FinancingLife.org is an educational website, aimed at people at all stages of their lives. I’ll point out some gems so you can get off to a quick start without wasting any time.

The articles and courses here are either about Personal Finance or about Investing.

Personal Finance addresses everyday questions and decisions that affect your earning and spending. All this ultimately determines how much you save.

Investing is what you do with those savings. I’ll help you here: smart investing for beginners.

I also recommend books because there are a lot of bad books from people who seem to confuse investing with speculating (gambling). After a course or two here you’ll clearly understand the difference and be able to spot the books to avoid yourself.

The courses link in the main menu takes you to the other side of my website which is called Financing Life Academy.

For Personal Finance, the introductory course I recommend is called Financing Life by Professor Bartlett. It’s listed under Free courses, and you can watch an introductory video, and look at the curriculum. One of the things that I want you to learn there is about net worth, and that lesson is available to preview.

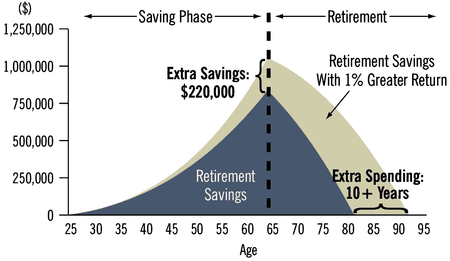

Net Worth is essentially all that you own that could be easily sold, minus any debt that you might owe. So if this line represents your lifetime, and your first job is here, a simple view of your net wealth would look something like this—with an accumulation phase followed by a retirement phase.

Source: Boglehead wiki

Avoiding 1% per year from unnecessary costs is typically worth hundreds of thousands of dollars. Learn how the returns for smart investors are typically 5% higher (footnote) and literally worth a fortune! There is huge value to these investors that learn common sense investing.

Financial education is not about teaching you to become rich, but about helping you achieve your financial goals.

- One goal is financing your short-term needs and wants.

- Other goals are to finance those longer-term dreams, including to retire comfortably.

Many start with student loan debt with the hope of a higher salary. Others start late and work hard to catch up. Everyone’s situation is different and reflects your lifestyle choices.

During the first decade of your career, your savings rate is more important than your investment rate of return. You need to focus on budgeting and saving. The course called Where Should I Put Money will help you to combine the risk and return tradeoff with your short- and long-term needs and learn about the safe and appropriate allocation of your money.

Most of FinancingLife.org is to help beginners learn how to invest. With a keen focus on eliminating unnecessary costs, it’s very reasonable to expect that we can help you achieve a peak net worth of several hundred thousand dollars higher than you typically would, which will substantially help you achieve all of these goals that are important to you.

Research shows that people are more likely to increase their savings if they think about personal finances as a lifelong priority. So, you’ll find that I am a huge advocate of simple planning—1-page plans that start with estimates and best guesses—but you put it in writing. Revisit it every year and it soon becomes an excellent plan.

The third course you should consider is what I call Common Sense Investing. Here you will learn simple time-proven investing wisdom. It’s not going to surprise you that Rule #1 is to develop a workable plan.

Sometimes these ten rules are also called Boglehead Investing. It’s not complicated, but it is not intuitive either—largely because all day long you are bombarded by people who are telling you something else—so you’ll buy what they are selling.

Research also shows that learning about finances from reliable sources improves financial literacy. So, I very much want you to know that the information about investing is widely regarded as best possible advice. And I want you to hear it come from the mouths of the world’s top experts to help boost your confidence.

Boiled down to one sentence, you will hear Warren Buffett explain why 98% of all investors should aim for extreme diversification at the lowest possible cost. First of all, that’s you, and that means something very specific—what I call the Common Sense Investing strategy—and I don’t want you to leave here until you are so comfortable that you can explain why you should do this to your friends—both the ones that don’t have a clue how to get started and the ones who like to tell you that they did really well investing in … some specific company stock.

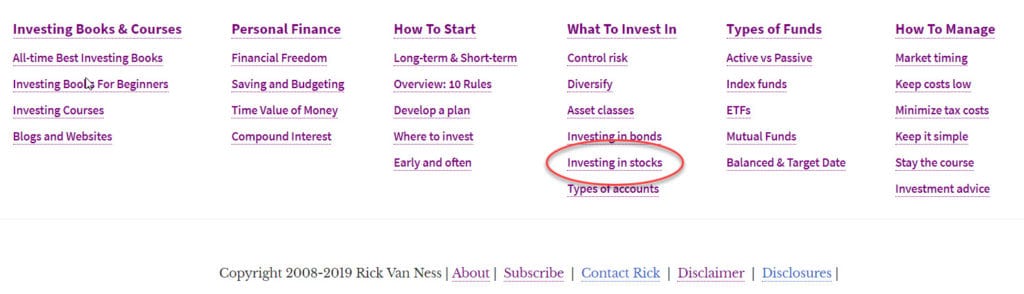

You can use the bottom of every page as a helpful navigation aid. Click on the topic “Investing in Stocks” and you will find eight Lessons From Stock Market History that will reinforce the key points about passive investing and index funds from the Common Sense Investing course. Hear directly from Noble Laureate winners, industry leaders, and other experts. They are excellent! I don’t want you to just understand, I want you to have full confidence that this is the best approach. These videos were produced by SensibleInvesting.tv in the UK. They share the same mission and let me use these videos.

In almost every course I mention that your most important decision is:

How much to allocate to stocks? How much to bonds?

Nearly everyone gets confused about bonds. To me, this is a simple topic because it is straightforward math. But it is so important that I wrote this book, Why Bother With Bonds, to explain it in plain English. I also made it into a course in Financing Life Academy.

Now everything I’ve shown you so far is free. This is the first book or course that is not. This month I am letting you pay that fee you think I deserve—even zero. It costs money to publish books and online courses. You can be part of making FinancingLife.org a sustainable financial literacy project. The book is called Why Bother With Bonds and the course is called: Build An All-Weather Portfolio.

Another area that people get confused about is diversification. What does that really mean in practice? “Don’t put all your eggs in one basket?” That’s half of the answer. But should you own the same amount of every stock? Should you use multiple mutual fund companies? Watch the introductory video to this course to decide whether you want to strengthen your understanding here. I call this course: Diversify Like A Pro. But I can assure you, that if you hire a pro to do this, you’ll be paying ten times too much.

I’m recording this in Feb 2019, so there will soon be other courses, articles, tutorials, and books that I’ll be recommending here. I don’t send regular emails, just when there is something to announce that might help you. So I encourage you to subscribe.

Subscribing means you get email announcements of new courses, video tutorials, articles, and book recommendations.

It is important to know that I do not publish regularly. But, when I do, I try to make it something that will directly help you.

Here are four ways that you can subscribe. Choose any or all of these:

1. Become a student at FinancingLife Academy

2. Request this one-page cheat-sheet

3. Steal This Book!

Here is something I recommend for everybody (Thank you William Bernstein!)

Acclaimed author William Bernstein wrote this for millennials and gave me permission to distribute it to you. Share it with your friends.

One of the best investment authors of our time is William Bernstein. In 2014 he wrote a gem to guide both young—and not so young—investors through the five hurdles that threaten to spoil their dreams.

It’s available for free as a PDF that you can read in an hour or two.

Or, buy from Amazon if you prefer paperback, or to give it as a wedding, birthday, or graduation gift.

4. Request this PDF course

This 140-page PDF is a self-paced course by Vicki Robin and others. Watch the short overview video to see if it interests you—it was life-changing for me.

And, of course, you can request all of these! That’s a good idea!

If you ever outgrow what I offer, just click unsubscribe and you’re done.

Ok. That’s your quick orientation. It’s time for you to get started. Welcome aboard!