Read this along with the step-by-step guide to build an all weather portfolio with stocks, CDs, bonds, and bond funds. Bonds provide the stability to stay the course during inevitable turbulent market periods. Investors are best rewarded for keeping their investment risk on the stock side of their portfolios. Treasury Inflation Protected Securities go one step safer and reduce risk from unexpected inflation.

TIPS reduce risk from unexpected inflation

KEY CONCEPTS

- TIPS, or Treasury Inflation Protected Securities, are special bonds where the principal adjusts with the consumer price index; TIPS investors win if inflation is higher than expected

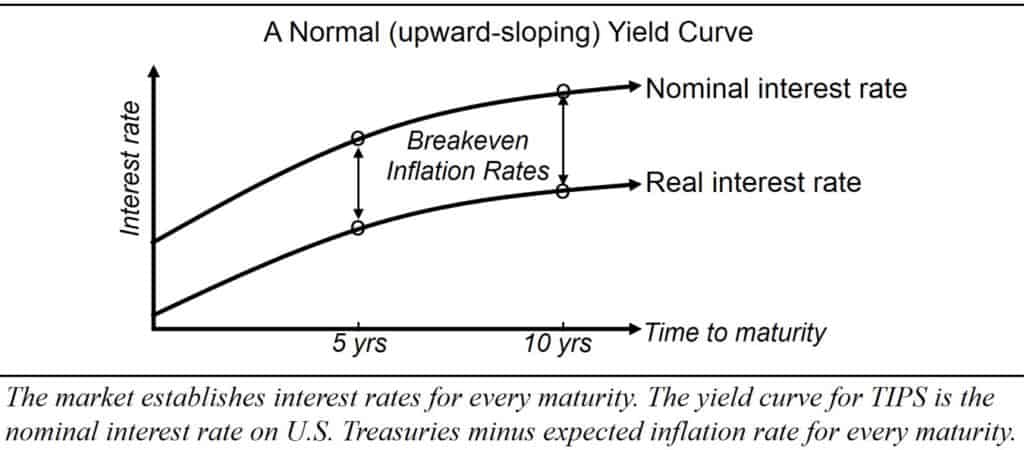

- The market establishes interest rates for every maturity. The result is a yield curve for a set of similar securities (e.g., the U.S. Treasury Yield Curve)

- In the end, we care about real (inflation adjusted) growth

- Nominal interest rates includes market’s best estimate of future inflation; investors win if actual inflation is lower

Inflation is a big risk. Long-term investments in stocks produce growth significantly above inflation, but what about portfolios that have a significant percentage of bonds?

Many choose Treasury Inflation Protected Securities (TIPS) for protection against unexpectedly high inflation. While these are issued with a lower coupon rate, don’t misunderstand this, because both the principal and interest of TIPS are indexed to inflation. So, if inflation increases by 0.2% one month, then the principal of this special type of bond increases by 0.2%, and the coupon interest rate applies to the new inflation-adjusted principal.

As a result, if there is 3% inflation every year for ten years, a $1,000 TIPS will return $1,344 (=1000*(1.03)10)to the bond holder when it matures, rather than $1,000 as would a normal Treasury bond. The purchasing power of the invested principal will be the same as the $1,000 had ten years earlier, it’s just that the principal money has been adjusted for inflation.

That’s it! You can skip ahead to the next chapter now about how to build your portfolio. Or, read on to learn more about how it works.

Real versus Nominal Interest Rates

Learning more is easy, but I need to teach you another word. All through this book we have talked about interest rates but now we need to be more precise. They were actually nominal interest rates.

Nominal interest rates are not inflation adjusted.

Real interest rates have inflation subtracted out from them.

Ultimately, we all seek to grow the purchasing power of our money after inflation. The coupons for Treasury Inflation Protected Securities (TIPS) are smaller and represent this real interest rate because the principal amount of these securities grow with the Consumer Price Index.1 The real interest rate is just that—the rate of interest an investment earns that is above inflation. The nominal interest rate that we have discussed so far is comprised of the inflation rate plus the real interest rate.2

Nominal = Real Interest Rate + Breakeven Inflation Rate

Our goal is to protect ourselves from inflation. We will identify strategies to protect our investments both if inflation is higher than expected, and if inflation is lower than expected. First we have to return to our friend, the yield curve. We are now in a position to discuss the determinants of a bond’s yield. As we will see, the yield on any particular bond is a reflection of a variety of factors, some common to all bonds and some specific to the issue under consideration.

The Valuable Meaning in a Yield Curve

I’m going to introduce this to you, not because you need to interpret yield curves (you don’t), but because this will help you to understand the relationship between interest rates and expected inflation.

A yield curve is a graph demonstrating the relationship between yield and maturity for a set of similar securities. A number of yield curves are available, but the one that investors compare all others to is the U.S. Treasury Yield Curve.

At any point in time, short-term and long-term interest rates will generally be different. Sometimes short-term rates are higher, sometimes lower. Each day, in addition to a table of Treasury prices and yields, the government publishes a plot of the yield curve for U.S. Treasuries at treasury.gov.3

These yield curves change over time. The Federal Reserve’s policy drives the yields for short maturities. The market sets all other rates (longer maturities).

Breakeven Inflation Rate

In this example, the nominal interest rate curve represents the current yields for U.S. Treasuries of each maturity. The curve beneath this are the current yields for Treasury Inflation Protected Securities (TIPS) of each maturity. The difference between them represents the Breakeven Inflation Rate.

Breakeven Inflation Rate is mostly the expected inflation that is built into Treasury interest rates. If inflation is less than expected, then investors that buy Treasuries come out ahead. If inflation is more than expected, then investors that buy TIPS come out ahead. The Breakeven Inflation Rate is actually slightly bigger than expected inflation because it also includes a small premium—being the cost investors are willing to pay to guarantee real returns.

This composite yield curve is hypothetical to illustrate the key concepts in a simple way. It would look different if inflation is expected to fall. Additionally, expected future real rates could be larger or smaller than the current real rate.

In 2012, all Treasuries with less than 20-year maturities were yielding less than inflation. Investors are paying a premium for safety when they invest in these securities. While unusual, this price for safety is not a good reason to abandon your investment plan and accept a higher level of risk than you accepted before.

That means that the corresponding real interest rates were negative! Why would you invest in a bond with negative yield? This does not mean that an investor will experience negative returns. Read on …

Why Include Treasury Inflation Protected Securities (TIPS) In Your Portfolio?

TIPS are like traditional Treasury bonds but offer insurance against inflation in a different manner. At each semi-annual coupon payment, the principal value of the bond receives an adjustment based on the current rate of inflation. Future interest payments are computed from the new inflation-adjusted bond value.

Traditional Bonds are a better investment if future inflation is less than expected, and TIPS are a better investment if future inflation is greater than expected. But there is more.

With a normal yield curve, investors can earn higher interest rates if they accept the risks associated with longer-term bonds—and that includes unexpected inflation.

Key Point: The biggest advantage of TIPS is that investors can earn that term premium without taking the risk of unexpected inflation.

TIPS have only been in existence since 1997, but long enough for bond expert Larry Swedroe to assert that TIPS are even slightly negatively correlated with the stock market (i.e. better than traditional Treasuries). This means a smaller amount of TIPS can achieve an investor’s risk position, enabling a bigger investment in the stock market for higher expected return.

Thought question …

Consider this: can you determine, based on these numbers, which is the better investment?

10-year Treasury bond yielding 2%, or

10-year TIPS yielding -0.5% (yes, that’s negative 0.5%)

No. You don’t know and you can’t know at the time you purchase the bond. That’s because the yield of the TIPS does not include the inflation adjustment that will be applied monthly to the price of the TIPS. It may be higher than 2% or lower, depending on the future inflation rate.

But these yields do tell us what the market expects will be the Breakeven Inflation Rate:

Breakeven inflation rate = YTM(traditional) – YTM(TIPS) = 2.5%

Key point: The breakeven rate is defined as the rate that would result in equivalent total returns for both types of bonds.

The expected return for the traditional Treasury bond is simply the yield to maturity (on the nominal curve). For TIPS, the expected return is the yield to maturity (on the real curve) plus the expected inflation adjustments. Notice that the expected returns between the two bonds are the same!4

If the rate of inflation turns out to be higher than 2.5%, then due to the inflation adjustment, the TIPS will turn out to have been the better buy. But if the rate of inflation is lower than 2.5%, then because of higher interest payments during the life of the conventional T-bond, that will turn out to have been the better buy.

Two Scenarios using Treasury Inflation Protected Securities

In this first scenario we see how the TIPS bond is the better buy when actual inflation turns out to be higher than expected:

Actual Inflation = 3.5% (higher than originally expected 2.5%)

Treasury bond | TIPS bond | |

Yield to Maturity | 2.00% | -0.50% |

Inflation Adjustment | (none) | 3.50% |

Actual Return | 2.00% | 3.00% |

Scenario #2

In this next scenario we see that when actual inflation is lower than expected, then traditional bonds do better.

Actual Inflation = 1.5% (less than originally expected 2.5%)

Treasury bond | TIPS bond | |

Yield to Maturity | 2.00% | -0.50% |

Inflation Adjustment | (none) | 1.50% |

Actual Return | 2.00% | 1.00% |

Key points about using TIPS

A strategy many investors use to protect themselves from inflation being different than expected (because nobody can predict the future) is to purchase half (or more) of their bonds as TIPS (Treasury Inflation Protected Securities).

Key Point: The difference between the yield of a Treasury bond and a TIPS with the same maturity reflects the market’s expectation of inflation for the period.

Key Point: The market’s expectations for inflation is built into the rates. If inflation turns out to be less than expected, investors come out ahead. And if inflation is greater than expected, investors do better with TIPS.

Key Point: There is not a single interest rate and the government does not set interest rates. Rather, the U.S. federal government sets Federal Funds rate and the market determines these yield curves based on their expectations about inflation and prospects for the future.

Key Point: A bond rides the yield curve for its entire life. It might be originally issued as a 20-year security, but after ten years it gets priced like it is a 10-year bond (because it is one now). And as it approaches maturity, the yield on it falls to essentially money market yields. Bond funds rarely hold bonds all the way to maturity.

Key Point: There are sweet spots on the Yield Curve. Investors might get a 0.1% per year increase in yield for extending maturity in the very short-term. Returns might increase 0.3% per year for extending maturity for years 4 through 10, and then decrease to only 0.1% per year for extending longer.

Choose maturity for TIPS bonds or bond funds

Bond expert Larry Swedroe has suggested a rule-of-thumb of choosing: select the longer maturity if the return is at least 0.2% per year for nominal bonds (or 0.15% per year for municipal bonds).5

Lastly, taxation matters, and issues can be avoided by holding TIPS as mutual funds, or holding individual TIPS in a tax-advantaged account.

To summarize, two factors are most important to characterize a bond’s risk: term to maturity, and credit quality of the issuer. The past few sections in this book have been discussing the implications of short-term or long-term bonds—and the premium you can earn by taking on term risk.

While maturity dates for individual bonds are explicit, funds are generally divided into three broad groups based on average maturity:

- Short-term (1 to 5 years)

- Intermediate-term (5 to 10 years)

- Long-term (more than 10 years)

As you’d expect, you can also earn a premium by taking on additional risks. The biggest of these would be investing in bonds with lower credit quality, which have increased risk of default. But other premiums can be earned for bonds that can be “called” or paid back early—depriving investors anticipated return when interest rates drop. Next we will look at credit ratings and why we normally want only the highest quality.

Credit Quality or Default Risk

KEY CONCEPTS:

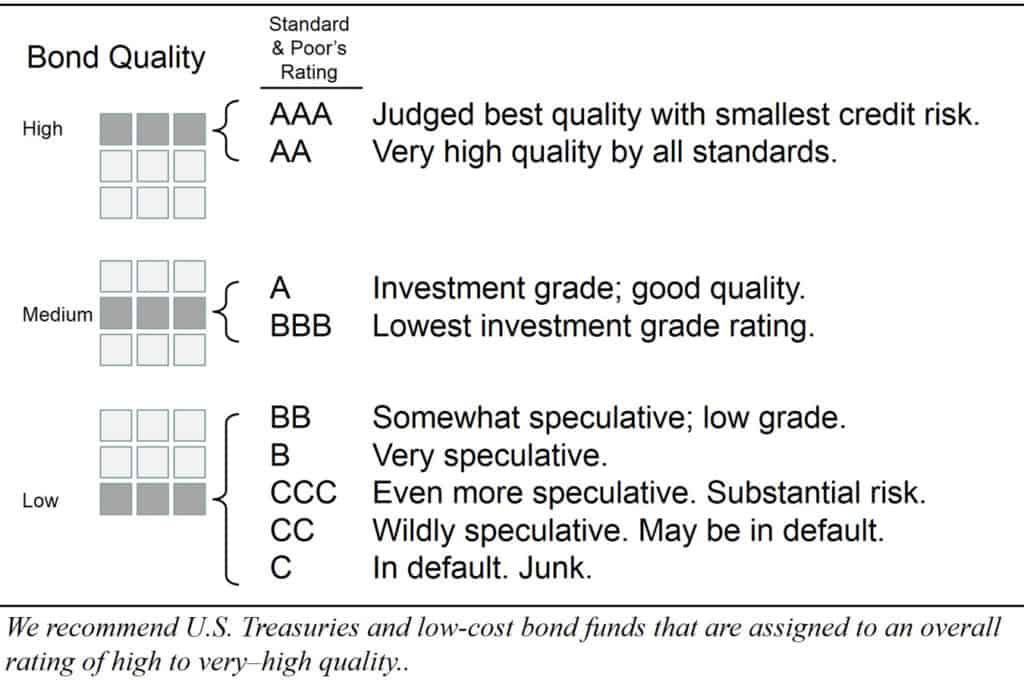

- Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

- Treasuries are low cost, don’t require diversification, and are the highest credit quality.

- Even the highest quality corporate bonds should be purchased in mutual funds because they lack price transparency and require diversification.

- High-yield corporate bonds should be avoided because they are more correlated with the stock market, illiquid, and have additional reasons for being called early.

Credit quality indicates the market’s assessment on whether a bond is likely to be repaid on schedule.

This is determined by several major rating firms. Here is how Standard & Poor ratings map onto a simple style guide.

The rating agencies each use slightly different nomenclature and fund companies have minor variations of the 9 box style guide, but the concept is the same.

Who should you loan your money to?

Many wise investors approach this like they approach their stock investments and simply invest in the total bond market by using a low-cost index fund. Since this is weighted to match the overall bond market, most of the funds will be U.S. Treasuries. This approach is extremely diversified and highly recommended. If you are not choosing a Treasuries fund, or a total bond market fund, then you need to look a little closer about what you are investing in.

You are choosing who you will loan your money to—or more precisely, who will issue the bond. Some people call simple bonds, like U.S. Treasuries, plain vanilla bonds, because they don’t have special ingredients—like a “call provision”. Homeowners are actually familiar with this concept if they use a mortgage to purchase their house. In this case, the banks are loaning money at specified rate while the homeowners want a call provision to be able to refinance their mortgage if interest rates become significantly lower.

I will discuss the important types of bonds in this section.

U.S. Treasuries

Prices for Treasuries are highly transparent and the market is highly liquid. Many mutual fund providers like Vanguard or Fidelity waive the transaction costs for new issues bought at auction, making these commodities with low to zero transaction costs. Investors may also purchase them directly from TreasuryDirect.gov. The bonds are as straightforward as I have described with no complicated call provisions. Interest is subject to federal income tax, but exempt from state or local income taxes.

U.S. Treasury Bills, Notes, and Bonds are the standards by which other bonds are measured because we essentially ascribe their likelihood of default to be zero. This includes Treasury Inflation Protected Securities (TIPS) and iBonds.

Short-term Treasury instruments with a maturity of up to six months are called Treasury bills. T-bills are issued at a price less their face value (or, “discounted”) and the interest is paid in the form of the price rising toward that face value (or, “par”) at maturity.

Treasury instruments with a maturity of two to ten years are called notes; and maturities beyond ten years are called bonds.

Buying Treasuries at Auction is Easy

One option is TreasuryDirect.gov where you can buy and redeem securities directly from the U.S. Department of the Treasury in paperless electronic form.

At Fidelity, Schwab, and E-TRADE, you can buy Treasuries (including TIPS) online for no commission. Vanguard also waives their fee for online auction orders if your account is above $100,000. Other brokers charge commissions. TD Ameritrade, for instance, charges $25.

A secondary market exists for the time between a new issue and the bond maturity. Everyone charges a fee to buy/sell Treasuries on the secondary market because they have to match sellers up with buyers.

Treasury Inflation Protected Securities (TIPS) are special U.S. Treasury Bonds where the face value changes with the Consumer Price Index (CPI) and is paid at maturity. The coupon rate is lower than a nominal Treasury bond with the same maturity but both the principal and the interest payments are indexed to inflation. TIPS are a good hedge against unexpected inflation.

Series I Savings Bonds (I Bonds) are government savings bonds issued by the U.S. Treasury that offer inflation protection. I Bonds offer tax-deferral for up to 30 years and are free from state and local taxation. I Bonds are not marketable securities and cannot be traded in the secondary market.

These are currently limited to $10,000 per year per social security number so I will not expand upon these here but suffice it to say that, like bank-issued CDs, these are slightly cumbersome to set-up but can be more attractive than Treasuries for individual investors and excellent short summaries can be found here:

www.Bogleheads.org/wiki/I_bonds

www.Bogleheads.org/wiki/I_Bonds_vs_TIPS

Agency Bonds

U.S. Government Agency Bonds include mortgage-backed securities or other asset-backed securities backed by the government, and by government-sponsored enterprises, such as Fannie Mae and Freddie Mac, that are not explicitly backed by the U.S. government.

Government-sponsored enterprises issue bonds to support their mandates, which typically involve ensuring certain segments of the population—like farmers, students and homeowners—are able to borrow at affordable rates. Examples include Fannie Mae, Freddie Mac, and the Tennessee Valley Authority. Yields are higher than government bonds, representing their higher level of risk, though are still considered to be on the lower end of the risk spectrum. Some income from agency bonds, like Fannie Mae and Freddie Mac are taxable. Others are exempt from state and local taxes.

Mortgage-backed securities

Agency bonds include the world of mortgage-backed securities. Banks and other lending institutions pool mortgages and submit them to quasi-government agencies which turn them into securities that investors can buy that are backed by income from people repaying their mortgages. This raises money so the lenders can offer more mortgages. Examples of MBS issuers include Fannie Mae, and Freddie Mac, which are public companies, but their obligations do not carry the full faith and credit of the U.S. government. Mortgage-backed bonds have a yield that typically exceeds high-grade corporate bonds. The major risk of these bonds is if borrowers repay their mortgages in a “refinancing boom” it could shorten the investment’s average life and lower its yield. These bonds are also risky if many people default on their mortgages.

One of my mantras is “don’t invest in things I don’t understand” and mortgage-backed-securities fall in this category of very complicated financial instruments—despite their stellar credit rating. It sure seemed like this category surprised a lot of people in the sub-prime mortgage crisis of 2007.

John C. Bogle also recommends the Vanguard Intermediate-Term Bond Index Fund. It is very similar to the Total Bond Market Index Fund except does not include the “bond-like” mortgage-backed securities. It includes both more Treasuries and more investment-grade corporate bonds.

International bond funds

International bond funds invest in a range of taxable bonds issued by foreign governments and corporations. The argument against investing in these is that they don’t offer anything beyond the rich choices that already exist in the U.S. bond markets. Worse, investors are not compensated for the currency rate risks which are introduced. The argument in favor of these is that they help investors diversify by spreading interest rate and economic risk across the globe. I’m not an expert about this, but I am not even tempted.

Corporate Bonds

Investment-grade corporate bonds range from high-grade down to medium-grade producing slightly higher expected yields. Only funds should be considered at, or below, this level to ensure diversification, low-cost, and liquidity.

High-yield bond funds include bonds rated below investment-grade. They sometimes also called high income, high opportunity, or aggressive income bond funds. They are regarded to be high-credit risks and because of their default risk they are generally called “junk” bonds. Proponents of actively managed funds (not me!), and speculators of all sorts, are going to be tempted to look at these.

Special Types of Bonds

Municipal bond funds. States, cities, counties and towns issue bonds to pay for public projects (roads, sewers) and finance other activities. The majority of munis are exempt from federal income taxes and, in most cases, also exempt from state and local taxes if the investor is a resident in the state of issuance. As a result, the yields tend to be lower, but still may provide more after-tax income for investors in higher tax brackets.

Even though bonds seem to come in flavors ranging from vanilla to whiskey hazelnut—they are all just ice-cream. And most of the time vanilla works just fine. Boring—maybe.

We’ve covered the bonds I think you need to know about, but there are others. Flavors are really unlimited.

Stick With High Quality

In the prior chapter we looked at bond maturity and term risk (interest rate risk). This chapter we have looked at credit quality and the risk of default from the issuer (the entity we loan our money to). Credit quality (or, risk of default) is the second of the two important factors that characterize bonds. While buying Individual Treasury Notes and CDs is often smart and attractive, buying lower quality bonds is usually not if your total bond investments is less than $500,000—because of cost and liquidity. Low-cost mutual funds offer an attractive alternative. We can summarize this as three levels of increasing risk:

- Low Risk: Bond or fund’s average rating: AAA or AA.

- Medium: Average rating below AA, but BBB or better.

- Higher Risk: Average credit rating is below BBB.

Staying with the highest quality bonds (AAA and AA) is desirable because they are the least correlated with the stock market. Some experts suggest staying away from lower quality bonds because they tend to correlate with the stock market at the worst times. It’s better to take risks in the stock market and use bonds to anchor the portfolio.

Municipal bonds have their own ratings and typically range from very low for infrastructure projects (e.g., water and sewer plants) to occasionally higher risks for projects like new hospitals.

This brings us, finally, to the central point of this book and your most important investment decision: What is the right allocation of stocks and bonds for you?

Start with your goals to determine your appropriate level of investment risk.

Read More about Treasury bonds and TIPS:

The short and outstanding book Explore TIPS by Harry Sit, The Finance Buff, provides you the most practical guide to investing in Treasury Inflation Protected Securities that I know of. I highly recommend both his book and blog.