Smart investors learn that index funds are the way to achieve broad diversification at the lowest possible cost. In this video, experts help beginners learn how to invest by explaining why index funds are the superior type of mutual fund.

Summary of video: Why Indexing Works

John begins by telling how he always knew there was someone on the winning side (i.e. beating the average)and somebody else on the losing side of every transaction. But he originally assumed that the professionals were on the winning side and the amateurs were on the losing side. But not so!

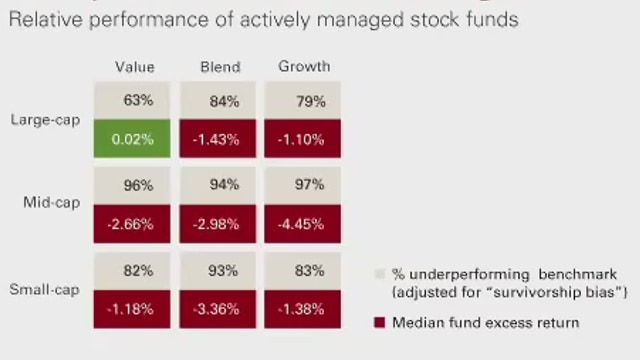

Gus provides the following evidence using the familiar Morningstar style boxes, showing how over the last 15 years active managers underperformed their benchmark indexes. Only in one case did they beat their index—and then only by 0.02%. The reason is because of the additional costs that actively managed funds charge.

Jane points out that while every year some active managers beat their benchmark indexes, the problem is that it is different managers each year. There is nothing that differentiates it from chance in the very long run.

Transcript of video: Why Indexing Works

Gus: Since our performance is a zero-sum game before cost, it’s a negative-sum game after cost. It turns out that managers who outperform before costs, become underperformers after cost. Majority of active investors should underperform the market itself.

John: When I started in the business 20 years ago, the assumption was the professional managers who actively run mutual fund portfolios would be on the winning side of the trades and the individual investors would be on the losing side of the trade. That’s how it was explained that you could have a zero-sum or negative-sum game as you explained. Yet, managers could always win. As we see with the evidence, that’s not the way it played out.

Gus: What we do observe is that really in all segments of the market, we look at the nine Morningstar to all boxes. You can see large cap growth for instance. Seventy nine percent of all active managers with a large cap gross style have underperform a large cap growth index. On average, 1.1%.

This is over the last 15 years. Fifteen-year time rising. As you can see, in the nine different style boxes, only in one style box have active managers actually beaten their index. It’s only by .02%. In fact, that’s actually 63% of underperforming index.

Jane: If I can add something to that. People who say, “I’m not going to be an indexer, because I’m going to find out that manager that outperforms.” You say, “Oh well, look. Thirty percent are outperforming the index. The only problem is, is that it’s a different 30% every time year.”

You say, “Okay, my guys outperform the index for five years,” but then, the next five years, some other guys going to outperform the index and you’re under. You’ll say, “Hey, wait a minute. What about these people that outperform the index all the time?”

Friends, there aren’t any. They don’t outperform the index all the time. I did one using Morningstar data once upon a time. Some years ago, I did for my column a rolling study of who is outperforming over five years and over ten years using rolling monthly averages. I looked at it, and here were all these different funds all the time. There was not one single fund at that time that it outperform its bench mark over fifteen years. There are these guys, they are outperforming only part of the time and the rest of the time, they’re down in what you call a zero-sum game and we try to call a loss.

Gus: In recognize, even the best managers, the ones that have had the best success over time, they went on maybe 52, 53% of their stock picks. They lose on 47, 48% of their stock picks. It’s a race or thin margin. It’s not easy picking stocks. Even the best in the world. They just barely turn the odds in their favor.

Footnotes and Credits:

This video is produced by The Vanguard Group and includes

- Gus Sauter, Vanguard Chief Investment Officer

- John Rekenthaler, Vice President, Morningstar, Inc.

- Jane Bryant Quinn, Financial journalist and commentator

It was published on their YouTube Channel on June 10, 2011 and titled, Why Indexing Works. I have created a summary and transcript to help you find the spots that interest you and make the best use of your time.

The Vanguard Group is the largest provider of mutual funds in the world. Of high interest: Vanguard is owned by the funds themselves and, as a result, is owned by the investors in the funds. Founder and former chairman John C. Bogle is credited with the creation of the first index fund available to individual investors, the popularization of index funds generally, and driving costs down across the mutual fund industry.