The shortest learning path is to have the right instructor guide you! Get oriented with free online …

Main Content

First-Timers: Quick Start Here

All the resources, training, and support you need to take control of your finances.

Find the right answers and the learning style that work best for you.

Rick! Where have you been? or Where have I been? Between "here's how this works" videos, and your gift in explaining Finance for humans, feeling really fortunate to have come ashore on your website. Ross, December 2018

Best Books On Investing for Beginners

Last updated October 12, 2019 in Best Books On Investing. Let these best books about investing …

Best explanation I have ever seen or read!Charles Van Citters, re: explanation of CDs, bonds, and bond funds

Consider one of my own books ...Why Bother With Bonds

A practical how-to guide ...for ordinary investors who want to build an all-weather portfolio—even …

Learn More about Consider one of my own books ...Why Bother With Bonds

Rick eloquently transforms the seemingly complex world of money management into ten simple and easy-to-read action steps. Bobby Borg, Instructor, UCLA

Watch my short video tutorials.

- Personal Finance articles help you create a sound financial lifestyle so you can spend your money on the people, things and experiences that you value most.

- Learn How To Invest articles are about taking as little risk as possible to get the return on investment you need to finance your bigger goals. Start by reading the three must-read guides listed below.

A Must-Read Guide:

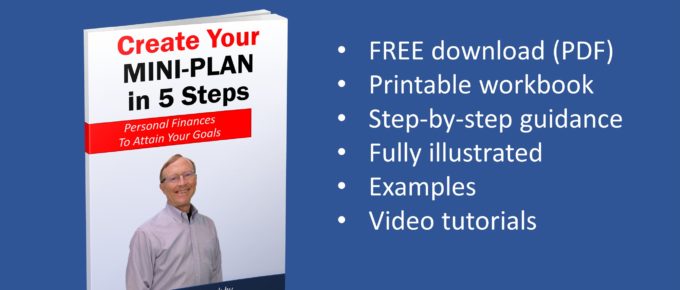

Create Your Own Financial Plan

Create your financial plan with this free workbook We promise to never send spam or share your address!People …

A Must-Read Guide:

Smart Investing For Beginners

Last updated July 8, 2020. Smart investing can be summed up with ten simple rules. This is the smartest way to invest money …

A Must-Read Guide:

Build an All Weather Portfolio

Last updated July 30, 2019 in Learn How To Invest. This draft is for early reviewers, but all comments are welcome! …