This video is about how smart investors should invest their money—whether to hire a professional investment company, or choose actively managed mutual funds, or use low-cost broadly diversified index funds. Learn how to invest by hearing directly from 24 of the world’s leaders in wealth management, and learn why passive investing is proven to be the best investment strategy for almost every investor. This video is of exceptional quality. It was produced by SensibleInvesting.tv on 29Nov2012 and remains timeless wisdom today (Feb 2019).

Summary of Passive Investing With Index Funds: The Compelling Evidence The Fund Management Industry Would Prefer You Not To See

This remarkable 54-minute video is produced by http://sensibleinvesting.tv , an independent voice of passive investing, and features 24 experts from the fund management industry. It is a great honor to include it in our collection of video tutorials about mutual funds.

Part 1: The Out-performance Myth About Beating The Stock Market

Link down page to transcript about the myth that investment fund managers can produce above-average stock market returns.

- Regardless the impression they like to give, fund managers regularly produce less than the average market return.

- Buying and selling shares is little more than a gamble, and strong returns are often down to luck.

- It’s harder than ever before for a manager to outperform the market consistently.

- Commercial pressure means fund managers often advertise funds they wouldn’t choose for themselves.

- And remember, although there are good managers out there, picking the next star manager is almost impossible.

Part 2: The Cost of Investing

(Watch on video starting at 7:03)

Link down page to transcript about the misconception that active fund managers produce returns higher than their costs.

- Fund managers have large overheads, not the least salaries and bonuses, and you pay the bill.

- Over time, charges that sound modest can seriously erode your savings.

- Many of the charges that consumers incur are hidden in the small print.

- And to add insult to injury, fund management charges have been rising year-on-year.

Part 3. A Better Alternative To Trying To Beat The Market

(Watch on video starting at 13:10)

Link down page to transcript about the wealth of evidence that supports passive investing as a better alternative to active investing.

- Passive investing with index funds is not so much a theory as a massive a mathematical fact.

- There’s a wealth evidence supporting it including the work Nobel Prize-winning economists.

- Studies have consistently shown that when costs are factored in passive investing produces better returns than active.

Part 4: Ultimate Diversification Also Reduces Your Investment Volatility

(Watch on video starting at 20:31)

Link down page to transcript of explanation how index funds are the cheapest and most effective way to spread your investment risk.

- Investing passively with index funds is the cheapest and most effective way to spread your risk.

- Because their holdings are restricted to a relatively small number of stocks, active equity funds are more volatile than passive ones.

- Active fund managers charge a premium for funds that invest in more than one asset class.

- And over the longer term, once charges are taking into account, the passive investor will always fare better the average active investor.

Part 5: A Healthier Way To Invest

(Watch on video starting at 28:24)

Link down page to transcript about how passive investing can also spare you unnecessary stress.

- Money worries in general, and poor investment decisions in particular, are major causes of stress.

- Rational analysis produces sensible investment decisions; emotions lead to bad ones.

- And for better returns, stop fretting about your investments and enjoy life. An annual review is all you need

Part 6: Hooked on Active Investing

(Watch on video starting at 34:52)

Link down page to transcript about the multitude of reasons that account for the continuous attraction to active management.

- The largely self-regulated fund management industry has a vested interest in maintaining the status quo.

- Human beings have a tendency towards overconfidence, and that’s reflected in the way we invest.

- And while active funds are widely advertised, passive funds aren’t. And nor do they command much media attention.

Part 7: The Tide is Turning To Much More Focus on Cost and Diversification

(Watch on video starting at 40:32)

Link down page to transcript about the trend towards more focus on cost, diversification, and quality of service.

- Passive investing with index funds has grown steadily in popularity in the United States since the 1970s and continues to do so

- Passive already accounts for more than 30 percent at the institutional investment market in the UK

- And increasingly, both financial advisors and independent experts are starting to recommend it to individual investors

Part 8: The Rational Choice Is A Passive Investment Portfolio

(Watch on video starting at 47:25)

Link down page to transcript about conclusion that a passive investment portfolio is the right solution for the vast majority of investors.

- A passive investment portfolio is the right solution for the vast majority have investors.

***** ***** *****

Again, this is an exceptional video and I encourage you to watch and listen. But for those who prefer to read, I provide a transcript below. I tried very hard to create an accurate transcript for you, but if there are any errors they are mine. This took a lot of time, but I hope that it adds to your understanding of this important overview.

Lastly, while this was produced for a British audience, I encourage every American to listen and learn. Simply think “dollars” whenever they mention “pounds”. And understand that the Financial Service Authority (FSA) was responsible for the regulation of the financial services industry in the United Kingdom until this was changed in 2013.

Transcript of: Passive Investing With Index Funds

Part 1: The Outperformance Myth

Investing for the future—it’s an issue none of us can afford to ignore. Hardly anyone’s job is safe these days. How would you cope if you lost yours? We’re all living longer too. So, are you saving enough to fund 25 years or more of retirement? Can you really afford to pay for your children or grandchildren to go to University, or help them onto the property ladder? And, what about all those holidays you promised yourself?

(At 0:48 start Robin Powell, Reporter)

We entrust the vast bulk of our investments to fund managers. Here in the UK, according to her Majesty’s Treasury, the industry has more than $4 trillion pounds of investors’ money under management. Fund managers invest our savings wherever they see fit, mainly in equities or shares in listed companies. They claim to be experts at making our money grow, at picking the stocks that will outperform the market. But all too often they disappoint, producing returns lower than the average return for a benchmark index such as the FTSE 100 in London or the S&P 500 in the States.

(At 1:29 start Charles Ellis, Yale University Economist)

If someone says “I can beat the market”, try taking the rate of return achieved by that manager, and all other like managers, and you will deduct from it the fees charged, and there are very few who over a long period of time do better than the market.

(At 1:47 start Michael Tubbs, Editor, Research Investments)

Well, the best study I know of was one carried out in the states over thirty-five years from 1970 to 2005. Matt looked to 355 funds. Just 9 of these funds beat the index by 2 percent or more over that period and just three of them showed sustained out-performance.

Now a study in the UK of 1200 funds, over three years finishing in March of 2011, showed that just 1.3 percent of those funds were in the top quartile for all three successive years.

(At 2:24 start John C. Bogle, investment guru)

To the veteran investment guru John Bogle the problem is simple: fund managers just onto smart as they’d like to think they are. I came into this business when I was at Princeton and I worked for brokerage firm in the summer. I want the old runners said, “Bogle, I’m gonna tell you everything you need to know if you’re going into the investment business.” And I said, “What’s that Raymond?” and he said, “Nobody knows nothing.” And that’s true—we don’t know what the future holds. We have all these opinions out there and we’ve gotta say I’m smarter than everybody else. And that just isn’t gonna happen.

(At 3:00 Reporter)

As it means trading against the view have numerous market participants with superior information buying or selling a security is effectively just a bet. So, while your fund manager might lead you to believe it’s his knowledge or intelligence that enables you to beat market, he’s really no better than a gambler.

(At 3:23 Charles Ellis, Yale University Economist)

There’s a wonderful human spirit that says: “I can do better.” That’s why we have gambling casinos—which are a marvelous place for people who own the casino to make a very substantial amount of money over a long period of time by entertaining people in the cheerful belief that somehow luck is going to come their way. Same thing is true about investing that advertisements about investment opportunity always show that there are great success is right around the corner. “You could have it too. This could be done for you. You could be a winner.” The sad reality is that the quantitative analysis of the hard data would lead to the conclusion that that’s just not going to happen very often for very many, and for most people most the time it’s going to be just the reverse.

(At 4:11 Ken French, Professor of Finance, Tuck School of Business)

We can’t systematically all pick the winner. So, the challenge now is, “OK, can I find those great active managers.” In fact, I don’t actually argue there are no great active managers. I’m willing to say, “Yea, maybe there are some out there.” My problem is, I don’t know how to identify who they are.

(At 4:31 Ben Johnson, Research Director, Morningstar)

It’s absolutely possible for active fund managers to beat the market, and to beat the market consistently over time, but there’s also the question of probability. And when you assign a probability to a fund manager beating the market consistently over time, it’s very very low.

(At 4:50 Reporter

So you might be lucky enough to choose the right fund manager, but you could just as easily pick the wrong one. According to the financial services company Best Invest, there are currently nearly $10 billion pounds of UK investors’ money languishing what it calls “dog funds”—in other words, funds which have underperformed their benchmark index funds for at least three consecutive years.

Ultimately, of course, fund management companies are businesses. They exist to make money for themselves. They want our business—even if it means persuading us to invest in funds which the managers themselves wouldn’t risk putting their own money in

(At 5:33 start Jasmine Birtles, Editor, Moneymagpie.com)

Occasionally in the tube stations you’ll see one of those big posters [maybe something like], “Stellar Growth Fund: make your money reach the skies.” You know, genuinely I laugh. I look at these I think, “yea right.” Yes honestly, because these funds—they’re rubbish. I mean really. You know, the vast majority of them are rubbish.

(At 5:51 start Rick Ferri, Financial author)

They will put out any product that they think the public will buy, whether [or not] the companies have any belief that that product is any good. Because the idea is to gather assets. The idea is to bring in as much money as you can and manage it. And if that product fails, you could then take that money and convince the client to go into a different product that you’re coming out with.

Back in the nineteen nineties, the turnover mutual funds was only about three percent per year now it’s up to almost 6 percent pure so it’s almost double.

(At 6:25 Reporter)

So to summarize:

- Regardless the impression they like to give, fund managers regularly produce less than the average market return.

- Buying and selling shares is little more than a gamble, and strong returns are often down to luck.

- It’s harder than ever before for a manager to outperform the market consistently.

- Commercial pressure means fund managers often advertise funds they wouldn’t choose for themselves.

- And remember, although there are good managers out there, picking the next star manager is almost impossible.

Part 2: The Cost of Investing

(At 7:03 Reporter)

It is now time to look what it actually costs to invest. Like all businesses fund managers have overheads. Running a fund management company isn’t cheap—especially when the top managers earn around 2 million pounds a year including bonuses. And remember, it’s you the customer who picks up the tab.

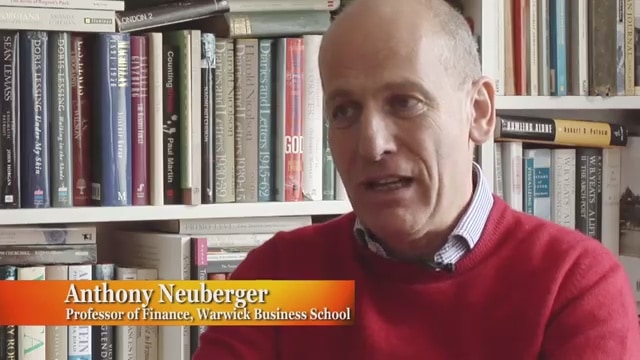

(At 7:30 start Anthony Neuberger, Professor of Finance, Warwick Business School)

How expensive these active fund management for the manager? In other words, what are they spending your money on?

Well, part of it is actually the costs of research and the costs of trading. The other major major component, which is important to any retail fund, is marketing.

(At 7:51 start Richard Wood, Barnett Ravenscroft Wealth Management)

To me, most to these investment companies are just purely marketing companies. Let’s set up a fund. Lt’s see what we can sell. It’s never really about what’s good for the investor, it’s about what’s good for the investment company.

(At 8:07 Reporter)

Ultimately fund managers need to make a profit. In fact they making around 10 billion pounds from us every year, and that’s regardless of whether or not they manage to produce a profit for us.

(At 8:18 start William Bernstein, Financial author)

The job up a stock broker is to transfer the wealth of the client to themselves. Typically they extract in the range of two or three percent of their assets per year from the clients. And if you do that over a period of 20, 30, 40 years, eventually your broker owns up with more of your assets than you do.

(At 8:40 John Bogle, Founder, The Vanguard Group)

We all get return from the stock market in the long run. I say for the purpose of argument that’s an eight percent return. But we in the markets get the net return—after the insanely high costs of financial intermediation. And those can be as much as say two percent a year. Wall Street, if you will in America, gets seventy percent of the return and puts up none of the capital and takes none of the risk. And we get 30 percent the return—we investors as a group—there’s no way around this—for putting up one hundred per cent of the capital and taking one hundred percent of the risk. That is just crazy.

(At 9:10 Reporter)

Part of the challenge is working out exactly what we are being charged. Investors typically use something called the annual total expense ratio, or TER, to compare the cost of investing in different funds. But, the TER excludes dealing commissions, stamp duty, and other turnover costs that can add considerably to the expense of investing over time. So, in addition to those hidden charges, what else are we, as investors, having to pay. And, more importantly, what impact the charges have on the value of our investments in the long term.

(At 9:50 Anthony Neuberger, Professor of Finance, Warwick Business School

You might be looking at one and a half percent per annum or more in management fees. It doesn’t sound very much, but if you’re talking about investment strategy lasting over twenty years it is large amount of money that you actually paying over to the fund manager and you want to make sure that if you are doing you getting what you’re paying.

(At 10:12 start Stephen Thomas, Professor of Finance, Cass Business School)

Studies are being carried out, and the FSA’s very active in this, on emphasizing that one of the main determinates of longer-term wealth destruction is the charges. People tend to underestimate the effect of say a 1, 2 or 3 percent charge each year, it’s a very substantial reduction in the wealth.

(At 10:32 Reporter)

And the bad news doesn’t stop there. Despite a marked increasing competition management charges in the UK have been steadily rising over the last 10 years.

(At 10:43 start Tim Hale, Financial author)

Charges are an insidious component of the investment proposition and, you know, for every pound that you pay out in charges is a pound that doesn’t go into your pocket which compounds over time. And what we’ve actually seen a recent research shows is that fees in the UK are actually going up rather than going down, as they are in the states, and as an absolute level they are actually higher than they are in the states. And you know I think there’s a lot of talk about charges and fees and fee structure the impact fees—this is an argument they’ve been having in the states for a long long time but it’s only just really beginning to be held seriously in the UK.

(At 11:20 Reporter)

There are some encouraging signs for consumers. The FSA’s retail distribution review will require fund manages to be fairer and more transparent when it comes to charges. In the meantime, investors should be on their guard

(At 11:35 start Jasmine Birtles, Editor, Moneymagpie.com)

I don’t think the financial services industry cares really about just how much the general population despise and distrusts them. They have really not learned the lessons that they should have learned. I think it’s endemic actually, the financial services industry, that they lie, they dissimulate and they use smoke-and-mirrors to make us think that something’s going to make us money when, in fact, it’s going to make them money. We are very cynical and, frankly, we are right to be cynical.

(12:09 Reporter)

So, in summary:

- Fund managers have large overheads, not the least salaries and bonuses, and you pay the bill.

- Over time, charges that sound modest can seriously erode your savings.

- Many of the charges that consumers incur are hidden in the small print.

- And to add insult to injury fund management charges have been rising year-on-year.

So conventional active investing—in other words, paying someone to pick your investments decide when to buy and sell—is expensive. And, as we’ve also heard, only very few managers are able to outperform the market consistently. But is there an alternative? A strategy that costs us less, that produces a higher than average return after costs in the long run? Yes there is. It’s called passive investing.

Part 3. A Better Alternative

(At 13:10 start Ben Johnson, Research Director, Morningstar)

Passive investing is really more about the vehicles of choice for given investor, so it’s about using index funds as opposed to trying to select active managers that may or may not ultimately best their market benchmark.

(At 13:26 start Lawrence Gosling, Editorial Director, Investment Week)

If you take a passive fun that’s going to follow the FTSE 100, the person running that fund buys shares in every single one of the 100 companies that’s within the FTSE 100 so it directly follows, or replicates the index is the jargon that is used—as opposed to an active manager who will say although he picked 20 shares, “I think it’s the best 20 in the FTSE 100.” You’re then relying on the skill that fund manager to find the best 20.”

13:52 Ben Johnson, Research Director, Morningstar

Mathematics tells us that the average active investor and the average passive investor, in a market where all of those investors equal the market, should earn identical returns net of fees. Now when we subtract the fees from those products what we see is because passive funds are inherently less costly to operate they tend to outperform active funds over time.

(14:15 Reporter)

Although it accounts for only a small share of the wealth management industry in the UK, passive investing is much more popular in the United States. American academics made a compelling case for it since the 1950’s. In the sixties, economist William Sharp developed the Capital Asset Pricing Model for which he was later awarded a Nobel Prize.

(At 14:38 start William Sharp, Nobel Prize-winning economist)

It has to do with the relationship between the price of a security, its risks and its expected return. And there are really the sort of two key takeaways if you will. One is that in that setting, the most efficient strategy for an investor is to hold basically a broadly diversified portfolio reflecting the market have securities that are available. And that gave birth to the notion of index funds. And the second is that there will be a reward in higher expected return, not guaranteed but expected, for bearing risk—but the kind of risk for which reward should be available is the risk of doing badly in bad times.

(15:33 Reporter)

After the Capital Asset Pricing Model came the Efficient Market Theory developed by Eugene Fama and Ken French—the idea being that shares of always priced correctly because they already reflect everything that’s publicly known about a company. More and more Americans were beginning to realize that paying a manager to buy and sell individual shares was a waste of time and money.

(At 15:58 start Dan Goldie, Financial author)

Market efficiency is the idea the market prices adjust very quickly to new information and theoretically one would believe the that market prices would incorporate all the known information that’s available. And so if that is mostly true, which I think is, then it’s very unlikely that any investment manager, or investment fund or group, will be able to have the knowledge and information to consistently take advantage of market errors.

(At 16:38 start Ken French, Professor of Finance, Tuck School of Business)

That doesn’t say that other investors are stupid when they go out hire an active manager. What it says is: if there is somebody who hires a successful active manager, there must be somebody else who’s hiring an inferior active manager.

(16:53 Reporter)

Weston Wellington used to work for a firm of active fund managers, but the more he read about the evidence in favor a passive investing the more it made sense.

(At 17:05 start Weston Wellington, Vice President, Dimensional Fund Advisors)

Almost everybody who adopts this particular investment viewpoint undergoes a similar journey. Because, for most people, the only definition of investment advice is trying to forecast the future in some way—which stocks will do the best, which managements are the best, which countries are the best to invest in, and so on—and it takes a while to understand that there might be more useful alternative. Now my particular journey was a function of, first, 15 years or so doing it the conventional way—reading all the usual sources and listening to all the usual experts and never really questioning it. But when I had do to undertake a position of making these decisions myself—I was the research director in charge of developing model portfolios—and I was a going to be held accountable for the performance of the various managers I selected, I had to keep track of what my performance was. When someone starts to keep track of what your recommendations are it’s a bit humbling to discover: well maybe you weren’t quite as smart as you thought you were.

(18:16 Reporter)

It was while working as an investment specialist in New York that Tim Hale came to the same conclusion. He believes that many active manages happily gamble with other people savings while quietly investing their own money index funds.

(At 18:30 start Tim Hale, Financial author)

A quick example was when I first arrived that I was trying to put together an investment performance track record for the firm that I was working for, and ultimately being unable to find consistent performance within the data that we had. And, you know, that began begin to sow the seeds of doubt in my mind, and my pension plan was full of passive investments. I think is quite a telling so the indication I guess of the increasing cynicism

(18:58 Reporter)

Although public awareness of the advantages of passive investing is very much lower here in the UK than it is in the US, British investors actually have more to gain from passive than their American counterparts. That’s because fund management charges are higher here in Britain than they are in the states. No wonder the move away from active fund management is starting to gain momentum on this side at the Atlantic.

(At 19:25 start Stephen Thomas, Professor of Finance, Cass Business School)

As company pension schemes become less popular, investors are forced to do it for themselves. So they need to be more and more aware that the low charges, associated with say passive investment, will ultimately over a very long time benefit them considerably relative to being with active fund managers.

(19:45 Reporter)

So to summarize:

- Passive investing is not so much a theory as a massive a mathematical fact.

- There’s a wealth evidence supporting it including the work Nobel Prize-winning economists.

- Studies have consistently shown that when costs are factored in passive investing produces better returns than active.

Of course, one of the golden rules of investing is not to put all your eggs in one basket and the cheapest, most effective way to diversify is to invest passively. Why pin your hopes on the shares of just a handful of companies when for less money you can spread your risk by taking a stake in the entire market.

Part 4: Ultimate Diversification

(At 20:31 start Dan Goldie, Financial author)

So there’s a return advantage to passive investing, and I also think there is a risk advantage in that when you’re investing passively you’re basically trying to capture market returns. So you are not going to be surprised by your investment manager’s underperformance. Or, you’re not going to be heavily concentrated in a few number of securities where the risk would be that if those securities do poorly that your results will be very bad.

(At 21:05 start William Sharp, Nobel Prize-winning economist)

There is a rule in real estate that the three most important things are: location, location, location. Well my rule in investments is the three most important things are: diversify, diversify, diversify. And then I’ll give you three more: keep costs low, keep costs low keep costs low. And the simplest way of doing that is a very-broadly-diversified very-low-cost index fund.

(21:30 Reporter)

Active funds managers like to give the impression their funds do spread the risk you’re taking. Although while index funds often hold hundreds or even thousands have stocks, the typical managed fund will only hold around 50. So if you choose an active fund, your opting for greater volatility and you’re paying a premium for the privilege.

(21:52 Anthony Neuberger, Professor of Finance, Warwick Business School)

If you go overboard on active management, you end up putting your money into few baskets—you’ll be under-diversified. So, you get very excited by tech stocks or you get very excited by commodity stocks so you put a lot of your portfolio into that. And if you do that, by concentrating your portfolio on certain areas of the market you pick up a lot more risk than if you had a better balanced portfolio.

(22:21 Lawrence Gosling, Editorial Director, Investment Week)

Depends how you judge risk, but at the end of the day, you know, you don’t want all your investments to be invested in the FTSE 100. Equally, people don’t want to have all their wealth in the house that they own. And if you use a number of passive investments, you lower the cost of that investment to you as an investor and cost is a big drag on investor’s performance after a 10 to 20 year term.

(22:41 Reporter)

Active fund managers do often more genuinely diversified investments. Recent years have seen a proliferation of so-called balanced, cautious, and defensive funds, as well as funds of funds. But the charges on these funds even higher. Among the most expensive funds of all are what are called absolute return funds which is supposed to provide investor with some sort of return whatever happens, but in reality often don’t.

Not only does the passive approach offer diversification within a fund, it also allows you to buy entire asset classes. There index funds virtually every type of asset, whether it’s European equities, commodities, or UK gilts. And even when you put your money into riskier assets you’re still spreading your risk by buying the whole market.

To find out how investing passively and helping week the high rewards have riskier assets a smoothing out some of the volatility I visited Austin Texas. This is home to Dimensional, a passive investment company specializing in investing in small companies and so-called value stocks.

(23:55 David Booth, Founder, Dimensional Fund Advisors)

When we first started people said look—all those tests on market efficiency—all these tests were done on large cap managers because there weren’t any small cap managers. So, we felt confident in the small cap area, that’s the area where they’ll be able to add value. But if you look at our evidence over the last thirty years, there very few small cap funds have done as well as we have in terms of performance

(24:24 Weston Wellington, Vice President, Dimensional Fund Advisors)

If you ask people where active management works the best, the advocates of active management often cite the so-called under-researched, or illiquid, or unusual asset classes (e.g. small companies, emerging stock markets) and that seems plausible to many people. Well if we look for the last ten years, for example, at least among US-registered equity funds—putting aside sector funds like those just investing in gold or just investing in one single country like Russia—if you look at diversified equity mutual funds, the best performing mutual fund is an emerging markets value fund. All the active money managers are out there, they could have bought the same securities—several thousand of them that comprise this dimension of risk and return—but for whatever reason they chose not to. So it was a passive emerging markets fund focusing on this value risk dimension that, as it turned out, had the highest return among all diversified equity funds for that ten-year period.

(25:36 Reporter)

An argument often put forward by proponents have active fund management is that when asset prices fall they often do so across-the-board. True, an index fund tracking, say the FTSE 100, will rise and fall in direct correlation with the index itself. But despite the disappointing performance of equities since 1999, a passive investor would still be sitting on a sizable profit now as long as they’d spread their investments, particularly when dividends are taken into account. On average, they’d also be better off than if they put their money into actively managed funds. And so, to that other golden rule if investing: always take the long-term view.

(26:21 Charles Ellis, Yale University Economist)

The best thing anybody who’s going to be an investor could do is to spend fair amount of time (4, 5, or 6 weekends) reading past issues of newspapers. Start with the 1930s; then read the 1940s; then read the 1950s; and keep on going until you have the feeling, “Gee, I really know a lot about markets, and the main thing I’m learning is the data that’s presented and a stories that are written up, don’t really have much significance over the long long run.”

(26:58 William Bernstein, Financial author)

The remarkable thing about finance is that you cannot predict at all what the market is going to do tomorrow, but you can predict with reasonable accuracy what the return of at least some asset classes is going to be over very long periods of time. You might look at the past 10 years and say, well it’s been a lost decade. US equities have had, you know depending on the 10-year period you measure, about a zero return. But there are other things that have gone quite well. That doesn’t mean that that pattern is going to continue into the future. In fact, I can guarantee you that that particular pattern won’t occur into the future, it’ll be a different pattern of returns. But the point is, if you will own all those asset classes you won’t screw up, you won’t make any big mistakes.

(27:46 Reporter)

So let’s summarize. Investing passively is the cheapest and most effective way to spread your risk:

- Because their holdings are restricted to a relatively small number of stocks, active equity funds are more volatile than passive ones

- Active fund managers charge a premium for funds that invest in more than one asset class

- And over the longer term, once charges are taking into account, the passive investor will always fare better the average active investor

Part 5: A Healthier Way To Invest

(28:24 Reporter)

Let’s look now at the impact of investing on our general health and well-being. Time and again surveys have shown money is the single biggest cause of stress in the Western world. We worry about it more than healthful relationships. Recent economic woes have only served to increase the pressure on everyone to spend and invest what money they have as wisely as possible.

(28:43 Karen Pine, Professor of Psychology)

Investing, or anything really which involves a reward, activates pathways in the brain which secrete pleasure chemicals which we call endorphins. So when you’re feeling a bit of a high or a buzz from having anticipated a reward, or thinking about you’re going to make some money, you can get a very good rush of these pleasure chemicals in the brain. What happens is that people get almost addicted to that rush and they want to get more and more of it, but the downside, of course, is when they lose money or things don’t turn out as planned, they can be a huge dip in the feelings and then chemicals that are secreted in the brain.

(29:21 Anu Bennett, Clinical Psychologist)

I’m thinking if someone I so quite recently and, in fact, he hadn’t told his wife about some of his investments. And I mean that they’re going to have to sell the house, their kids’ education is going to be affected and I think the marriage is really seriously under threat now because this guy wasn’t very sort of upfront about what he’d been doing. He thought investing was going to be a solution to many of the problems he was experiencing, but in fact, it wasn’t a solution. It’s become huge problem.

(29:58 Reporter)

We’ve already established how passive investing is better for you financially in the long term, but it could also spare you unnecessary stress. Of course, financial markets are bound to go up and down. But as long as you take care to spread your risk across different asset classes, there’s no need at all for your mood to go up and down with them.

(30:19 David Booth, Founder, Dimensional Fund Advisors)

We react the past with always a self doubt—I knew I should have done this; I know I should have gone out there. You know, there is a certain transformational experience that goes on with accepting the notion market efficiency, in which there gets to be—let’s call it an ah-ha moment, where people go, “Ah-ha, that’s the way markets work.” And once that happens, they’re much more accepting of the fact that markets go up and go down—they always have and always will. That leads to a better overall experience. And experienced to me means more than just having better returns, it’s a better lifestyle as well.

(31:04 Jasmine Birtles, Editor, Moneymagpie.com)

I think passive investing is a good lifestyle choice. Because as far as I’m concerned, money is something that supports your life. It’s not something you should be thinking about, worrying about, fearing about, racing after all the time. It’s something that should be kept in its place, you know, underneath you. And the great thing about passive investing is: it works. And all you need to do is put your money in ideally wrapped in a [retirement account] if you can, or put in a [retirement account] and leave it there.

(33:32 Reporter)

The beauty of passive is that because it’s a rational approach rooted in mathematics it takes the emotion out of investing. Emotion, you see, can seriously damage your wealth.

(33:44 Lawrence Gosling, Editorial Director, Investment Week)

It is human emotion—it is behavior—that drives stock markets up and down. Take away that sort of irrational behavior, as it were, you get more some sensible level of investing—which is the way most people invest. They invest over time: five, ten, twenty years so.

(31:58 Karen Pine, Professor of Psychology)

We have to remember that the media doesn’t like neutral stories, they only like the rather extreme stories. So it’s easy to get swayed by the media. And, of course, men are avid readers of the financial pages and we know that women aren’t. And there may be something in that, because man also more likely to react to what they read and to talk about it again with perhaps peers and colleagues, and to feel that they have to act upon it. And I think the secret the good investor is to probably to be able to tune out a lot of what goes on in the media because it probably isn’t particularly useful.

(32:34 William Bernstein, Financial author)

We tend to want to be in tune with the people around us, because human beings are such social creatures. And again, the reason for that is evolutionarily. And so when everyone else is buying, we tend to want to buy. When everyone else is selling, we want to tend to sell. And that means two things: that means that markets can be very unstable if everybody’s buying at the same time, and then it turns around on a dime and everyone starts selling at the same time. You get a great deal of volatility and then you also wind up doing the wrong thing at the wrong time.

(33:09 Richard Wood, Barnett Ravenscroft Wealth Management)

[The problem is,] by constantly buying and selling the funds, or buying and selling individual stocks, that ratchets up the costs more. Our philosophy is you rebalance according to the where the portfolio should be sitting. So, what I mean by that, if you’re supposed to hold forty percent in equities and sixty percent bonds and it goes to 50-50, or 30-70 say, that triggers a rebalance. And the beautiful thing about rebalancing based on percentage is it takes away the emotion.

(33:36 Karen Pine, Professor of Psychology)

I think the passive approach to investing is a way of protecting yourself against some of the unnecessary stress that people get from over-turning over-monitoring their investments. So really, a good plan that’s only visited perhaps by an annual review will be enough, and you can spend the rest of your time enjoying your life and doing things that are less stressful.

(34:00 Reporter)

So to sum up:

- Money worries in general, and poor investment decisions in particular, are major causes of stress.

- Rational analysis produces sensible investment decisions; emotions lead to bad ones.

- And for better returns, stop fretting about your investments and enjoy life. An annual review is all you need.

You might be thinking this all sounds just too good to be true. Passive costs you less money and yet it offers ultimate diversification. It’s good for your health and ultimately your wealth. If passive really is superior to active in so many ways, why aren’t more people doing it? Let’s find out.

Part 6: Hooked on Active

(34:52 Reporter)

Perhaps the single biggest reason why active still holds sway is the fund management industry itself. It’s a powerful sector with a vested interest in maintaining the status quo.

(35:03 Rick Ferri, Financial author)

When you have a market that’s a trillion dollars, and they’re able to scrape off twenty billion dollars a year—or two percent per year from that to feed themselves—they don’t want to give that up. So there’s an awful lot about marketing, and a lot of convincing of the public, that they need an active manager, that they need to pay 2 percent per year. It’s all about keeping the money in the pockets of the people who are creating the funds, as opposed to putting the money in the pockets of the people who are taking the risk.

(35:34 Reporter)

Of course, the industry spends vast amounts on advertising. The news media might also play a part in making us invest the way we do.

(35:44 David Booth, Founder, Dimensional Fund Advisors)

There is quite a bit of evidence that when you are dealing with very complex issues such as investing that the complexity is so severe that people end up just going with quick hunches. And you have a whole industry out there, the finance industry, that is built on the illusion that there’s a free lunch out there. That’s what you are being sold every day in the magazines because a magazine can’t make money saying, you know, you should be passive and to do the same this year as you did last year.

(36:22 Ken French, Professor of Finance, Tuck School of Business)

We can have an article week, after week, after week, telling people: you know passive investing, that’s the way to go. That story gets old. There’s no news here! Verses: I’m trying to write an investment story. This week I have this really beautiful articulate woman who’s got a strategy. Next week I’ve got this really handsome outgoing gregarious guy who has a strategy. They all make the cover of my magazine, it makes it much more interesting. Verses me: put me on the cover—you’re not selling anything.

(36:57 Weston Wellington, Vice President, Dimensional Fund Advisors)

There is another explanation I think, which is overconfidence. There is a mountain of literature from the psychological field explaining that people, for whatever reason, exhibit this persistent behavioral characteristic: we tend to both think we know more than we do, and we think it’s easier to see the future than it actually is. And it’s fairly straightforward to document this. What’s more interesting is that the research also tends to show that even when you point out these behavioral biases to people, they continue to engage in it.

(37:36 Ben Johnson, Research Director, Morningstar)

I think passive investing is less popular than using active managers because in many ways it seems inherently defeatist. It’s almost saying, “I don’t possess the skills to select a superior manager. It’s impossible to beat the benchmark so why even try it.” I think this almost defeatist angle really turns some people off to the idea passive investing because, after all, we all ultimately believe that were exceptional.

(38:06 Igors Alferovs, Barnett Ravenscroft Wealth Management)

Even with the knowledge know the possum investing is better, a lot of people still won’t to adopt it because they like to think they can do better. You know, it’s human nature. You know that everybody thinks that they’re a better than average driver. And in the same way, they think that they can pick a better a fund, better than anybody else.

(38:27 Reporter)

For others, the main reason why active investing is still far more popular than passive is a simple lack of awareness among the general population.

(38:36 Jasmine Birtles, Editor, Moneymagpie.com)

Primarily, I would say it’s a lack of education. But then secondly: passive funds, because they don’t make much money for the financial companies while they do make money for us, they’re really not promoted.

(38:48 Ken French, Professor of Finance, Tuck School of Business)

People are simply confused. Most people don’t get the opportunity hear that, you know, active investing is clearly a negative sum game. Just an adding up constraint: no science, just arithmetic. That’s news to most people.

(39:02 Richard Wood, Barnett Ravenscroft Wealth Management)

It’s not about getting investment returns or superior returns of both the rest to the market or beating our competitors. Our job is to educate the general public. And I do believe over the next 10 to 15 years, the general public will realize that the only way to have a successful investment experience is to own as much as the market as you can, be well diversified, and make sure that you sit in a really really diverse portfolio with substantially reduced charges.

(39:33 Reporter)

In summary then:

- The largely self-regulated fund management industry has a vested interest in maintaining the status quo.

- Human beings have a tendency towards overconfidence, and that’s reflected in the way we invest.

- And while active funds are widely advertised, passive funds aren’t. And nor do they command much media attention.

So, what does the future hold for the passive approach when fund management companies are spending vast amounts of our money trying to convince us that active is best? Can passive really challenge that perception people have: that if only they find the right manager they will beat the market? Well actually, passive has been growing in popularity in the United States for many years and all the signs are but it’s starting to take off here in Britain as well.

Part 7: The Tide is Turning

(40:32 Reporter)

When a company called Vanguard introduced the first index fund for individual investors in 1976, critics said it wouldn’t catch on. It’s now one of America’s largest investment companies with more than one and a half trillion dollars of assets under management and it’s expanding worldwide.

(40:51 Bill McNabb, Chairman, The Vanguard Group)

When we first opened our London office in 2009, we had three employees there. And I think in the first couple months there were 100 different articles written about us coming to the UK, and they said that was the best press coverage per employee if anywhere in the world. And what it what it really underscored for us was: I think the British financial press saw — we call it the Vanguard effect. You know, bringing somebody like us into the market would put a much more focus on cost, diversification, quality of service, and so forth.

(41:25 Reporter)

In fact, Vanguard believes that passive investing has far greater potential in the UK because the cost active fund management is higher over here cities in the US.

(41:36 Gus Sauter, Vanguard)

Investors in the UK are paying very high cost to gain exposure to the market. We’re very excited about our opportunities to expand here because we think by offering a very low-cost way of gaining exposure to the marketplace will provide a great service to investors.

(41:52 Bill McNabb, Chairman, The Vanguard Group)

I think passive investing is going to go through one of these exponential growth periods. That’s really our bet in the UK. I think it would not be surprising to me that if that seven percent of retail assets, that are currently passively managed, doubles in the next decade. That would not shock me at all.

(42:10 Reporter)

Although passive still accounts for a very small share of the retail investment market, in other words the market for individual investors, institutional investors already have 30 percent of their portfolios invested in passive funds.

(42:27 Stephen Thomas, Professor of Finance, Cass Business School)

The trend is definitely towards more money being invested in passive as investors become aware of the fact that performance a long period of time is very good for passive funds and the costs are very low. And a very important ingredient good performance is the low cost. And the researcher has suggested that low-cost is, in fact, a good predictor of future performance.

(42:47 Reporter)

One of the companies helping individual investors to take advantage of the lower costs and higher than average returns offered by passive investing is Barnett Ravenscroft Wealth Management.

(42:58 Igors Alferovs, Barnett Ravenscroft Wealth Management)

We got together and we decided to we needed to assess everything properly and we took time out over a period of about two years for just looking through all the academic research that was available, and it became evident, after looking at what was out there, that the passive approach was best not only the Barnett Ravenscroft as a firm but for all our clients.

(42:25 Richard Wood, Barnett Ravenscroft Wealth Management)

I think for once, we’ve actually got to say, what we are in this business for—it is to service the clients and to make sure that they’re the ones that are successful. It’s not about, “That client’s got X amount of pounds, let’s take that money. Oh and look at the benefit to us; look what we can charge them.” If we can focus on giving the best investment experience, we’ll keep the client for life, they’ll work with us for life. They benefit, and indirectly we benefit.

(43:49 Reporter)

There are also signs that the media is becoming more receptive to the arguments for passive investing. Several independent internet sites, which unlike the financial press don’t rely on fund management companies for advertising revenue and can therefore say what they really think about active funds, are also starting to recommend it.

(44:10 Jasmine Birtles, Editor, Moneymagpie.com)

You’ve got more and more web sites—like mine Moneymagpie and also, of course, the Motley Fool which has promoted passive investing for years—and more and more people who know are saying, “Actually you know you’re better off with passive funds.” So that trickles down—it’s like fashion, you know. When the top people are saying the same thing, and gradually they’re moving in that direction, that does trickle down.

(44:37 Ken French, Professor of Finance, Tuck School of Business)

I’ll forecast, going forward, we’ll see more and more of the money invested in the UK moving toward passive. The advantages are just too strong. As people become better informed, you see more and more people saying, “I’m gonna give it up. I have not succeeded in the past trying to invest actively. I’m gonna give up trying to do that. I’m just gonna go passive where I can be sure that I will beat the average active investor.”

(45:06 William Bernstein, Financial author)

There will always be all large number of people who are overconfident enough—a large number of participants who are overconfident enough—that they’ll try to beat the market. But at the same time, the trend that you see and the pattern that you see is the increasing passive management—particularly in this this country. Assets are flowing away from active managers, away from stockbrokers, and they are flowing toward companies like Vanguard. They are flowing towards advisers who manage money passively. Where does it equilibrate out? I suspect 50/50 won’t be far from it.

(45:46 Reporter)

So to summarize:

- Passive investing has grown steadily in popularity in the United States since the nineteen seventies and continues to do so.

- Passive already accounts for more than 30 percent at the institutional investment market in the UK.

- And increasingly, both financial advisors and independent experts a starting to recommend it to individual investors.

In 1973, an American economist named Burton Malkiel wrote a book that’s become a classic. It’s called A Random Walk Down Wall Street. Now though he backed it all up with details, statistics, charts, and studies, his argument is a simple one: you can’t predict share prices. If you do manage to beat the market, it will be more than likely down to luck. Even then, transaction costs will likely cancel out any excess returns you make. As for picking the next star fund manager, you might as well forget it. To quote the author himself, “A blindfolded chimpanzee throwing darts at the stock pages could select stocks as well as the experts.” In the intervening 30 years, the fund management industry has poured scorn on Malkiel’s theory, but no one, so far, has managed to disprove it. Now in his seventies, very wealthy, Malkiel is more convinced than ever that passive investing is the rational choice for every investor.

Part 8: The Rational Choice

(47:25 Burton G. Malkiel, Financial author, Princeton University)

Every time I do a new addition, the 10th just came out, I ask myself, “Is the hypothesis true? Do index funds outperform?” And every time I do it, I find that index funds do better than about two thirds of the actively managed funds. And then, when I look at it in the next period I find exactly the same thing—and the one-third that beat the index in one period aren’t the same one-third that beat the index in the second period.

(48:01 Reporter)

In fact, despite there being a wealth evidence in favor of passive investing—produced by some of the world’s most distinguished economists and statisticians—the intellectual case active investing has been almost non-existent. Active’s most vehement supporters are fund managers themselves (i.e. those who earn a very comfortable living from it).

(48:22 Weston Wellington, Vice President, Dimensional Fund Advisors)

I find, as a generalization, most active money managers have little interest in these debates. If they’re involved in a debate at all, they simply point to people who have been successful at managing money and say this is proof that active management works. Well it isn’t proof. It doesn’t demonstrate that the results are any better than luck. But it’s the best they could come up with.

(48:49 Reporter)

One former active manager who converted to passive says many active manages privately admit that passive makes much more sense.

(48:58 Rick Ferri, Financial author)

When I converted over to passive, and I started writing about index funds and how my peers are going to have a very difficult time beating the market, and here the statistics and here the data, I can say that I wasn’t invited to any more parties. I can’t say that I was shunned, because I could show up to the parties just because I was part of the group, but it wasn’t invited anymore. Now I will also say though that one-on-one with my peers, in a private setting where nobody could hear the conversation, they would readily admit that it was very difficult for them to beat the market and that they personally believed in what I was doing.

(49:43 Reporter)

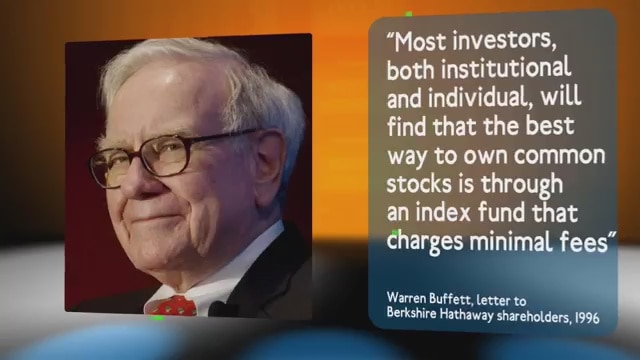

And this is what Warren Buffett, the world’s most successful active manager, says about passive investing, “Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund the charges minimal fees.”

(50:01 Jasmine Birtles, Editor, Moneymagpie.com)

I particularly like the fact with passive investing that you put your money in, and if your sensible, you don’t even think about it more than once a year. That’s what I’ve done, and that’s what I recommend to people who don’t have the time or the interest to spend a lot of time in front of screens learning about companies, learning about sectors, reading company reports, etc. I don’t have that time, you know, and I’m working in money. I don’t have that interest. If you do have the interest—really to spend the amount of time that you need to—you know the kind of time that Warren Buffett for example spends—then sure. But on the whole, for most people who have lives, who have jobs, who have families, passive investing makes perfect sense. And having mentioned Warren Buffett, he thinks the same. So, you know, can’t be that bad, eh.

(50:52 Reporter)

Of course, the passive approach doesn’t guarantee big returns, no matter how long your timescale. But even in turbulent economic times such as these, a balanced passively managed portfolio, carefully weighted to match your own emotional tolerance risk, does guarantee something even more valuable than that: peace of mind.

(51:13 Richard Wood, Barnett Ravenscroft Wealth Management)

People often ask me with regards to our clients, do they contact me with worry about what’s going on. The answer to that is: no, they don’t. Because when I say they join a program, our job is to educate. Once they’ve been on the program for 12 to 18 months they are probably better armed to actually know more about investment management than probably sixty to seventy percent of the financial advisors and some other fund managers.

(51:42 Reporter)

Now you may have noticed that we’ve deliberately avoided singling out specific fund management companies for criticism. As long as you read the small print you can see for yourself how much each company charges, and it’s easy enough to find out whether they really do deliver the returns they say they can. But we did ask the industry regulator the Financial Services Authority for an interview. This was its response: “Unfortunately we will have to decline your request to participate in the program. The FSA has strict rules about being seen to endorse a particular firm and that will prevent us from participating.” Indeed this film has been funded by company that specializes in passive investing. But, given all the advertising for actively managed funds that we’re constantly bombarded with—also privately funded of course using customers money, you could say it’s about time that someone redressed the balance.

So, you’ve heard the main reasons why we think the fund management industry is letting investors down and why a passive investment portfolio is the right solution for the vast majority have investors. But don’t just take our word for it. Why not investigate a little further? It won’t take long, nor will it cost much, if anything at all. But, financially at least, it might just be the best investment you’ll ever make.

(53:09 Rick Ferri, Financial author)

I think with a lot of investors who go into the passive investing side, and go into an index fund, it’s a road of self-discovery. Something sparks them to start looking into it. And once you start looking into it, and you read a book, and leads to another website, it leads to another video, and all the sudden you have like what I had: which is a chemical reaction, and you say, “I get it!”

Footnotes and Credits:

The video on this page is the best I’ve seen on this topic. It was produced by Sensibleinvesting.tv and they own the copyright. They have given me permission to embed this via YouTube onto this educational website.

Sensibleinvesting.tv provides information and opinion on low-cost, evidence-based (passive) investing. They are based in the United Kingdom, but their lessons are universal.