The sixth of the Ten Rules of Investing For Beginners is to use index funds. Or, most accurately, use passive funds for the lowest possible costs. Usually these are index funds. The secret Wall Street doesn’t want you to know: actively managed funds under-perform the market.

Recent winners make the “recommend” list—but don’t pay much attention to that. There are very few that can outperform the market in the long run because of costs. A very few will, but since you can’t choose them in advance—don’t even try.

Next steps:

- Watch next video in this series: Rule #7: Keep costs low.

- Download cheat sheet Ten Simple Rules to Common Sense Investing,

a printable 1-page PDF summarizes Boglehead Investing. - Take a free course: Common Sense Investing,

or Where Should I Put Money?

Read the transcript for Use Index Funds and Passive Investing

In prior videos we’ve established that you’ll want both stocks and bonds, from many, diversified companies, and that you need to avoid market timing.

Mutual funds are definitely the convenient way to invest in hundreds, or even thousands, of diverse companies. So, how do we recognize a good mutual fund from a bad one?

This is where our instincts get us in trouble. We are comfortable using rating systems to guide our other purchases. So most people are attracted to mutual funds rated four or five stars by Morningstar.

Here’s an actively-managed fund that tries to beat the market return, and a passively-managed fund that attempts to match the market return.

A key point that I want you to understand is that these rankings are based on past performance so have very little relevance!(1)

Here’s why. Remember, “the Market” is the collection of all stocks, all investors. So for every active manager who beats the average market return, another loses by the same amount. Unfortunately, the only way to profit from those winning funds is to know the winners in advance, which is impossible to know.(2)

There are a variety of reasons why the winners don’t enjoy persistent success. Sometimes success attracts an over-whelming amount of new money to a fund. Sometimes the manager’s style of investing goes out of favor. And sometimes the manager was never good, just lucky, and their luck runs out.(3)

In contrast, Index Funds are passively managed and can be very low cost. An index fund simply owns all the stocks that make-up an asset category, or in this case, all asset categories. The goal is not to beat the market, but to match the market return as measured by a benchmark index. For instance, the S&P 500 is a benchmark index for the 500 largest companies in the United States. A different, broader index benchmarks the entire stock market.

Active funds require a talented staff, excellent insightful research to try to predict which companies will outperform tomorrow, and frequent trading. All these expenses get paid first; investors just get what is left. So to beat the market after subtracting these costs is very challenging. Only 37% of active funds beat the market every year.(4,5) But there is little persistence and within five years the number of winners has dropped to 25%. Over a period of 10 years, a mere 15% of the actively managed funds beat the “market return”, which is what you would get if you had invested in a low-cost highly-diversified index fund.

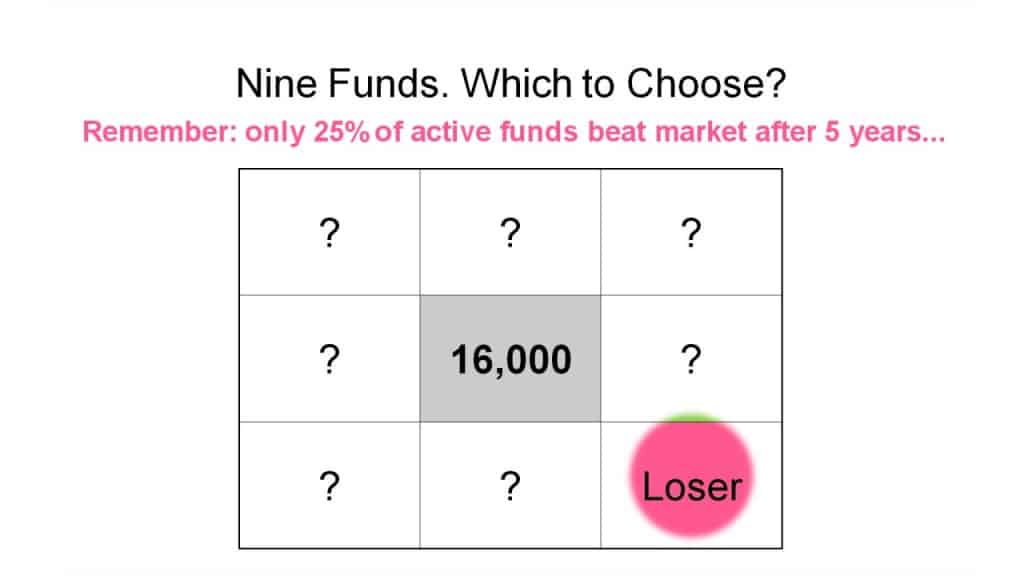

Imagine that you want to invest 10,000 dollars and there are only nine mutual funds in the world.(6) Eight of them are active funds with an annual cost of 2%. One of them is a low-cost index fund which closely tracks the overall market return.

You are clairvoyant and can foresee that you have 2 out of 8 chances of outperforming the market over the next five years, and you know the odds will decline further with time.

The reward for such long odds is an extra two or four thousand dollars. But the average return from all the active funds is less than the market return by $1300 — the same as the amount subtracted for expenses.

You have this information, so you further notice that if it wasn’t for those expenses, four of the active funds would beat the market, and four would not. And, averaged together, the eight active funds would have achieved the market return. After all, that’s what the market return is, by definition.

You can know the odds. You can know the arithmetic. But you can’t know in advance which funds are going to outperform so we’ll cover them up. You are going to have to guess. Do you want to invest in the index fund and get the average market return, or do you want to try to beat the market with one of the active funds. And, if so which one?

Congratulations if you chose the index fund. It shows that you are a rational, risk-averse investor.

Now, do you agree with me that this ranking might be a little misleading? Five stars for a fund that outperformed recently, but has a very low chance of outperforming over the next ten years? And of course the index fund is only rated mid-pack: It can’t outperform the market; it tracks the market!

The best predictive measures of a fund’s future performance are its costs, and how closely it tracks the market.(7) Now, do you think that you don’t have costs because you only buy “no load” funds? Watch the next video.

Find other explanatory videos, smart tips, and links to useful resources at FinancingLife.org.

Related articles:

- Must-read guide: Smart Investing for Beginners

- Video overview of Intro: Ten Rules of Investing for Beginners

- Step 1: Develop a workable plan.

- Step 2: Start saving early.

- Step 3: Choose appropriate investment risk.

- Video overview of Step 4: Diversify.

- Video overview of Step 5: Never try to time the market.

- Video overview of Step 6: Use index funds when possible.

- Video overview of Step 7: Keep costs low.

- Video overview of Step 8: Maximize after-tax returns.

- Video overview of Step 9: Keep it simple.

- Video overview of Step 10: Stay the course.

- Video overview of The ABCs of Common Sense Investing

- Must-read guide: How To Build An All Weather Portfolio With Stocks and Bonds

- Courses at: FinancingLife Academy

Footnotes and Video Production Credits for Rule #6: Use Index Funds and Passive Investing

(1) Morningstar explains their rating system in this pdf: http://corporate.morningstar.com/us/documents/methodologydocuments/factsheets/morningstarratingforfunds_factsheet.pdf

(2)The Arithmetic of Active Management, William F. Sharpe

http://www.stanford.edu/~wfsharpe/art/active/active.htm

(3) All About Index Funds, by Richard A Ferri, 2nd Edition, McGraw-Hill, 2007, p.26.

(4) All About Index Funds, by Richard A Ferri, 2nd Edition, McGraw-Hill, 2007, p.25.

Copyright 2019, Rick Van Ness

————————————————————————–

What’s your learning style? Would you prefer a book?

- to learn at your own pace?

- to mark with notes?

- to use as reference?

- to give as a gift?

- or, even just to support this non-profit educational website (thanks!)

Take a closer look at the paperback book.