Keep costs low! That’s the seventh of the Ten Rules of Investing For Beginners. Keep costs low to capture index funds returns. Don’t strive to beat the market. Few do. Most lose. Strive your fair share of the market’s return. Do that by driving out costs, and capture index funds returns. You need to be vigilant and recognize how service providers make their livings.

Next steps:

- Watch next video in this series: Rule #8: Maximize after-tax returns.

- Download cheat sheet Ten Simple Rules to Common Sense Investing,

a printable 1-page PDF summarizes Boglehead Investing. - Take a free course: Common Sense Investing,

or Where Should I Put Money?

Read the transcript for Keep Costs Low (to capture index funds returns)

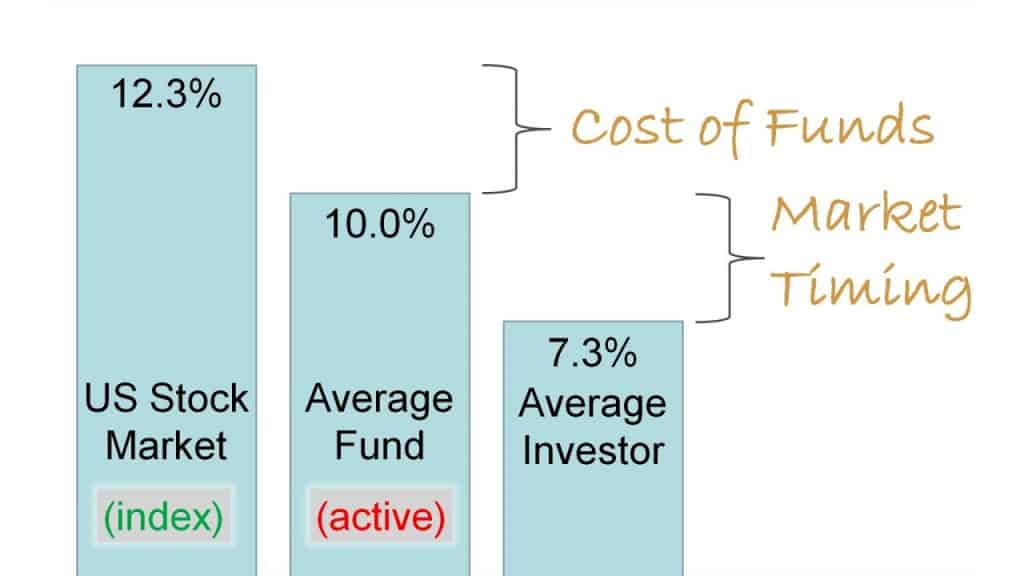

The return-on-investment for vast majority of investors is substantially worse than the stock market as a whole.

Two videos ago we looked at how the behavior of market timing, or trying to pick specific stocks or funds, accounts for about half of this gap. The rest we give away as costs.(1)

Last video we introduced the idea that the best and lowest cost way to buy the whole stock market is with index funds. This is because the costs of actively managed funds make them very unlikely to beat the total market index funds.

Only a small percentage of active funds outperform the total stock market index funds, and you can’t choose them in advance. Moreover, that probability gets lower every year. (2)

Three costs that I want you to be very aware of are sales charges, operating expenses, and taxes.

A sales charge (or, Load) on purchases is exactly what you’d expect. If there’s a 5% sales charge, you write a check for $10,000 but only $9,500 gets invested because $500 goes to the salesman. Sometimes a back-end sales load is deducted from the redemption proceeds instead.

Too often, brokers or commissioned agents actually think they are helping you by recommending to you recent top-performing actively-managed funds. This is bad advice! It makes other people wealthy instead of you.(2,3)

Related article: Hidden Costs of Mutual Fund Investing. The all-inclusive costs, the hidden costs of mutual fund investing, is several times larger than the expense ratio. Over time these costs kill your returns. To make this point, this article starts with an interactive chart so that you can calculate when your broker will have more of your money that you! (Better sit down.)

When you can, buy from one of the big discount brokerage houses and look for low-cost highly-diversified index funds without these sales fees. These kind of funds are called no-load funds, or marked NTF for no transaction fee, although there might be a footnote that restricts this to online purchases that are held longer than some number of months.

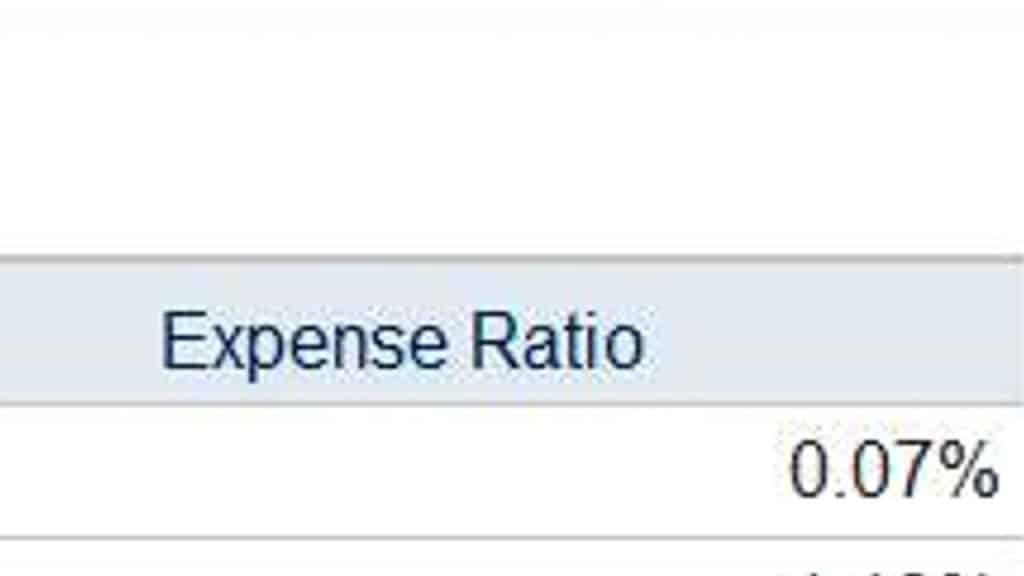

Now here is the important number that I want you to remember from this video. The annual recurring management fees is usually called expense ratio. It’s a funny term that you need to remember. It is the percentage of a mutual fund’s assets that the investment firm incurs for all of its regular operating costs.

The cost of owning mutual funds is not limited to their respective expense ratios. Transaction costs and market spreads are examples of additional costs a fund incurs every time it buys or sells a security. I only mention them because frequent trading is part of the reason that active mutual funds underperform the total stock market.(4)

Here’s an example: the Total Stock Market Index Fund offered by Vanguard. We can click on the Fees tab to find the expense ratio is 0.07% for this particular fund. All funds must publish this. If our total investment was only $10,000 then we would pay only $7 per year. This is excellent. They subtract that first and investors get what is left.

With mutual funds, it’s not “you get what you pay for.” This is the key point: “You get to keep EXACTLY what you don’t pay for.”(5)

You get to keep EXACTLY what you don’t pay for.

John C. Bogle

What you pay as expenses comes directly out of your pocket. So let’s scroll down and see if there are any other fees listed. This one has no sales charges. Down here we see that sometimes there is an annual fee for the account but they point out ways to avoid these as well.

These little percentages make a big difference! Back here they show us how their expense ratio compares with the industry and how, if reinvested, that could be worth nearly $2600 after ten years.

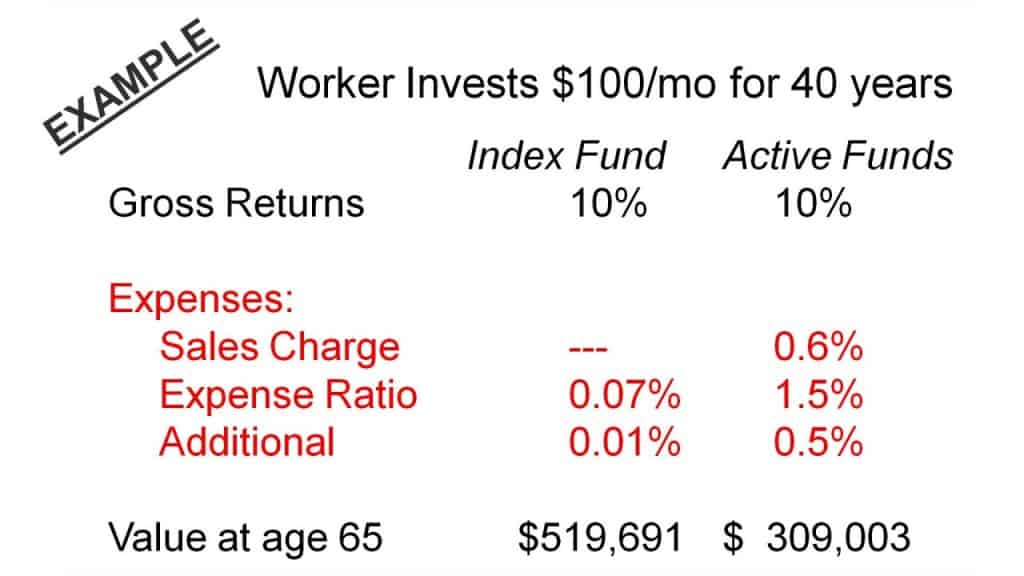

To understand the devastating impact of these costs, consider a 25 year old who invests $100 per month in a Roth IRA until he is 65. The left shows the amount he would earned using a historic stock market average captured with a low-cost index fund. The right shows the amount he would earn with the same gross returns, but a sales charge of 60 cents for each $100 investment and fund expenses of 2% per year. At age 65 he would have earned $210,000 less, and that difference would continue to get worse. Now if future returns are lower, then these costs take an even bigger bite out of what you earn. Clearly, costs matter! Keep them low.(6)

Unfortunately, some 401(k) plans do not offer any index funds at all. In that case, look for the largest, most diversified funds with the lowest fees.

Now, some of your savings will be in a taxable account where (guess what!) taxes are the third big cost that dramatically affects your return. We’ll look at this in the next video

Find other explanatory videos, smart tips, and links to useful resources at FinancingLife.org.

Related articles:

- Must-read guide: Smart Investing for Beginners

- Video overview of Intro: Ten Rules of Investing for Beginners

- Step 1: Develop a workable plan.

- Step 2: Start saving early.

- Step 3: Choose appropriate investment risk.

- Video overview of Step 4: Diversify.

- Video overview of Step 5: Never try to time the market.

- Video overview of Step 6: Use index funds when possible.

- Video overview of Step 7: Keep costs low.

- Video overview of Step 8: Maximize after-tax returns.

- Video overview of Step 9: Keep it simple.

- Video overview of Step 10: Stay the course.

- Video overview of The ABCs of Common Sense Investing

- Must-read guide: How To Build An All Weather Portfolio With Stocks and Bonds

- Courses at: FinancingLife Academy

Footnotes and Video Production Credits for Rule #7: Keep Costs Low (to capture index funds returns)

(1) The stock market index fund was providing an annual return of 12.3 percent and the average equity fund was earning an annual return of 10.0 percent, the average fund investor was earning only 7.3 percent a year. The Little Book of COMMON SENSE INVESTING, by John C. Bogle, 2007, p.51.

(2) All About Index Funds, by Richard A Ferri, 2nd Edition, McGraw-Hill, 2007, p.25.

(3) Unfortunately there is no persistence to the funds or fund managers that recently outperformed the market average, and ultimately cost (expense ratio) becomes best predictor of future success. The Little Book of COMMON SENSE INVESTING, by John C. Bogle, 2007, p.189.

(4) The Bogleheads’ Guide to Investing, by Larimore, Lindauer, and LeBoeuf, 2007, pp 110-116

(5) In Investing, You Get What You Don’t Pay For, 2005 Keynote Speech by John C. Bogle, http://johncbogle.com/speeches/JCB_MS0205.pdf

(6) This example uses cost figures that are LESS than the Total Annual Costs of U.S. Equity Market Funds (3.3%) that were prepared by Jack Bogle and the Bogle Research Center and then presented in The Boglehead Guide to Investing p. 115. Higher costs produce worse results.

The opening/closing music “Because” is by David Modica from his Stillness and Movement album, published and licensed by www.Magnatune.com.

The closing photo “Trees in the Fog” is by Yann Richard under the terms of the Creative Commons BY 2.5 license.

This video may be freely shared under the terms of this Creative Commons License BY-NC-SA 3.0.

Video copyright 2009-2019 Rick Van Ness. Some rights reserved.

————————————————————————–

What’s your learning style? Would you prefer a book?

- to learn at your own pace?

- to mark with notes?

- to use as reference?

- to give as a gift?

- or, even just to support this non-profit educational website (thanks!)

Take a closer look at the paperback book.