Goal-based investment planning starts with your imagination and then creates a simple plan to finance your dreams. I demonstrate this with a comprehensive example for retirement planning. The trick for beginner investors is simply to get started.

Rule #1: Use goal-based investment planning to make a workable plan

In this video I’m going to tell you the four steps to goal-based investment planning and then illustrate with an example.

Our example will focus on retirement planning because it is one thing that you are guaranteed to all have in common. And it helps to start early.

This is important for everyone. Perhaps particularly for women, because many women:

- Live longer

- Earn less

- Spend years out of the workforce to care for children or elderly parents

- And have other disadvantages

- Qualify for less Social Security benefits, and often

- Work for companies without retirement benefits

I’m Rick Van Ness. You’re watching The Ten Rules of Common Sense Investing1, a video series about saving and investing to maximize lifelong happiness. These rules help you answer two questions:

- How much to save? and

- How much risk to take?

- Rule #1: Use goal-based investment planning to make a workable plan

- The Big Financial Risks Ahead

- Example: Simple Retirement Income Planning

- Example Step 1: Simple goal, date, cost

- Example Step 2a: Estimate retirement living expenses

- Example Step 2b: Two methods to estimate the total savings that will be required

- Example Step 3: Separate essential needs, wants and wishes

- Example Step 4: Compare three strategies to match investment assets with each goal.

- Summary: using goal-based investment planning

- Investing for beginners video series

- Recommended books for beginner investors

- Endnotes: goal-based investment planning

Some of our dreams need a little money. This list is where we begin.

We need to have some idea of how much we need to save and how we will save that.

There may be part of you rebelling already. Relax! Of course you don’t know the future! But it will serve you to imagine one scenario. The enemy of a good plan is the search for a perfect plan.

Make assumptions, and then change them when you get better ideas, or better information. Our goal is to enable these possibilities.

Step 1: Start simple with goals, dates, and costs

Expect to change your plan every year. That’s OK! Keep it simple or you won’t remember it! Write it down now. Improve it later.

Your goals are dreams with deadlines. Think in terms of how old you will be. That’s the same as a date, but you are imagining it. It’s more personal.

Make a quick wild guess at how much money each goal will need. I promise you: that turns your radar on, and subconsciously you’ll begin gathering information that will improve your initial guess. So don’t worry about being way off!

You know, just doing this simple exercise is the hardest part. It’s not a workable plan yet, but it is a direction. And you may eventually get where you want—just by going in that direction.

Step 2: Improve the cost estimates

Whether your goal is to buy a house, remodel your kitchen, or to plan a comfortable retirement, the place where these planning steps differ the most is in how to improve the dollar estimates. You probably don’t need as much help with your other goals, which is another reason I’ve chosen our example to focus on retirement planning.

Considerations for retiring include figuring out the savings you’ll require, when to start Social Security, and whether to use CDs, a lifetime annuity, stock index mutual funds, or a combination of these kind of things.

Step 3: Prioritize by needs, wants, and wishes

The idea here is to match safe investments for your essential needs and consider investment risk only for the wants and wishes that you could live without — if risk rears its ugly head.

Step 4: Match each goal with investment risk

This will be the grand finale and easiest for me show by our example. The challenge here is to turn retirement savings into monthly income — for however long you might live, and avoid some of the other big financial risks ahead.

The Big Financial Risks Ahead

The big risks are probably:

- Not saving enough

- Inflation

- Stock market volatility

- Outliving your money

- and common investing mistakes, because we’re human.

More about those risks

Not saving enough

Most Americans don’t save enough. Their futures becomes whatever they can string together. The purpose for this article is to give you simple guidance about how you can use very simple goal-based investment planning to save and invest towards those lifetime goals and dreams — and maximize your happiness.

Inflation risk

Beginner investors don’t think about inflation, but if their investments aren’t keeping up with inflation their goals will become unreachable. This article/video will introduce you to inflation-indexed saving backed by the U.S. government. They are not sexy, and you probably have never heard of them, but they may very well be your best safe choice.

Stock market risk

Some people forgot what stock market risk is. And after more than a decade of tremendous returns discovered in March 2020 that they shouldn’t have carried that risk. This is the topic of Rule #3.

Outliving your money

This is a big one. Should you create a plan for living to age 70? or age 90? This might be the single biggest reason that people don’t plan. So, this example will illustrate how to eliminate that risk entirely.

Common human mistakes

Finally, there are numerous smaller risks that you can eliminate by learning the essentials — that I think everyone should be taught, but aren’t. Well, you’ll learn them here in Rules 4-10 in the Ten Rules of Common Sense Investing.

Example: Simple Retirement Income Planning

People use all the uncertainties as their reason not to plan. Hog wash! Work with what you know. Strive to get the general direction right. Let’s dive in.

Example Step 1: Simple goal, date, cost

We’ll use an easy to follow example. His name is Ed. He was single his whole life and is now retiring at age 66.

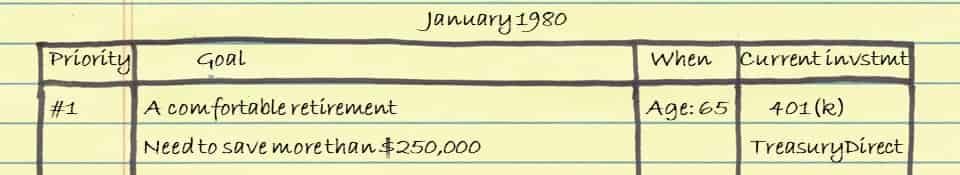

Every year since he was age 25 he wrote this same goal, and kept adjusting it every year for inflation. Back in 1980 it looked like this:

It now takes three times as much money to retire with the same standard of living. Always keep your plan updated in today’s dollars.

The total savings dollar goal is important to choose. It’s often called your “nest egg”.

Example Step 2a: Estimate retirement living expenses

Goal-based investment planning for retirement starts with an estimate of annual living expenses.2

Most people want to keep their lifestyle in retirement to be the same as they had just before retirement, and they can do that by replacing only a portion of their pre-retirement income. This replacement income is lower because

- you no longer need to save for retirement,

- your tax rate might be lower,

- you may have paid off your mortgage,

- the kids may have moved out,

- you spend less related to your career (food, clothing, transportation),

- you have more time to shop around for a good deal and more time to cook at home.

Example Step 2b: Two methods to estimate the total savings that will be required

The next step to come up with a dollar amount to save for this goal is to estimate the amount of retirement living expenses that will need to come out of your savings. The primary sources for retirement income are Social Security, pension benefits, and accumulated savings.

In the U.S., your Social Security benefit is most significant for low earners. For high earners, a larger portion will need to come from savings.

Here are two methods to compute the “nest egg” you’ll want to save up for retirement.

Method 1: for low-earners (<$50K)

Method 1 is to multiply replacement income by 12.

The idea here is to assume your Social Security benefit will cover about half of your retirement income need.

In our example, Ed used this approach because it was simple. Later in this video you’ll see how it works out for him.

He recently estimates required replacement income to be 65% of his ending salary, for a total of $65,000 a year.

So, his total savings in his nest egg needs to be twelve times that, or $780K.

Method 2: for middle- and high-earners

Method 2 is to subtract other income sources and then multiply by 25: (“Replacement Income” – SS benefit – Pension) by 25

For our example, this method suggests Ed needs a slightly larger nest egg. For 30 years of $65,000 of inflation-adjusted income, he subtracts his Social Security benefit and multiplies by 25 to get $875,000 required savings.

In our example, Ed only saves the smaller amount of these two methods but he does safely avoid both inflation and stock market risk. The next two steps will look at how he should invest this money.

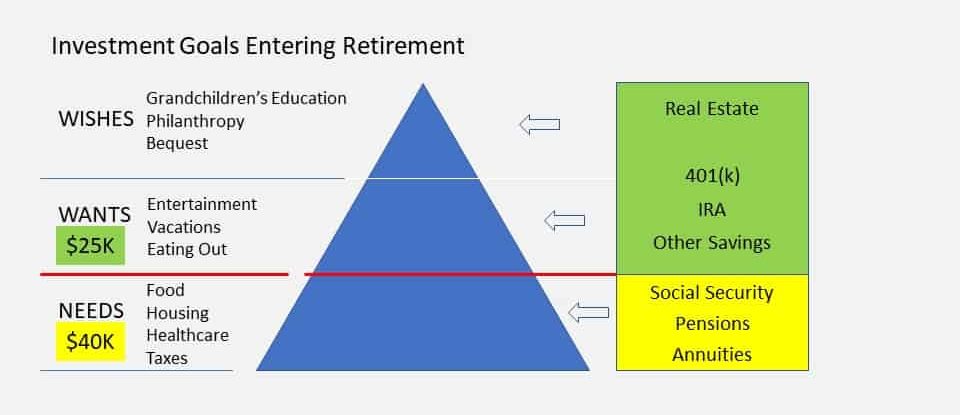

Example Step 3: Separate essential needs, wants and wishes

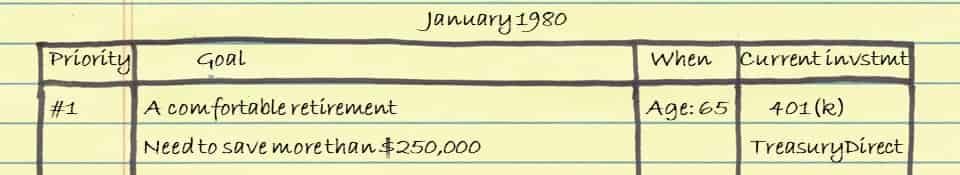

Ed has met his retirement saving goal and would like to retire this year at age 66. To achieve a worry-free retirement he now expands his one goal into three: his essential needs, his wants, and his wishes. Here’s a closer look at how his annual living expenses break down.

- His essential NEEDS are not optional. They add up to $40K/yr.

- His WANTS are discretionary. He could live without these, but they are important to his quality of life. They are another $25,000/yr.

- If he had enough money, he has additional WISHES as well.

For Step 4 we’ll compare three strategies to convert your nest egg into monthly income that meets your goals.

Example Step 4: Compare three strategies to match investment assets with each goal.

Use goal-based investment planning to establish safe, guaranteed income sources for your essential needs that will last your lifetime. That’s the needs below this red line.

Since there is uncertainty about how long you will live, Social Security, pensions and some commercial annuities are well-suited for matching with this goal. This is the role of annuities. People that live short lives subsidize people that live long lives. Society comes out ahead, because everyone is not over-saving for a long-life contingency. This frees up money for people to take trips or other spending that increases happiness. My example will illustrate this.

What is an annuity?

Think of Social Security as an annuity that is backed by the federal government.

The Social Security benefit is precious for three reasons:

- It is a guaranteed income stream for as long as you live,

- backed by the U.S. government which is as safe as possible in our world, and

- it has an annual cost of living adjustment.

So, it goes a long ways to eliminate your longevity risk (of outliving your money), any credit risk (because they’ll never go bankrupt), and inflation risk.

A key point is that the Social Security benefit gets dramatically bigger if you can delay starting that benefit until age 70. Watch for this in the examples just ahead.

Think of a pension as an annuity that is backed by a corporation, state or municipality. Very few people have pensions today. Many corporations have shifted from defined benefit pension plans to defined contribution plans, like 401(k)s.

And lastly, if you don’t have enough Social Security and pensions to cover your essential expenses, you can purchase an annuity. This would be lifetime guaranteed income that is backed by a highly rated insurance company. I’ll demonstrate this as well.

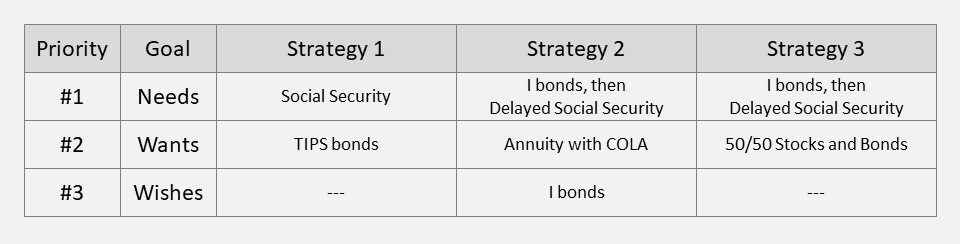

Next, Ed considers three different ways to match investments with his goals.

- First, hedging inflation with Social Security and TIPS bonds.

- Second, delaying Social Security and buying a lifetime annuity.

- Last, using low-cost index funds instead of an annuity.

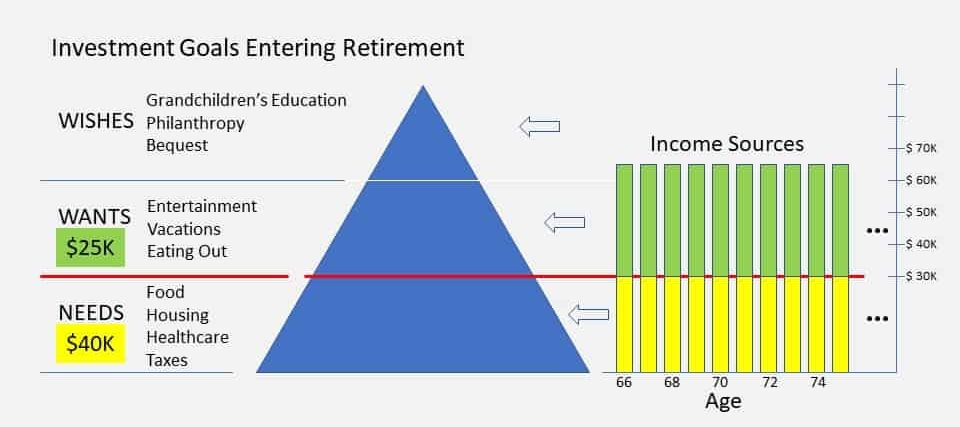

To evaluate these strategies, Ed must consider them as generating steams of income for each year of his retirement, with income for his essential needs coming from one source, and income matched with his wants coming from perhaps another source.

Detaching this income from the stock market enables a worry-free retirement. Ed’s goal is to create inflation-protected replacement income of $65,000 and expect about half to come from Social Security and half from savings.

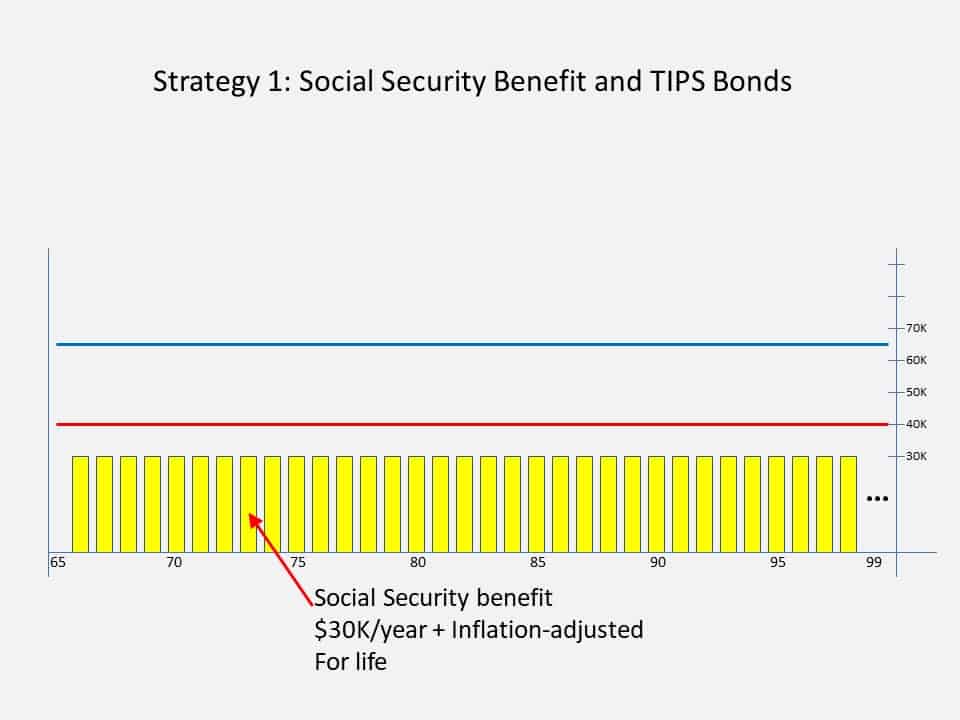

Strategy 1: Social Security plus TIPS bonds

Ed’s first strategy is to hedge inflation using both his Social Security benefit and inflation-indexed bonds called TIPS bonds.

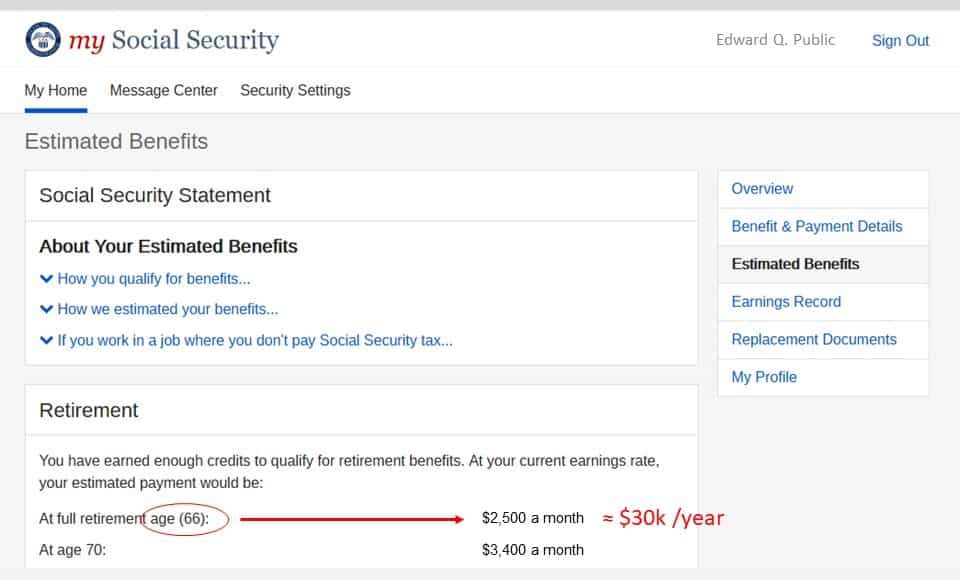

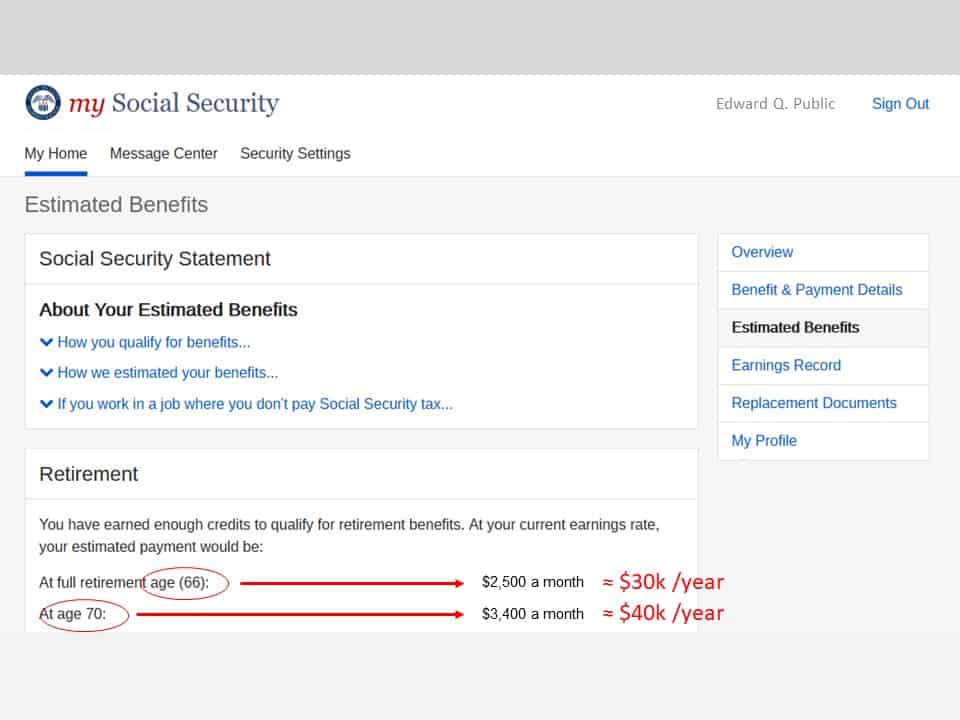

To evaluate this, Ed looks up his Social Security benefit at mySocialSecurity.gov.

It shows you your monthly benefit for different start ages. Starting at age 66, Ed’s benefit will be 12 times this monthly amount, or about $30,000 this year, with an annual inflation adjustment.

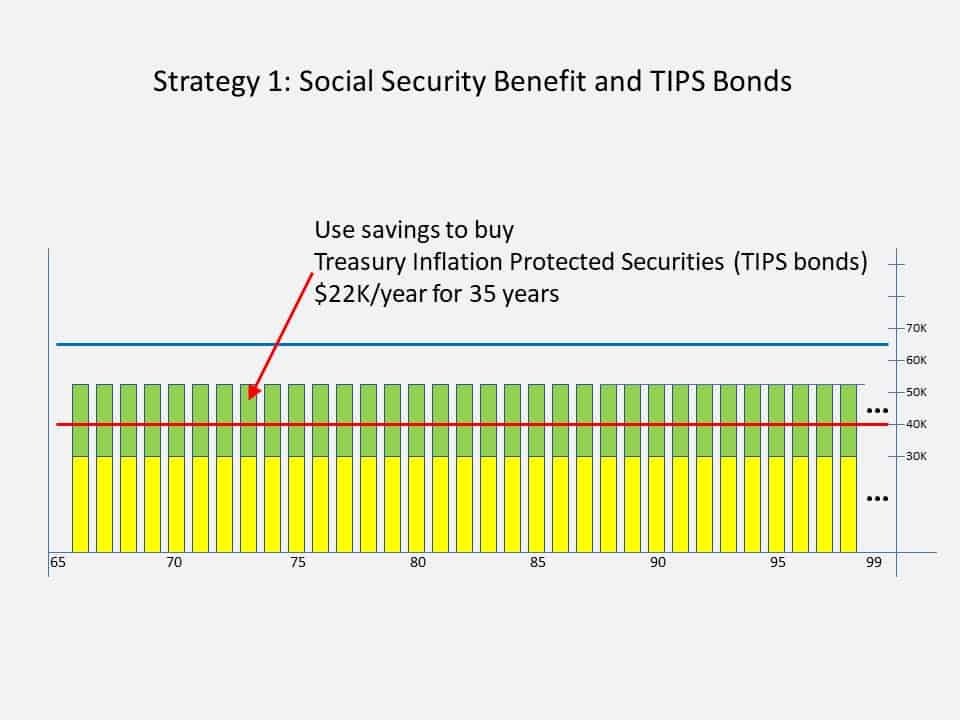

He receives the social security benefit for as long as he is alive. But so far, he’s $10,000 shy of the red line—his annual bare essential needs, which are $40k /yr.

His savings could give him an additional 22K until he is 100. ($22K x 35 years = $770K)

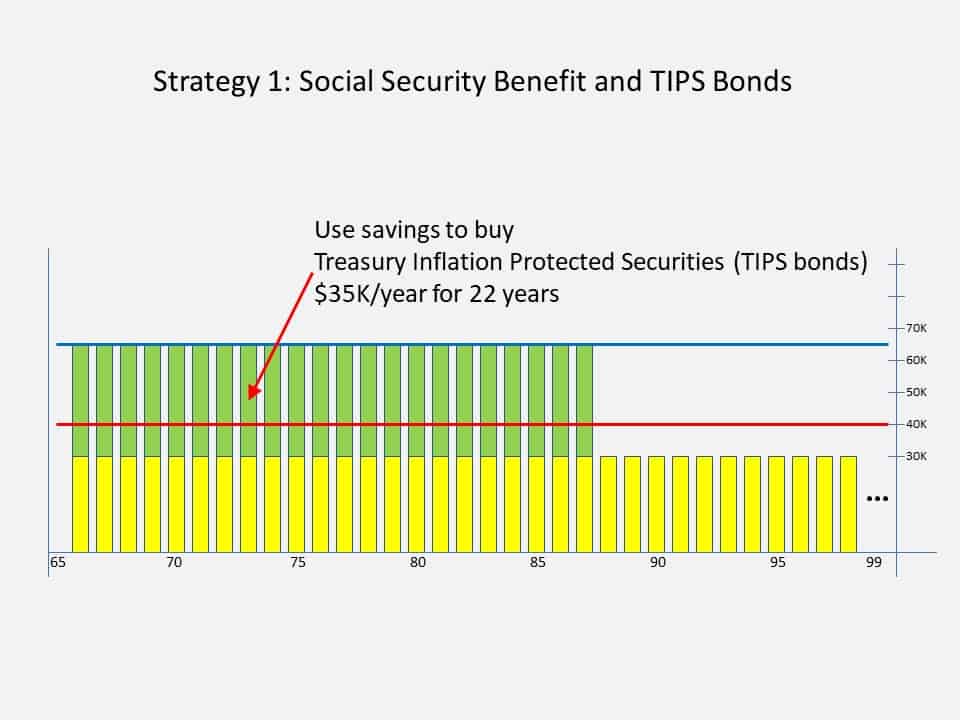

But that doesn’t even cover half of his WANTS, so he sees that as an unhappy retirement.

Alternatively, he could fully fund his budget for WANTS, but he would run out at age 87 and he would have to hope to get into a desirable Medicaid facility. He’s not excited about that.

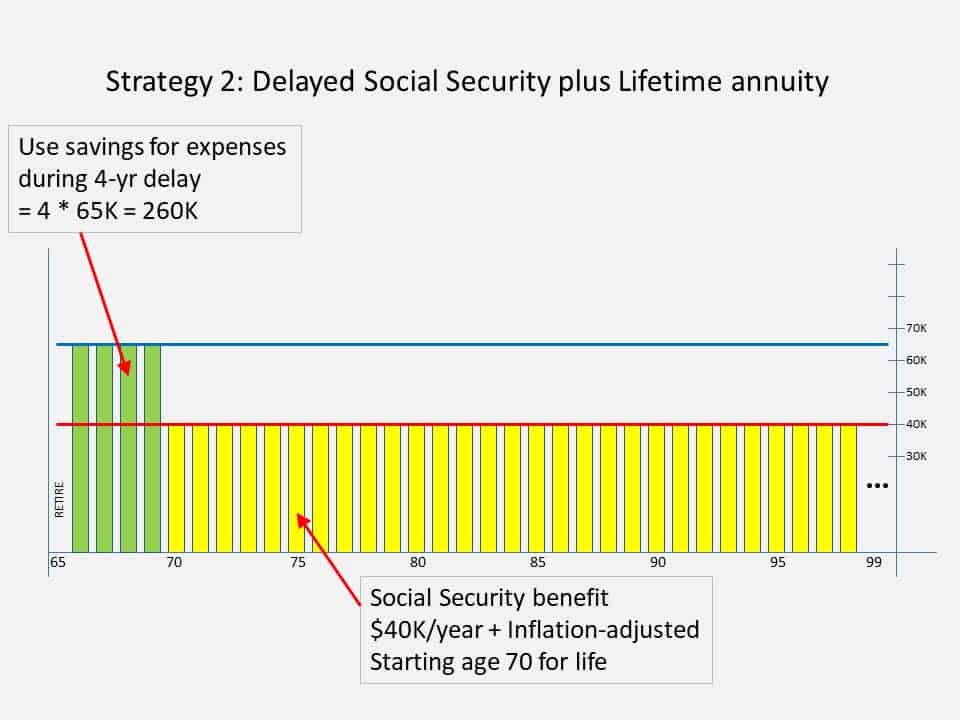

Strategy 2: Delayed Social Security plus lifetime annuity

Hmmm, Ed thinks. That Social Security benefit is looking better than ever! They never go bankrupt and it does include a cost of living adjustment.

There is a huge benefit from delaying Social Security until age 70. In this example it is an additional $10,000 per year.

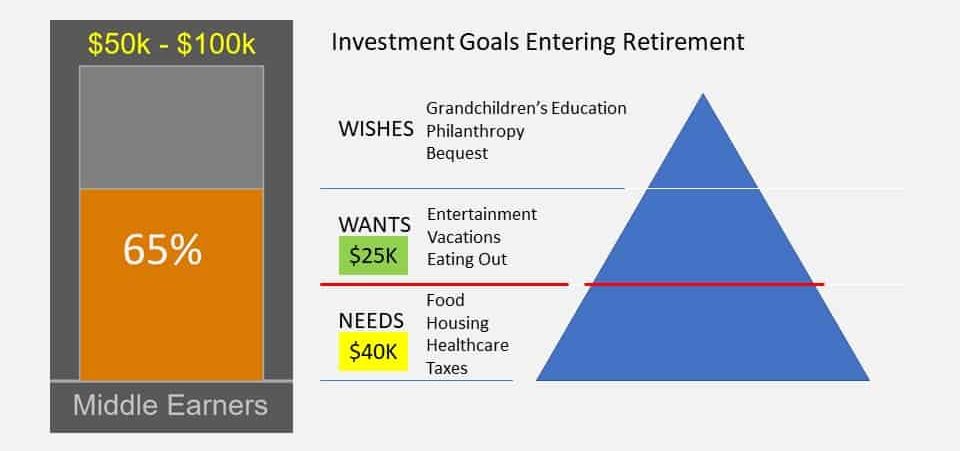

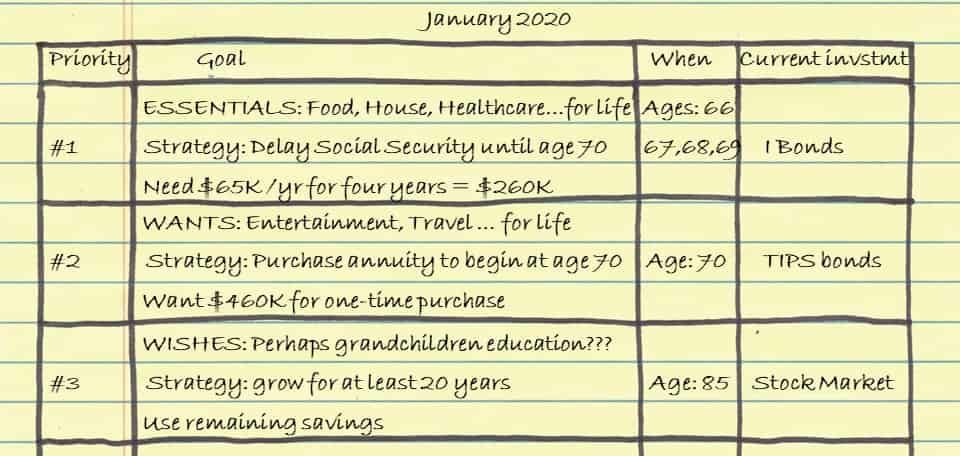

So, Ed goes back to his Social Security benefits statement and sees that he’d get $40K /yr for the rest of his life. For most people, this is an exceptionally good deal.

In this second strategy, Ed still retires while age 66 and uses maturing bonds to fund the four years before his Social Security benefit starts at age 70, which will now be $40,000 and fully cover his essential needs.

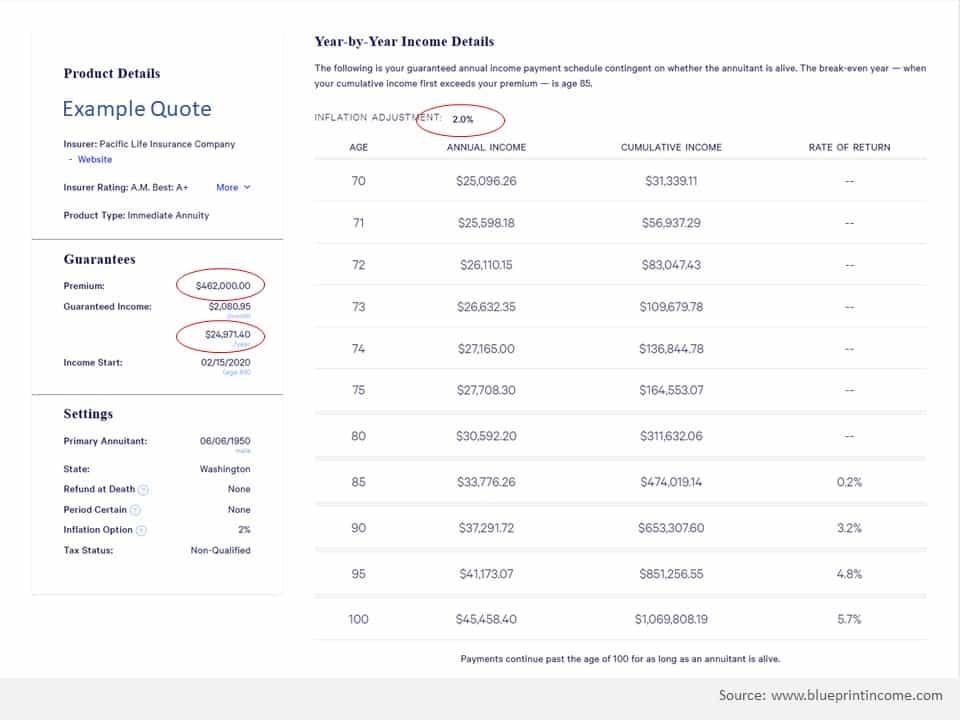

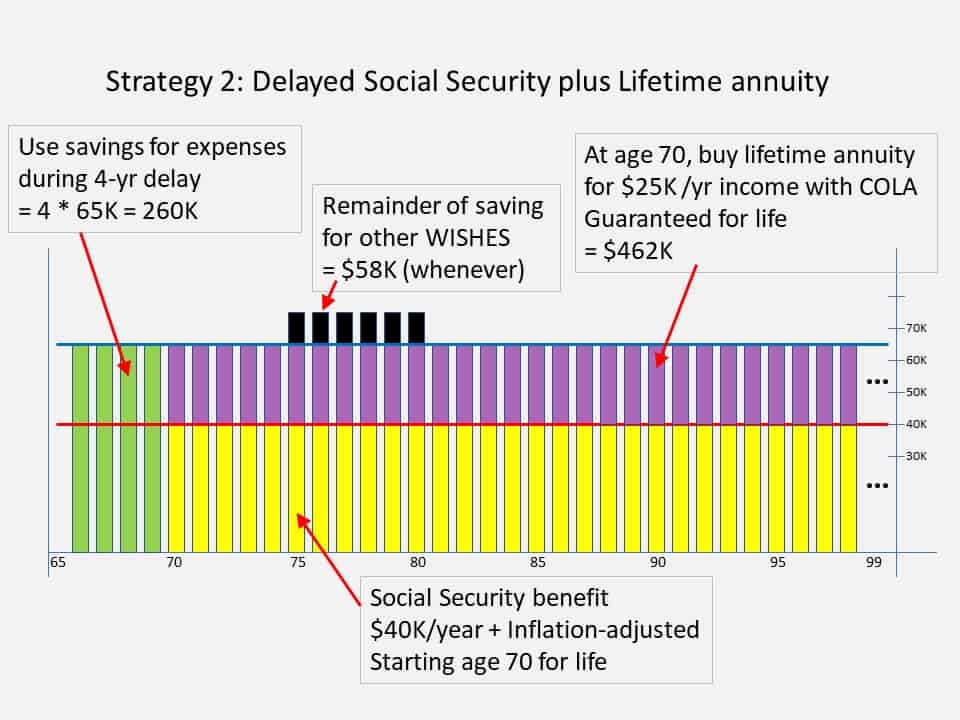

With the balance of his money he plans to purchase an immediate income annuity, also at age 70.

He looks up a free quote for an immediate income annuity to fully fund his WANTS for as long as he lives, keeping up with inflation with 2% cost-of-living-adjustments.

Looks good. Again, he retires at age 66, uses his savings for 4 years to get the higher SS benefit, and buy an annuity with a cost-of-living-adjustment when he reaches 70 to cover all his WANTS.

In fact, he’ll have 58K left over to use for his WISHES.

He has eliminated longevity risk, inflation risk, and market risk!

Looks pretty good. All his needs and wants are covered, and he’ll sleep well—never to worry about the stock or bond markets again. But, he WISHES he could be more generous — which he maybe could be if he didn’t purchase the annuity. So, for completeness, he considers whether he might rather be in stock mutual funds.

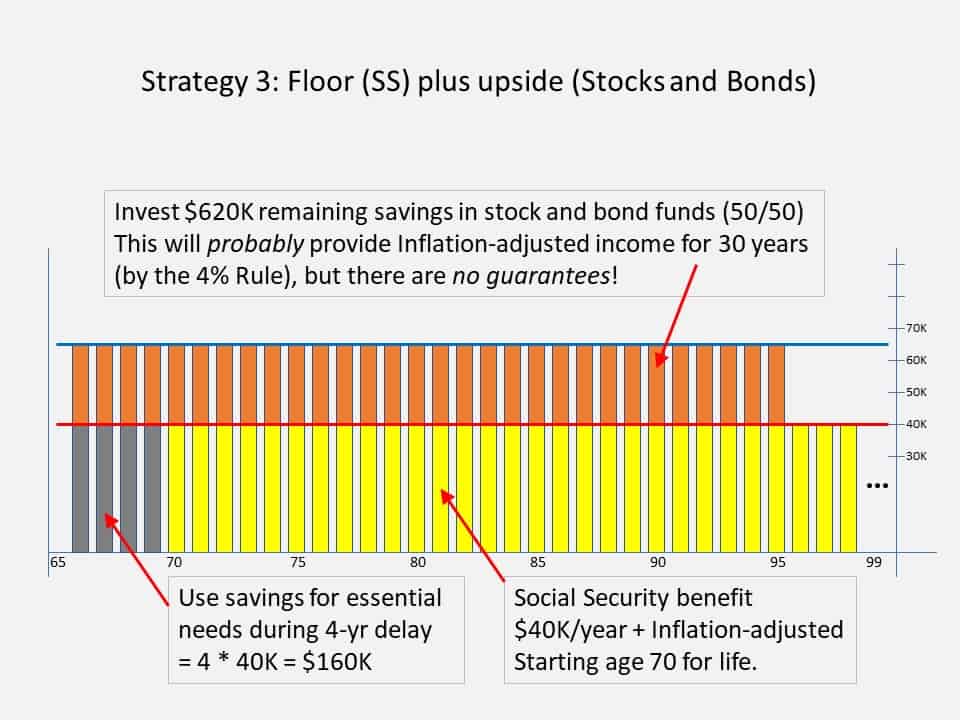

Strategy 3: Delayed Social Security plus stock and bond funds

He could allocate money to cover his essential needs to get the delayed Social Security benefit. The, using the 4% Rule for the rest of his nest egg would suggest that he could safely meet his WANTS for 30 years with a portfolio of stock and bond index funds. This would give him the best chance of additional funds if the market is strong, but also the greatest risk of shortfall if the market does badly. He’d especially be in a jam if his retirement years start with a sequence of bad returns.

This isn’t a good strategy for Ed. But everyone is different! Somebody very frugal, with very few WANTS, might prefer this. Or, somebody wealthy enough that they could bear the market risk.

Summary: using goal-based investment planning

In this video I’ve shown that it is easy to make a plan and improve it each year. It starts by putting your goals in writing.

For our retirement planning example, we used guidelines to estimate our annual living expenses and then calculate the total savings “nest egg” required for that retirement income.

We prioritize to separate essential needs from those we could live without.

And finally, match investment risk with each goal.

But, there’s more to learn. Keep watching this video series. Learn how to take control of your finances and live the life that you want to live.

The next video, Rule#2, will look at saving. How do people save that much money? What important tricks make it easier?

Investing for beginners video series

▼The Ten Rules of Common Sense Investing is a series to teach investing for beginners:

🠞 The Smart Investing for beginners summary guide

https://financinglife.org/smart-investing-for-beginners/

✅ Rule #1: Develop a workable plan

https://www.youtube.com/watch?v=P38tR8IoTGI&list=PL21534875BFC50EEE

✅ Rule #2: Start saving money early

https://www.youtube.com/watch?v=08s12IUc-Lc&list=PL21534875BFC50EEE

✅ Rule #3: Control stock market risk exposure

https://www.youtube.com/watch?v=qCeB7_sn4ZM&list=PL21534875BFC50EEE

✅ Rule #4: Diversify stocks

https://www.youtube.com/watch?v=zXnbxLtRhrU&list=PL21534875BFC50EEE

✅ Rule #5: Never try to time the market

https://www.youtube.com/watch?v=b3pnpbWYfwc&list=PL21534875BFC50EEE

✅ Rule #6: Use index funds when possible

https://www.youtube.com/watch?v=GF5vThMkF-U&list=PL21534875BFC50EEE

✅ Rule #7: Keep costs low

https://www.youtube.com/watch?v=GqQfA4xPvAo&list=PL21534875BFC50EEE

✅ Rule #8: Minimize taxes

https://www.youtube.com/watch?v=bLDJN-sbhuA&list=PL21534875BFC50EEE

✅ Rule #9: Keep it simple

https://www.youtube.com/watch?v=rmUJeDRGi2k&list=PL21534875BFC50EEE

✅ Rule #10: Stay the course

https://www.youtube.com/watch?v=aHi2RdQ81Yk&list=PL21534875BFC50EEE

Recommended books for beginner investors

Here’s a list of my book recommendations.

Risk Less and Prosper book by Zvi Bodie and Rachael. I wasn’t ready for this book when it was published in 2012. Shame on me. This is a better approach to goal-based investing than blindly focusing on accumulating a pot of money. It’s better because the focus is not on the probability of achieving a particular number, but instead on the consequences of not achieving enough for your minimum needs. Finance is about risk, and this is a more rational approach to risk.

Endnotes: goal-based investment planning

1. This series of ten rules is also endearingly called the Bogleheads investment philosophy — investing advice inspired by John C. Bogle. I prefer to call it Common Sense Investing as a nod to one of my favorite books by John C. Bogle↩

2. How much income do you need in retirement? a short video by Dimensional Fund Advisors.↩