This 8-part series about investing in stocks is for beginners who want to learn how to invest. This lesson recaps the highly studied advantage to diversify stocks. This outstanding video series was produced by SensibleInvesting.tv. I have created a summary and transcript to help you find spots that interest you and make the best use of your time.

Summary of video: Lessons From Stock Market History Pt.6: diversify stocks

NEXT STEPS: Watch the 8-part series Lessons from Stock Market History

- Part 1: world stock markets (video)

- Part 2: market expectations (video)

- Part 3: market volatility (video)

- Part 4: stock market timing (video)

- Part 5: keep investing simple (video)

- Part 6: diversify stocks (video)

- Part 7: buy and hold (video)

- Part 8: sensible investing (video)

SensibleInvesting.tv is an independent voice that makes important educational videos about passive investing—the best I’ve seen. This series features some of the biggest names and brightest minds in the investment world. It is presented and produced by Robin Powell and his team at SensibleInvesting.tv, and published on YouTube. It is a great honor to include it in our collection of video tutorials about “Investing in Stocks”.

Key points about investing in stocks from this video:

- The one free lunch in investing that screams from every page of market history: diversify stock investments.

- The U.S. was once an emerging market back when the U.K. was the leading economic power.

- It’s often the less fashionable sectors that provide the greatest returns.

Transcript of: Lessons From Stock Market History Pt.6: diversify stocks

(0:08 Robin Powell)

It’s been called the golden rule, the one free lunch in investing, and it’s a lesson that screams from every page of market history: diversify.

(0:19 Prof. William Sharpe, Nobel Prize-winning economist)

There’s a rule in real estate that the three most important things are location, location, location. Well, my rule in investments, the important things are diversify, diversify, diversify.

(0:30 Tim Hale)

The future is uncertain and the one tool we have against that is diversification. It’s about having a sensibly balanced portfolio. It’s about spreading your risks in the equity markets through developed markets and emerging markets and through value and small cap stocks, and simply owning as diverse a portfolio as you possibly can.

(0:48 Richard Wood)

Anybody that potentially just goes into one particular investment, one particular fund, because it’s based on past returns or investing in a certain asset class, they will catch a cold.

(1:01 Robin)

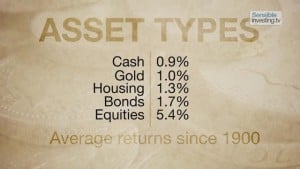

These are the average returns that different asset classes have produced since 1900, but they are just average returns. Over the long term, equities deliver a much higher return than any other type of asset. But often in any one year, shares produce negative returns. The good news is that when equities go down in price, bonds usually go up and vice versa, which is why spreading your risk between asset classes makes sense. Diversifying within asset classes is also advisable. After the Revolution of 1917 for example, investors exposed entirely to Russian equities lost everything.

(1:44 Prof. Elroy Dimson)

We all know about the prolonged difficulty that Japanese investors have experienced since the end of the 1980s, but only historians would look towards Japan and say they were the lucky ones, because they would be able to look at what happened in Russia, or what happened in China during the 1940s when investors didn’t lose a large proportion of their wealth but all of their wealth. The message, I think, for investors who are free to invest globally is that not only can companies lose all or much of their value, but sometimes even complete markets can do that. Spreading your money across different geographies, different asset classes, different types of securities, that reduces the extremes that you might suffer.

(2:40 Robin)

The economy is much more globalized now, and markets in different regions are more closely correlated than ever before, but as the 2008 crash showed, there’s always at least one region that fares much better than the rest.

(2:54 Janette)

There’s always a new market which is growing, for example at the moment Africa is being talked about as an emerging market, frontier markets. You have to re-balance to be with the new market as it changes shape. There’s no point staying in the old shape of market when things are happening globally which you need to belong to.

(3:13 Robin)

There are those who say that now is the time to turn away from traditional markets like Europe and the United States and to invest entirely in emerging markets such as Brazil, Russia, India, China, and yes, Africa. But that, market history teaches us, would be a mistake.

(3:30 Bill McNabb, Vanguard Asset Management)

If you went back to the 1880s, late 19th century, the leading economic power was the UK and sort of the emerging market. The China of that period, if you will, was the United States, and most people would say, you get to the 20th century, the United States economic growth was greater than that of the UK, greater than that of Europe in general. If you were to ask somebody about equity returns, most people would say the U.S. equity market outperformed the UK equity market because of that more rapid growth. Actually, it’s not true. The UK and the U.S. had almost identical equity returns for the 20th century, and the reason for that is British companies became much more global in their approach and actually took advantage of the faster growth that was occurring in the United States and other parts of the world.

(4:19 Robin)

As well as diversifying geographically, equity investors should also spread their investments between different sectors.

(4:26 Weston Wellington)

The so called dot com crash revealed the very unhealthy overexposure that many investors had to large growth stocks in particular, often in just a hand full of industries like telecommunications. Those kinds of stocks suffered dramatically. Roughly speaking in that downturn, the Russell 1000 growth index was down about 55% or so, whereas during that same period value type stocks or small value stocks had positive returns, 5 or 10%.

(5:02 Robin)

Don’t be a fashion victim. Remember it’s often the less fashionable sectors that provide the greatest returns. We’ve now looked at five key lessons to learn from market history. There’s just one more left, and in many ways it’s the most important lesson of all. What is it? Find out in part seven.

Footnotes and Credits:

This video was produced by SensibleInvesting.tv and published on YouTube Sep 6, 2013 on their YouTube channel SensibleInvesting. Their videos are the best I’ve seen on this topic. They produce them and own the copyright. They have given me permission to embed this via YouTube license onto this educational website.

Sensibleinvesting.tv provides information and opinion on low-cost, evidence-based (passive) investing. They are based in the United Kingdom, but their lessons are universal.