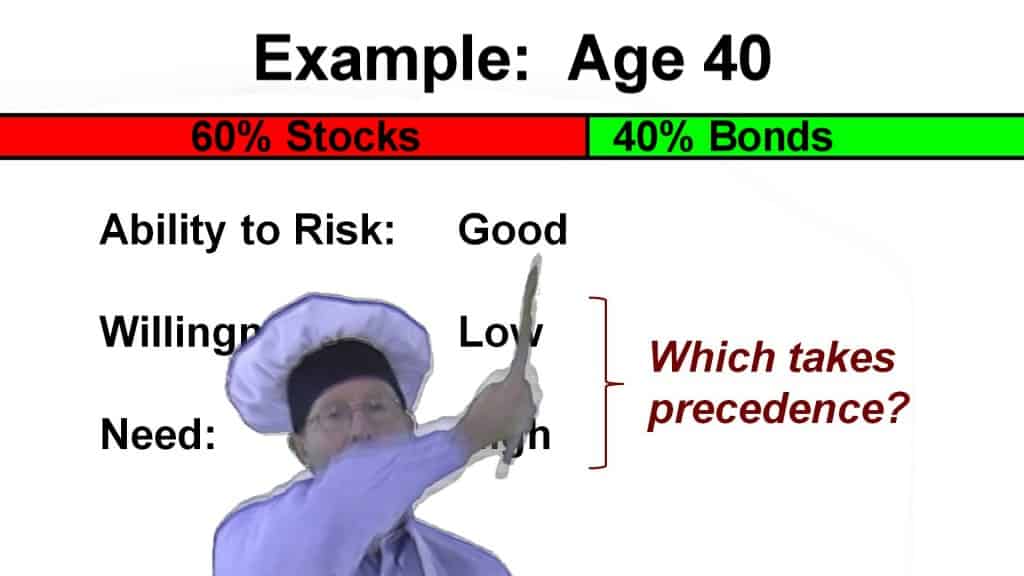

There is no “right” portfolio, but there is one that is best for YOU. In order to determine what it is, you must think about your ability, willingness, and need to take risk.

Your ability to take risk is determined by your investment horizon and the stability of your income. At the beginning of this series you considered how much money you needed for your goals, and when. The longer you have, the better you can weather the inevitable market downturns. If you need the money in a few years you should keep it out of the stock market. Money that you won’t need for 10 or 20 years might be best in stocks. Also, the more stable your job, the greater your ability to handle the risks of owning stocks.

Nick is a 30 year-old who’s been saving aggressively for 8 years. He is saving half of his money for a new house in a few years and the other half is for his retirement. It is important for him to keep the risk out of his money that he might need in the short-term. His retirement investments might be as much as entirely in the stock market–depending on these other considerations.

Next, consider your willingness to take risk. As we saw before, the stock market has high long-term returns, but in the short term it is very volatile. Any year your stock could lose half its value. The key thing is how you will behave during the next recession. If you sell when the market is low–you do yourself a real disservice. You are better off starting with a number you can live with and then stick to it!

Finally, your need to take risk is determined by your financial goals and what rate of return is required to achieve them.

Now, if you are 40 years old, very risk averse and haven’t started to save for your retirement yet, then your willingness to take risk might conflict with your financial needs. You will need to either earn more, save more, retire later, acquire the temperament to carry more risk (more stocks), or some combination.

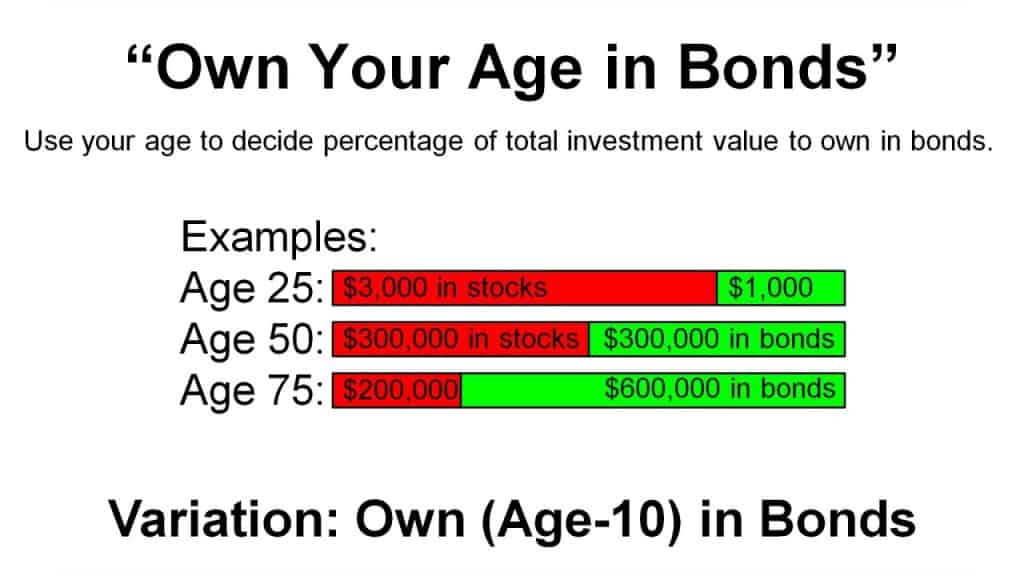

If you are having trouble choosing what level is right for you, I will tell you that I think a good starting place is the advice to “Own Your Age in Bonds”. So, a 25 year old might own 25% bonds and 75% stocks, gradually changing these by 1% every birthday.

Once the stocks and bonds decision is made, you can move on to the decision on what types of mutual funds you’ll want to own.

Find other explanatory videos, smart tips, and links to useful resources at FinancingLife.org.

Related articles:

- Must-read guide: Smart Investing for Beginners

- Video overview of Intro: Ten Rules of Investing for Beginners

- Step 1: Develop a workable plan.

- Step 2: Start saving early.

- Step 3: Choose appropriate investment risk.

- Video overview of Step 4: Diversify.

- Video overview of Step 5: Never try to time the market.

- Video overview of Step 6: Use index funds when possible.

- Video overview of Step 7: Keep costs low.

- Video overview of Step 8: Maximize after-tax returns.

- Video overview of Step 9: Keep it simple.

- Video overview of Step 10: Stay the course.

- Video overview of The ABCs of Common Sense Investing

- Must-read guide: How To Build An All Weather Portfolio With Stocks and Bonds

- Courses at: FinancingLife Academy

Footnotes and Video Production Credits for Rule #3: Choose Appropriate Risk and Return with Asset Allocation

(1) The Four Pillars of Investing, William Bernstein, 2002, p.101.

Special thanks to Jennifer Howell for her valuable feedback and encouraging words.

The opening/closing music “Because” is by David Modica from his Stillness and Movement album, published and licensed by www.Magnatune.com.

The closing photo “Trees in the Fog” is by Yann Richard under the terms of the Creative Commons BY 2.5 license.

The photo “Dancing ladies on overhanging rock” was taken at Glacier Point, Yosemite in the 1890s by George Fiske and later promided to San Joaquin Valley Library System as a contribution to education and scholarship.

An excellent discussion about ability, willingness, and need to take risk is in The Successful Investor Today by Larry E. Swedroe, 2003, pp 222-225.

This video may be freely shared under the terms of this Creative Commons License BY-NC-SA 3.0.

Video copyright 2009-2019 Rick Van Ness. Some rights reserved.

————————————————————————–

What’s your learning style? Would you prefer a book?

- to learn at your own pace?

- to mark with notes?

- to use as reference?

- to give as a gift?

- or, even just to support this non-profit educational website (thanks!)

Take a closer look at the paperback book.