Everyone needs to understand ten simple rules if they want to learn how to invest. This is the smart investing strategy that many thousands of people call this Boglehead Investing, and although I call it Common Sense Investing, both names are endearing references to John C. Bogle who for half a century has been the world’s tireless champion for ordinary investors.

Although simple, these truths become meaningful once you’ve established a sound financial lifestyle. Creating income and budgeting wisely produce savings that can be invested. Then you’ll be ready to learn why investing is imperative for financing life and then you’ll be ready to learn where to put that money to finance your dreams.

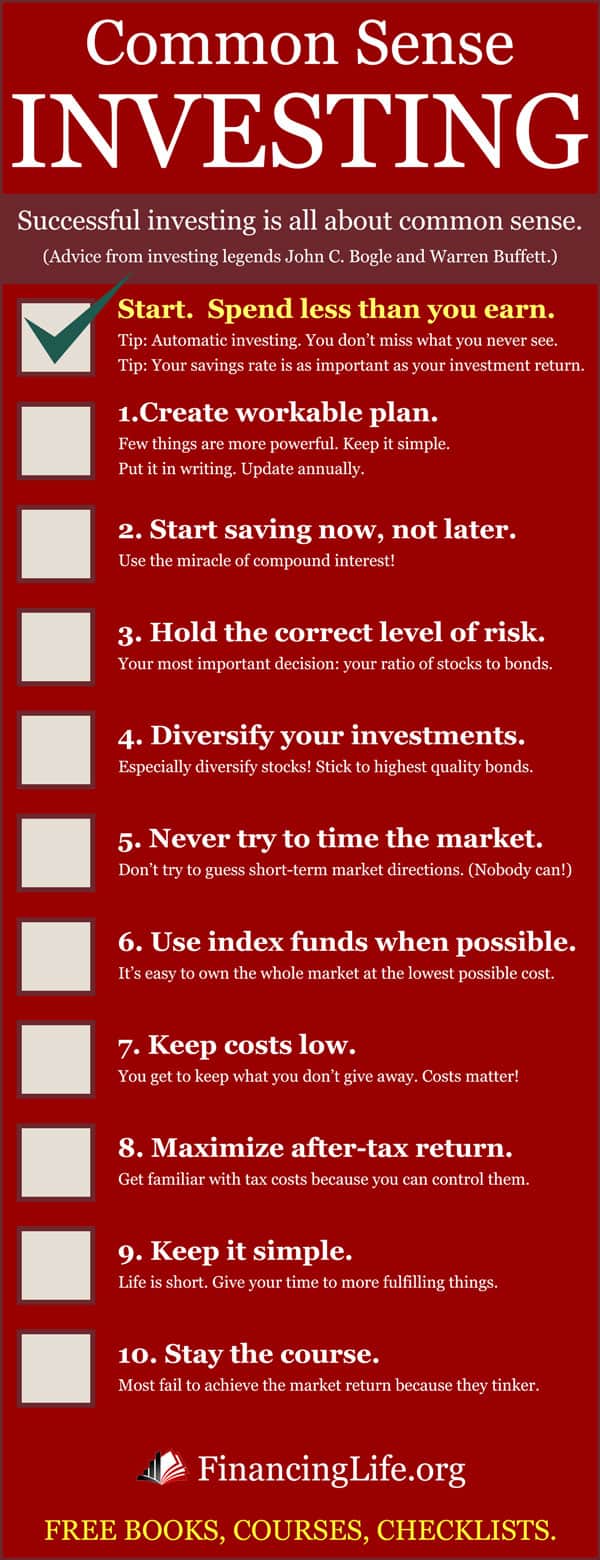

This video is a short introduction to the ten rules of investing for beginners. If pressed to summarize further, there are four principles: start saving early, diversify your investments, minimize costs, and stick to your plan!

Watch this video now, or jump to the transcript below.

Next steps:

- Watch next video in this series: Rule #1: Develop a Workable Plan.

- Download cheat sheet Ten Simple Rules to Common Sense Investing,

a printable 1-page PDF summarizes Boglehead Investing. - Take a free course: Common Sense Investing,

or Where Should I Put Money?

The Transcript: Smart Investing = Boglehead Investing

If you are like most of us, you are busy living your life, and just not interested in becoming an expert in investing. My goal is to show you that it is actually not hard to take control of your finances, save and invest wisely, and then get on with your life with a sound financial lifestyle that will support your dreams. You are going to learn how to correctly buy and hold a diversified portfolio of stocks and bonds for the long term.

Start by tuning out all the shows and newsletters trying to sell you something.

For us there is no better mentor than legendary mutual fund industry veteran John C. Bogle. We’ll also incorporate the work of a few noble laureates and distinguished academics.

Quite frankly, it is the advice I wish I heard when I was 25 years old. We’ll develop four general principles as 10 simple rules.

The first two rules are all about getting started, and finding a way to save a portion of what you earn. Because if you can’t do this, the other 8 rules are moot. There are some great tips in here so I hope you’ll find this helpful.

If starting to save now is the most important habit you need to form, the way that you then allocate this to stocks and bonds is the most important decision you need to make. Diversify Your Investments. I know you think you know what this means, but most people actually don’t. These will be our next three rules. It’s not hard, but since this is all about risk management and it is sooo important, take a listen and make sure you grasp these simple concepts.

Small percentages make a HUGE difference over the course of our lifetime. Our next three rules will show you how you can keep what you earn by not giving it away in unnecessary fees and taxes.

Our last rules will help you create a simple one-page written plan–and that very action will help give you the discipline to stick with these time proven rules that we’ll now explore individually in more detail.

Each of these rules are a short video. You can watch from start to finish, or skip ahead to any of particular interest.

Find other explanatory videos, smart tips, and links to useful resources at FinancingLife.org.

Related articles:

- Must-read guide: Smart Investing for Beginners

- Video overview of Intro: Ten Rules of Investing for Beginners

- Step 1: Develop a workable plan.

- Step 2: Start saving early.

- Step 3: Choose appropriate investment risk.

- Video overview of Step 4: Diversify.

- Video overview of Step 5: Never try to time the market.

- Video overview of Step 6: Use index funds when possible.

- Video overview of Step 7: Keep costs low.

- Video overview of Step 8: Maximize after-tax returns.

- Video overview of Step 9: Keep it simple.

- Video overview of Step 10: Stay the course.

- Video overview of The ABCs of Common Sense Investing

- Must-read guide: How To Build An All Weather Portfolio With Stocks and Bonds

- Courses at: FinancingLife Academy

————————————————————————–

What’s your learning style? Would you prefer a book?

- to learn at your own pace?

- to mark with notes?

- to use as reference?

- to give as a gift?

- or, even just to support this non-profit educational website (thanks!)

Take a closer look at the paperback book.

Footnotes and Video Production Credits for Smart Investing For Beginners, or Boglehead Investing

Special thanks to Karina Buck and Jennifer Howell for valuable feedback and encouraging words. This video may be freely shared under the terms of this Creative Commons license BY-NC-SA 3.0.>

Copyright 2019, Rick Van Ness

Finally, here’s an infographic for all you Pinterest fans: