Start saving money early. Learn how to save money first; then learn how to invest. We’ll use risk-free strategies to accumulate savings in this episode, and then introduce stock market risk in the next.

Rule #2: Start saving money early

Our first episode looked at developing a workable plan. Unknowns about our career, family, health and lifespan make planning challenging. Yet, we found some workable strategies in the face of these uncertainties.

In this second episode, we’ll look at: When should you be saving? How should you be saving? and, Where should you be investing—so that your savings grows faster than inflation, and meet all your goals?

You’ll learn why your savings rate is more important than rate-of-return. Then I’ll show you risk-free ways of reaching your goals. And finally, some time-proven secrets to saving — including paying yourself first with automatic saving.

Hi, I’m Rick Van Ness. You’re watching The Ten Rules of Common Sense Investing1, a video series about saving and investing to maximize lifelong happiness. These rules help you answer two big questions:

- How much to save? and

- How much risk to take?

Start saving money early. Time is your friend.

“Time is your friend; impulse is your enemy.”

— John C. Bogle

Time is your friend. John Bogle had a gift for colorful quotes.

This is partly about exponential growth. Just as bacteria, plants, and animals can reproduce exponentially, this can happen with money.

I used to compare two women. Both saved for only ten years. One started early and then stopped. The other started late but saved twice as much over 10 years. She never caught up.

These stories are interesting and motivating — but misleading without a corresponding discussion about investment risk.

So, let’s not put the cart in front of the horse. The primary motivation for saving is to be able to spend at a smooth rate over your entire lifetime. Taking investment risk may, or may not, result in greater wealth and happiness. I love the stock market, but it is not for everybody. I will talk about risk in episode 3, then investing with mutual funds in episodes 4-10. But none of that is relevant if we don’t have saving nailed down.

What is risk free?

Saving is setting aside a portion of your earnings for future use.

Investing is choosing which assets to buy with those savings.

Risk, for us, is the possibility that your savings will not be there when you need it for an important goal. It’s not just about probabilities, but about bad consequences.

People take investment risk seeking a higher rate-of-return. But that may, or may not, be appropriate for you. And quite frankly, you may not know yet. So, let’s just start with the basics.

Today, mid-year 2020, the risk-free real interest rate before taxes is zero. Risk free means not vulnerable to the stock market, the bond market, business failures, or inflation. Let’s start there, for at least our essential needs.

Accumulating risk-free savings

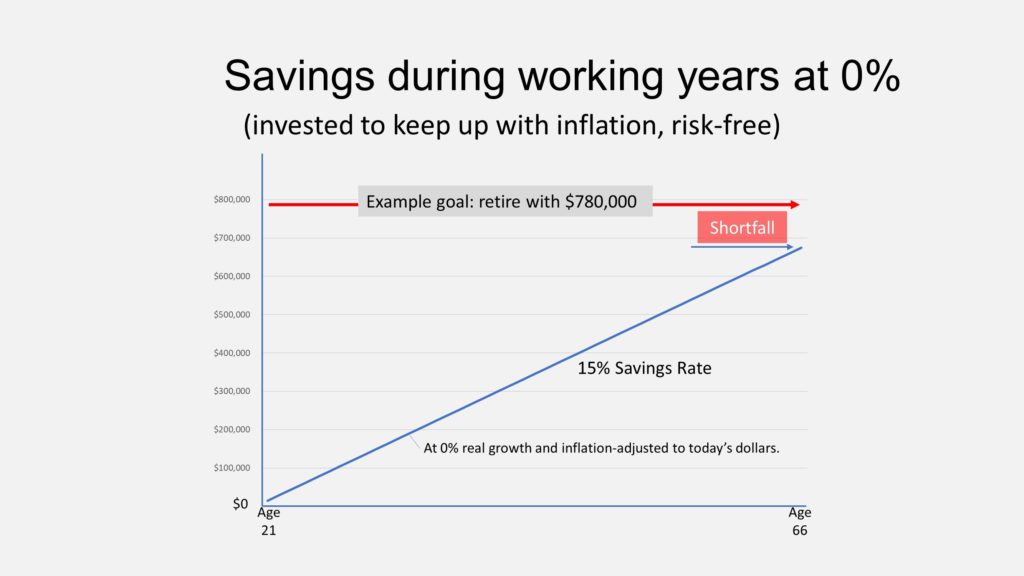

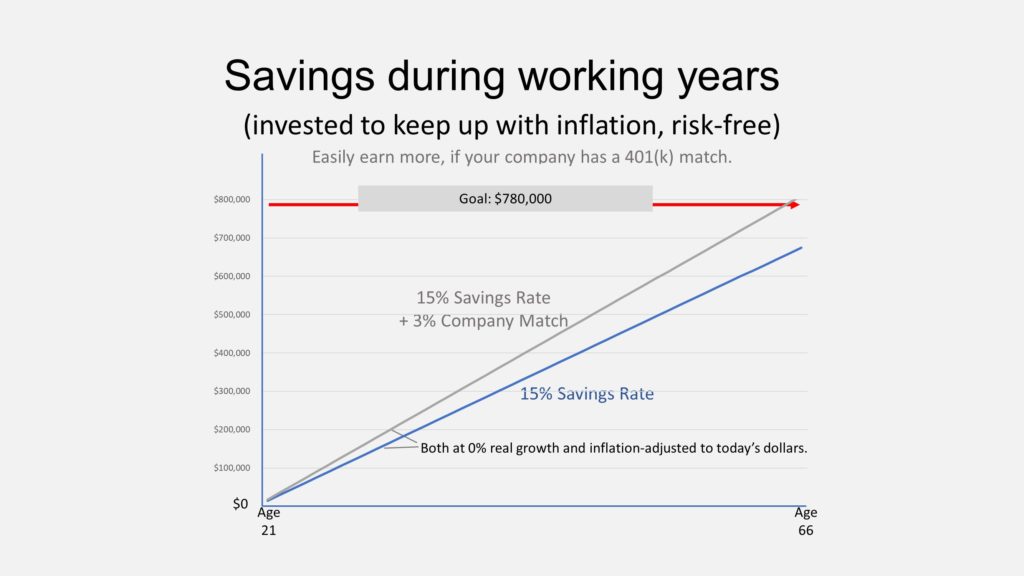

The last episode had an example where Ed retires at age 66 with $780,000. How do you save that much money? Is there a risk-free way? Here’s how Ed did this:

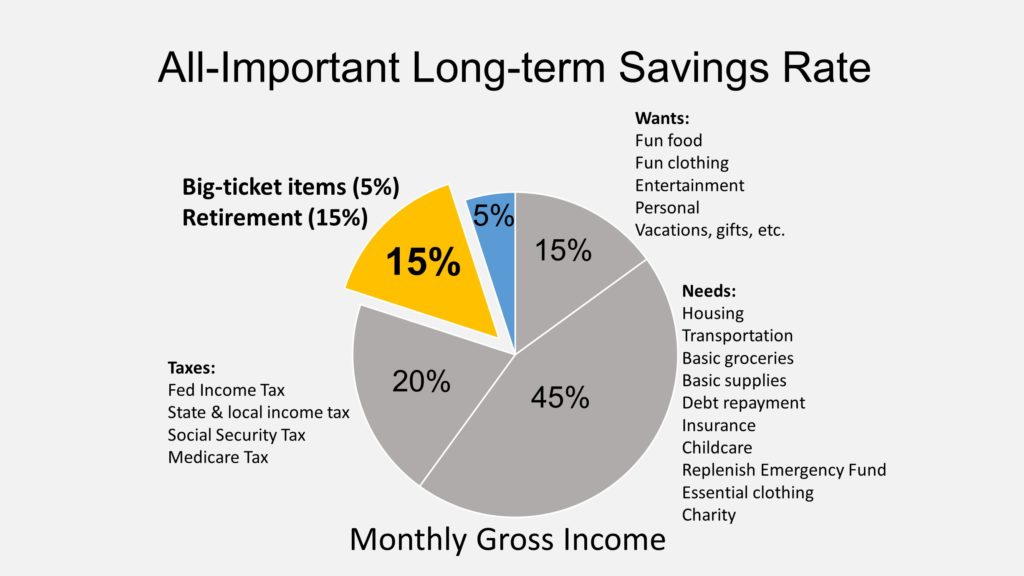

Ed saved 15% of his total earnings for his retirement; plus another 5% for other big purchases. He used inflation-protected securities called T.I.P.S. and I bonds. These are U.S. Treasury bonds, generally regarded as the safest investments in the world.

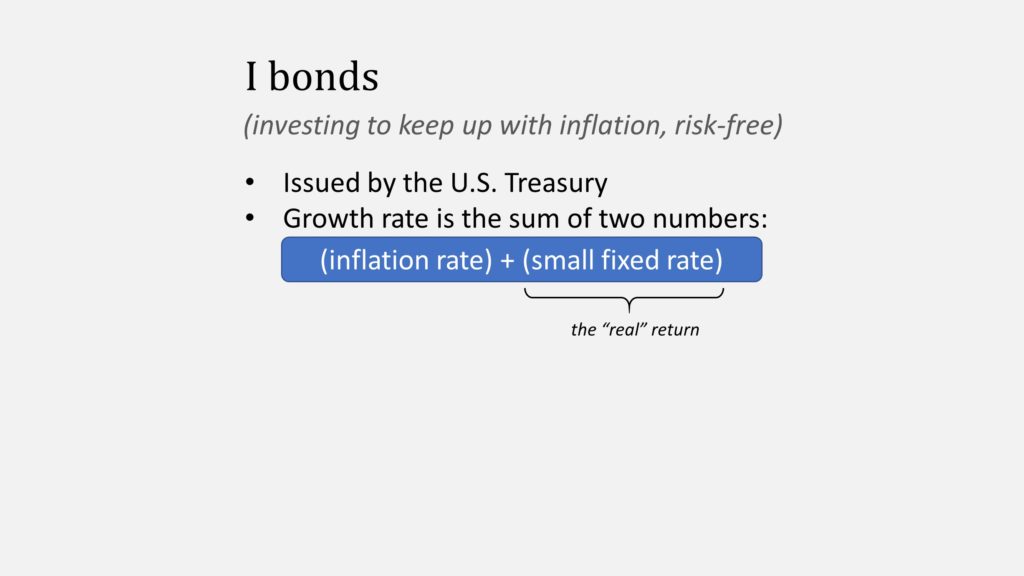

An I bond is like a bank CD that grows with inflation plus has an additional fixed rate of interest. The inflation component changes year to year.

The fixed component remains at whatever it is when you buy it, which today happens to be zero. It isn’t always zero, but the ones you can buy today are. So, let’s use that.

Ed sets up automatic payroll deduction and investment from his salary. After 45 years, at zero percent above inflation, he would save an impressive amount, but still be a little short of his goal. We’ll work on that.

Time is your friend. Because it will take a lot of time to achieve this goal —without introducing risk and hoping for good luck.

Now remember, 45 years ago Ed wasn’t earning a hundred thousand. His salary has increased with inflation for his entire career. He was earning a lot less, so his 15% contributions were a lot less. But, because they were invested in inflation-protected bonds, every one of his contributions have grown to become equivalent to a $15,000 investment today.

That’s a pretty powerful statement, so I want you to believe it. Let me show you. At age 21 Ed’s salary was a little over $40K and he contributed 15% of that. That contribution grew at the rate of inflation, and is worth $15,000 today — as did every other contribution. It’s exactly as though he did 45 contributions of $15,000 in today’s dollars.

What is a real interest rate of zero?

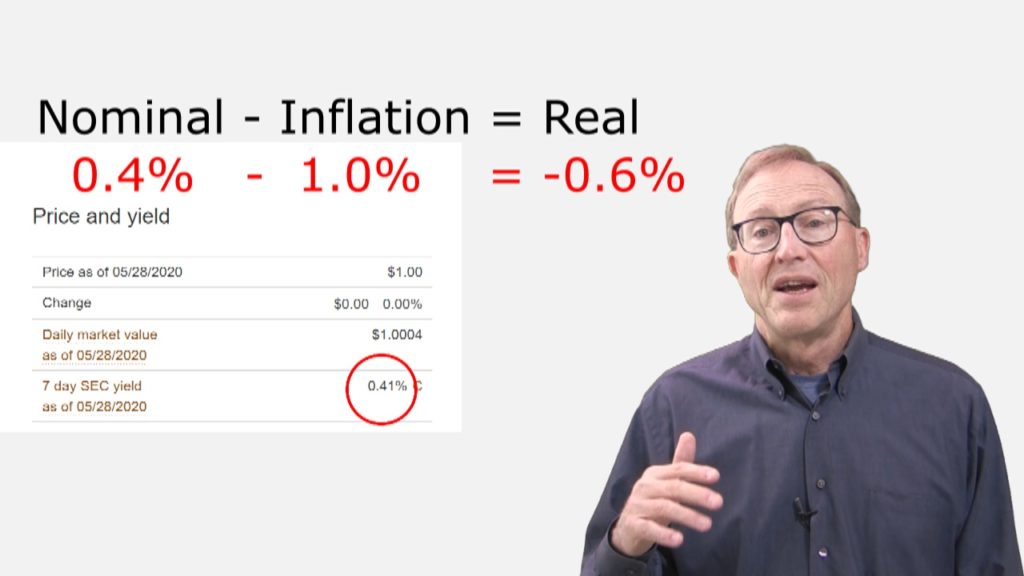

A real interest rate is adjusted for inflation. So a real-interest rate of 0% has a yield that tracks the Consumer Price Index but nothing more. So your savings maintain their purchasing power.

“Wait!”, you say. “I earn more than zero”, and you show me your money market fund.

Yes, these are the normal way people talk about interest rates — they are called nominal interest rates. They are before inflation. Subtract the current inflation rate to find their current real yield.

If the current inflation rate is 1%, these savings accounts are actually not keeping up with inflation — and you are gradually losing purchasing power.

TIPS and I bonds protect you from unexpected inflation.

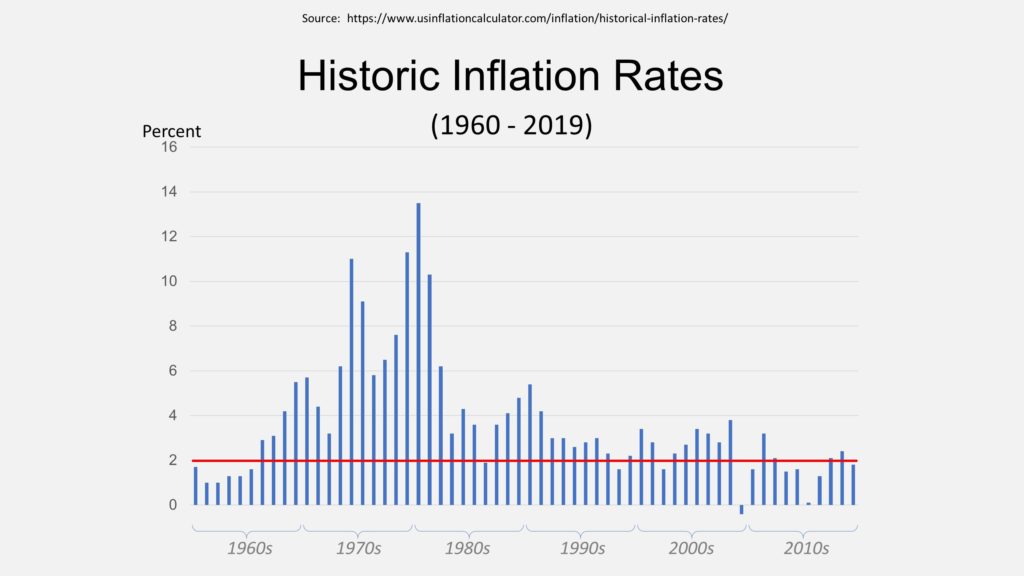

Inflation is currently pretty low, but here’s what inflation has been over my adult years.2 Remember, none of us have a crystal ball.

We haven’t found a path for Ed to meet his savings goal yet. His choices are to earn more, save more, work longer, scale back his goal, or to consider investment risk.

Example: how Ed meets his goal

Earn more?

One strategy is to earn more money. That’s always a good idea, and sometimes it is the only way you are going to accumulate savings.

Use a 401(k) company match?

[$2 employee contribution + $1 company match => $3 investment into 401k]

Many of you are lucky enough to work for a company that offers a retirement program with a matching contribution. The most common of these is when the company contributes 50 cents for every dollar the you contribute—up to 6 percent of your salary. This is essentially giving yourself a 3% raise. The 401(k) is a tax-deferred account which we’ll also discuss in a later episode.

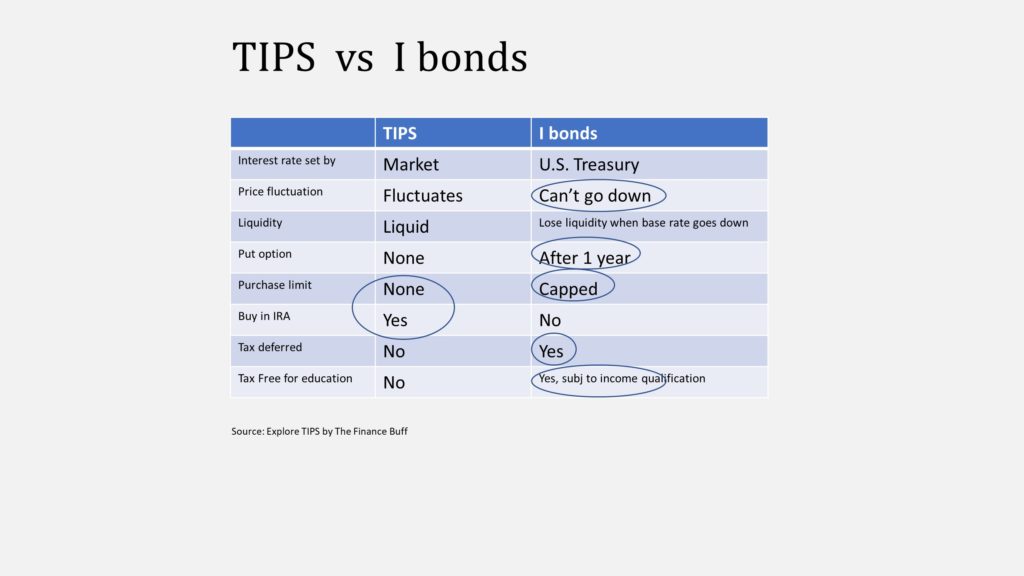

I bonds are not available in retirement accounts, but you might find a way to buy a U.S. Treasury bond called T.I.P.S.

In a nutshell, TIPS are most like Treasury bonds and I bonds are most like bank CDs. They are both great products. This table3 shows some reasons why TIPS are preferred by serious investors and I Bonds preferred by small savers.

Note that a 3% company match is more than enough to meet the goal in this example, without taking on investment risk. What if his employer doesn’t have that program, or he works for himself?

Save more?

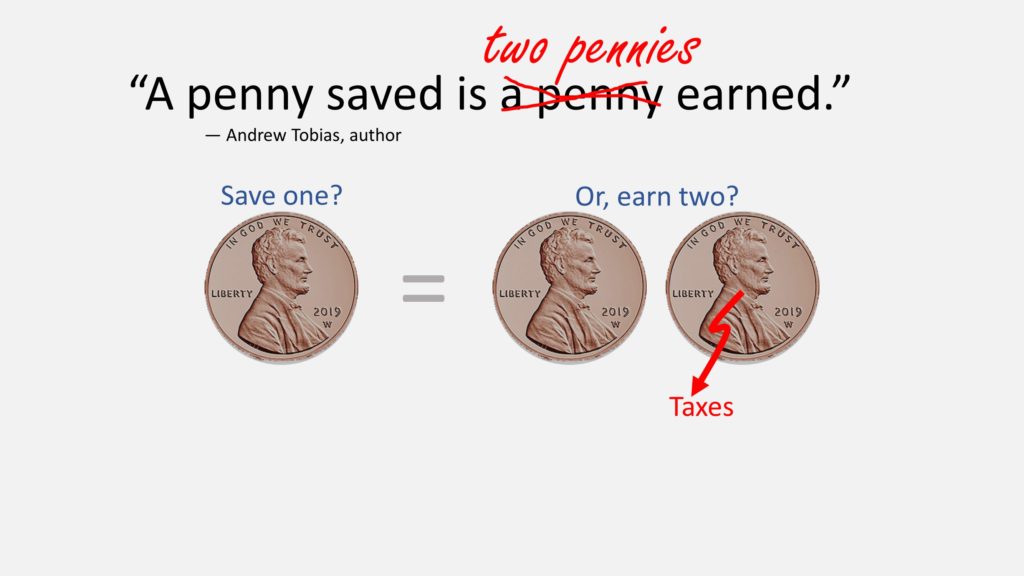

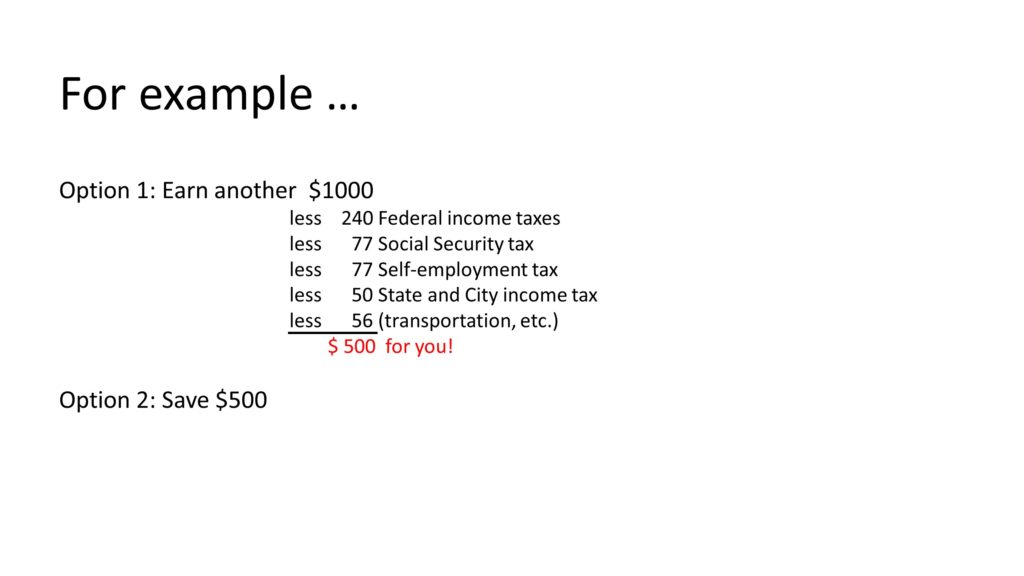

Author Andrew Tobias asserts4 that if Benjamin Franklin was here today he would update his saying to: “A penny saved is two pennies earned.” They didn’t have an income tax back then. This update reveals that it is often much easier to accumulate wealth by saving more than by earning more — after you consider the costs of working plus taxes.

For some of you, your tax rate could be as high as 50%—meaning that you would need to make an extra $2 just to have one extra dollar for yourself!

Your tax rate could be higher than you think. If some of you earn $1000 more, 240 will go to federal income tax and 76.50 to Social Security. Some of you also have to pay self-employment tax, state and city income taxes, the cost of getting to and from work, plus other things.

Bottom line: you may only get to spend about half of what you earn.

In our example, Ed needed to save an additional $100,000 over these years. He could save a little more from what he is already earning. Or, he could work to earn quite a bit more.

Saving more might be the easiest way to meet tough goals, but there are other choices. Working more years is sometimes an option.

Work longer?

Starting to save early is one way to save more — by saving over more years.

This might also be smart if there may be unplanned years out of the workforce—maybe to take care of children or for aging parents; perhaps an unplanned layoff .

Twenty-one is already early, because these early years must establish an emergency fund and avoid debt.

Another way to finance your goals is to plan to retire later.

But admittedly, that’s not always an option for many types of jobs. Many of us are vulnerable to uncontrollable circumstances, like recessions, wars, or pandemics.

Choose higher rate-of-return?

Well, why not just choose an investment with a higher rate-of-return? You’d get there faster. Or would you?

Professor Zvi Bodie warns against taking risks to meet your important needs:

“If your needs are not attainable through safe instruments, the solution is not to increase the rate of return by upping the level of risk.”

— Professor Zvi Bodie

Remember your hierarchy of needs, wants and wishes from Rule #1. Choosing more investment risk as an alternative to saving more to meet your future essential needs could be fool hardy — akin to foregoing fire insurance on your house because your budget is tight. It might generally work out, but the consequences when it doesn’t can be bad.

Time-proven secrets to save money

Saving is challenging. You need to talk yourself into saving—especially if your friends spend freely. So, here are some time-proven tips to becoming a good saver.

Focus on savings rate

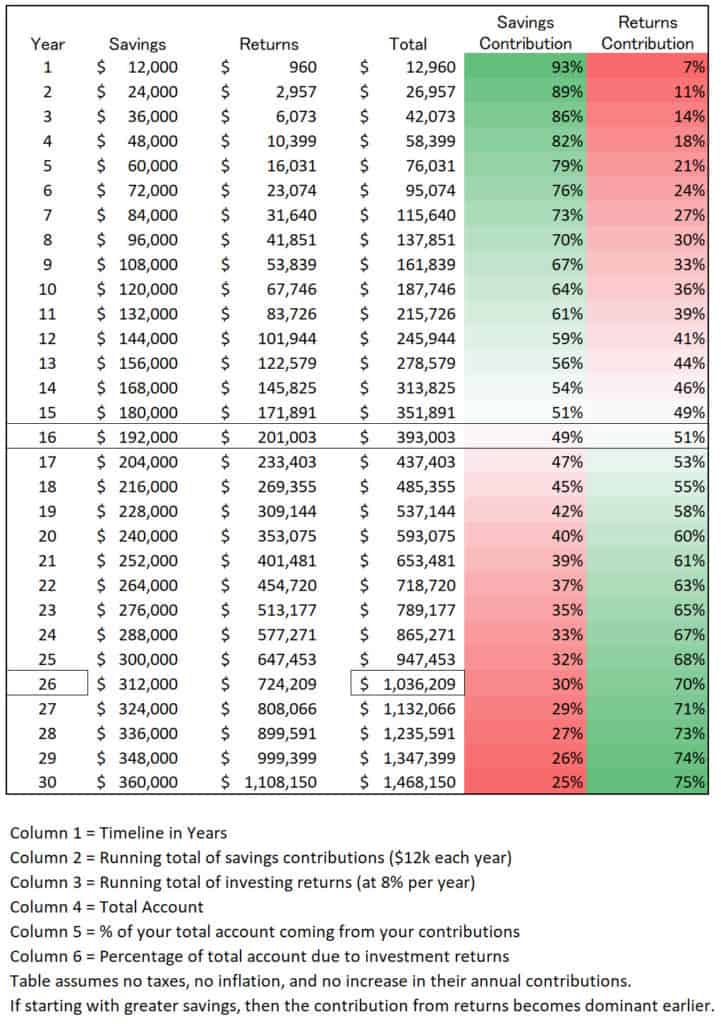

It turns out that your saving rate is more important than your investment rate-of-return for a long time.

Let’s imagine you contribute $12,000 each year and earn a very generous constant 8% on your investments.

Each year, the portion of the total balance from your investment returns grows.

It will take 17 years before your returns contribute more than your savings to your accumulating wealth. And the lower the return, the longer it will take.

Save money automatically

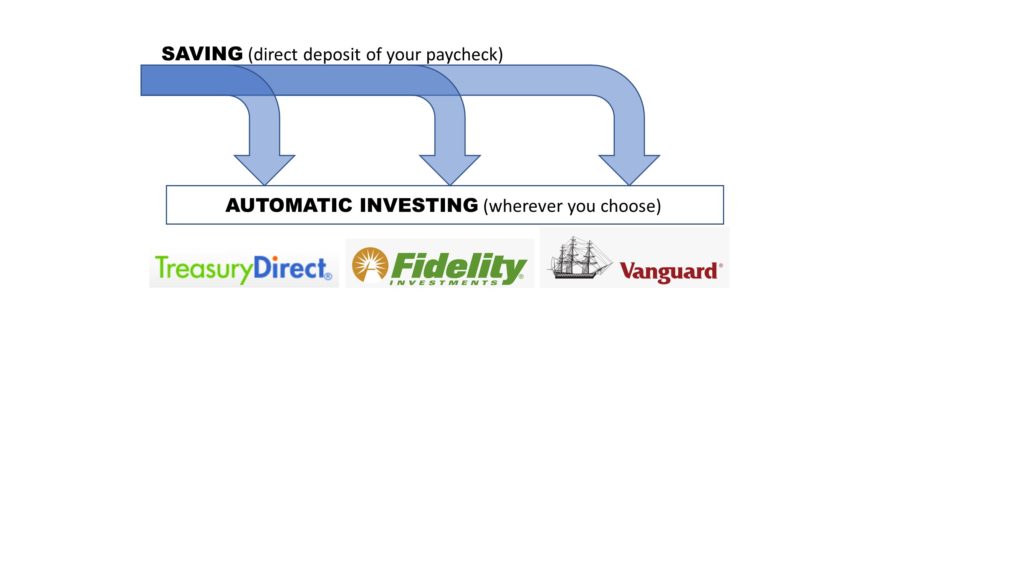

Even more powerful for me was adopting the concept of automatic-investing early. You don’t miss (or spend) what you don’t see. You already withhold money from your paycheck for taxes and Social Security.

Automatic investing is the same concept for your long-term goals. Direct deposit your paycheck to your bank, and then set up automatic investing to your investment accounts.

Increase spending gradually

Ultimately, it comes down to controlling your lifestyle.

People want to keep, or increase, their standard of living—not decrease it! Increasing it slowly and smoothly helps achieve that.

Some people—professional athletes, celebrities, and others—have inconsistent income streams and should save a lot more during their peak years.

We value an extra dollar a lot more when our spending is low than when our spending is high. Economists can prove that consumption smoothing increases happiness, but I immediately recognized this truth when I heard a version of this from popular author Vicki Robin.5

She describes the happiness and fulfillment you get from buying things. The slope is steep when we are young. We get a lot of happiness from a first bike, first car, first house… but incrementally less as we acquire more stuff. A bigger house, bigger mortgage. And without even thinking about it you become dependent on your job to pay for stuff that – well, frankly, you might look back on it as clutter. This concept of “enough” is fun to explore, along with other ways to get happiness that don’t require spending.

Respect your time

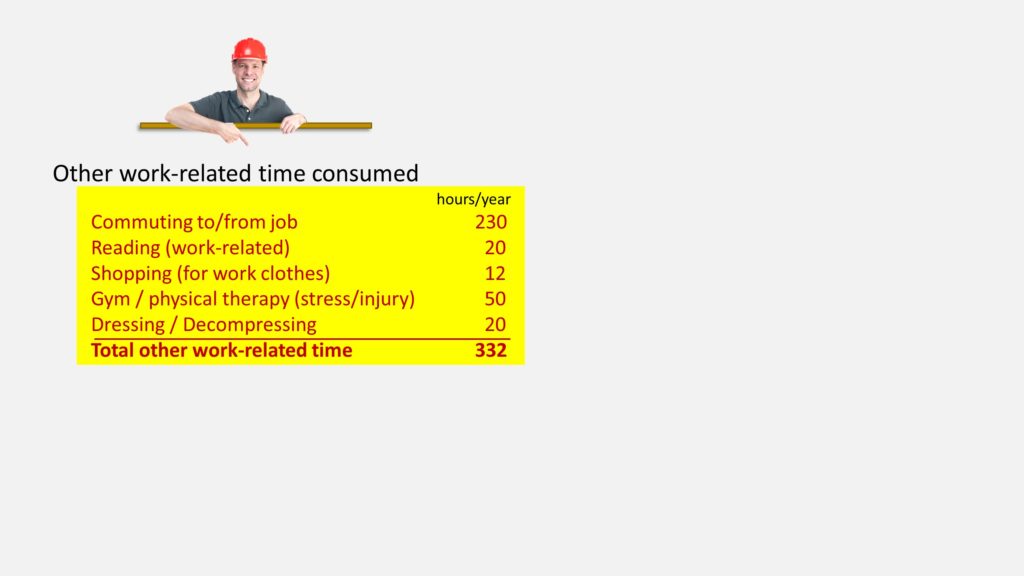

The big idea that Vicki contributes is to think about what you buy in terms of equivalent hours of work to pay for it. Her insight goes further than our modern-day Benjamin Franklin [blink] by recognizing that your time is precious and limited. It’s your life energy. So become aware of your real hourly wage.

We saw before that there are taxes and other expenses that you wouldn’t have if you were not working: commuting costs, maybe childcare, simple repairs that you hire out because you lack the time, or extra restaurant meals because you are too tired to cook.

There are also time consuming activities that wouldn’t exist if you didn’t have that job.

If Ed subtracts the extra expenses and add that extra time, the end result is that his real hourly wage isn’t $50 an hour like you’d think, but rather $25.

So, every $25 he spends represents one hour spent working. This is valuable and helps you make spending decisions. For instance, if you could buy a sports ticket for $100, you would ask yourself: Is it worth 4 hours of working to see that game? Only you can answer that.

Summary: how to save money

In summary, learn how to save money first; then learn how to invest.

- Focus on your saving rate.

- Put it on auto-pilot so that you don’t have to think about it.

- Spend mindfully, because you are trading your life energy

- Let money be another invitation to think about who we are, how we live, and what is important.

We begin to talk about smart investing with our next episode about investment risk.

After that, learn how to reduce risk by diversifying stocks, and why bonds are different.

See you in the next video!

Learn more about how to save money

Investing for beginners video series

▼The Ten Rules of Common Sense Investing is a series to teach investing for beginners:

🠞 The Smart Investing for beginners summary guide

https://financinglife.org/smart-investing-for-beginners/

✅ Rule #1: Develop a workable plan

https://www.youtube.com/watch?v=P38tR8IoTGI&list=PL21534875BFC50EEE

✅ Rule #2: Start saving money early

https://www.youtube.com/watch?v=08s12IUc-Lc&list=PL21534875BFC50EEE

✅ Rule #3: Control stock market risk exposure

https://www.youtube.com/watch?v=qCeB7_sn4ZM&list=PL21534875BFC50EEE

✅ Rule #4: Diversify stocks

https://www.youtube.com/watch?v=zXnbxLtRhrU&list=PL21534875BFC50EEE

✅ Rule #5: Never try to time the market

https://www.youtube.com/watch?v=b3pnpbWYfwc&list=PL21534875BFC50EEE

✅ Rule #6: Use index funds when possible

https://www.youtube.com/watch?v=GF5vThMkF-U&list=PL21534875BFC50EEE

✅ Rule #7: Keep costs low

https://www.youtube.com/watch?v=GqQfA4xPvAo&list=PL21534875BFC50EEE

✅ Rule #8: Minimize taxes

https://www.youtube.com/watch?v=bLDJN-sbhuA&list=PL21534875BFC50EEE

✅ Rule #9: Keep it simple

https://www.youtube.com/watch?v=rmUJeDRGi2k&list=PL21534875BFC50EEE

✅ Rule #10: Stay the course

https://www.youtube.com/watch?v=aHi2RdQ81Yk&list=PL21534875BFC50EEE

Endnotes and Resources

The content of this video is for illustrative purposes only.

1. This series of ten rules is also endearingly called the Bogleheads investment philosophy — investing advice inspired by John C. Bogle. I prefer to call it Common Sense Investing as a nod to one of my favorite books by John C. Bogle↩

2. https://www.uninflationcalculator.com/inflation/historical-inflation-rates/↩

3. Explore TIPS: A Practical Guide to Investing in Treasury Inflation-Protected Securities, by The Finance Buff, 2010(Available at Amazon.com)↩

4. Andrew Tobias, The Only Investment Guide You’ll Ever Need, 2010, pg.13.↩

5. Vicki Robin and Joe Dominguez, Your Money or Your Life: 9 steps to transforming your relationship with money and achieving financial independence, updated 2018. (Available at amazon.com)↩