Diversification is important for investing because the portfolio will yield higher returns at lower risk. In fact, owning the market portfolio will provide the maximum investment return per unit of risk. The other extreme, owning individual stocks, might have a potentially higher return but at substantially greater risk. Not just greater risk, but uncompensated risk—because the market will not reward you for carrying risk that can be diversified away. Learn the fourth of the Ten Rules of Investing For Beginners is: Diversify stocks!

Diversification is important for investing because the portfolio will yield higher returns at lower risk.

This video introduces this fundamental financial principle that is called Modern Portfolio Theory. It’s not just spreading risk (aka. “don’t put all your eggs in one basket”). The heart of this is that every risky asset will improve the return/risk of the portfolio if that asset is not perfectly correlated with the portfolio. In other words, stocks that don’t move together help the portfolio.

Diversification is important for investing because there is some combination of risky assets that is superior to all other combinations and any of the assets individually.

Astoundingly, there is a best portfolio: the Market Portfolio. It is when each of the assets is held in proportion to its size (it’s capitalization). This logically has to be true because all investors seek this and this is the point where the market clears. It allows us to say: Diversification is important for investing because it enables investors to get the highest return for the lowest unit of risk. And this is very easy to own with modern low-cost total market index funds.

Stocks and bonds are poorly correlated so work well together, but here’s an important point. It is important to hold the highest quality bonds for this to be true when stocks tumble. Also, investors get rewarded better for investment risk on the stock side of their portfolio than on the bond side. There is no advantage to diversifying the highest quality bonds (e.g. U.S. Treasury bonds) because the credit risk is already as good as it gets.

Next steps:

- You might also like: Warren Buffett on Diversification (video). Listen to Warren Buffett explain why 99% of Americans should pursue extreme diversification by way of index funds at the lowest possible cost.

- Watch next video in this series: Rule #5: Never try to time the market.

- Download cheat sheet Ten Simple Rules to Common Sense Investing,

a printable 1-page PDF summarizes Boglehead Investing.

Read the video transcript to Diversification is Important in Investing!

Previously we saw how owning many stocks eliminated “specific company risk”, which is risk that can be diversified away. Now we are going to see that it is not enough to simply own hundreds of companies. You’ll learn the great advantage of owning poorly correlated assets. This part is truly cool! “Magical.”

Diversify stocks by owning all of them

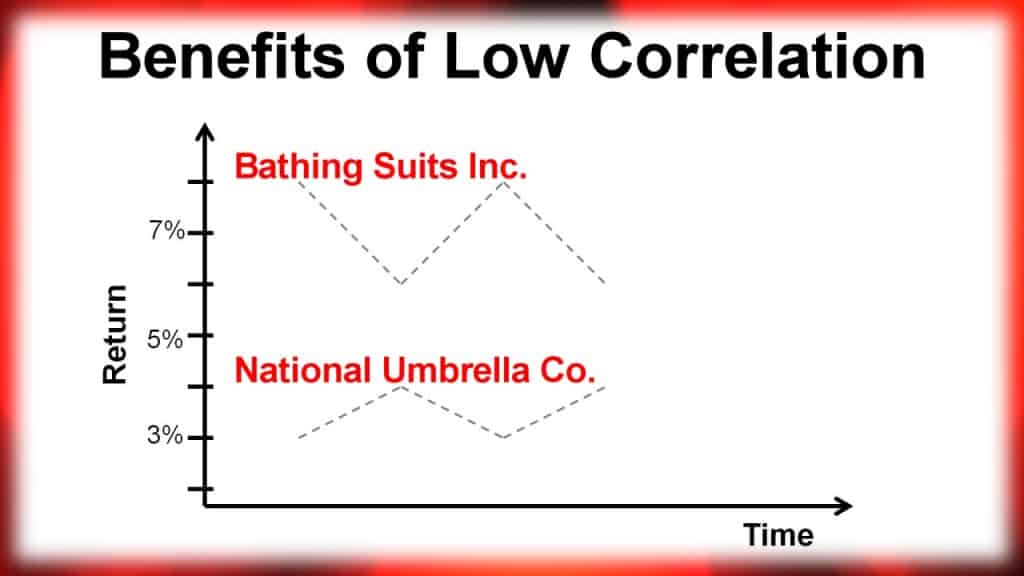

To help me show you, let’s imagine two companies: Bathing Suits Inc. and National Umbrella Company. A rainy year means sales at the Bathing Suit company fall but the umbrella company does well. In a sunny year, the bathing suit company does well and the sales of umbrellas fall.

The price of these company stocks move in opposite directions so they are negatively correlated. The Bathing Suit company is more volatile because the total annual return has an average value of 7% but a variable component of plus or minus 1%. This is both higher return and higher risk than the umbrella company which has an average return of 3.5% plus or minus 1/2%.

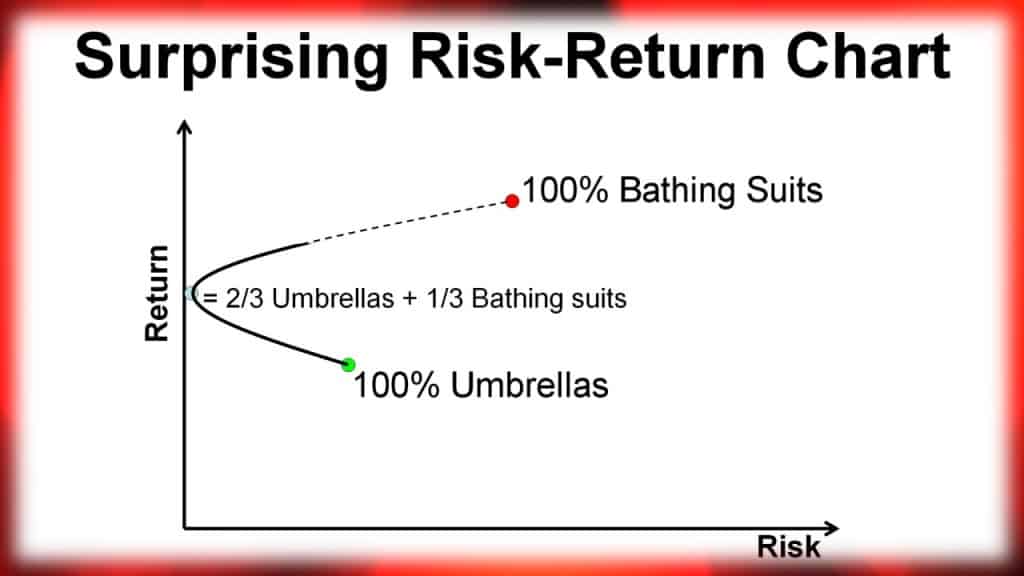

This is the magical part. Look what happens if you invest 2/3 of your money in the umbrella company and 1/3 in the bathing suit company. WOW! Adding some of the more volatile company not only increases the average return, but it lowers the variability (or risk). Pretty much a free lunch!

Here what it looks like on a risk-return chart. The Bathing Suit Company is up here with twice the expected risk and return as the umbrella company. If you owned 100% of the umbrella company you’d be here. Now if you gradually invest part of your portfolio in the more risky Bathing Suit Company, your returns increase as you expected, but your risk, as measured by the variability of that return, actually decreases. Owning both is superior to only owning either of the companies.

Further, diversify stocks with bonds

Negatively correlated companies are hard to find and still achieve diversified investments, so we look for the next best thing: poorly correlated investments. Recall that the price of bonds move in the opposite direction of interest rates. But interest rates don’t impact the sales of bathing suits and umbrellas at all, and the weather doesn’t impact the price of bonds. So we pretty generally say that the stock market and Treasury Bonds are nearly uncorrelated and we get this same magical benefit. Adding a little of the stock market to an all-bond portfolio not only increases the returns but decreases the risk.

This is precisely how it works in the real world. Say you determined that 50% stocks and 50% bonds was the right level of risk for you. Instead of being here like you might expect, the fact that stocks are poorly correlated with bonds puts you here. You can think of it as less risk for a given rate of return, or more return for a given level of risk.1

What else can we do? If we take a closer look at stocks, we find out that the primary factors that determine the outcome of stock investments in the long-term are: size of the companies, whether they are a glamorous growth company or a less glamorous value company, and then what region of the world it is in.2

It is easy to diversify with low-cost index funds

The S&P500 companies are so huge that this famous benchmark index is a good approximation of the entire US Stock Market. It encompasses both large Value and large Growth companies. Alternatively, choose a Total US Stock Market Index fund to further diversify with smaller companies and to now own a portion of several thousand companies!

Stocks in foreign companies are even less correlated3 with the US stock market, but are more expensive to own and have added risk from currency exchange fluctuations. Many investors make 1/4 to 1/2 of their total stock percentage a broad international stock index fund.

You’ve started a plan with goals and a saving routine that might look something like this. In the last video you choose an appropriate level of stocks and bonds that matched your ability, willingness, and need to take risk. That’s always your most important decision. So, here is what your target allocations might look like now.

Bonds are much simpler. You can keep the risk out of bonds by keeping them short- to intermediate-term, and very high quality. To diversity against inflation it is popular to make half of them US Treasury bonds called “TIPS”, for Treasury Inflation-Protected Securities.

Conclusion

- Diversification eliminates risk that can be diversified away.

- For 99% of people (i.e. all ordinary investors) stock diversification is important in investing because it it improves portfolio returns, lowers portfolio risk, or both.

- Add high-quality bonds to control overall portfolio risk.

- Building an outstanding portfolio doesn’t have to be complicated at all!

Find other explanatory videos, smart tips, and links to useful resources at FinancingLife.org.

Related articles:

- Must-read guide: Smart Investing for Beginners

- Video overview of Intro: Ten Rules of Investing for Beginners

- Rule #1: Develop a workable plan.

- Rule #2: Start saving early.

- #3: Choose appropriate investment risk.

- #4: Diversification is important in investing.

- #5: Never try to time the market.

- #6: Use index funds when possible.

- #7: Keep costs low.

- #8: Maximize after-tax returns.

- #9: Keep it simple.

- #10: Stay the course.

- The ABCs of Common Sense Investing

- Must-read guide: How To Build An All Weather Portfolio With Stocks and Bonds

- Courses at: FinancingLife Academy

Footnotes and Video Production Credits for Rule #4: Diversification is Important in Investing Because…

(1) The benefits of poorly correlated assets is today known as Modern Portfolio Theory for which several won the Nobel Prize. This particular Stocks & Bonds chart reproduces one in All About Asset Allocation, by Richard Ferri, 2006, p.45.

(2) The importance of company size and style (growth vs value) for predicting stock investment outcome is today known as he Fama-French Three Factor Model.

(3) The correlation of various asset classes to the S&P 500 Index is listed in The Only Guide To A Winning Investment Strategy You’ll Ever Need, 2005, by Larry Swedroe, p 144.

The opening/closing music “Because” is by David Modica from his Stillness and Movement album, published and licensed by www.Magnatune.com.

The closing photo “Trees in the Fog” is by Yann Richard under the terms of the Creative Commons BY 2.5 license.

Copyright 2019 Rick Van Ness

————————————————————————–

What’s your learning style?

Would you prefer a book to:

- learn at your own pace?

- mark with notes?

- use as reference?

- give as a gift?

or, even just to support this non-profit educational website (thanks!)

Take a closer look at the paperback book.