Smart investing can be summed up with ten simple rules. This is the smartest way to invest money for 98% of all investors—that includes you. Learn why and become comfortable making good choices and decisions.

Smart Investing is an essential must-read guide for ordinary investors that will answer three key questions:

- How much to save?

- How much risk to take?

- Where to invest your savings to match your goals.

Smart Investing — ten simple rules.

Smart investors adhere to these simple principles. Choose the learning style that suits you.

- Read on this webpage. The table of contents is below.

- Watch in a YouTube playlist. Each topic also has a dedicated webpage with an embedded YouTube video plus a transcript.

- Free course for a more focused active learning experience. Find this at FinancingLife Academy called Common Sense Investing.

Time needed: 2 hours.

Learn the steps to invest in stocks and bonds the smartest way. Get your first rough draft personal finance plan in a day.

- Develop a workable plan

Few things are more powerful than a 1-page draft; then update.

- Start saving early

Learn how to save money automatically. Pay yourself first!

- Choose appropriate risk

Your most important decision: your ratio of stocks to bonds.

- Diversify!

Especially diversify stocks! Stick to the highest quality bonds.

- Never try to time the market

Don’t try to guess short-term market directions. (Nobody can!)

- Use index funds when possible

It’s easy to own the whole market at the lowest possible cost.

- Keep costs low

You get to keep what you don’t give away. Costs matter!

- Minimize taxes

Get familiar with tax costs because you can control them.

- Keep it simple

Life is short. Give your time to more fulfilling things.

- Stay the course

Most people fail to achieve the “market return” because they tinker.

These ten rules are also endearingly called the Bogleheads® investment philosophy. I refer to them as Common Sense Investing, which is also a nod to my favorite book by John C. Bogle.

Introduction

If you are like most of us, you are busy living your life and just not interested in becoming an expert in investing. My goal is to show you that it’s not hard to take control of your finances, save and invest wisely, and then get on with your life with a sound financial lifestyle that will support your dreams. You are going to learn how to correctly buy and hold a diversified portfolio of stocks and bonds for the long term.

Start by tuning out all the shows and newsletters trying to sell you something. For us, there is no better mentor than legendary mutual fund industry veteran John C. Bogle. We’ll also incorporate the work of a few Nobel Laureates and distinguished academics. Quite frankly, it is the advice I wish I heard when I was 25 years old. We’ll develop four general principles as 10 simple rules.

▶ Watch this video overview: Intro: Ten Rules of Investing for Beginners Quick video introduction to Boglehead Investing, which is the common sense investing strategy that should be adopted by nearly all investors according to industry leaders and Nobel Prize-winning economists. It is smart investing. Simple enough for beginning investors.

Start saving now, not later

The first two rules are all about getting started and finding a way to save a portion of what you earn. If you can’t do this, the other eight rules are moot. There are some great tips in here, so I hope you’ll find these helpful.

These first two chapters teach important concepts using money invested risk-free.

Diversify your investments

A higher expected rate-of-return from your investments requires accepting investment risk. So first, learn what this is and whether it is appropriate for you. Then, learn why diversification is essential for the vast majority of investors and how to do this correctly.

If starting to save now is the most important habit you need to form, the way that you then allocate this to stocks and bonds is the most important decision you need to make.

Minimize costs

The remaining five rules are tactics for success.

Small percentages make a huge difference over our lifetime. Our next three rules will show you how you can keep what you earn by not giving it away in unnecessary fees and taxes.

Stick to your Plan!

Our last rules will help you create a simple one-page written plan—and that very action will help give you the discipline to stick with these time-proven rules that we’ll now explore individually in more detail.

Each of these rules is a short chapter. You can read them from start to finish or skip ahead to any of particular interest.

You can also learn about investing for beginners from a free course called Common Sense Investing at FinancingLife Academy. It is the identical content as this guide presented in ten short videos. You’ll find other helpful courses.

Click here to get a printable 1-page cheat-sheet of these ten rules!

Smart Investing for Beginners — Ten Simple Rules

#1: Develop a workable plan

Goal-based investment planning starts with your imagination and then creates a simple plan to finance your dreams. I demonstrate this with a comprehensive example of retirement planning. The trick for beginner investors is simply to get started.

Rule #1: Use goal-based investment planning to make a workable plan

In this video, I’m going to tell you the four steps to goal-based investment planning and then illustrate with an example.

Our example will focus on retirement planning because it is one thing that you are guaranteed to all have in common. And it helps to start early.

This is important for everyone. Perhaps particularly for women. Because many women:

- Live longer

- Earn less

- Spend years out of the workforce to care for children or elderly parents

- And have other disadvantages

- Qualify for less Social Security benefits, and often

- Work for companies without retirement benefits

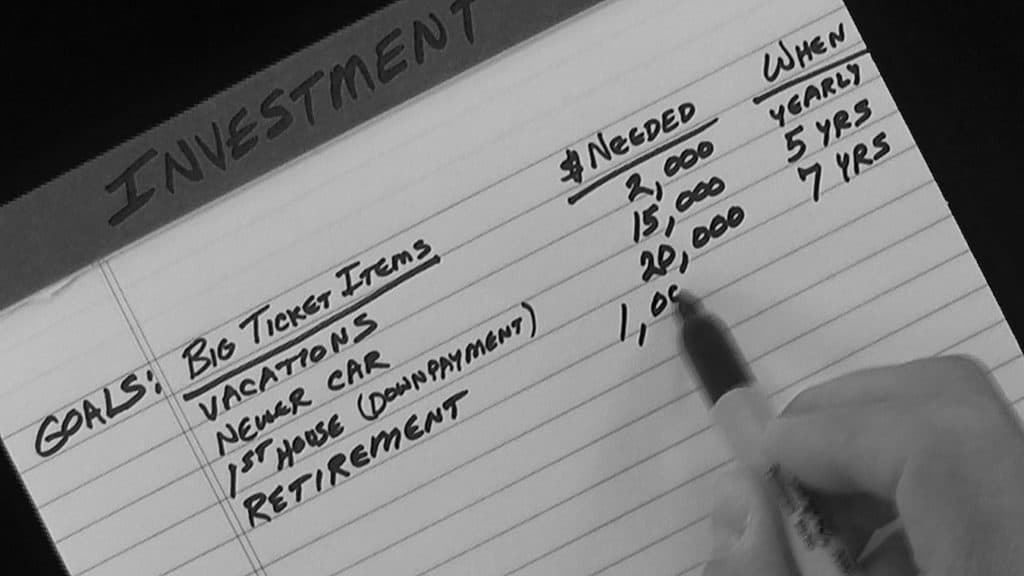

Some of our dreams need a little money. This list is where we begin.

We need to have some idea of how much we need to save and how we will save that.

There may be part of you rebelling already. Relax! Of course, you don’t know the future! But it will serve you to imagine one scenario. The enemy of a good plan is the search for a perfect plan.

Make assumptions, and then change them when you get better ideas or better information. Our goal is to enable these possibilities.

Step 1: Start simple with goals, dates, and costs

Expect to change your plan every year. That’s OK! Keep it simple or you won’t remember it! Write it down now. Improve it later.

Your goals are dreams with deadlines. Think in terms of how old you will be. That’s the same as a date, but you are imagining it. It’s more personal.

Make a quick wild guess at how much money each goal will need. I promise you: that turns your radar on, and subconsciously you’ll begin gathering information that will improve your initial guess. So don’t worry about being way off!

You know, just doing this simple exercise is the hardest part. It’s not a workable plan yet, but it is a direction. And you may eventually get where you want—just by going in that direction.

Step 2: Improve the cost estimates

Whether your goal is to buy a house, remodel your kitchen, or to plan a comfortable retirement, the place where these planning steps differ the most is in how to improve the dollar estimates. You probably don’t need as much help with your other goals, which is another reason I’ve chosen our example to focus on retirement planning.

Considerations for retiring include figuring out the savings you’ll require, when to start Social Security, and whether to use CDs, a lifetime annuity, stock index mutual funds, or a combination of these kinds of things.

Step 3: Prioritize by needs, wants, and wishes

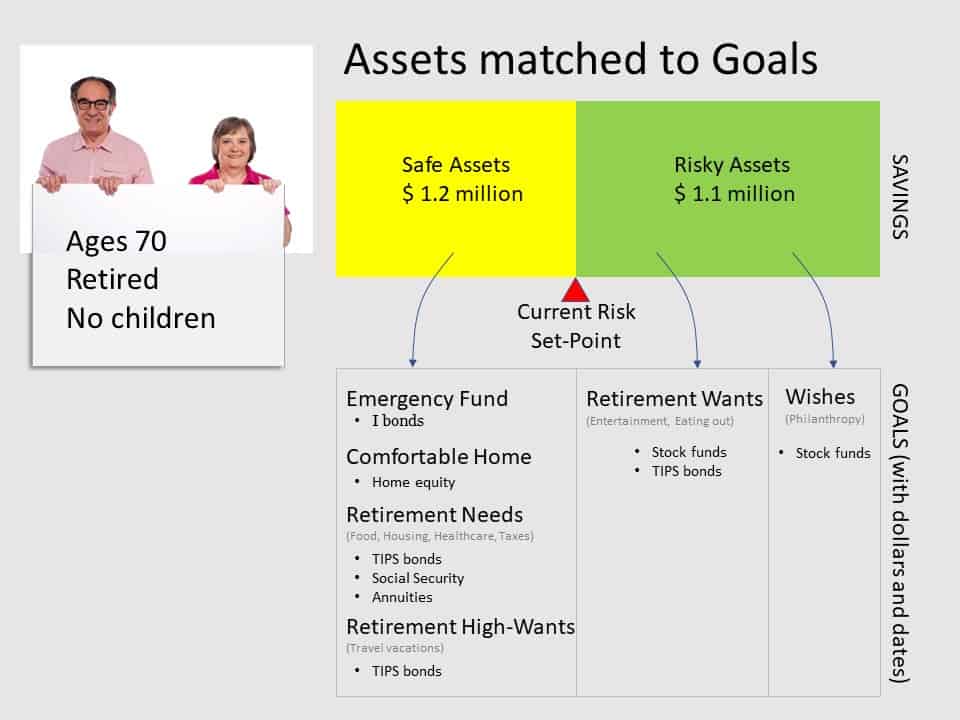

The idea here is to match safe investments for your essential needs and consider investment risk only for the wants and wishes that you could live without — if risk rears its ugly head.

Step 4: Match each goal with investment risk

This will be the grand finale and easiest for me to show by our example. The challenge here is to turn retirement savings into monthly income — for however long you might live, and avoid some of the other big financial risks ahead.

The Big Financial Risks Ahead

The big risks are probably:

- Not saving enough

- Inflation

- Stock market volatility

- Outliving your money

- and common investing mistakes, because we’re human.

More about those risks

Not saving enough

Most Americans don’t save enough. Their futures become whatever they can string together. The purpose of this article is to give you simple guidance about how you can use very simple goal-based investment planning to save and invest towards those life goals and dreams — and maximize your happiness.

Inflation risk

Beginner investors don’t think about inflation, but if their investments aren’t keeping up with inflation their goals will become unreachable. This article/video will introduce you to inflation-indexed savings backed by the U.S. government. They are not sexy, and you probably have never heard of them, but they may very well be your best safe choice.

Stock market risk

Some people forgot what stock market risk is. And after more than a decade of tremendous returns discovered in March 2020 that they shouldn’t have carried that risk. This is the topic of Rule #3.

Outliving your money

This is a big one. Should you create a plan for living to age 70? or age 90? This might be the single biggest reason that people don’t plan. So, this example will illustrate how to eliminate that risk.

Common human mistakes

Finally, there are numerous smaller risks that you can eliminate by learning the essentials — that I think everyone should be taught, but aren’t. Well, you’ll learn them here in Rules 4-10 in the Ten Rules of Common Sense Investing.

Example: Simple Retirement Income Planning

People use all the uncertainties for their reason not to plan. Hogwash! Work with what you know. Strive to get the general direction right. Let’s dive in.

Example Step 1: Simple goal, date, cost

We’ll use an easy-to-follow example. His name is Ed. He was single his whole life and is now retiring at age 66.

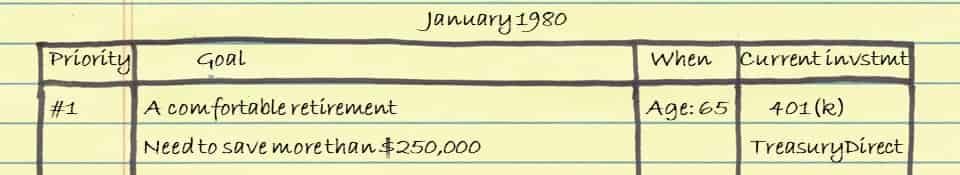

Every year since he was age 25 he wrote this same goal and kept adjusting it every year for inflation. Back in 1980, it looked like this:

It now takes three times as much money to retire with the same standard of living. Always keep your plan updated in today’s dollars.

The total savings dollar goal is important to determine. It’s often called your “nest egg”.

Example Step 2a: Estimate retirement living expenses

Goal-based investment planning for retirement starts with an estimate of annual living expenses.1-2

Most people want to keep their lifestyle in retirement to be the same as they had just before retirement, and they can do that by replacing only a portion of their pre-retirement income. This replacement income is lower because

- you no longer need to save for retirement,

- your tax rate might be lower,

- you may have paid off your mortgage,

- the kids may have moved out,

- you spend less related to your career (food, clothing, transportation),

- you have more time to shop around for a good deal and more time to cook at home.

Example Step 2b: Two methods to estimate the total savings that will be required

The next step to come up with a dollar amount to save for this goal is to estimate the amount of retirement living expenses that will need to come out of your savings. The primary sources for retirement income are Social Security, pension benefits, and accumulated savings.

In the U.S., your Social Security benefit is most significant for low earners. For high earners, a larger portion will need to come from savings.

Here are two methods to compute the “nest egg” you’ll want to save up for retirement.

Method 1: for low-earners (<$50K)

Method 1 is to multiply replacement-income by 12.

The idea here is to assume your Social Security benefit will cover about half of your retirement income need.

In our example, Ed used this approach because it was simple. Later in this video, you’ll see how it works out for him.

He recently estimates required replacement income to be 65% of his ending salary, for a total of $65,000 a year.

So, his total savings in his nest egg needs to be twelve times that, or $780K.

Method 2: for middle- and high-earners

Method 2 is to subtract other income sources and then multiply by 25: (“Replacement Income” – SS benefit – Pension) by 25

For our example, this method suggests Ed needs a slightly larger nest egg. For 30 years of $65,000 of inflation-adjusted income, he subtracts his Social Security benefit and multiplies by 25 to get $875,000 required savings.

In our example, Ed only saves the smaller amount of these two methods but he does safely avoid both inflation and stock market risk. The next two steps will look at how he should invest this money.

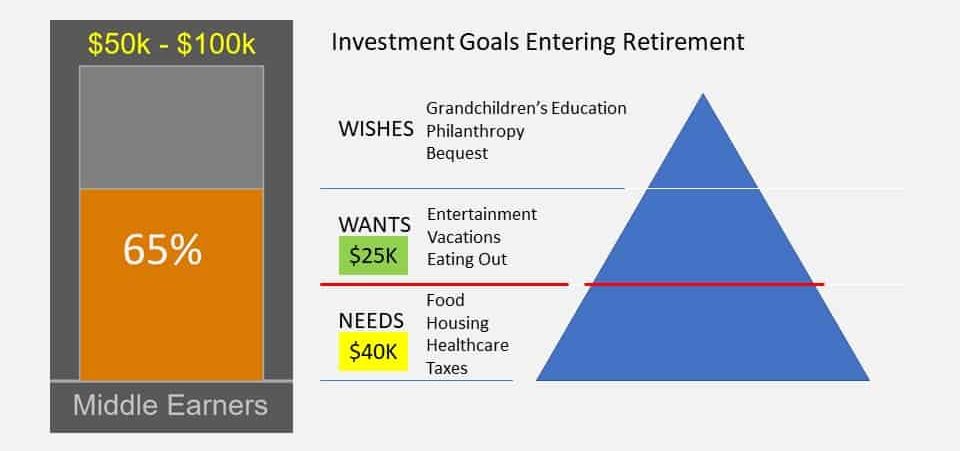

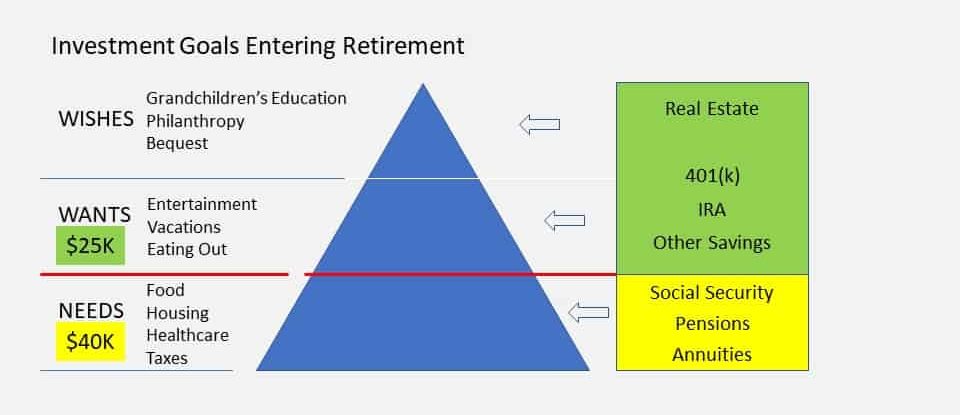

Example Step 3: Separate essential needs, wants and wishes

Ed has met his retirement savings goal and would like to retire this year at age 66. To achieve a worry-free retirement he now expands his one goal into three: his essential needs, his wants, and his wishes. Here’s a closer look at how his annual living expenses break down.

- His essential NEEDS are not optional. They add up to $40K/yr.

- His WANTS are discretionary. He could live without these, but they are important to his quality of life. They are another $25,000/yr.

- If he had enough money, he has additional WISHES as well.

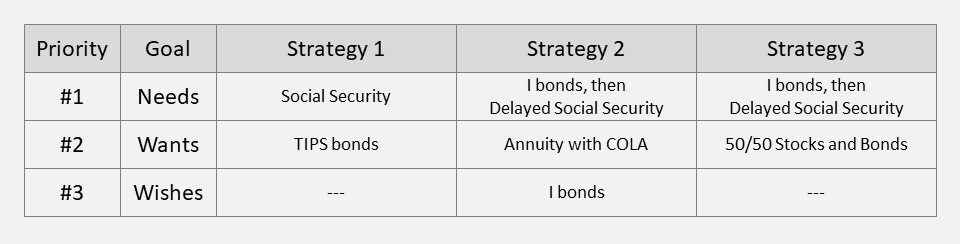

For Step 4 we’ll compare three strategies to convert your nest egg into monthly income that meets your goals.

Example Step 4: Compare three strategies to match investment assets with each goal.

Use goal-based investment planning to establish safe, guaranteed income sources for your essential needs that will last your lifetime. The needs are below this red line.

Since there is uncertainty about how long you will live, Social Security, pensions and some commercial annuities are well-suited for matching with this goal. This is the role of annuities. People that live short lives subsidize people that live long lives. Society comes out ahead because everyone is not over-saving for a long-life contingency. This frees up money for people to take trips or other spending that increases happiness. My example will illustrate this.

What is an annuity?

Think of Social Security as an annuity that is backed by the federal government.

The Social Security benefit is precious for three reasons:

- It is a guaranteed income stream for as long as you live,

- backed by the U.S. government which is as safe as possible in our world, and

- it has an annual cost of living adjustment.

So, it goes a long way to eliminate your longevity risk (of outliving your money), any credit risk (because they’ll never go bankrupt), and inflation risk.

A key point is that the Social Security benefit gets dramatically bigger if you can delay starting that benefit until age 70. Watch for this in the examples just ahead.

Think of a pension as an annuity that is backed by a corporation, state, or municipality. Very few people have pensions today. Many corporations have shifted from defined benefit pension plans to defined contribution plans, like 401(k)s.

And lastly, if you don’t have enough Social Security and pensions to cover your essential expenses, you can purchase an annuity. This would be a lifetime of guaranteed income that is backed by a highly rated insurance company. I’ll demonstrate this as well.

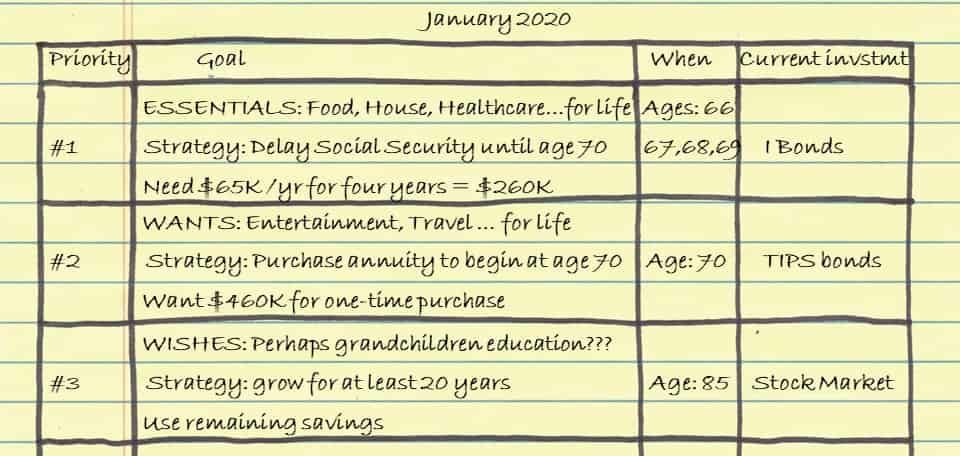

Next, Ed considers three different ways to match investments with his goals.

- First, hedging inflation with Social Security and TIPS bonds.

- Second, delaying Social Security and buying a lifetime annuity.

- Last, using low-cost index funds instead of an annuity.

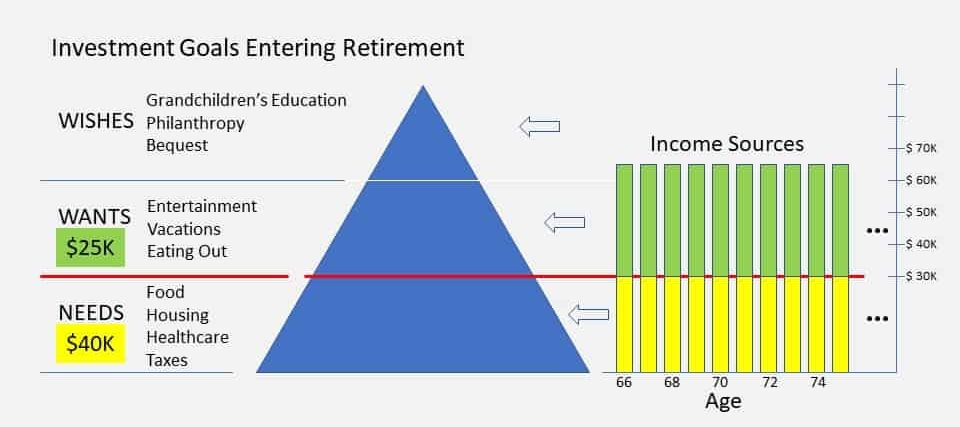

To evaluate these strategies, Ed must consider them as generating streams of income for each year of his retirement, with income for his essential needs coming from one source, and income matched with his wants coming from perhaps another source.

Detaching this income from the stock market enables a worry-free retirement. Ed’s goal is to create an inflation-protected replacement income of $65,000 and expect about half to come from Social Security and half from savings.

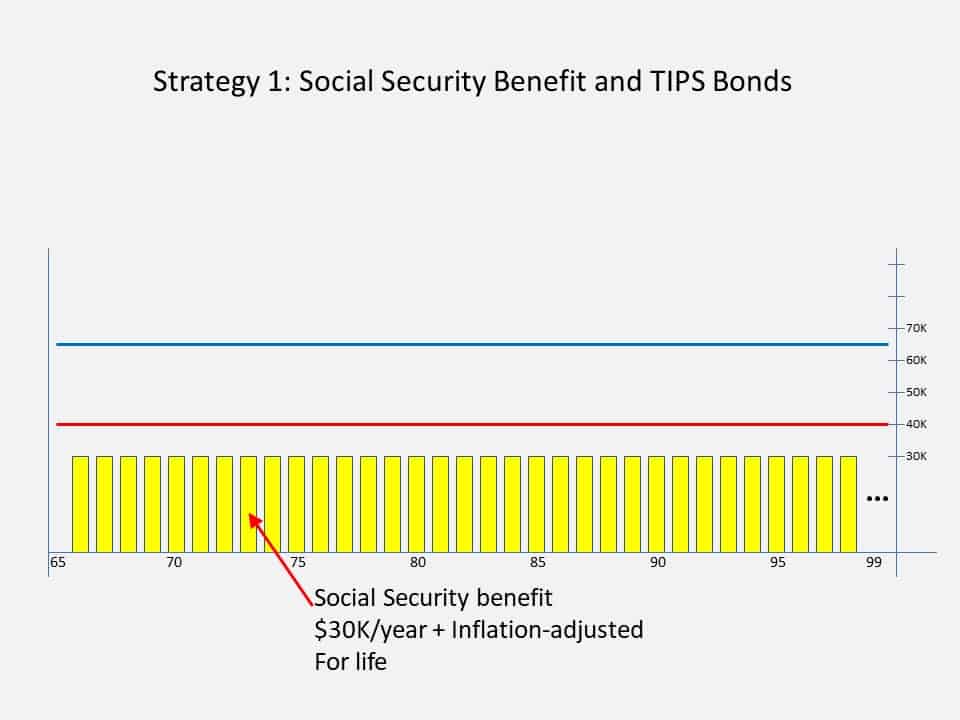

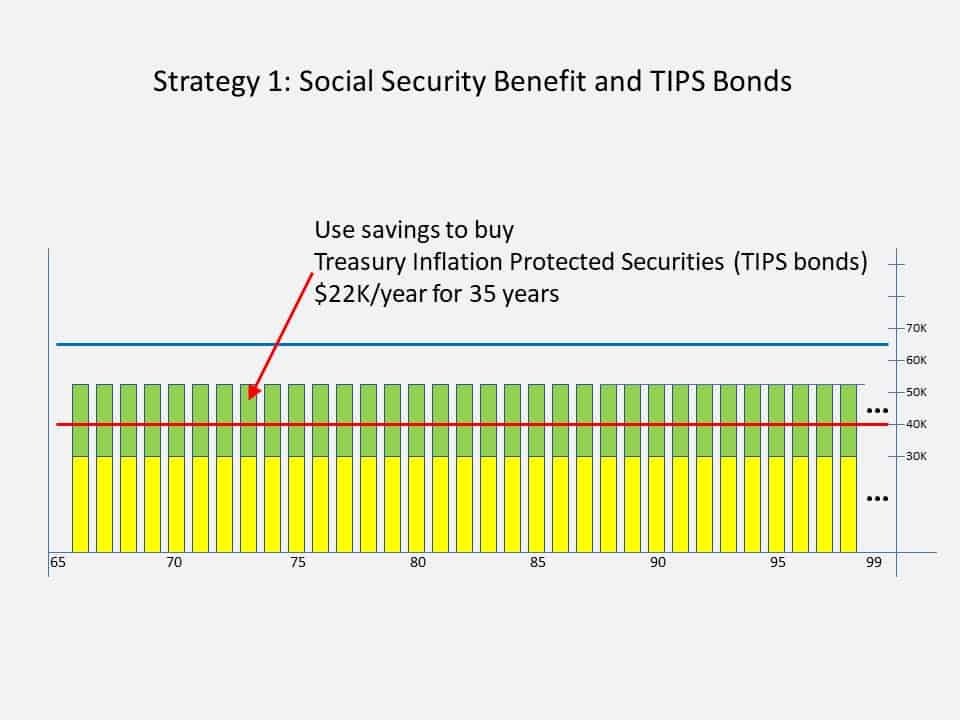

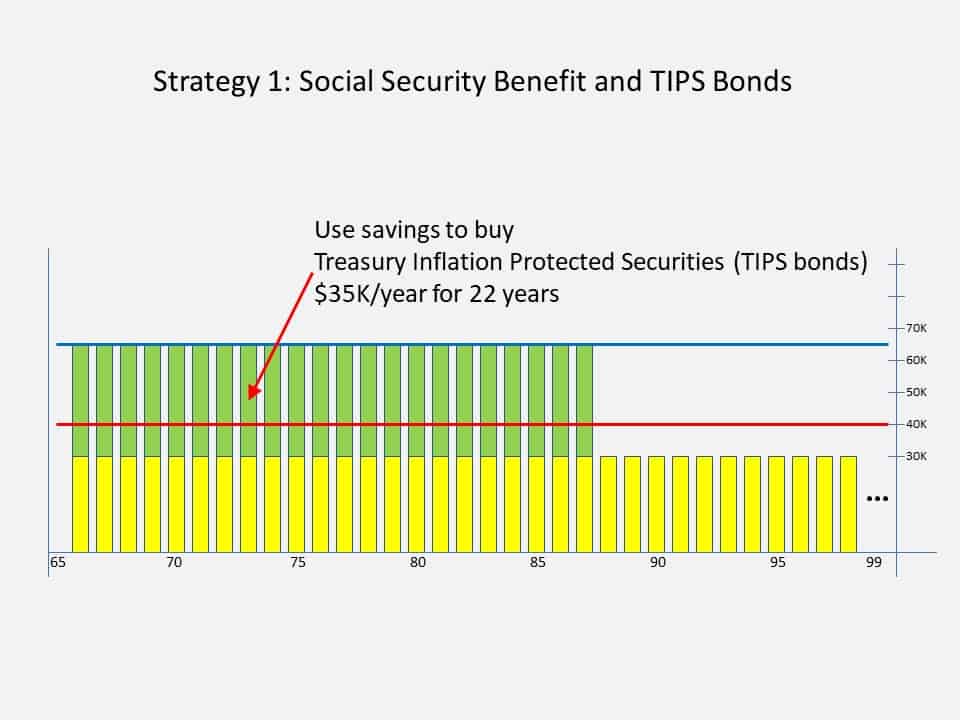

Strategy 1: Social Security plus TIPS bonds

Ed’s first strategy is to hedge inflation using both his Social Security benefit and inflation-indexed bonds called TIPS bonds.

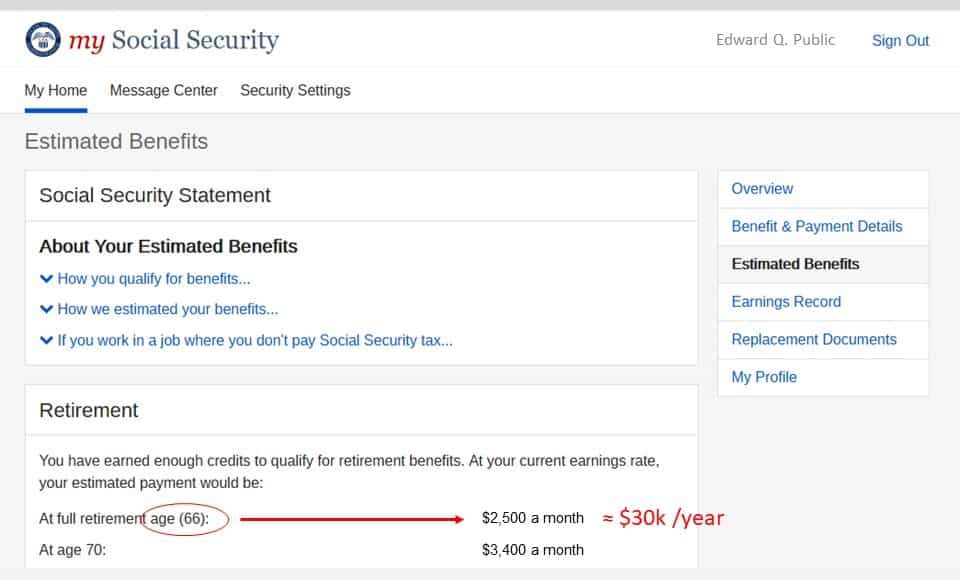

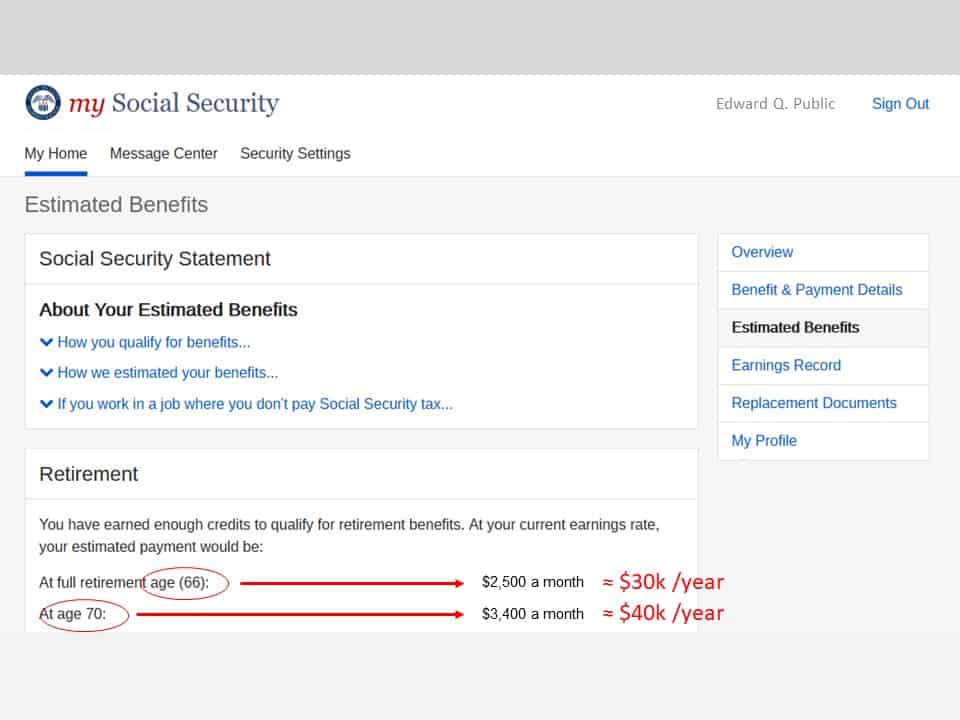

To evaluate this, Ed looks up his Social Security benefit at mySocialSecurity.gov.

It shows you your monthly benefit for different start ages. Starting at age 66, Ed’s benefit will be 12 times this monthly amount, or about $30,000 this year, with an annual inflation adjustment.

He receives the social security benefit for as long as he is alive. But so far, he’s $10,000 shy of the red line—his annual bare essential needs, which are $40k /yr.

His savings could give him an additional 22K until he is 100. ($22K x 35 years = $770K)

But that doesn’t even cover half of his WANTS, so he sees that as an unhappy retirement.

Alternatively, he could fully fund his budget for WANTS, but he would run out at age 87 and he would have to hope to get into a desirable Medicaid facility. He’s not excited about that.

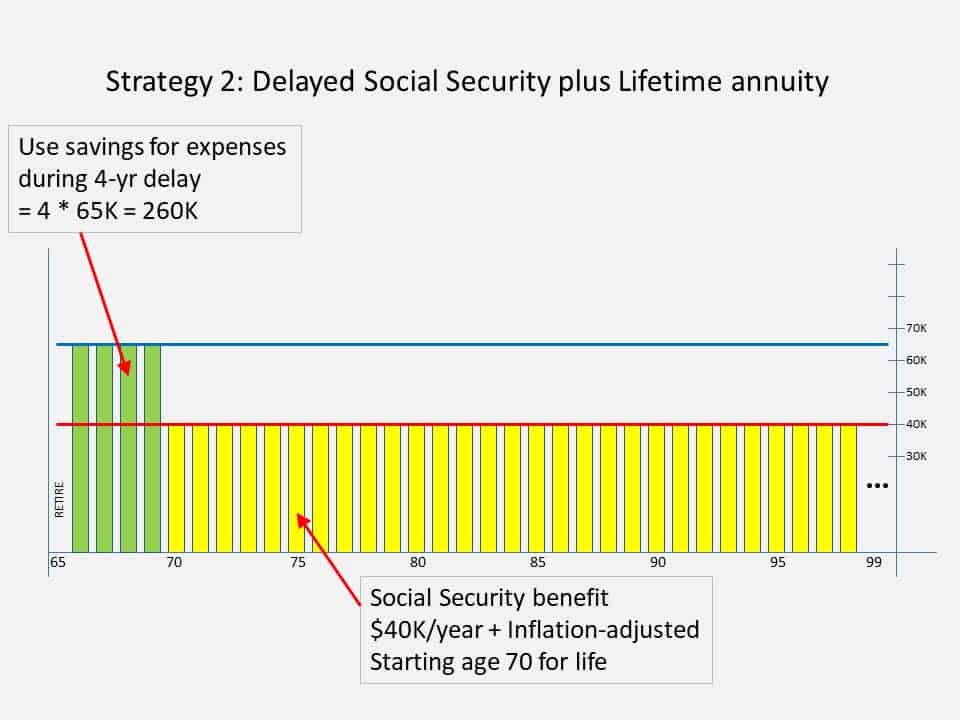

Strategy 2: Delayed Social Security plus lifetime annuity

Hmmm, Ed thinks. The Social Security benefit is looking better than ever! They never go bankrupt and it does include a cost of living adjustment.

There is a huge benefit from delaying Social Security until age 70. In this example, it is an additional $10,000 per year.

So, Ed goes back to his Social Security benefits statement and sees that he’d get $40K /yr for the rest of his life. For most people, this is an exceptionally good deal.

In this second strategy, Ed still retires at age 66 and uses maturing bonds to fund the four years before his Social Security benefit starts at age 70, which will now be $40,000 and fully cover his essential needs.

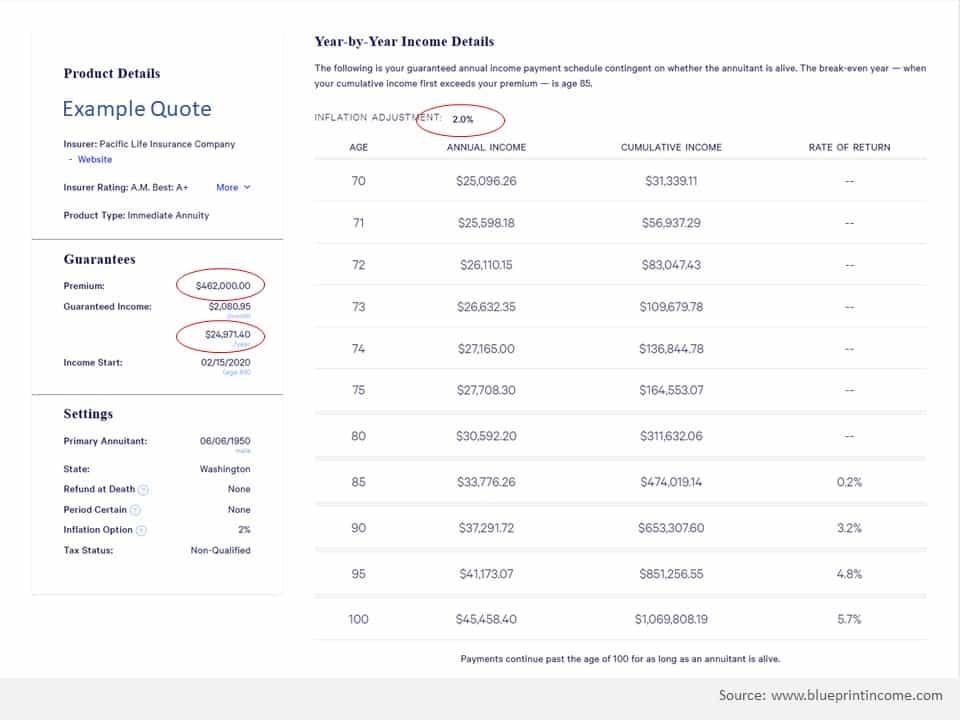

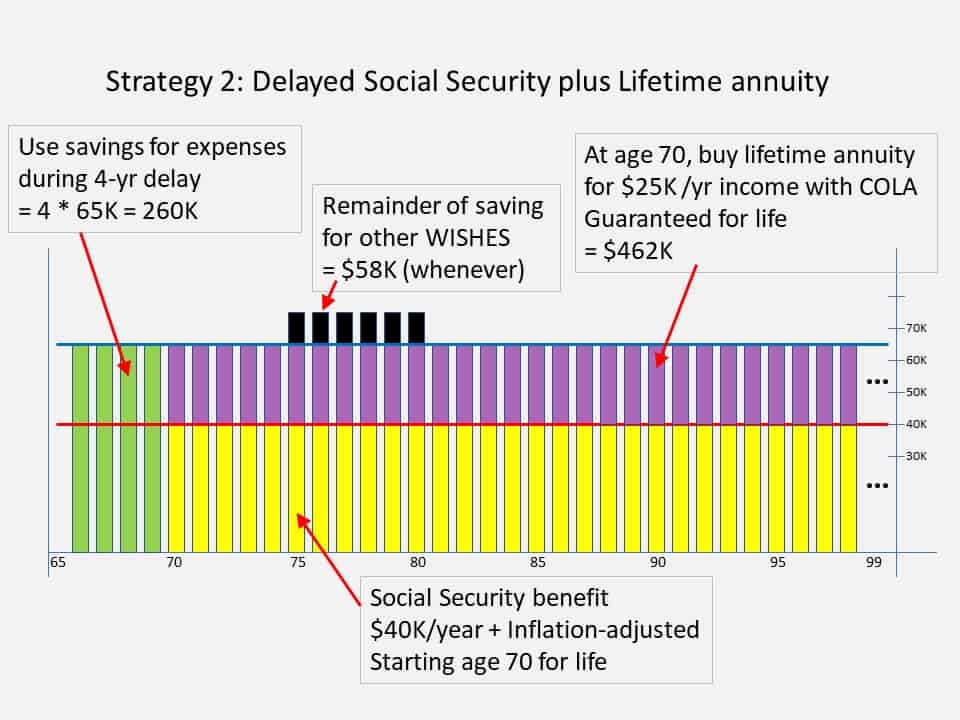

With the balance of his money, he plans to purchase an immediate income annuity, also at age 70.

He looks up a free quote for an immediate income annuity to fully fund his WANTS for as long as he lives, keeping up with inflation with 2% cost-of-living-adjustments.

Looks good. Again, he retires at age 66, uses his savings for 4 years to get the higher SS benefit, and buy an annuity with a cost-of-living-adjustment when he reaches 70 to cover all his WANTS.

He’ll have 58K left over to use for his WISHES.

He has eliminated longevity risk, inflation risk, and market risk!

Looks pretty good. All his needs and wants are covered, and he’ll sleep well—never to worry about the stock or bond markets again. But, he WISHES he could be more generous — which he maybe could be if he didn’t purchase the annuity. So, for completeness, he considers whether he might rather be in stock mutual funds.

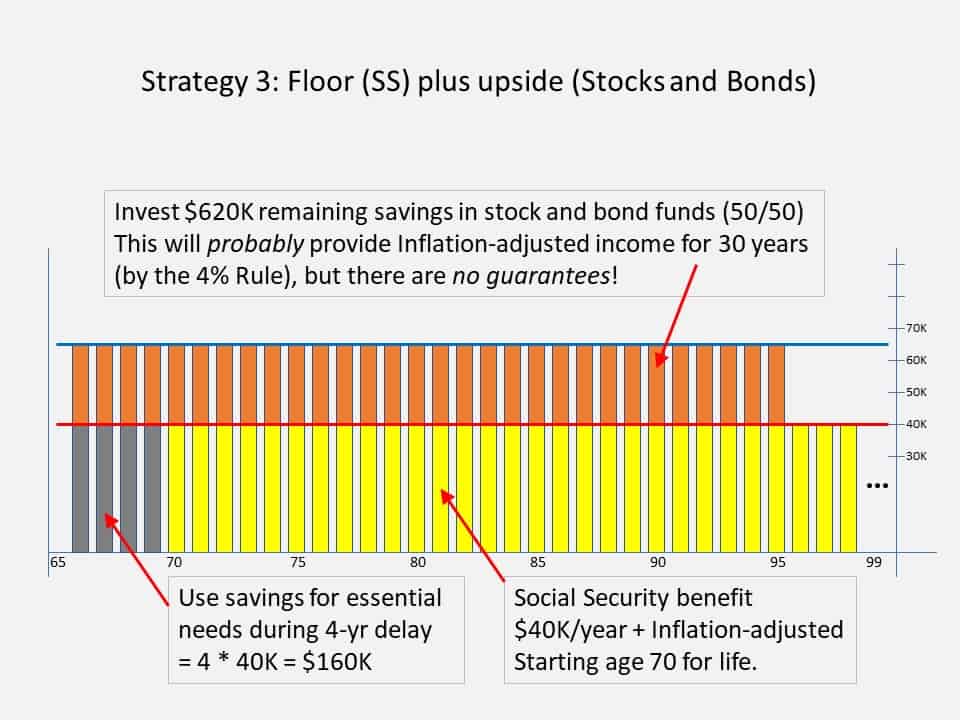

Strategy 3: Delayed Social Security plus stock and bond funds

He could allocate money to cover his essential needs to get the delayed Social Security benefit. Then, using the 4% Rule for the rest of his nest egg would suggest that he could safely meet his WANTS for 30 years with a portfolio of stock and bond index funds. This would give him the best chance of additional funds if the market is strong, but also the greatest risk of a shortfall if the market does badly. He’d especially be in a jam if his retirement years start with a sequence of bad returns.

This isn’t a good strategy for Ed. But everyone is different! Somebody very frugal, with very few WANTS, might prefer this. Or, somebody wealthy enough that they could bear the market risk.

Summary: goal-based investment planning

In this video, I’ve shown that it is easy to make a plan and improve it each year. It starts by putting your goals in writing.

For our retirement planning example, we used guidelines to estimate our annual living expenses and then calculate the total savings “nest egg” required for that retirement income.

We prioritize to separate essential needs from those we could live without.

And finally, match investment risk with each goal.

But, there’s more to learn. Keep watching this video series. Learn how to take control of your finances and live the life that you want to live.

The next video, Rule#2, will look at saving. How do people save that much money? What important tricks make it easier?

Smart Investing for Beginners — Ten Simple Rules

#2: Start saving money early

Start saving early. Learn how to save money first; then learn how to invest. We’ll use risk-free strategies to accumulate savings in this episode, and then introduce stock market risk in the next.

Rule #2: Start saving money early

Our first episode looked at developing a workable plan. Unknowns about our career, family, health, and lifespan make planning challenging. Yet, we found some workable strategies in the face of these uncertainties.

In this second episode, we’ll look at: When should you be saving? How should you be saving? and, Where should you be investing—so that your savings grow faster than inflation, and meet all your goals?

You’ll learn why your savings rate is more important than rate-of-return. Then I’ll show you risk-free ways of reaching your goals. And finally, some time-proven secrets to saving — including paying yourself first with automatic saving.

Start saving money early. Time is your friend.

“Time is your friend; impulse is your enemy.”

— John C. Bogle

Time is your friend. John Bogle had a gift for colorful quotes.

This is partly about exponential growth. Just as bacteria, plants, and animals can reproduce exponentially, this can happen with money.

I used to compare two women. Both saved for only ten years. One started early and then stopped. The other started late but saved twice as much over 10 years. She never caught up.

These stories are interesting and motivating — but misleading without a corresponding discussion about investment risk.

So, let’s not put the cart in front of the horse. The primary motivation for saving is to be able to spend at a smooth rate over your entire lifetime. Taking investment risk may, or may not, result in greater wealth and happiness. I love the stock market, but it is not for everybody. I will talk about risk in episode 3, then investing with mutual funds in episodes 4-10. But none of that is relevant if we don’t have saving nailed down.

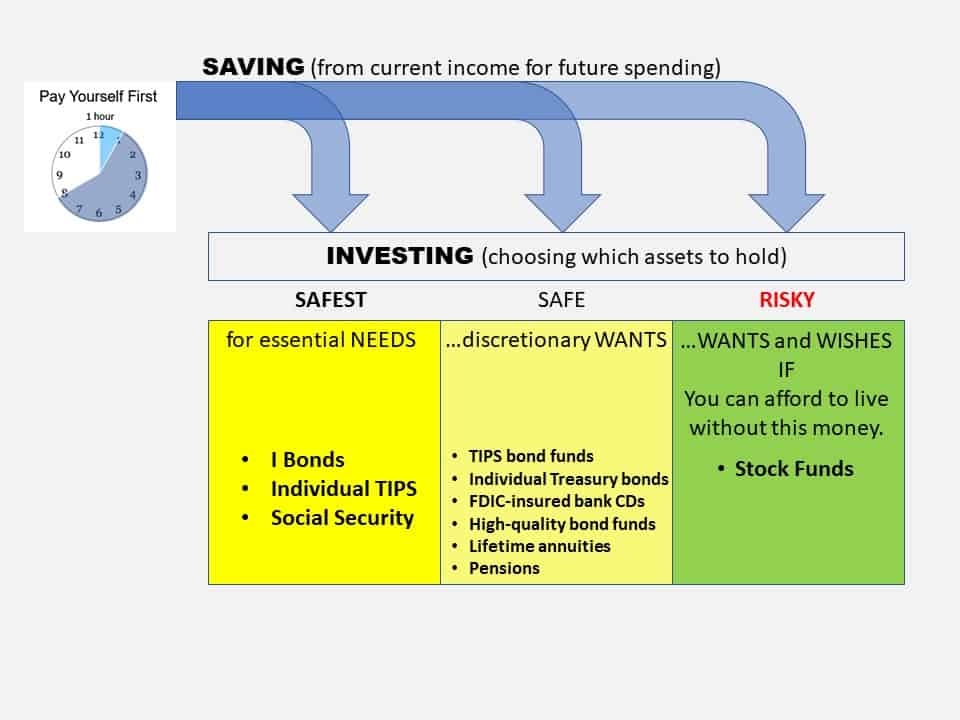

What is risk-free?

Saving is setting aside a portion of your earnings for future use.

Investing is choosing which assets to buy with those savings.

Risk, for us, is the possibility that your savings will not be there when you need it for an important goal. It’s not just about probabilities, but about bad consequences.

People take investment risk seeking a higher rate-of-return. But that may, or may not, be appropriate for you. And quite frankly, you may not know yet. So, let’s just start with the basics.

Today, mid-year 2020, the risk-free real interest rate before taxes is zero. Risk-free means not vulnerable to the stock market, the bond market, business failures, or inflation. Let’s start there, for at least our essential needs.

Accumulating risk-free savings

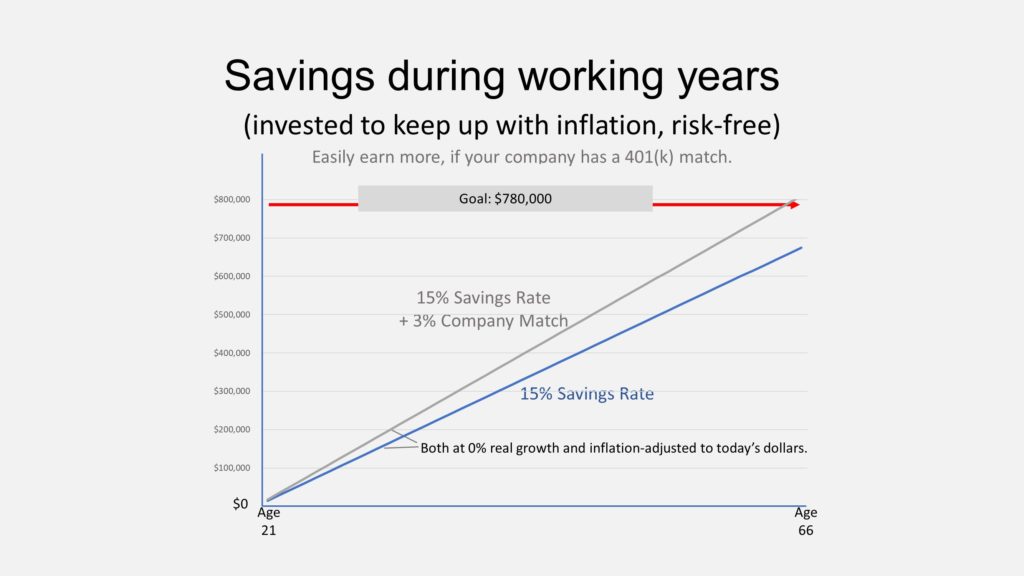

The last episode had an example where Ed retires at age 66 with $780,000. How do you save that much money? Is there a risk-free way? Here’s how Ed did this:

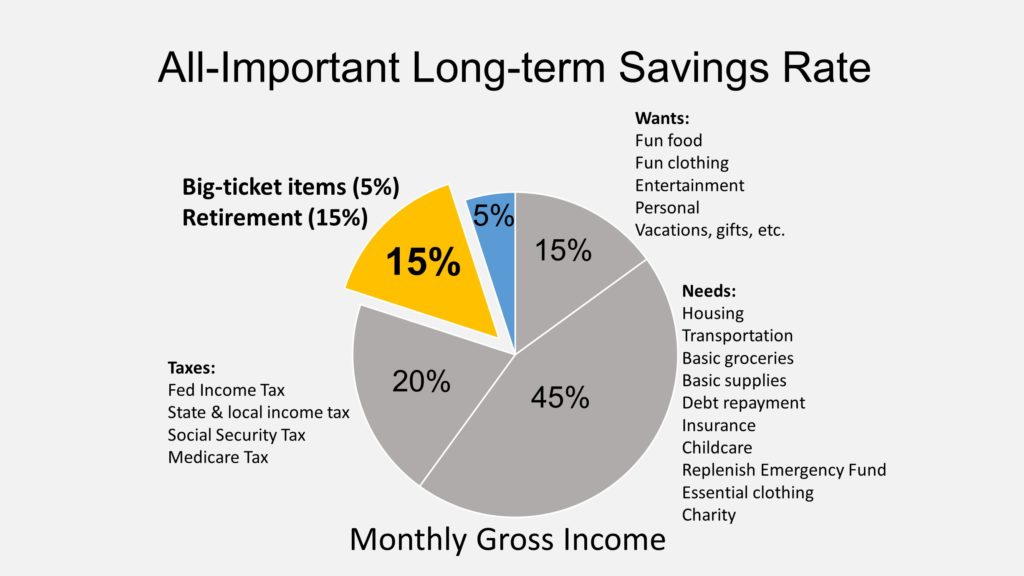

Ed saved 15% of his total earnings for his retirement; plus another 5% for other big purchases. He used inflation-protected securities called T.I.P.S. and I bonds. These are U.S. Treasury bonds, generally regarded as the safest investments in the world.

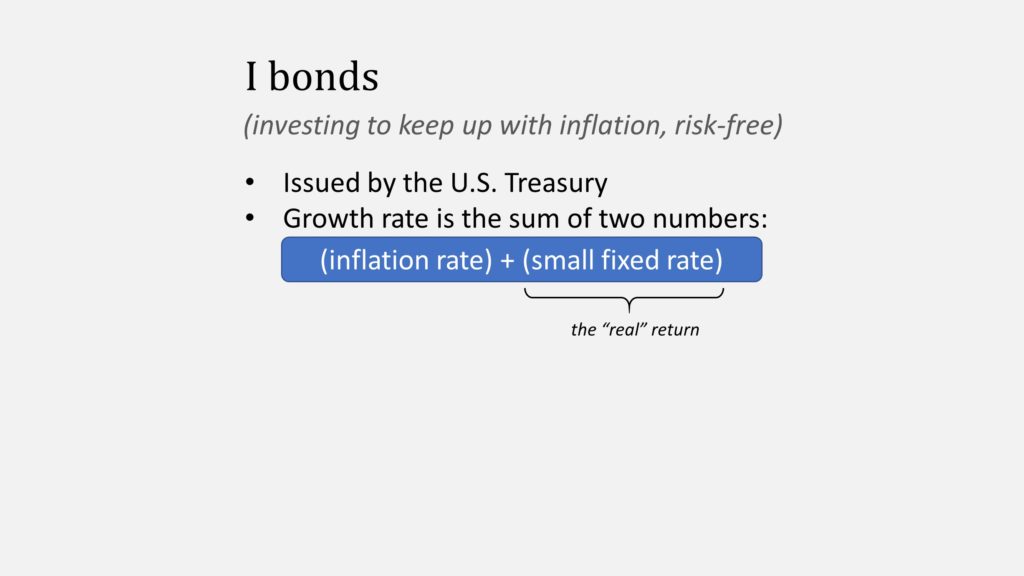

An I bond is like a bank CD that grows with inflation plus has an additional fixed rate of interest. The inflation component changes year to year.

The fixed component remains at whatever it is when you buy it, which today happens to be zero. It isn’t always zero, but the ones you can buy today are. So, let’s use that.

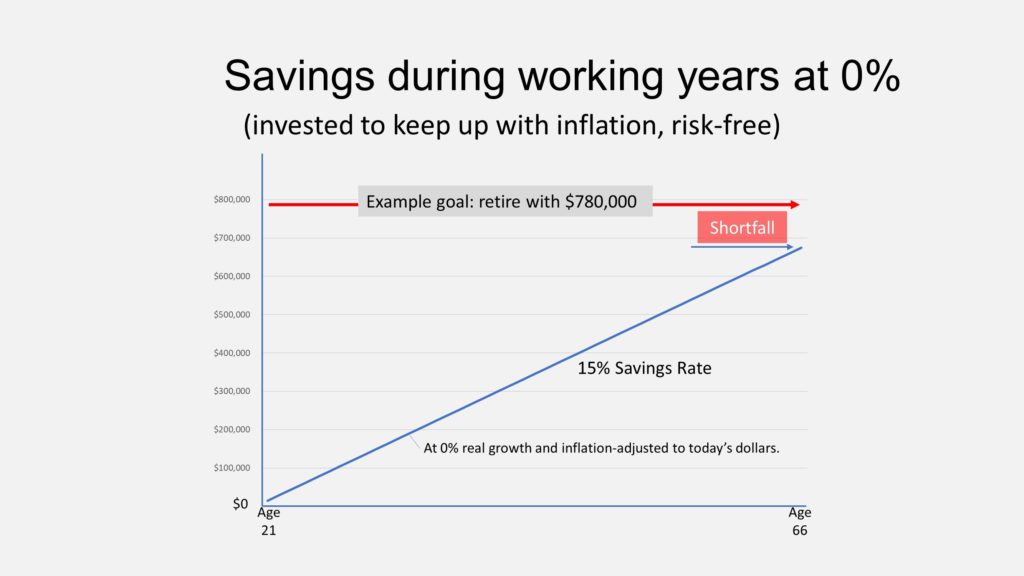

Ed sets up automatic payroll deduction and investment from his salary. After 45 years, at zero percent above inflation, he would save an impressive amount, but still be a little short of his goal. We’ll work on that.

Time is your friend. Because it will take a lot of time to achieve this goal —without introducing risk and hoping for good luck.

Now, 45 years ago Ed wasn’t earning a hundred thousand. His salary has increased with inflation for his entire career. He was earning a lot less, so his 15% contributions were a lot less. But, because they were invested in inflation-protected bonds, every one of his contributions has grown to become equivalent to a $15,000 investment today.

That’s a pretty powerful statement, so I want you to believe it. Let me show you. At age 21 Ed’s salary was a little over $40K and he contributed 15% of that. That contribution grew at the rate of inflation and is worth $15,000 today — as did every other contribution. It’s exactly as though he did 45 contributions of $15,000 in today’s dollars.

What is a real interest rate of zero?

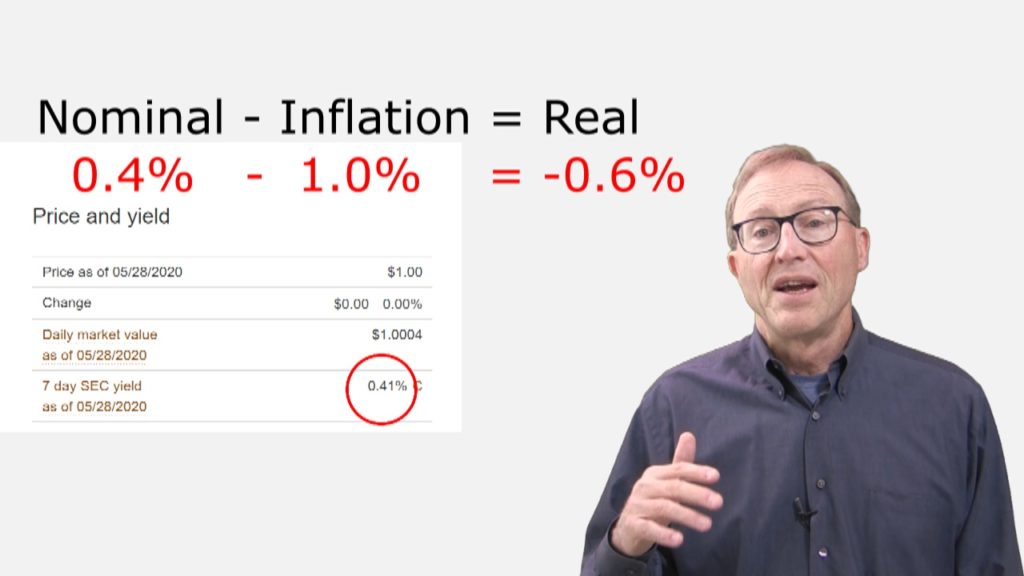

A real interest rate is adjusted for inflation. So a real interest rate of 0% has a yield that tracks the Consumer Price Index but nothing more. So your savings maintain their purchasing power.

“Wait!”, you say. “I earn more than zero”, and you show me your money market fund.

Yes, these are the normal way people talk about interest rates — they are called nominal interest rates. They are before inflation. Subtract the current inflation rate to find their current real yield.

If the current inflation rate is 1%, these savings accounts are not keeping up with inflation — and you are gradually losing purchasing power.

TIPS and I bonds protect you from unexpected inflation.

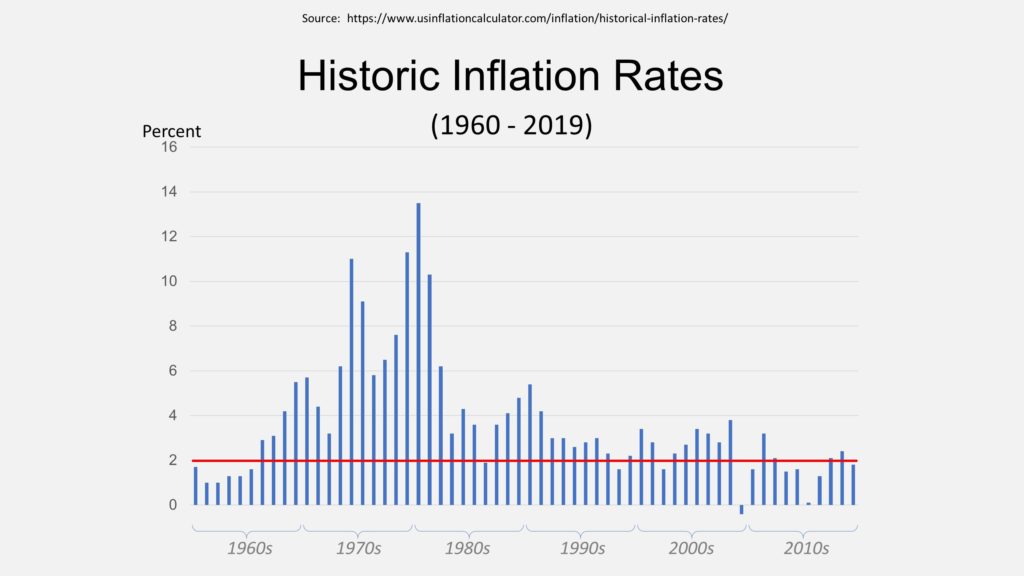

Inflation is currently pretty low, but here’s what inflation has been over my adult years.2-2 Remember, none of us have a crystal ball.

We haven’t found a path for Ed to meet his savings goal yet. His choices are to earn more, save more, work longer, scale back his goal, or to consider investment risk.

Example: how Ed meets his goal

Earn more?

One strategy is to earn more money. That’s always a good idea, and sometimes it is the only way you are going to accumulate savings.

Use a 401(k) company match?

[$2 employee contribution + $1 company match => $3 investment into 401k]

Many of you are lucky enough to work for a company that offers a retirement program with a matching contribution. The most common of these is when the company contributes 50 cents for every dollar you contribute—up to 6 percent of your salary. This is essentially giving yourself a 3% raise. The 401(k) is a tax-deferred account which we’ll also discuss in a later episode.

I bonds are not available in retirement accounts, but you might find a way to buy a U.S. Treasury bond called T.I.P.S.

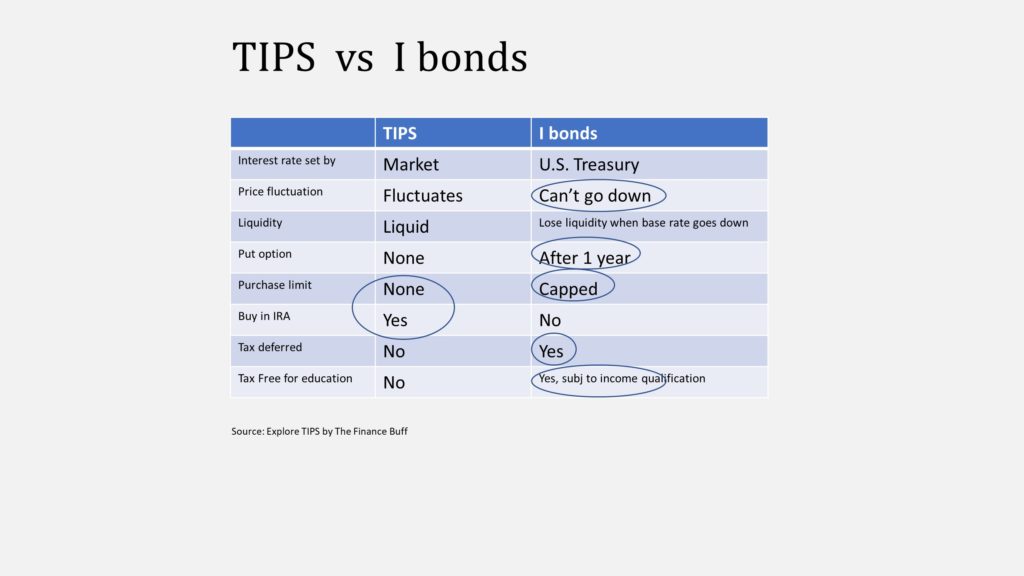

In a nutshell, TIPS are most like Treasury bonds and I bonds are most like bank CDs. They are both great products. This table2-3 shows some reasons why TIPS are preferred by serious investors and I Bonds preferred by small savers.

Note that a 3% company match is more than enough to meet the goal in this example, without taking on investment risk. What if his employer doesn’t have that program, or he works for himself?

Save more?

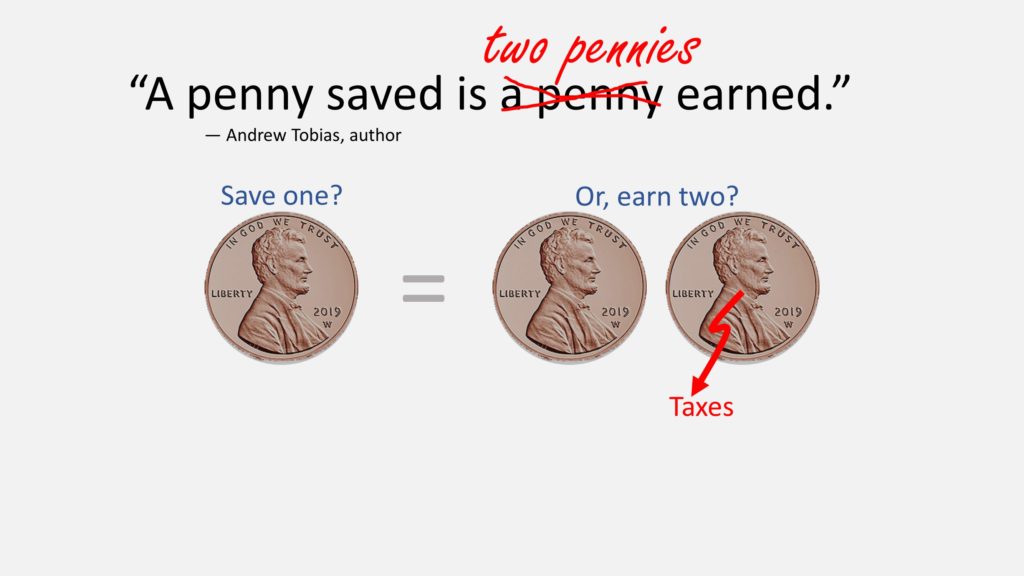

Author Andrew Tobias asserts2-4 that if Benjamin Franklin was here today he would update his saying to become: “A penny saved is two pennies earned.” They didn’t have an income tax back then. This update reveals that it is often much easier to accumulate wealth by saving more than by earning more — after you consider the costs of working plus taxes.

For some of you, your tax rate could be as high as 50%—meaning that you would need to make an extra $2 just to have one extra dollar for yourself!

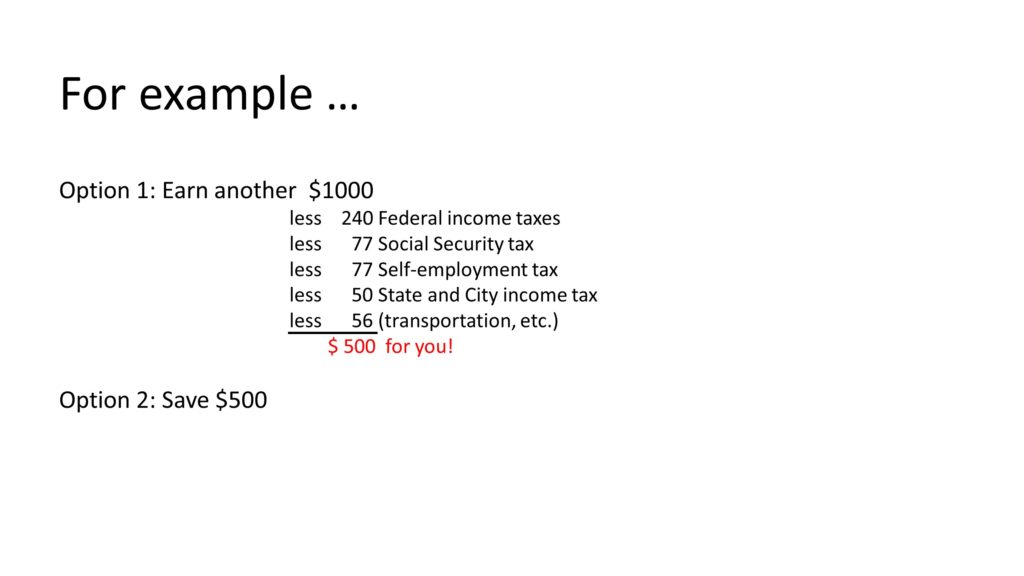

Your tax rate could be higher than you think. If some of you earn $1000 more, 240 will go to federal income tax and 76.50 to Social Security. Some of you also have to pay self-employment tax, state, and city income taxes, the cost of getting to and from work, plus other things.

Bottom line: you may only get to spend about half of what you earn.

In our example, Ed needed to save an additional $100,000 over these years. He could save a little more from what he is already earning. Or, he could work to earn quite a bit more.

Saving more might be the easiest way to meet tough goals, but there are other choices. Working more years is sometimes an option.

Work longer?

Starting to save early is one way to save more — by saving over more years.

This might also be smart if there may be unplanned years out of the workforce—perhaps to take care of children or for aging parents; perhaps an unplanned layoff.

Twenty-one is already early because these early years must establish an emergency fund and avoid debt.

Another way to finance your goals is to plan to retire later.

But admittedly, that’s not always an option for many types of jobs. Many of us are vulnerable to uncontrollable circumstances, like recessions, wars, or pandemics.

Choose a higher rate-of-return?

Well, why not just choose an investment with a higher rate-of-return? You’d get there faster. Or would you?

Professor Zvi Bodie warns against taking risks to meet your important needs:

“If your needs are not attainable through safe instruments, the solution is not to increase the rate of return by upping the level of risk.”

— Professor Zvi Bodie

Remember your hierarchy of needs, wants, and wishes from Rule #1. Choosing more investment risk as an alternative to saving more to meet your future essential needs could be foolhardy — akin to foregoing fire insurance on your house because your budget is tight. It might generally work out, but the consequences when it doesn’t can be bad.

Time-proven secrets to save money

Saving is challenging. You need to talk yourself into saving—especially if your friends spend freely. So, here are some time-proven tips to becoming a good saver.

Focus on your savings rate

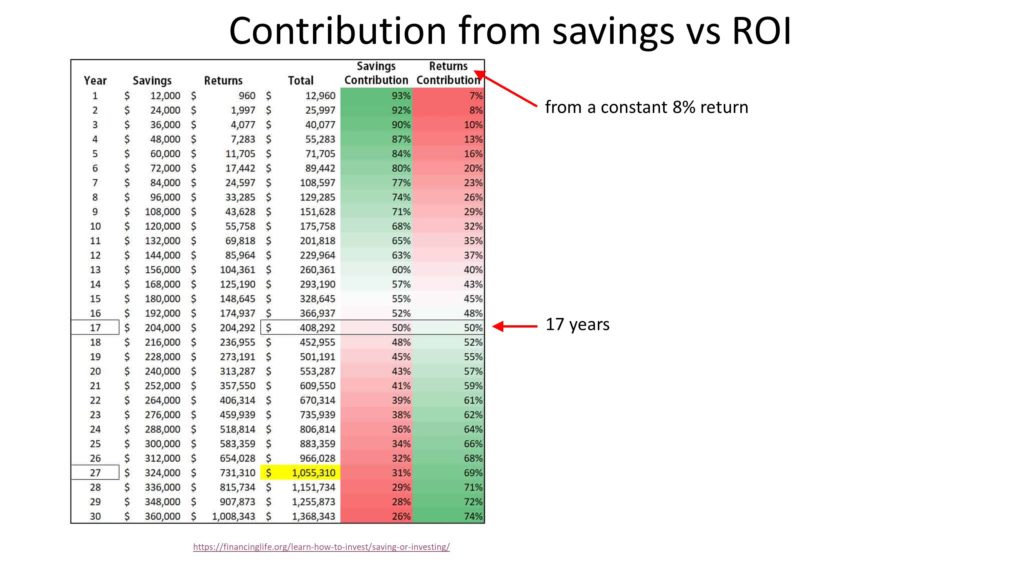

[image: contribution from savings vs ROI]

It turns out that your saving rate is more important than your investment rate-of-return for a long time.

Let’s imagine you contribute $12,000 each year and earn a very generous constant 8% on your investments.

Each year, the portion of the total balance from your investment returns grows.

It will take 17 years before your returns contribute more than your savings to your accumulating wealth. And the lower the return, the longer it will take.

Save money automatically

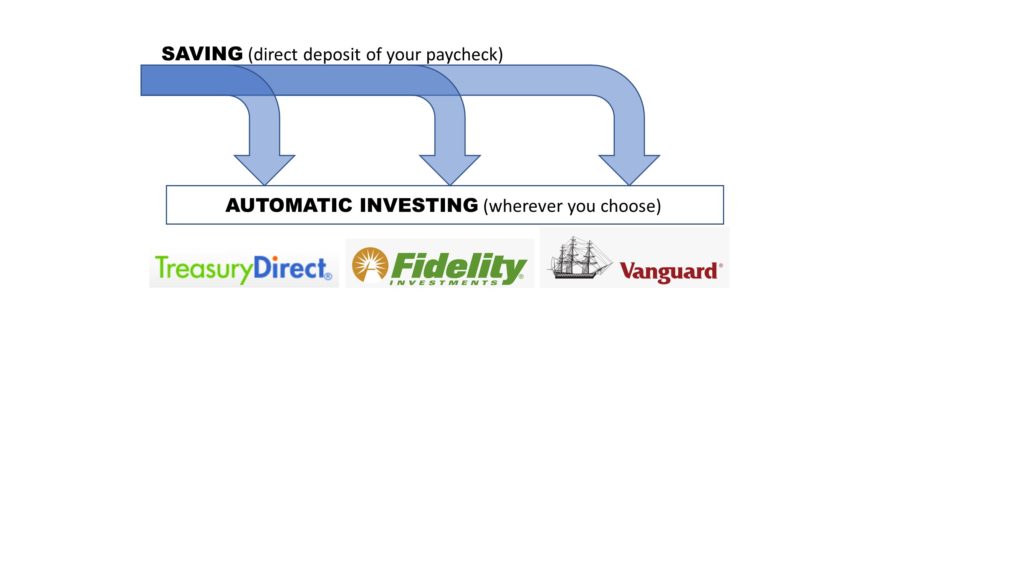

Even more powerful for me was adopting the concept of automatic-investing early. You don’t miss (or spend) what you don’t see. You already withhold money from your paycheck for taxes and Social Security.

Automatic investing is the same concept for your long-term goals. Direct deposit your paycheck to your bank, and then set up automatic investing to your investment accounts.

Increase spending gradually

Ultimately, it comes down to controlling your lifestyle.

People want to keep, or increase, their standard of living—not decrease it! Increasing it slowly and smoothly helps achieve that.

Some people—professional athletes, celebrities, and others—have inconsistent income streams and should save a lot more during their peak years.

We value an extra dollar a lot more when our spending is low than when our spending is high. Economists can prove that consumption smoothing increases happiness, but I immediately recognized this truth when I heard a version of this from popular author Vicki Robin.2-5

She describes the happiness and fulfillment you get from buying things. The slope is steep when we are young. We get a lot of happiness from a first bike, first car, first house… but incrementally less as we acquire more stuff. A bigger house, bigger mortgage. And without even thinking about it you become dependent on your job to pay for stuff that – well, frankly, you might look back on it as clutter. This concept of “enough” is fun to explore, along with other ways to get that joy that doesn’t require spending.

Respect your time

The big idea that Vicki contributes is to think about what you buy in terms of equivalent hours of work to pay for it. Her insight goes further than our modern-day Benjamin Franklin [blink] by recognizing that your time is precious and limited. It’s your life energy. So become aware of your real hourly wage.

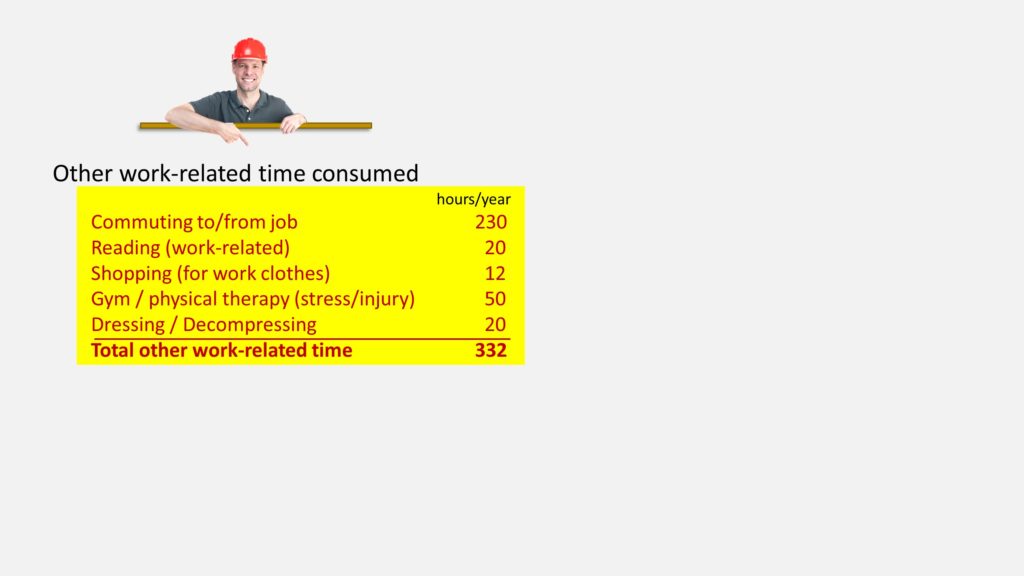

We saw before that there are taxes and other expenses that you wouldn’t have if you were not working: commuting costs, maybe childcare, simple repairs that you hire out because you lack the time, or extra restaurant meals when you are too tired to cook.

There are also time-consuming activities that wouldn’t exist if you didn’t have that job.

If Ed subtracts the extra expenses and adds that extra time, the result is that his real hourly wage isn’t $50 an hour like you’d think, but rather $25.

So, every $25 he spends represents one hour spent working. This is valuable and helps you make spending decisions. For instance, if you could buy a sports ticket for $100, you would ask yourself: Is it worth 4 hours of working to see that game? Only you can answer that.

Summary: how to save money

In summary, learn how to save money first; then learn how to invest.

- Focus on your saving rate.

- Put it on auto-pilot so that you don’t have to think about it.

- Spend mindfully, because you are trading your life energy

- Let money be another invitation to think about who we are, how we live, and what is important.

We begin to talk about smart investing with our next episode about investment risk.

After that, learn how to reduce risk by diversifying stocks, and why bonds are different.

See you in the next video!

Smart Investing for Beginners — Ten Simple Rules

#3: Control investment risk

It’s important to choose an appropriate level of investment risk and return. This video will help you understand stock market risk and whether stocks get safer with time. They don’t.

Rule #3: Control investment risk and return

In the first two episodes, we looked at developing a plan and your most important habit—saving for your goals. In both those episodes, we looked at the risk of inflation and introduced ways of hedging that risk with I bonds and T.I.P.S. Stocks are another way to achieve that, but they introduce substantial new risks.

This episode will help you understand stock-market risk. I help you understand why stocks don’t get less risky by owning them longer. I want you to understand well enough that you can explain this to your friends.

Also, learn about bond market risk and how to allocate between stocks and bonds.

Stock investment risk and return

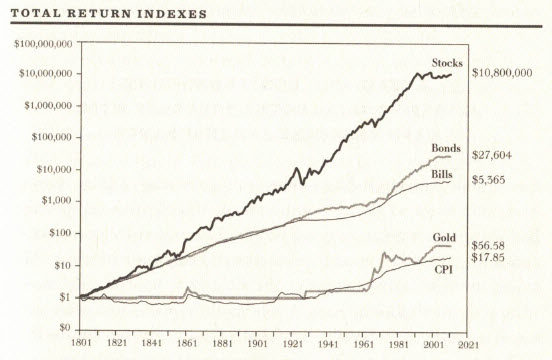

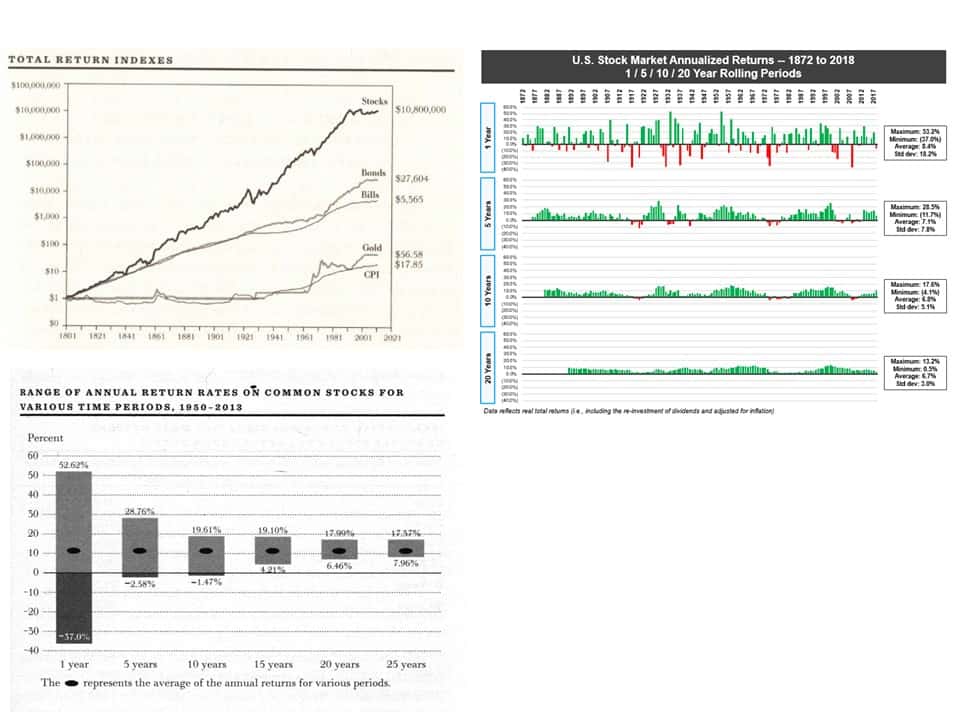

Here’s a chart I like.3-2 At a glance you can compare the total returns for stocks and bonds. Risk and return go hand-in-hand.

KEY POINT: higher expected returns come with higher risks.

The bond market is much bigger than the stock market. And yet, stocks have substantially outperformed bonds over the last two centuries. Why wouldn’t all these bond owners prefer stocks for their superior returns?

Think of bonds as loans. You loan your money to a company or the government that they pay back with well-described terms. There is great certainty.

Stocks are ownership of businesses. The upside for investors comes from the profitability and growth of those businesses. But there are no guarantees. Investors take a much higher risk for much higher expected returns.

Even a well-diversified stock portfolio can lose half of its value in any year.

This year is a vivid example of the stock market plunging. This happens regularly. It’s unpredictable, but the stock market is always reflecting our collective best estimate of the future profitability of these businesses.

Some of you are thinking, “I’ve been here before and the stock market always recovers quickly.” In other words, you’re safe if you are a long-term investor.

Here are the last three decades of the Japanese stock market3-3 to show a counterexample. Larry Swedroe emphasizes that investors, particularly individual investors, should “never treat what may seem highly unlikely to them as impossible.” That’s why the very first episode in this series had you look at what you need money for and when.

Do stocks become safer with time?

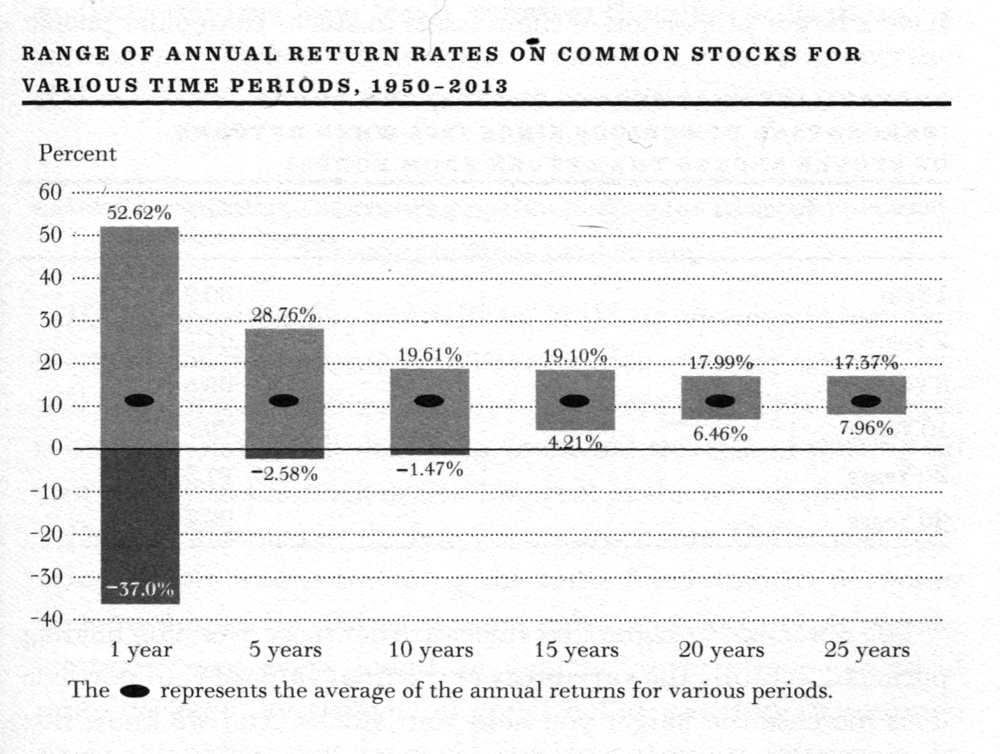

Charts like this next one are very common.3-4

This means the 1-year returns, for all the years they studied, had an average return of about 10% and a range of values from up 53% to down 37%. This chart seems to promote owning stocks for their greater return if you can own them for 15, 20, or more years—that time erases risk, which it certainly does not.

If you look at probability without regard to consequence, there is some truth to this. A diversified portfolio of stocks does become increasingly more likely to do better than risk-free investments.

But, my goal is to strengthen what you already know intuitively — that in any upcoming day, week, or even year, stocks will be riskier—far riskier—than short-term U.S. bonds.

Follow me here. The deviations from the average rate-of-return disappear when many years are averaged together. This chart is statistically true but often misinterpreted to mean that risk somehow magically gets erased when you own stocks for a longer period.

What investors are concerned about is the amount of wealth they will have at a future date. I’ll show you that the range of final values increases with time.

What’s missing on this chart is the uncertainty of future returns. This chart says nothing about the future, only about the past. Unlike bonds, there’s no predestined rate-of-return with stocks. The risk is the possibility that, in the long run, stock returns will be terrible and you don’t meet your goals.

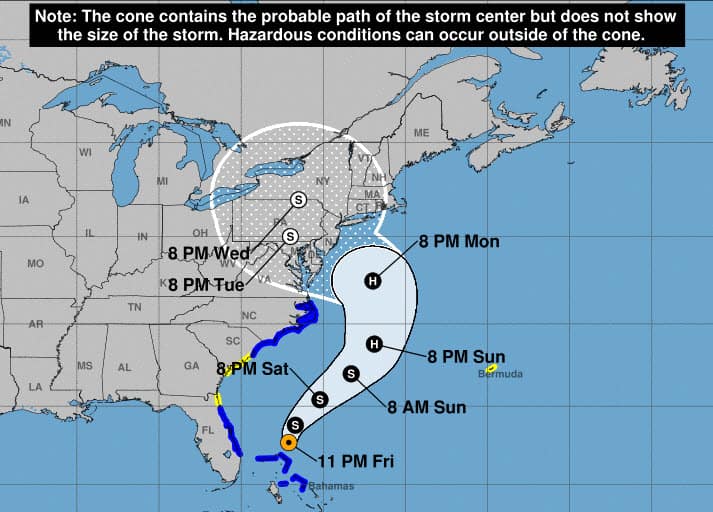

Uncertainty increases with time.

Predicting the future value of your stock portfolio is much like predicting the path of a hurricane.3-5 Uncertainty increases with time.

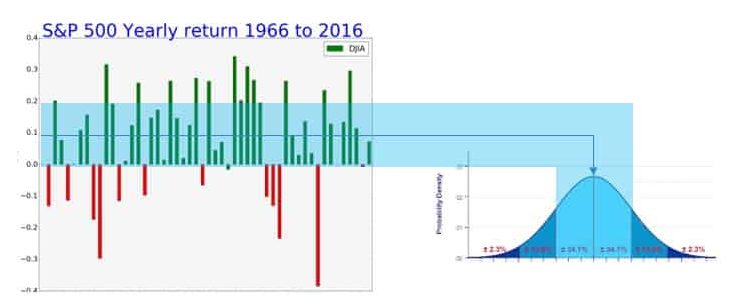

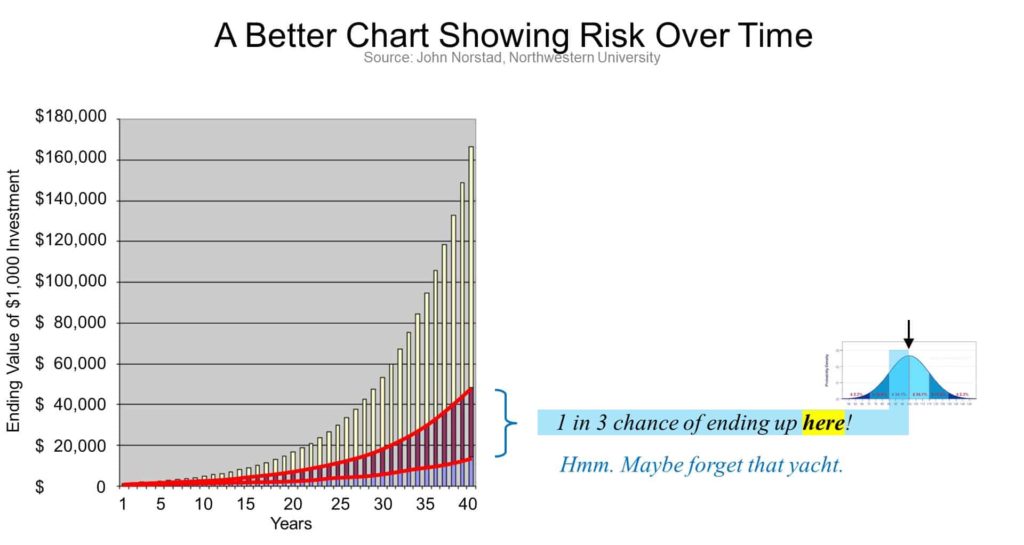

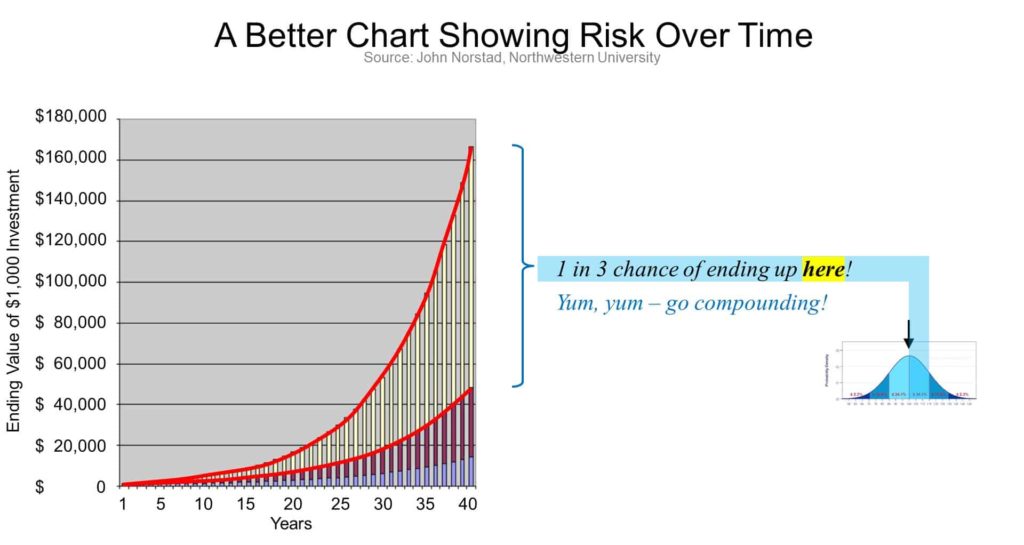

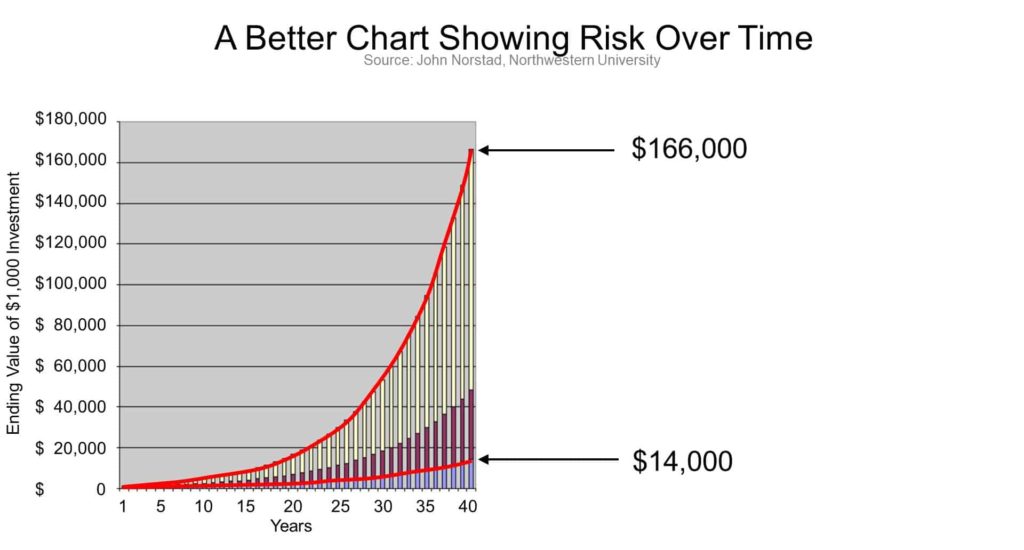

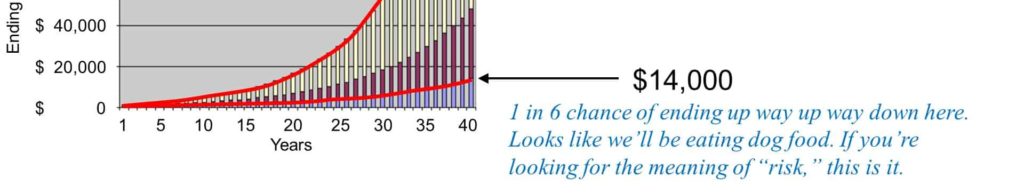

John Norstad shows this visually in a compelling article by representing the actual S&P 500 returns as a normal distribution.3-6 I’ll explain here.

Stock returns vary widely, but they do have an average value. And 2/3 of the returns are within one standard deviation of that.

Let’s use that and look at the possible end values of investing $1000 over time horizons ranging from 1 to 40 years.

We have a 1 in 3 chance of the final value in this slightly disappointing range.

Also, a 1 in 3 chance the final value is in this range above average.

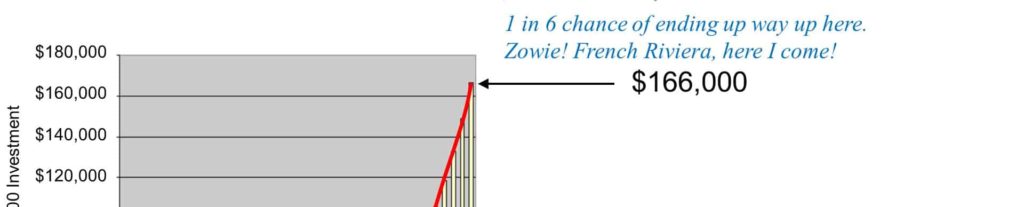

That means if the stock market performs as it did I the past, we have a 2 in 3 chance that the ending value will be somewhere between $14,000 and $166,000. This is an enormous range of possible outcomes.”3-7

There is even a 1 in 6 chance that you’ll end up higher. That’s the miracle of compound interest.

But that also comes with a 1 in 6 chance that you’ll end up somewhere near the bottom.

KEY POINT: it is the total return that matters.

“Now this chart is revealing. Because for an investor concerned with the value of his portfolio at a future date, it is this total return that matters, not the annualized return.”3-8

To recap this section about stock market investment risk and return:

- Stock returns are high because they are risky.

- Stocks are just as risky tomorrow whether you have owned them 1 year or 10 — if measured by volatility.

- Short-term volatility may not be a concern to long-term investors with a safety net, but it certainly is for individuals with upcoming spending needs.

- Lastly, the range of possible total returns increases over time.

Test Yourself. Fooled by statistics?

Has this made sense so far? Then test yourself — because most people are still misled by statistics.

In this animation, you can see how U.S. stock market returns have trended when we look at 1 / 5 / 10 / 20 year rolling periods.3-9

Taking a 1-year view, we see lots of red — there were plenty of years in which the market was down.

As we take a longer and longer periods (from 5 to 10 to 20 years), the range of possibilities narrows, and the chance of losing money diminishes. Or does it?

By the last line, where each of these green lines represents 20-years, you won’t see any more flashes of red. Their message is, “The U.S. stock market has never lost money over any 20 years.”

OK. Tell the truth. Does that not scream out to you that the stock market becomes safer in the long run? What could go wrong? Right?

Can you see that these two charts are presenting the same information in two different ways?

What we are watching here is, once again, merely a demonstration that stocks produce a superior average return in comparison to safer investments.

KEY POINT: stocks produce a superior average return compared to safer investments because they are riskier. Investment risk and return go hand-in-hand.

This is what we have seen before, and that’s as it should be because the higher return compensates investors for taking the added risk.

But this does not mean that stocks become less risky over long time horizons. The risk is that the stock market might be down when you need to pull your money out.

I think you can understand intuitively that the idea that “stocks become safer with time” is a fallacy. Yet, this notion remains widely misunderstood. You’ll be doing your friends a favor if you could enlighten them.

I’ll provide links in the transcript if you want to dive deeper. Professor Zvi Bodie has a compelling argument with his proof using option pricing.3-10

But now, let’s look at some practical questions and incorporate wisdom from some additional experts.3-11

Need stocks to accumulate more wealth?

First, do you need stocks to accumulate more wealth? For lifelong happiness, we need to be able to spend money today as well as save enough for a potentially long retirement.

It’s true. The probability of accumulating more wealth is greater using stocks than with risk-free I bonds. But, it would be an error not to consider consequences.

For instance, you would probably also accumulate more wealth if you didn’t pay for fire insurance for your house. I mentioned this in episode 2. Unlikely events that are highly consequential are perfect for insurance.

This question is essentially asking whether you could save less by investing in stocks. Maybe, but choosing to invest that in risky assets for a better return could have a disappointing outcome.

The practical way to do that, writes Dr. Bodie, is to separate your goals into needs and wants. Lockdown the income to meet your essential needs and important goals by matching them with safe investments. Keep your risky investments allocated to your wants and wishes—that you could live without, if chance works against you.3-12

What about stocks for young people?

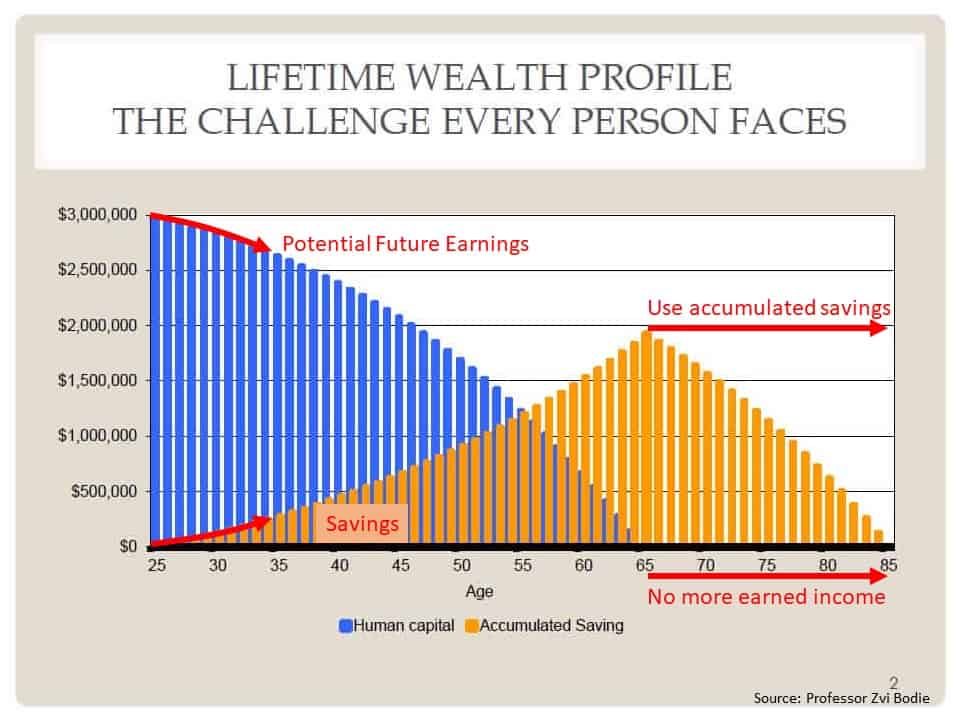

What about stocks for young people?

Here, Professor Bodie agrees that age does matter, but not because of the commonly mistaken idea that the stock market becomes safer over long holding periods. Rather, younger people have a longer time horizon to build wealth through work. He explains this with a simple life-cycle model.

All your future earning power starts high and gets depleted when you retire.

What you save for future spending becomes accumulated wealth.

Your total wealth, at all times, is the sum of your potential future earnings and your accumulated savings. So, you can see that if their accumulated savings are in risky investments, that’s only a tiny fraction of their total wealth when they are young. The consequences of loss are small.

But if your future-earnings capacity is weak, or you are near retirement, then the consequences of loss are hard to recover from.3-13

William Bernstein warns against staying invested in stocks after you’ve met your goal, saying:3-14

When you’ve won the game, why keep playing it? The risks for a retired person can be nuclear-level toxic.

WILLIAM BERNSTEIN

Which brings us to this next good question.

Bond investment risk and returns

How risky are bonds?

Are they more or less risky than are bond funds? First of all, compared to the stock market, bonds are much simpler!

Stock risk is intuitive

If you own a stock fund, you own a slice of all publicly traded businesses. You get that.

Your companies try to create value for customers. That’s their purpose. And the value of your shares is the market’s prediction of those future earnings. You get that too.

A lot can go wrong: company management can change, workers might strike, competition, government regulation, pandemics. You get all that too.

Stocks are complicated. But people have a pretty good intuitive understanding of them — other than wishful thinking — that they’ll be safe as long-term investors.

Bonds are much simpler

Bonds are much simpler than stocks. But new investors find bonds less familiar and therefore a little confusing. I have a separate video series about bonds. But for now, I want you to think about them like a bank CD. You are comfortable with how they work, right?

A bank CD is a simple form of a bond. You loan your money to the bank. They pay you a fixed interest rate for the use of your money for the term of the loan. You know exactly what you are getting with a bank CD. You can depend on it.

Then, you tell me that you could loan your money to your cousin for a higher rate. Now you get the idea! That would be called a “junk bond”. They are marketed as high-interest bonds with lower credit quality.

Bond funds are a convenience

You’ll have the option of letting a bank CDs roll over into a new CD at the prevailing rates when they mature. If you own a whole bunch of them you essentially have a bond fund. Bond funds are a convenience. The quality of the bond fund is as good as the bonds that comprise it.

When interest rates change, it causes the bonds or CDs you already own to temporarily be worth more, or less. You can eliminate interest-rate risk by holding individual Treasury bonds or CDs to maturity, or by choosing short-term bond funds. Further, you can eliminate default risk by sticking with the highest quality bonds. Eliminate inflation risk by choosing inflation-indexed bonds.

Key Point: Bonds can provide great certainty compared to the stock-market!

Bond funds are perfect when the role of bonds is to stabilize your portfolio for some long-term goals. Individual bonds and CD’s are perfect when you can match their maturity with when you will need that money for a specific goal.

How should we allocate between stocks and bonds?

Own Your Age in Bonds.

JOHN C. BOGLE

John Bogle famously said: “Own your age in bonds.” It is memorable, and therefore useful. It is a starting point until you have created a workable plan for yourself. This has its limitations, but it does reduce your exposure to the stock market as your future earning potential decreases. Adjust that to fit your situation.

Asset allocation is an important decision, but there is no perfect answer. Close is good enough.

Choosing between risky and safe investments is a goal-by-goal decision. Prioritize your goals. Every situation is different.

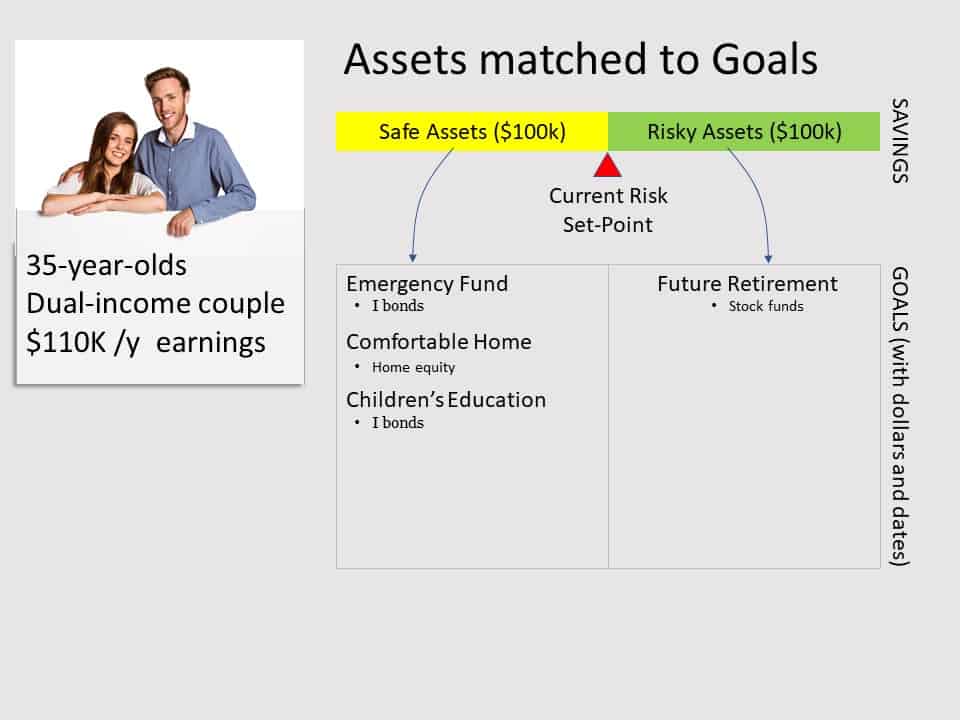

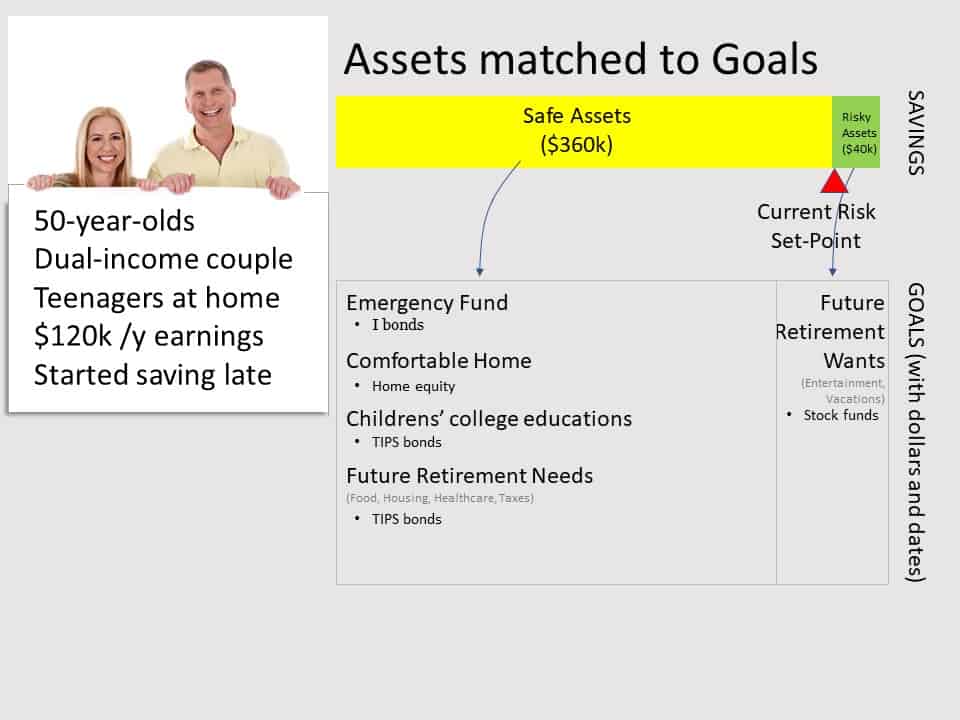

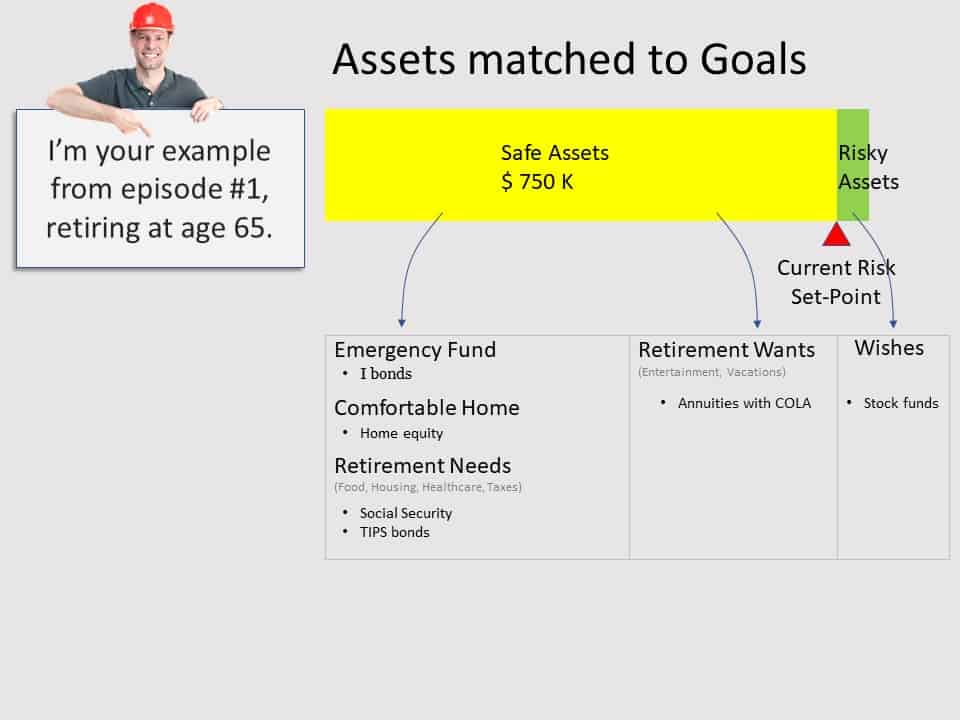

It’s not age that needs to drive this, but rather considering both the probability and consequence of market drops. How much do you stand to lose? How severe would be that loss? Your spending goals have fixed dates and dollar amounts. You should never put at risk what you cannot afford to lose. Some more examples might help clarify this:

This 35-year-old couple is just entering their prime earning years with secure jobs and can afford to take a risk in their investment portfolio for their retirement 30 years away. Meanwhile, they have other important goals that they don’t want to risk in the stock market.

This couple started late. They are tempted to accept investment risk and try to catch up, but they remember 2008, and now 2020, and know that could happen again at any time. So, they are focused on building a safe floor of income plus pay for their kid’s imminent college educations.

Here’s the example we developed in the first two episodes. He set himself up to be completely worry-free using delayed Social Security and an annuity to eliminate the risk of outliving his money.

This couple is retired with no kids and all their essential needs met, plus more than enough for both their retirement “needs” and “wants”. Their remaining investments are intended for charitable organizations.

SUMMARIZE

In summary, both stocks, and bonds can be appropriate for your portfolio — if you have your eyes-wide-open about investment risk. The next video begins to look at how to go about choosing a stock fund.

It turns out that you won’t get a higher expected return for certain kinds of risk that can be diversified away. Learn that there is a “best portfolio” of stocks that will produce the highest return for any level of risk taken. All that in the next episode about diversification.

See you in the next video.

Smart Investing for Beginners — Ten Simple Rules

#4: Diversify! Diversify! Diversify!

Previously, we saw how owning many stocks eliminated ―specific company risk. Now we are going to see that it is not enough to simply own hundreds of companies. You’ll learn the great advantage of owning poorly correlated assets. This part is truly cool! Magical.

Low correlation provides a “free lunch”

To show you, let’s imagine two companies: Bathing Suits Inc. and National Umbrella Company. A rainy year means sales at the Bathing Suit company fall but the umbrella company does well. In a sunny year, the bathing suit company does well and the sales of umbrellas fall.

The prices of these company stocks move in opposite directions. They are perfectly negatively correlated. The Bathing Suit company is more volatile because the total annual return has an average value of 7.0% but varies by plus or minus 1.0%. This is both higher return and higher risk than the umbrella company which has an average return of 3.5% plus or minus 0.5%.

This is the magical part. Look what happens if you invest 2/3 of your money in the umbrella company and 1/3 in the bathing suit company. WOW! Adding some of the more volatile company shares to your portfolio not only increases the average return, but it lowers the variability (or risk). Pretty much a free lunch!

Next, see what it looks like on a risk-return chart. The Bathing Suit Company is in the upper right with twice the expected risk and return as the umbrella company. If you own 100% in the umbrella company you have less risk and lower expected return. Now if you gradually invest part of your portfolio in the more risky Bathing Suit Inc., your returns increase as you expected, but your risk, as measured by the variability of that return, actually decreases. Owning both is superior to only owning either of the companies.

Adding a riskier stock can increase returns and lower risk

This is an important, and surprising, point. In the previous rule, we saw how different types of investments are distributed along a line that extends up to the right on a Risk-Return chart. This is because investors demand higher expected-returns in exchange for shouldering more risk. But now we see that when you can combine poorly correlated assets, you get the desirable situation where adding a more volatile asset can increase expected returns and lower risk.

Everyone should own some bonds

Negatively correlated stocks move in opposite directions or, more precisely: one tends to produce returns above its average when another the other tends to produce returns below its average. These are hard to find and still achieve diversified investments, so we look for the next best thing: poorly correlated investments.

For instance, recall that the price of bonds moves in the opposite direction of interest rates. But interest rates don’t impact the sales of bathing suits and umbrellas, and the weather doesn’t impact the price of bonds. The stock market and Treasury Bonds are nearly uncorrelated and we get this same magical benefit. Adding a little of the stock market to an all-bond portfolio has historically increased the expected returns and decreased the volatility (risk). Going forward, we may expect something similar, but caution: correlations can change when viewed over different timeframes.

Diversifying improves returns and risk

This is precisely how it works in the real world. Say you determined that an allocation of 50% stocks and 50% bonds was the right level of risk for you. Instead of being halfway between like you might expect in the diagram above, the fact that stocks are poorly correlated with bonds puts you up in a region with higher expected return and lower risk. This is terrific!4-1

What else can we do? If we take a closer look at stocks, we find out that the primary factors that determine the outcome of stock investments in the long-term are: the size of the companies, whether they are a glamorous growth company or a less glamorous value company, and then what region of the world it is in.4-2

The companies in the S&P 500 are so huge that this famous benchmark index is a good approximation of the entire US Stock Market. These 500 companies encompass both large Value and large Growth companies. Alternatively, choose a Total US Stock Market Index fund to further diversify with smaller companies and to now own a portion of several thousand companies!

Add some international diversity

Stocks in foreign companies are even less correlated4-3 with the US stock market, but are more expensive to own and have added volatility (risk) from currency exchange fluctuations if the assets are

unhedged. Many investors make 1/4 to 1/2 of their total stock percentage a broad international stock index fund.

You started a plan with goals and a saving routine—fully knowing that you may change it as life happens. In the last chapter, you chose an appropriate level of stocks and bonds that matched your ability, willingness, and need to take investment risk. That’s always your most important decision. Now you can see how broadly-diversified index funds are perfect for your target stock allocations.

Bonds are much simpler than the stock market

Bonds are much simpler. You can keep the risk out of bonds by keeping them short- to intermediate-term and very high quality. To diversify against inflation it is popular to make half the bonds US Treasury bonds called TIPS, for Treasury Inflation-Protected Securities. High-quality bonds also differ from high-yield bonds in that they are less correlated with the stock market—important to get that ―magical‖ benefit known as the Modern Portfolio Theory advantage.

Building an outstanding portfolio doesn’t have to be complicated at all!

Other resources for Rule #4: Diversify!

- Link to popular video the importance of diversifying investments

- Link to course called Diversify Like A Pro

▶ Watch this video overview: Rule #4: It is important to diversify investments. Diversification is important in investing because you want the most return for every measure of investment risk you are willing to take. It turns out that there is a theoretically ideal portfolio to accomplish just that. Start with that theoretically best-diversified investment before choosing anything different. Learn even more about diversified investments in the course Diversify Like A Pro where I explain Modern Portfolio Theory in plain English.

If you are not a professional investor, if your goal is not to manage money in such a way that you get a significantly better return than the world, then I believe in extreme diversification.

—Warren Buffett

I believe that 98 or 99 percent — maybe more than 99 percent — of people who invest should extensively diversify and not trade. That leads them to an index fund with very low costs.

All they’re going to do is own a part of America. They’ve made a decision that owning a part of America is worthwhile. I don’t quarrel with that at all — that is the way they should approach it.

Listen to him yourself:

Skip to the 1:12 mark of the following online video. Warren Buffet explains to MBA students at the University of Florida why he believes index funds are the best choice for most investors. https://youtu.be/P-PobeU4Ox0?t=72

Smart Investing Tips For Beginners:

- With smart investing, you achieve broad diversification of stocks at the lowest possible cost. This can be accomplished with one to three index funds. It’s that simple!

- You get the most reward for taking risks in the stock market. Keep the bond side of your portfolio in the highest quality bonds or bond funds for portfolio ballast, stability.

Read these simple rules in order, or click on the page buttons below …