What is a fixed income investment? Fixed income investments generally pay a return (interest) on a fixed schedule, though the amount of the payments can vary. Fixed income securities provide stability to your portfolio. Fixed income examples include money market funds, CDs, bonds, and bond funds.

Read this article along with the step-by-step guide to build an all weather portfolio with stocks, CDs, bonds, and bond funds. The allocation to fixed-income securities help investors to stay the course across the inevitable turbulent market periods.

Consider fixed-income alternatives: what they are; how they work.

Should you choose a money market fund or a bond fund? Or perhaps dividend-paying stocks?

At first glance, some investing options look similar. Consider this: which types of investment will give you both a stable income stream and keep the principal at a stable value? In other words, if you have $40,000, is there a way to invest it such that every month they’d pay you a fixed amount, say $100, but at any time you desire you could stop and get your $40,000 back?

Suppose we want both: a stable income stream and maintain a

stable principal value. Would you look for a:

- money market fund?

- bond?

- dividend-paying stock?

- or none of these?

Make your best guess. Choose one, and then I’ll tell you the answer.

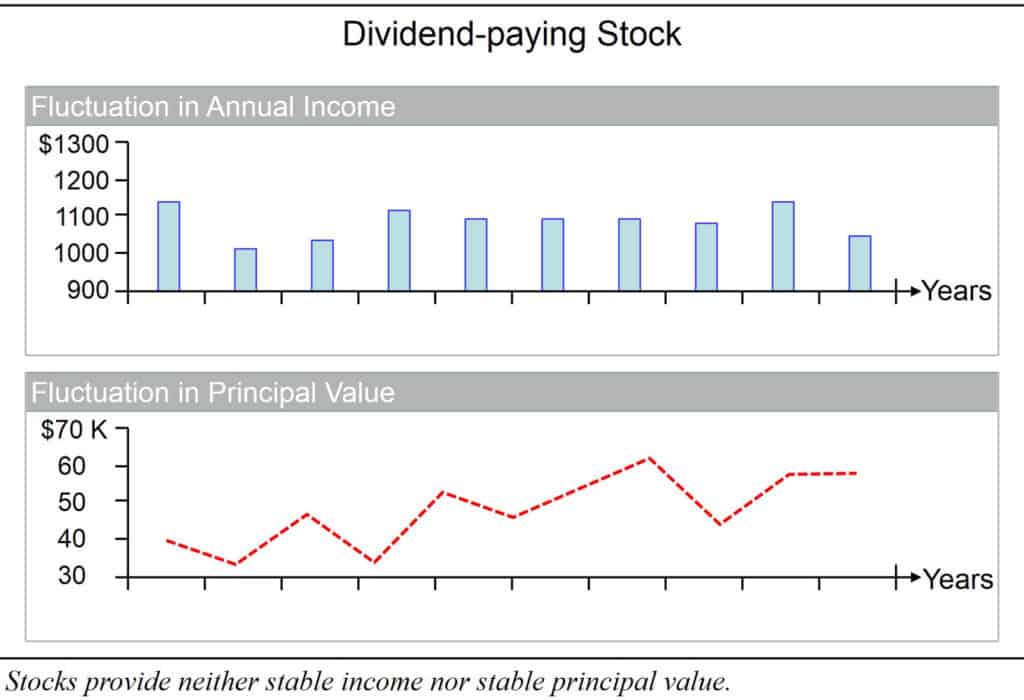

Did you choose “a dividend-paying stock”?

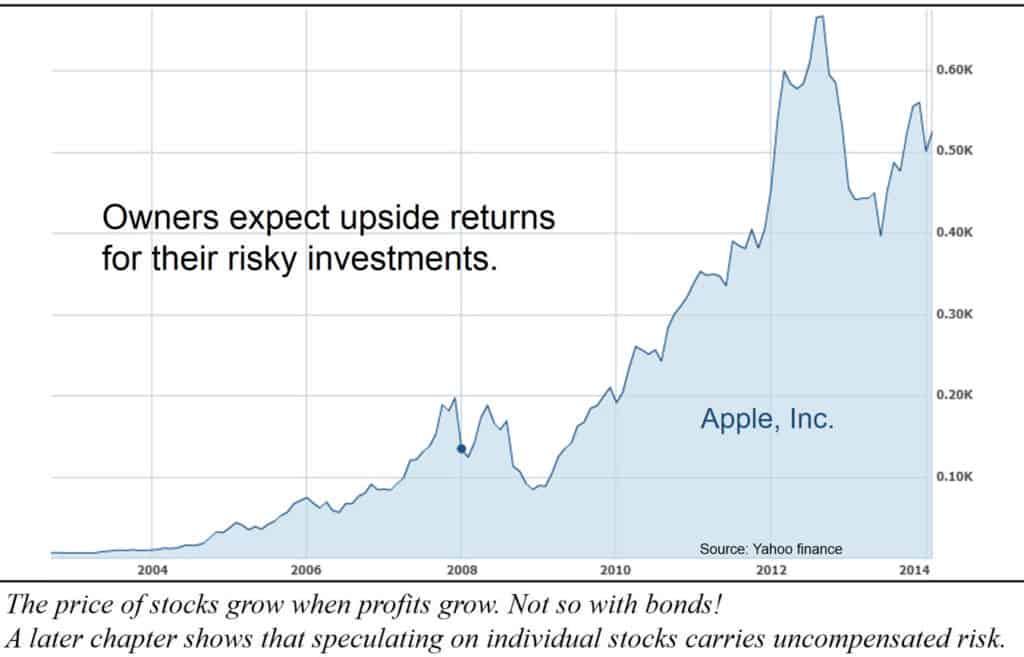

Stocks pay dividends. Buying a stock is buying ownership in a company. You can own it forever. You might wonder about whether these dividends are like bond dividends—after all, they are both called dividends, and both are payments on specific dates. But stock dividends are not contractual obligations with stockholders—they can be changed at any time, even eliminated. And the value of the stock moves with the stock market. No guarantees, but probably not the best answer to our thought problem.

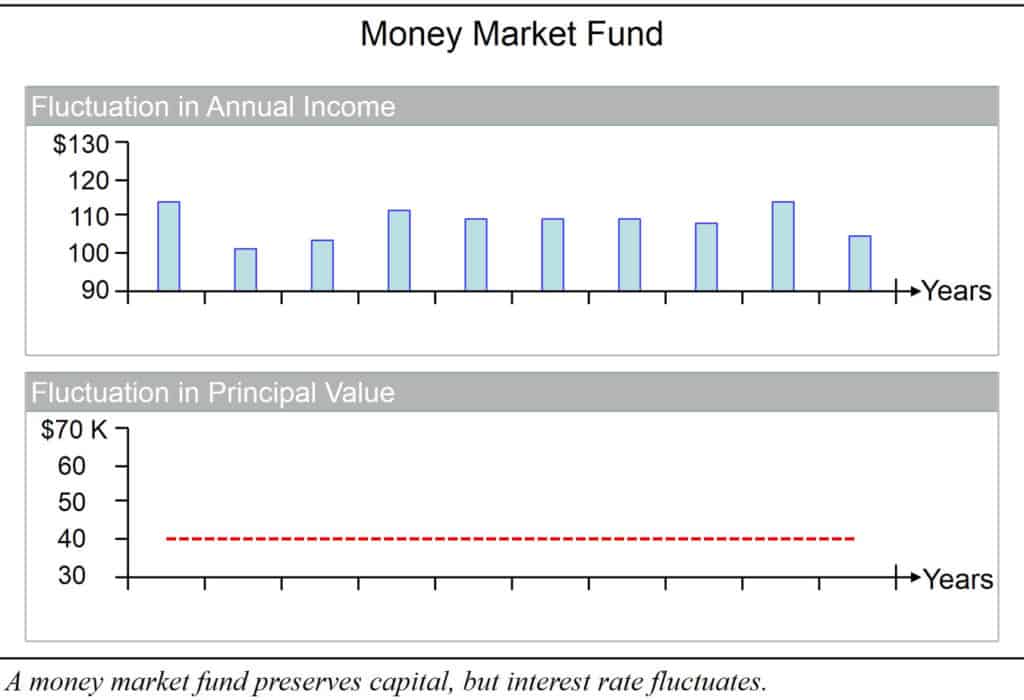

Did you choose “a money market fund”?

A money market fund does guarantee to protect your investment. It’s a perfect place to stash your cash for a short term. You can always get back your investment, plus they pay you some interest for that money every month. But, the interest rate varies so don’t rely on it for stable income stream.

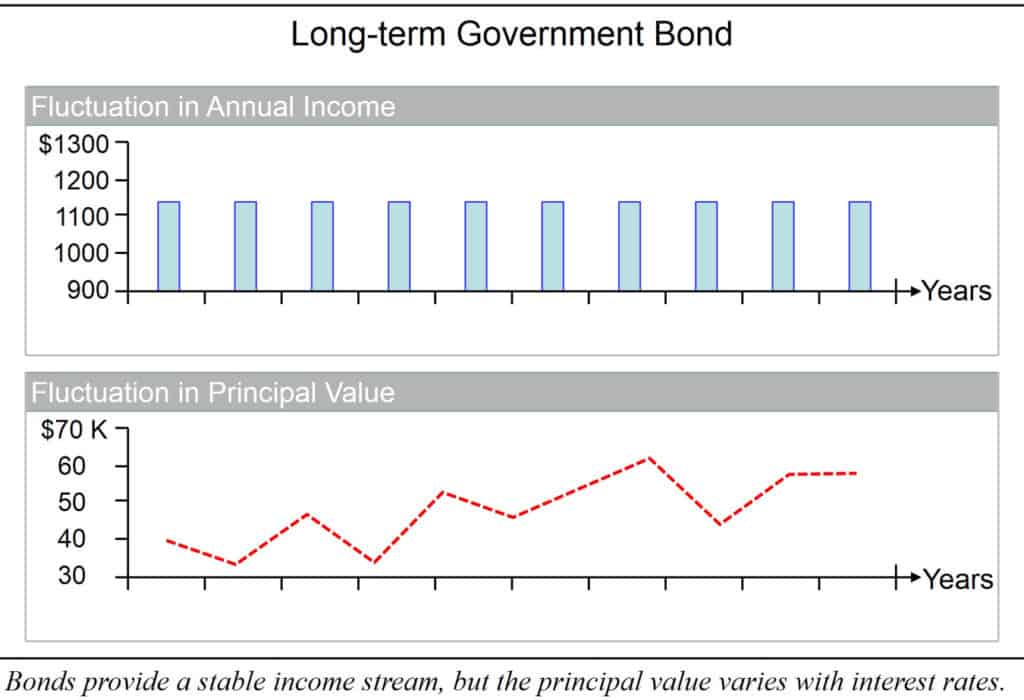

Did you choose “a bond”?

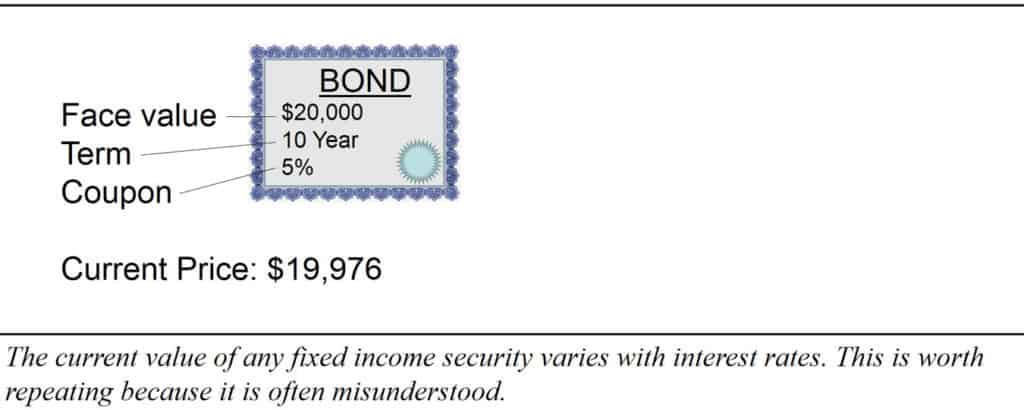

Bonds do that. They are a simple loan for a fixed length of time, and in return you get a fixed dividend every period and your money returned at the end of the term. So, bonds can assure you a stable income stream, but the market value of the bond can fluctuate over the term. In fact, it varies every time interest rates change. The price wanders in a totally unpredictable direction (since you can’t predict interest rate changes) but gradually drifts towards that one date when you’re guaranteed to get your investment back, the end of the term when the bond matures.

Did you choose “none of these”?

Correct. It’s “none of these.” So, to summarize: You can have stable income stream or stable principal value, but you cannot have them both.1 This is a primary distinction between a bond and a money market fund.

Investors can either buy an ownership stake in a company, or lend their money using vehicles such as a money market, CDs, or bonds. Now let’s take a closer look.

▶ Watch video: Bond Basics 1: What is a money market fund? (video) A money market fund is essentially like a bank savings account. All are extraordinarily safe, and some are even FDIC-insured. What these all have in common is that the value of your investments doesn’t change with the market’s interest rate. But, unlike CDs or bonds where the interest rate is set at the time issues, the interest rate on a money market fund does change with the market.

Fixed income example #1:

What is a Money Market fund?

KEY CONCEPTS:

- Money markets are set up so that the value of one share is constant ($1.00) but the interest rate varies.

- Bonds, and bond funds, provide interest payments as fixed amounts (a stable income stream) but the value of the bond varies with the current interest rate.

- You can have stable income stream or stable principal value, but you cannot have them both.

A money market fund is an ideal place to park your money temporarily. It’s:

- lending your money with a day-to-day agreement regarding the interest rate.

- like your bank savings account, but not FDIC insured.

- a special type of mutual fund that invests in very short-term high-quality securities.

The returns on money market funds tend to be lower than other types of bond funds, and it differs in a more fundamental way.

You will learn that bonds are debt with very specific repayment terms. The interest payments (also called coupon payments) are fixed amounts at fixed times over longer periods. Consequently, the value of a bond, or bond fund, will change with current market interest rates.

In contrast, the value of a money market share is held at $1.00 per share. Your invested principal is stable but the interest you receive as an investor changes with the market.

The key principal is that it is only possible to have fixed interest payments if the current market price fluctuates (e.g., bond funds), and that it is only possible to have fixed share price if the current interest rate moves with the market (e.g., money market funds).

The types of securities held by money market funds allow them to maintain a stable share price even during times of financial market stress. But they are not guaranteed; it is possible to lose money, although unlikely.

Use money market accounts like a bank account—a convenient place to park cash for short terms and to hold emergency funds. We will consider these “cash equivalents” and will not consider them for a long-term investment because they are unlikely to keep pace with inflation.

Fixed income example #2:

The Huge Bond Market

Stocks and bonds are both methods a company can use to raise money. Bonds are simple interest-only loans. Each has a specific term, usually one to thirty years, after which the principal is repaid. Everything is specified in a formal legal agreement called an indenture—which, unlike CDs or loans, makes a bond a negotiable instrument that can be bought or sold. If the worst happens, default, the bond holders get repaid in the bankruptcy proceedings before the stockholders get anything. The best that can happen is for the bondholders to get their principal back per the written agreement.

Stocks are ownership—forever. There are very few constraints, no bounds, no guarantees. Stocks are generally called “equity.” Although the stock market often commands more media attention, the bond market is even bigger. It is vital to the ongoing operation of both the public and private sectors.

Cities, states, the federal government and corporations issue bonds to raise money. The primary and secondary bond markets are an essential part of the capital-raising process.

Bonds are bought and sold in huge quantities in the U.S. and around the world. Some bonds are easier to buy and sell than others—but that doesn’t stop investors from trading all kinds of bonds virtually every second of every trading day.

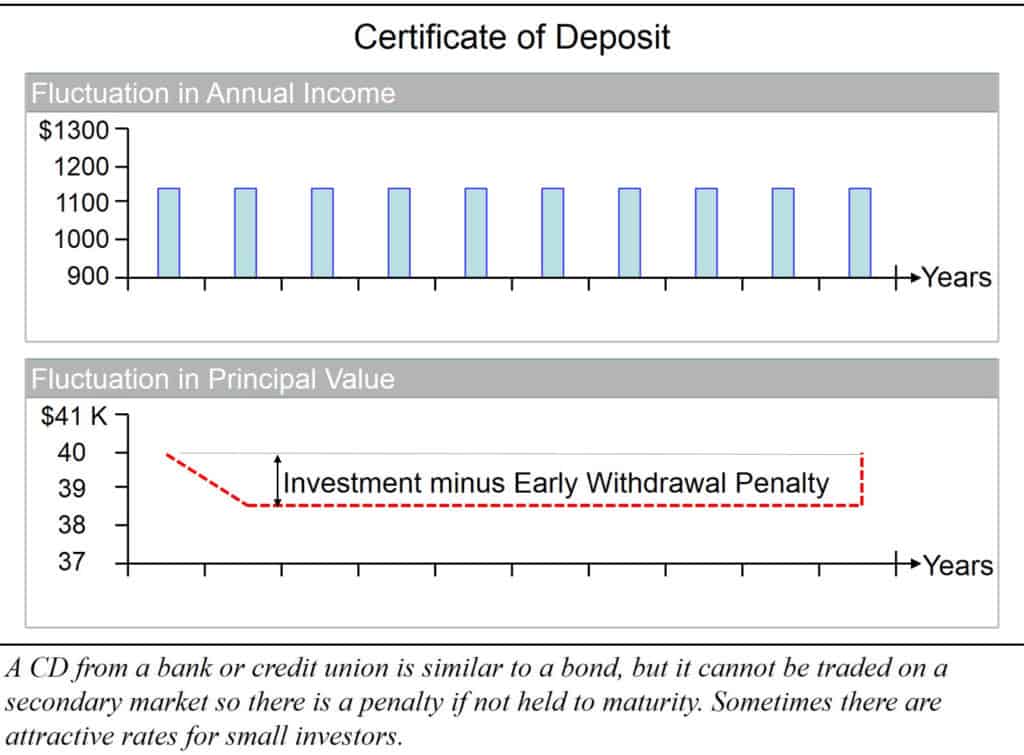

Stable principal or stable interest payments—you can’t have both. You may think that CDs might be an exception—and even more like a bank account because they are FDIC-insured. Learn some surprisingly interesting things about CDs in the next chapter.

▶ Watch video: Bond Basics 2: Certificate of Deposit: Better Than Bonds? (video) How should you compare a CD vs bond? The short answer about a cd vs bond is that CD is very much like a U.S. Treasury bond in quality and behavior. This video shows how occasionally CDs can offer higher returns than equivalent Treasuries when banks are doing promotions to attract new customers.

Fixed income example #3:

Are CDs better than bonds?

KEY CONCEPTS:

- Banks and credit unions issue Certificates of Deposit (CDs) and government agencies insure them.

Sometimes CDs are better than bonds! Learn the rare advantage that small investors have over institutional investors in this episode.

A certificate of deposit (CD) offers a higher interest rate than a money market fund or a bank savings account but you don’t have access to your money for a period of time without paying an early withdrawal fee. CDs offered by a bank or credit union are simple interest-only bonds that are sometime very attractive.

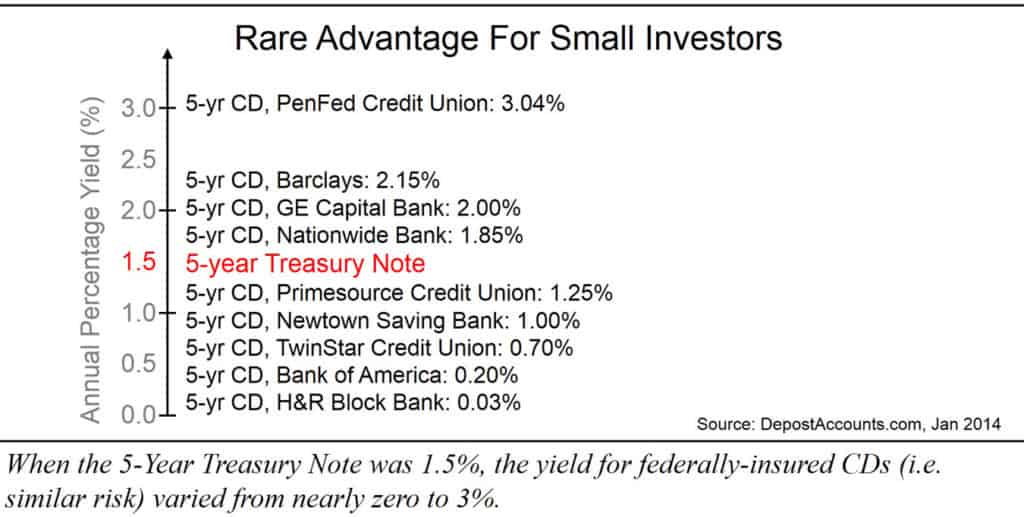

The highest paying CDs have higher yields than Treasury bonds and give the small investor a rare advantage over conventional bonds and brokered CDs. For instance, today the annual yield on a 5-year Treasury note is about one and a half percent. But, in contrast, the yield for CDs with equivalent term and risk varies from a high of 3% to nearly zero. Wow, that’s quite a range, isn’t it.2

CDs are like bonds in that they provide fixed monthly payments but cannot guarantee the full return of principal before the end of the term. The amount of the early withdrawal fee is limited: commonly 3 to 12 months of interest, depending on the bank or credit union.

While that’s generally true, I’ve seen the early withdrawal fee waived for CDs in IRA accounts if you are over some age. I only mention this to emphasize the point that while the bond market is incredibly efficient, the CD market is not, and that creates some attractive opportunities for individual investors.

Are you familiar with CDs? Which of these would you say is true?

- Sometimes CDs are better investments than bonds.

- Large institutional investors invest in CDs.

Did you choose “institutional investors buy CDs”?

This is false. Banks and credit unions issue Certificates of Deposit (CDs) and government agencies insure them. So CDs—like U.S. Treasury Bonds—have essentially zero credit risk. But the FDIC or NCUA insurance levels are limited to amounts that make CDs attractive to individuals, but inappropriate for large institutional investors.

Did you choose “sometimes CDs are better”?

This is true. Keep in mind that bank CDs aren’t negotiable—meaning, you can’t sell them in any market. To redeem them, you must go back to the bank (or credit union) where you purchased them. But, as I have shown, sometimes banks offer CDs at above-market interest rates with low early-withdrawal fees.

If you can lock in a CD with a higher rate than the equivalent Treasury bond, then you obviously come out ahead for no additional credit risk. If interest rates go up, it can be even better!

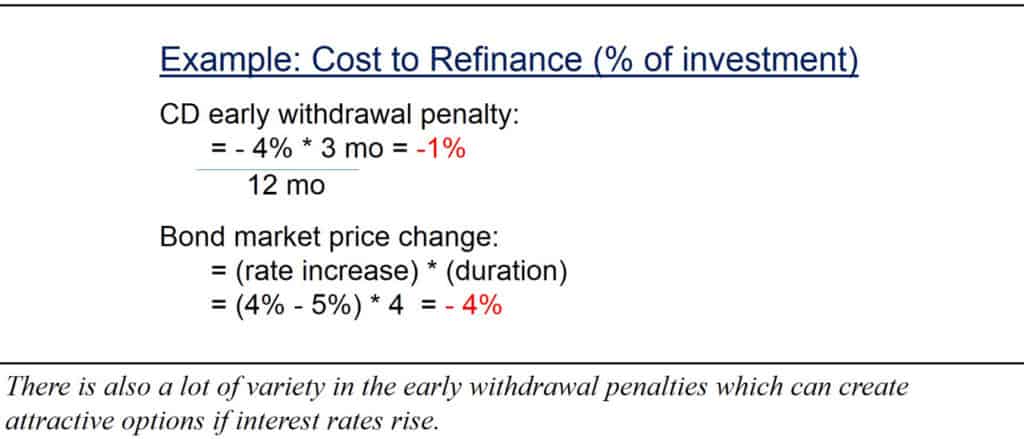

I’ll show you with a simple example. Here, you buy both a 4% CD and a 4% Treasury note—$1,000 for each. Towards the end of the first year, interest rates increase to 5% and you’d like to replace both to take advantage of the higher interest rates.

To sell your CD you will have to pay an early withdrawal penalty, which we’ll say is 3 months interest for this example. Our annual interest rate divided by 12 is the interest rate per month, which we’d multiply by 3 months to get the early withdrawal penalty ($10). The penalty remains one percent of the amount of the CD for any day after that until the CD matures.

But an ordinary bond is different. There is no early withdrawal penalty, but its price changes every time the interest rates changes, and the amount the price changes gets smaller as the bond approaches maturity, or more precisely, as the bond duration approaches zero.

Remember, we bought this bond one year ago so there are now four years left on this bond. For now, let’s say the duration is also equal to four years.

A bond price always changes in the opposite direction as interest rates by an amount equal to the rate change times the duration. So our simple estimate is that the cost to refinance the bond is four times more than the CD, or $40, which is our point. Sometimes, CDs are better than bonds.

Heads-up: there is also something called a “Brokered CD” and I cannot think of when they would be attractive—so tread carefully if your broker tries to sell you one.

Again, you’re not going to get rich with bonds, but bonds are a critical element for controlling the level of risk in any portfolio, so it’s vital that you understand the basics about how they work. Now if you understand how CDs work then you are well on your way to understanding how other bonds work—that’s next!

▶ Watch video: Bond Basics 3: What Are Bonds? (video) Bonds should be an important component of every portfolio and a method to manage overall investment risk. Learn what bonds are in this video about bond basics.

Fixed income example #4:

What are bonds?

KEY CONCEPTS:

- Bonds are simple interest-only loans.

- Bond markets are extremely efficient.

- A bond’s value (price) moves in opposite direction than interest rates—but not necessarily a bad thing for investors.

- Individual bonds and CDs return the face value at maturity—a uniquely valuable feature when the maturity date is matched with specific scheduled needs.

- On average, bonds do not appreciate in price like stocks do, but their prices do fluctuate over time.

- Using past returns for bond funds is particularly dangerous and usually misleading.

What are bonds? Bonds are simple interest-only loans. It’s that simple! Learn what every investor should know about bonds and fixed-income securities.

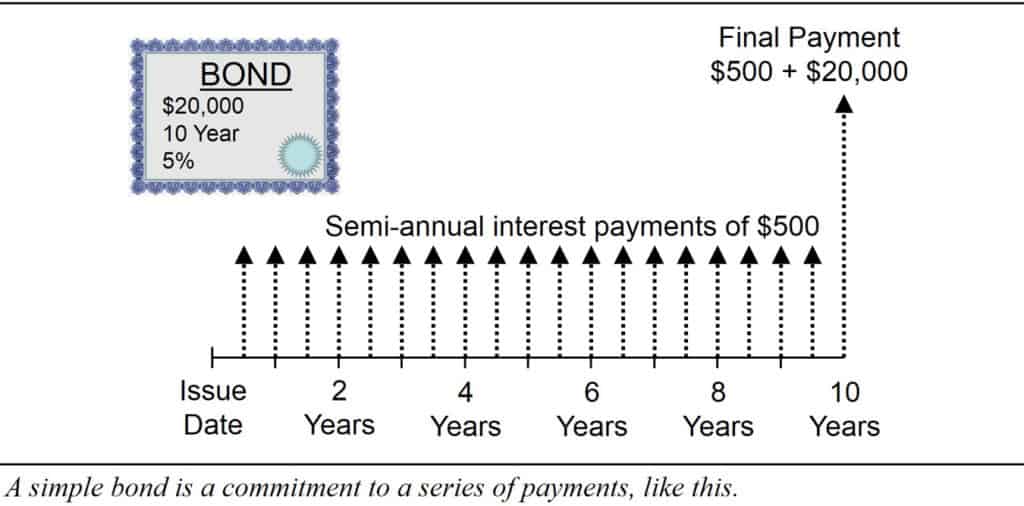

Unlike buying a stock—where little is promised but the potential reward is unbounded—with a bond, everything is spelled out, and you don’t get more than that. If we draw it as a picture, we’re going to expect interest payments over regular periods but none of the principal is repaid until the end of the loan.

Certificates (agreements)

These agreements are called certificates when the borrower is a bank or credit union . When the borrower is a government or corporation, these are called bills, notes, or bonds, depending on the length of the loan. They have a face value—which is the amount you’ll get back at the end of the term of the agreement, and a coupon which specifies the fixed dollar amount you’ll receive every year as interest, in either monthly or semi-annual payments. Bonds with longer terms or poorer credit ratings need to offer higher coupons to attract investors.

The coupon rate never changes. That’s the reason that bonds, like CDs, are called fixed-income investments. What makes these different from an IOU, a loan, or even a bank CD, is that these are “negotiable”—meaning you can buy and sell these in a market, for the current price.

It’s a competitive market

It’s a competitive market, and the prevailing interest rate for similar bonds determines the current price. There is only one day that the price has to be equal to the face value of the bond, and that’s its maturity date.

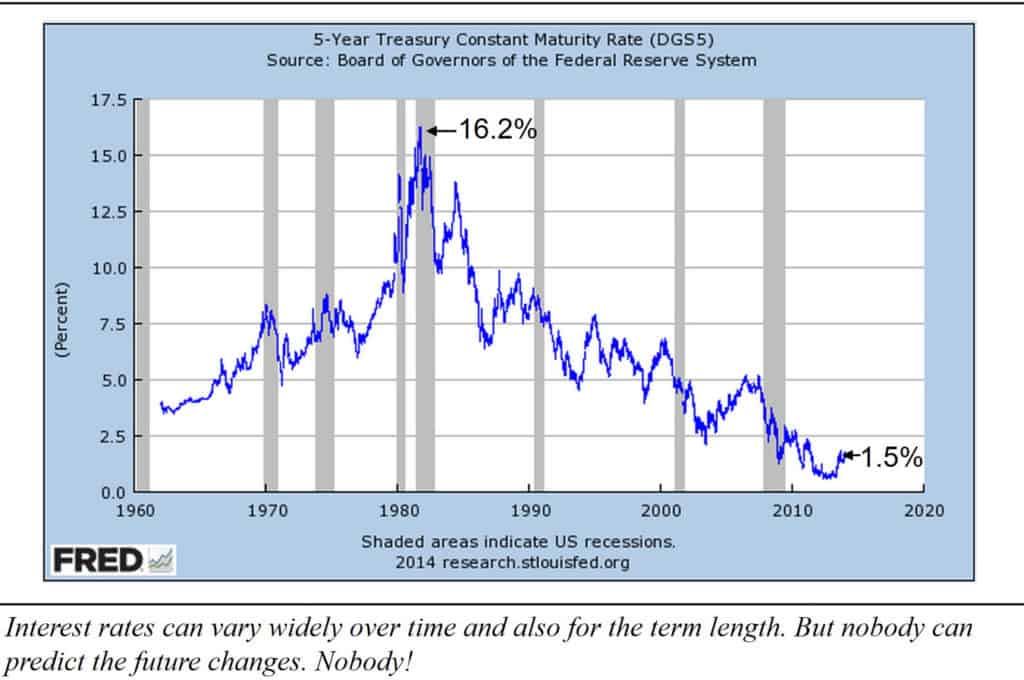

Interest rates move around daily. Today’s interest rate for a 5-year Treasury note is around one and a half percent. At one point 30 years ago it was over fifteen percent.3 Rates are determined by supply and demand in the market.

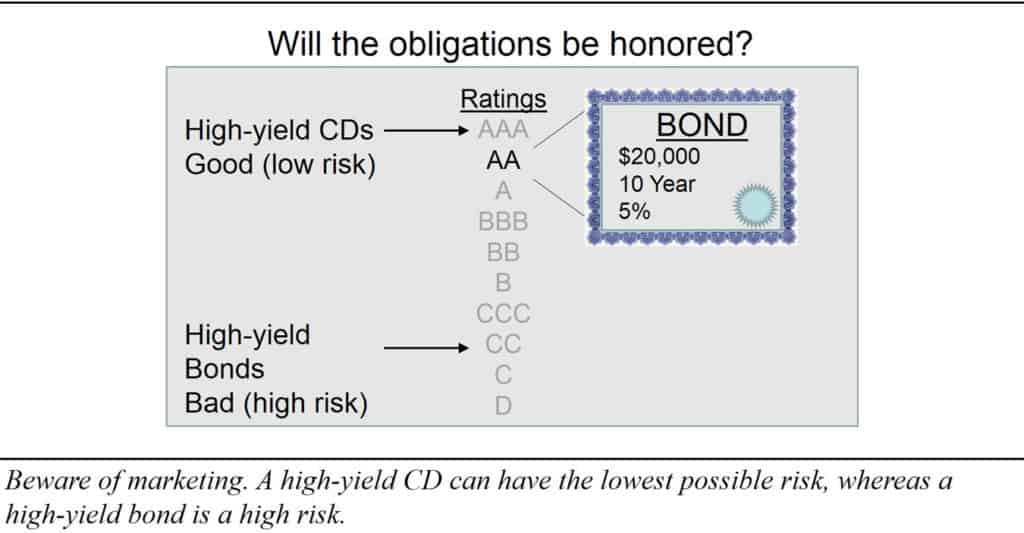

The credit rating of the issuer is very important. Many corporations with outstanding credit ratings also issue bonds to raise money. Corporations with weaker credit ratings need higher coupons to attract investors. Marketing people name these “high-yield bonds.”

Now, as always, beware of marketing. While high-yield certificates are good, because they are government insured, high-yield bonds are bad—at least from our point of view that it’s better to use high-quality bonds to stabilize your portfolio and keep your risk in your stock investments.4 Because, in addition to default risk, junk bonds tend to go south when the stock market tanks, exactly the wrong time!

Thought Question:

Think now. Which of these two facts is true?

- All bonds are subject to interest rate risk—unless held to maturity.

- Bonds prices vary with interest rates but do not grow like stock prices do.

Did you choose “unless held to maturity”?

This is false. Interest rate risk (also known as price risk) refers to the risk that the price of a bond will fall due to an increase in interest rates. There are no exceptions. When interest rates rise, and you have your money locked-up in a bond, you are missing out on investing that money at the new higher rate. The bond you own is instantly worth less from the amount of your lost opportunity. It’s a lost opportunity even if you hold it to maturity and get each and every payment as promised, on time.

Did you choose “all bonds prices vary with interest rates”?

This is true. The market prices for bonds do not grow the way stock prices do, but their prices do fluctuate with interest rate changes.

The value of a stock reflects what people perceive the future profits will be for a company. So as a company grows, the value of the stock appreciates.

Price and interest rates — opposite directions

Not so with bonds. A bond price, and the current interest rate, are directly connected, but the effect is not permanent.

To see this, consider a 5-year Treasury note. If interest rates never change, the market price for that bond would remain flat every day for five years.

But if interest rates went up 1% at the end of the first year the value is immediately worth a few percent less. Still, that Note will be worth exactly the face value on the very last day.

And if interest rates fall, the opposite occurs.

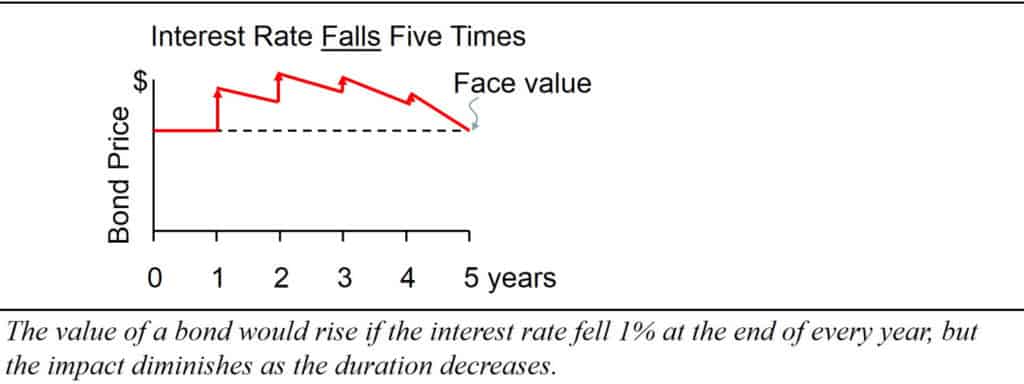

If interest rates fell an additional 1% every year for the life of the bond, the value of the bond might look like the following, where each fall in interest rates makes the bond more valuable. Intuitively this is what you’d expect, because your bond locked in higher interest rates than what’s available in the market, but that ceases to have any additional value when the bond matures and is worth the face value.

Now, can you see that the same size interest rate changes have a bigger impact on the bond price when the maturity date is further away?

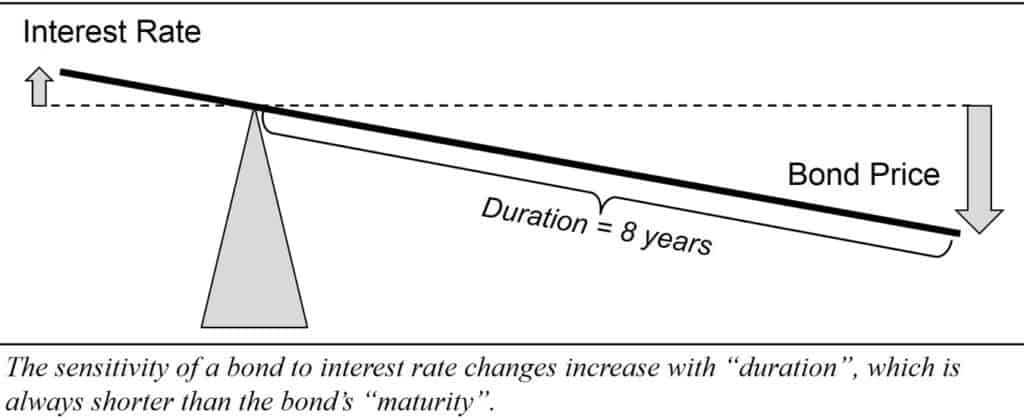

Bond prices move instantaneously in the opposite direction when interest rates change by a factor you can control called “duration”. Now I want you to see that if the interest rate were to instantly rise 1%, the price of a bond (or bond fund) with a 1-year duration would go down 1%. Down 1% causes a price rise of 1%. Longer-term bonds, and bonds with smaller interest payments, are more sensitive to interest rate changes because they have a longer duration. If the duration is 8 years, then a 1% change of interest rates causes the price to change by 8%.

The primary point is that a bond price isn’t merely influenced by interest rates, they are directly connected by math.

We care about price sensitivity so we can invest in the appropriate type of bonds. We don’t expect to get a return because of interest rate changes—because nobody can reliably predict interest rates. We’re investors not speculators, so we’re more concerned with total return which includes the dividends and reinvested dividends.

Next, we need to clear up the confusion about whether to buy individual bonds, bond funds, or bond ladders.

▶ Watch video: Bond Basics 4: What Are Bond Ladders? (video) If you buy a 5-year CD every year, and continue as they begin maturing five years from now, you have a bond ladder. You can do this with CDs; you can do this with individual bonds. If you do this with thousand of bonds, your bond ladder has become a bond fund.

Fixed income example #5:

What is a bond ladder?

KEY CONCEPTS:

- Bond ladders are a collection of individual bonds; a self-managed fund.

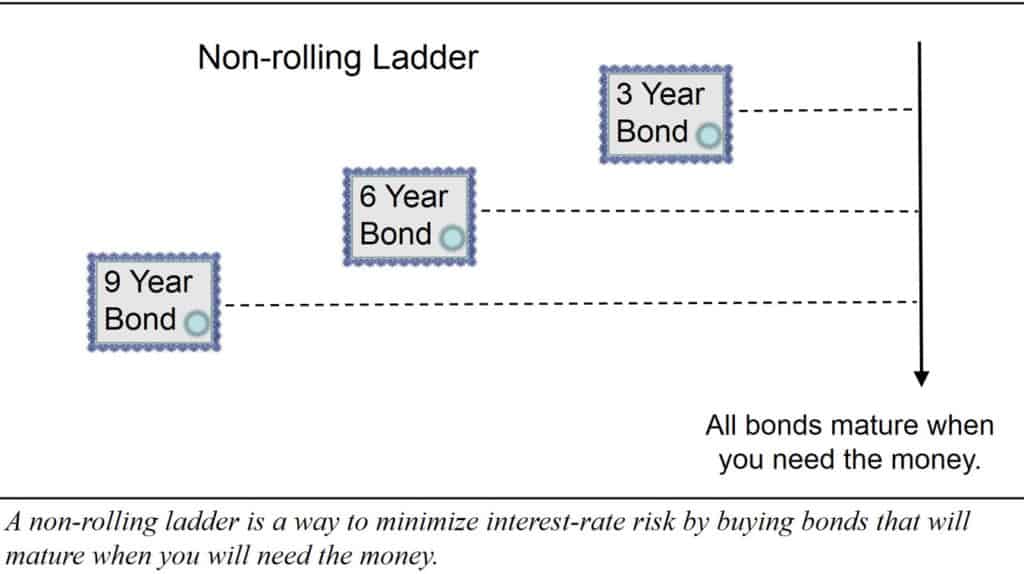

- Use a single bond or a non-rolling ladder to automatically reduce interest rate risk as a date approaches.

- Use a rolling ladder to achieve the lowest possible fund expenses plus potential tax-loss harvesting.

At least two things are cool about individual bonds and bond ladders! Let first let me explain what a ladder is.

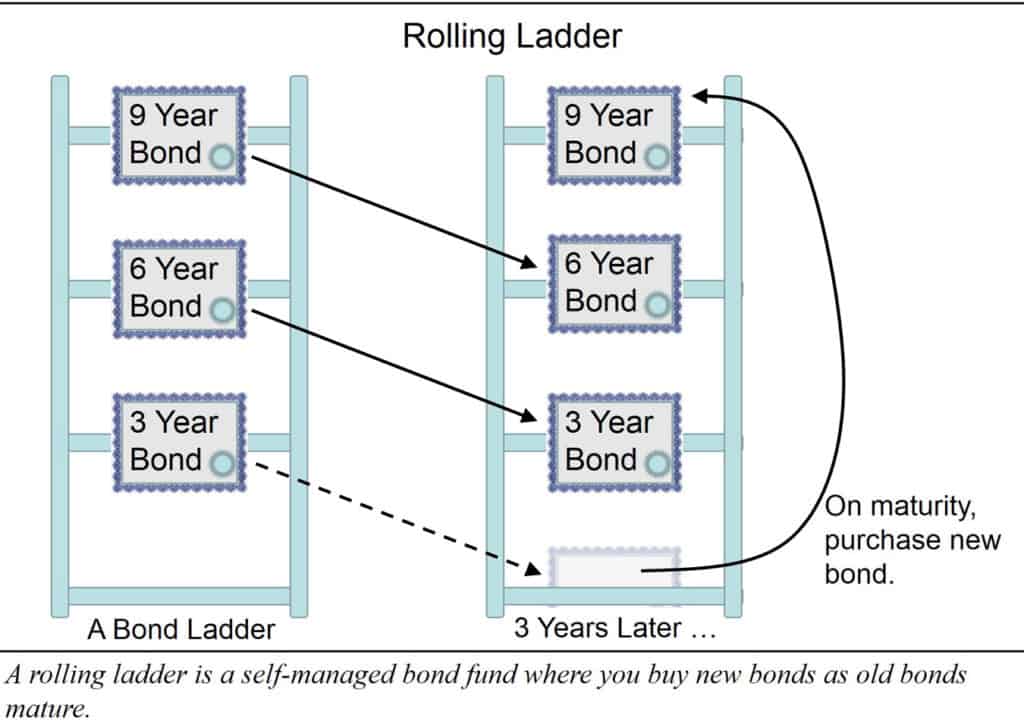

If you bought a ten-year bond every year for ten years we would call that a ladder. We give it that name because nine years in the future the first bond will have one year remaining, the second will have two years remaining, and so forth up to the last bond purchased which will have ten years remaining. The collection of maturities are like the rungs on a ladder.

If new bonds are purchased as older bonds mature, you get a recurring, or rolling, ladder. A ladder may be comprised of any sort of bonds to effectively achieve a self-managed fund. In practice, it’s only practical for CDs and U.S. Treasuries—because you can purchase these without a transaction cost or commission.

So if you have the time and discipline, you can build your own fund—and thereby avoid the expenses of a managed fund. That would be one of two good reasons to use individual bonds rather than a bond fund. But it’s hard to beat the low cost of a good bond fund.

A second good reason to own Treasury bonds

A second good reason to own individual bonds is a little less common, but it’s exactly the strategy Savvy Buck used to purchase his house. In the last section we introduced the concept of “duration” as a measure of a bond’s price sensitivity to a change in the interest rates.

A bond fund usually maintains a relatively constant duration. But both an individual bond or CD, and a non-rolling bond ladder, have a duration that decreases over time to zero. This means they become less sensitive to interest-rate changes as they approach maturity. That makes them perfect to fund a date-certain future liability. In fact, you could continue to buy them for that target date as I’m showing here. This collection of CDs or bonds is called a non-rolling ladder.

It is usually possible to buy CDs, or Treasury Bonds when issued, without a fee. So a rolling ladder comprised of these would be a way to create a bond fund with the lowest possible annual expense.

Stay away from other individual bonds

However, stay away from other types of individual bonds. They often come with hefty fees of a few percent that are, unfortunately, not visible to ordinary investors.5 You’re usually better off buying a low-cost bond fund, and that’s what we will talk about next.

Bond ladders are appropriate if you are willing to stay rather involved with your investments. Do you enjoy reading blogs and online discussions, like the Bogleheads forum? Then you have a good chance of knowing when and where there might be attractive CDs, or when TIPS (discussed later) might be attractive. Also, are you comfortable opening an account at a new online credit union, reading their fine print, and transferring your money to get their attractive CD rates? For you, owning individual bonds can be even better than owning low-cost bond mutual funds.

For the rest of us, it is easier to use low-cost bond mutual funds.

▶ Watch video: Bond Basics 5: Individual bonds vs bond funds? (video) This shouldn’t be confusing, yet there is bad advice about whether to buy individual bonds vs bond funds. Simply put, a bond fund is merely a collection of bonds. There is no difference. The misguided advice to prefer CDs and individual bonds vs bond funds is based on the belief that a bond or CD doesn’t change with the current interest rate in the market.

Every individual bond, or CD, does change value as the current the interest rates but always delivers the face value at maturity. But for the particular instance where you have a single future liability on a specific date, then getting a CD or individual bond that matures on that specific date is ideal.

Individual bonds or a bond fund?

KEY CONCEPTS:

- A bond fund is identical in both performance and risk to a rolling bond ladder with the same duration.

- Low-cost is key.

- For savvy investors, sometimes individual bonds or CDs are the best opportunities.

- Bond mutual funds provide liquidity, are convenient, and many are both excellent and low cost.

- Electronically Traded Funds (ETFs) are similar to mutual funds but traded like stocks. They are useful for investors who want to be slightly more involved.

Should you own individual bonds or a bond fund? For most of us, a bond fund is the easy answer. The major factors in deciding whether to use a bond fund come down to convenience, costs, and control over maturity.

That said, here are five instances when individual bonds and CDs can be more attractive than bond funds.

- Expenses. You don’t need much diversification if you use CDs and US Treasuries, and you can own these with no purchase fees or annual expenses.

Other individual bonds, on the other hand, can have spreads between the bid price and the asking price from 0.5% up to 5.0%, and you will, unfortunately, have no idea that you are paying these hefty fees to your broker.6

A bond fund is more convenient than buying individual securities. Bond mutual funds are just like stock mutual funds in that you put your money into a pool with other investors to be invested professionally. This can be done at a very low cost. - Opportunities. For various reasons CDs are sometimes available with well above market yields. Similarly, the inflation-adjusted return from owning TIPS (discussed later) varies and savvy investors opportunistically buy when these real returns are up.

- Matching bond maturity to a date-specific need guarantees you can meet that need despite any interest rate changes.

Two additional reasons why individual bonds are sometimes better than bond funds in taxable accounts are worth mentioning: - Tax-loss harvesting, and

- State-specific tax costs (e.g., municipal bonds from other states).

But, aren’t individual bonds safer than bond funds? No! What some people find confusing is that generally bond funds never mature. So while there’s not a specific date when they’ll return what you invested, the fund has a price and you can sell it at any time.

Remember, we don’t expect this price to appreciate, like we would with the stock of a growing company. We care about the total return, which we’ll talk more about later, and sometimes we care about how sensitive that price is to interest rate changes. That sensitivity is best expressed by its duration. A short-term bond fund is less sensitive to interest rate changes than a long-term bond fund.

Thought Question:

Your last challenge question is an easy one. Which of these is true?

- An interest rate increase can be good for investors.

- A bond fund is just as risky as a stock fund.

Did you choose “risky as a stock fund”?

This is false. First of all, a terrible year in the stock market is when the value of your investments drops forty to fifty percent. Whereas a terrible year in the bond market might be if interest rates suddenly jump a few percent causing the value of all bonds to drop. Hang on though, if you chose a bond or bond fund that you’ll hold for longer than its duration, then rising interest rates are actually your friend.

Did you choose “interest rate increase can be good”?

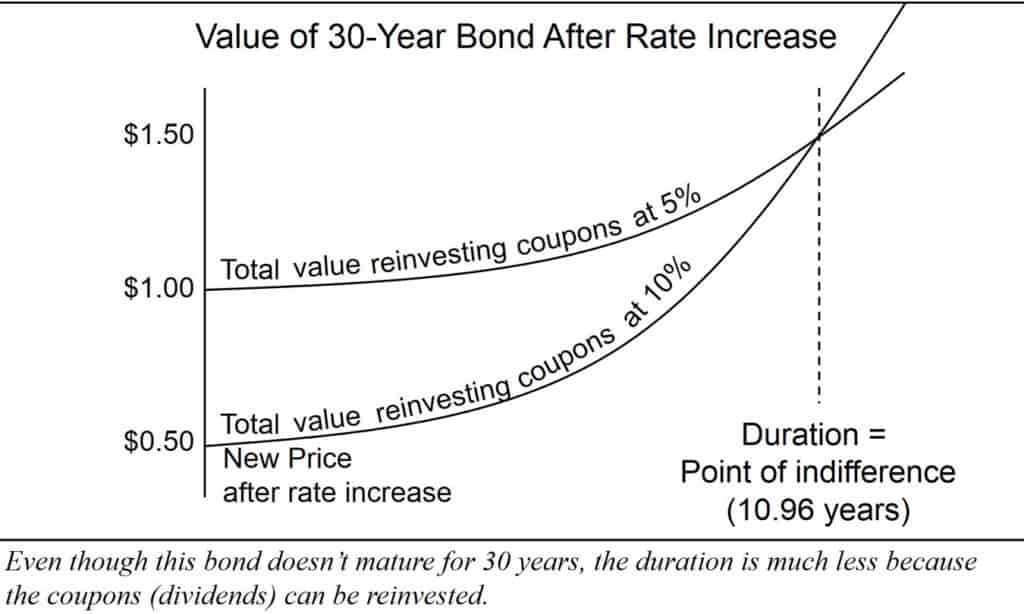

This is true. If you reinvest dividends at the new higher interest rate, then you come out ahead if you hold bonds for longer than their duration. Let me use an example to illustrate this.

This investor buys a 30-year 5% Treasury bond at par, and seconds after it is issued, yields suddenly rise to 10%. This bond is now worth less than 53 cents on the dollar. However, since this bond throws off coupons which can be reinvested at the new higher yield, it takes our investor less than 11 years to break even—so this defines the bond’s duration. And note that—because of the coupons—the duration is always less than the maturity, sometimes considerably so. To reiterate, after 11 years, this investor is better off for the fall in price because of the rise in yield.

Key point: The duration is the period of time at which you are indifferent to interest rate changes.7

Typically, when you invest in a bond mutual fund, they keep investing in new bonds such that the duration of the fund remains fairly stable. Such a bond mutual fund is similar in both performance and risk to a rolling bond ladder with the same duration.

Joe thinks he understands duration now, and finds a low-cost Long-Term Treasury Bond fund that lists its duration as eleven years. Even though it is a fund, rather than an individual Treasury bond like in the last example, Joe figures if interest rates were to increase any amount, he wouldn’t care about that change if he owns it for another eleven years longer and reinvest the interest coupons at the new rate. Is he right? … Yes!

Mutual funds not only provide professional management but superb liquidity and very low-cost. As always, low-cost is key.

There are hundreds of funds to choose from. How do you recognize a good one? That’s next. But first, let’s recap what we’ve learned so far.

RECAP

Throughout this website I use “bonds” loosely for fixed income securities. This article shows numerous fixed income examples—all of which accomplish the task of adding stability to your investment portfolio.

Bonds are essential to every investment portfolio—even when yields are at record low levels—because stocks are so risky. Owning the right amount of bonds helps make that stock market risk palatable. They’re the perfect investment when you need money at a specific time. And bonds that are uncorrelated with the stock market are a very attractive diversifier.

Stocks and bonds are the two most important asset classes. A smart investor gets this allocation right. People that talk about three major asset classes are merely recognizing the importance to diversify stocks, and consider U.S. stocks separately than International stocks.

Stocks, bonds, and money market funds are each very different, and we took a look at this to introduce this current series about bonds. CDs are a special type of bond, and we looked at how and why, sometimes, CDs are better than bonds.

Then we talked about bonds and their two major attributes: the quality (or credit rating) of the issuer, and the time-to-maturity of the bond. We saw how a bond price is tied to the interest rate, and introduced the concept of “duration” to describe price sensitivity.

Bond price and yield are mathematically tied to each other—when one rises, the other falls—but the periodic payments (also called “coupon” payments) remains the same.

It is easy to buy CDs and individual bonds from your bank or broker and make a bond ladder. This is interesting for the lowest possible annual expenses, and when you want them to mature on a specific date for some reason.

Low cost is the way to go. This can be achieved with both individual Treasury bonds and CDs, or with low-cost bond funds.

We looked at how duration helps us decide between short-, intermediate-, and long-term bond funds.

Imagine Homer writing this on a chalkboard:

This is often misunderstood. There are no exceptions. All bonds are subject to interest rate risk—whether insured, AAA, or guaranteed—all certificates of deposit, all individual bonds, and all bond funds.

Next: Learn more about bond risks and returns. Why? You will be tempted by higher yields.

- Understand yield, price, and making comparisons.

- How to reduce risk from interest rate changes. Learn about common misunderstandings.

- Myth: holding a bond (or CD) to maturity eliminates interest rate risk.

- Myth: rising interest rates are bad for bond holders.

- How to reduce risk from unexpected inflation.

- Credit Quality or Default Risk.

Read more:

- How To Build an All Weather Portfolio

- Bond Returns and Risks: Bonds Stabilize Your Portfolio

- Treasury Inflation Protected Securities

Related videos:

- Bond Basics 1: What is a money market fund? (video)

- Bond Basics 2: Certificate of Deposit: Better Than Bonds? (video)

- Bond Basics 3: What Are Bonds? (video)

- Bond Basics 4: What Are Bond Ladders? (video)

- Bond Basics 5: Individual bonds vs bond funds? (video)

Notes:

1. Pillar nine from John C. Bogle’s The Twelve Pillars of Investment Wisdom, http://www.vanguard.com/bogle_site/april272001.html↩

2. https://www.depositaccounts.com/cd/5-year-cd-rates.html, Jan 2014↩

3. https://fred.stlouisfed.org/series/DGS5/↩

4. Larry E. Swedroe and Joe H. Hempen, The Only Guide To A Winning Bond Strategy You’ll Ever Need: The Way Smart Money Preserves Wealth Today, 1st ed (New York: Saint Martin’s Press, 2006), pg. 123, 125, 128.↩

5. “Bonds vs. Bond Funds? An Easy Choice!” by Allan Roth, www.cbsnews.com, December 14, 2009.↩

6. Ibid.↩

7. This comes from William J. Bernstein’s explanation of “duration” http://www.efficientfrontier.com/ef/999/duration.htm ↩