The hidden costs of mutual fund investing, may astound you. The all-inclusive cost can be several times larger than the expense ratio. You’ll be glad to learn how to recapture more of the returns you earn. This lesson begins with this fun interactive chart—the outcome is astonishing! Then I’ll add more explanation below to uncover, and help you understand, all the hidden costs of investing with mutual funds. And show you how easy it is to control them.

Instructions:

1) Make your first entry TWICE to force Excel to begin updating chart.

2) Note how sensitive the crossover year is to Total Costs.

Your surest path to superior investment returns is broad diversification of stocks at the lowest possible costs and then hold them long-term.(1) So you must understand these costs. Play with this calculator to see how your actual total costs, including all hidden costs, can have a devastating impact on your investment returns.

William Bernstein gives us this chart in his highly acclaimed book The Four Pillars of Investing. The chapter is titled “Your Broker Is Not Your Buddy”. To make his point, Bernstein “hypothetically assumed that you and your broker can both earn 8% per year, but that he takes 4% of your portfolio each year, leaving you with a 4% return. Meanwhile, he can invest his commissions at 8%. After 17 years, he has accumulated more than you have, and after 28 years, he has twice as much.”(2)

Wow! But is this realistic? Yes. And sadly, it is typical. But learn how easy it is to virtually eliminate these costs.

You are using one of three strategies for managing your money. After reading this article you may want to improve that.

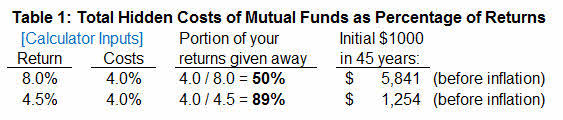

Strategy #1: Pay for someone to manage your money, and watch your savings disappear. For example:

- Market Return: 8%

- Total Costs (all-inclusive): 4%

- Value of $1000 after 45 years: $5,841

Strategy #2: Occasionally pay a reputable unbiased advisor as needed (not a recurring annual fee). For example:

- Market Return: 8%

- Total Costs (all-inclusive): 1%

- Value of $1000 after 45 years: $21,000

Strategy #3: Invest in yourself and become educated enough to be a competent do-it-yourself investor. For example:

- Market Return: 8%

- Total Costs (all-inclusive): 0.1%

- Value of $1000 after 45 years: $31,000

Other investment strategies (think day-trading, choosing individual stocks, investing in gold, etc.) involve uncompensated risks, speculating, gambling or are variations of Strategy #1.

The astonishing difference between the results of these strategies is simply explained by wisdom that John C. Bogle and other have spent their careers trying to help us understand:(3)

“We investors as a group get precisely what we don’t

pay for. So if we pay nothing, we get everything.”

This is opposite our common experience of: you get what you pay for—which is true for many other parts of our lives. Bogle’s little poetic truism is a hard lesson for most investors to embrace because it is hard to recognize the true costs, the conflict of interests, and the quality of advice. Too often you are “sold” investment products rather than “buy” the investment products that are virtually guaranteed to produce superior returns in the long run. More often than not, there’s a built-in conflict of interest having your advisor also be your salesman.

Next, this article will help you appreciate and understand the all-inclusive costs of investing in mutual funds and the impact of fees, indirect costs and investor borne costs. Costs matter—they are among the very few things that you can control to dramatically increase your retirement savings without additional investment risk.

Most of the costs of investing in mutual funds are unreported and hidden to ordinary investors. That makes understanding the all-in costs of investing more difficult. This simple calculator is a powerful demonstration of how seemingly small costs compound over time, and often turn retirement dreams from robust to skimpy. But to make sure you really believe this, let’s identify the specific hidden costs of mutual fund investing. Think of “the broker” in the above example as a metaphor—he’s not your buddy. But rather, he is the combination of your advisor, the management company, your Uncle Sam, and even the worst part of your own behavior, all together. We will help you understand the problem, and then show you the simple solution. Are you ready?

The Hidden Costs Of Mutual Fund Investing

All-inclusive Costs Are Typically Much Larger Than The Expense Ratio

Most investors know to check the expense ratio, the standard measure of how costly a mutual fund is to own. This is the percentage of the assets that are paid each year to the portfolio manager and for other operating expenses. The average U.S.-stock fund charges 1.31% and the trend is a gradual decline according to Morningstar Inc.(4)

The expense ratio is always published and it is easy for investors to find. Morningstar has proved that it is a powerful indicator:

“If there’s anything in the whole world of mutual funds that you can take to the bank, it’s that expense ratios help you make a better decision. In every single time period and data point tested, low-cost funds beat high-cost funds.”(5)

So, a high expense ratio is bad. But the total all-in cost is actually much worse.

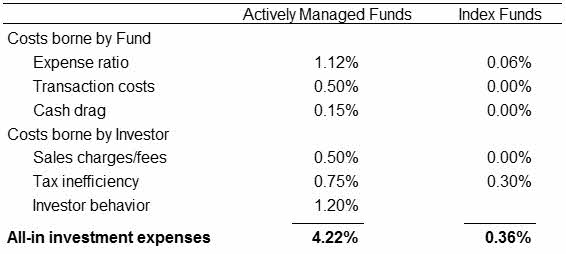

John C. Bogle says, “. . . the use of a mutual fund’s expense ratio offers only a pale approximation of the total costs paid by investors in actively managed equity funds.” Specifically, he recently compared the all-in investor costs for actively managed equity funds with investors owning low-cost index funds as follows:(6)

Mr. Bogle was founder and retired CEO of The Vanguard Group and inventor of the index mutual fund and I accept his analysis as a reasonable and instructive estimate. His total all-in investment expenses of 4.22% per year is conservative compared to 4.67% for a similar analysis done by Forbes Magazine(7). I will explain these hidden costs in this article.

Transaction Costs

The first “invisible” fund costs are the transactions costs incurred by the funds themselves. Various academic groups have calculated average annual trading costs of 1.44%. Actively managed funds are constantly buying and selling stocks and incur these costs in an effort to beat the market. Each fund’s turnover rate is a useful, but imprecise, metric of this activity. A typical fund portfolio turnover might be 100%, meaning that every stock in the portfolio is sold and replaced every 12 months. This generates costs in brokers’ commissions and costs from bid-ask spreads.

Large funds holding small company stocks also have market impact costs, when they may wish to sell at $50 per share but it gets broken into several transactions. The first sell goes through at $50.00 and then the balance gets only $49.98 per share. John Bogle believes market impact costs to be close to zero and settles on a round 0.50% for the transactions costs of actively managed funds.

An index fund is passively managed. It has a buy-and-hold strategy within the fund and generally report its turnover to be around 2% per year. Index funds incur some transaction costs, but they are so minimal they have no significant impact on the returns of those funds. In fact, the annual returns of major large-cap index funds lag behind those of their target indices by only the amount of their expense ratios. So Mr. Bogle assumes zero total transactions costs for the index fund.

Cash Drag

Active funds fairly consistently carry cash in the range of 5% of assets, whereas index funds are normally fully invested. If we assume an annual long-term equity premium for stocks over cash of as little as 6%, there would be a drag (or cost) of an additional 5% x 6% = 0.30% on active fund returns. Some of the larger actively managed funds reduce this cost by holding index futures so Mr. Bogle adds a cost of just 0.15% for the cash holdings of active funds.

Sales Charges

In the old days (before 1980) fund distributors charged purchase fees (sales loads) averaging about 8% of the dollar amount of shares purchased. For the typical investor who paid an 8% front-end load and held his shares for eight years, the amortized load was 1% per year. Today is radically different.

First, no-load funds have soared in importance and now account for almost half of long-term industry assets. Further, the typical front-end sales load has dropped from 8% to 5%. Also, the “retail” distribution system is rapidly changing from a front-end load model to an annual asset charge. And even load funds often waive sales charges for plans and registered investment advisors and brokers who charge their clients an annual fee.

To further muddle the calculation of “distribution drag,” some individual investors are do-it-yourself (DIY) investors, incurring few, if any, extra costs. But most rely on brokers and advisers who charge fees for their services. Fees paid by investors to brokers and investment advisers typically run to about 1% per year and these costs are accounted for in this category—as an indirect cost of fund share distribution.

Therefore, with some investors incurring almost no additional distribution costs and others subject to costs in the range of 1% or more, Mr. Bogle conservatively uses an average annual distribution cost of 0.5% for individual investors in actively managed funds, which includes total annual broker and adviser costs and sales loads. Because no major index fund charges sales loads and because investors in traditional index funds are largely, but not entirely, DIY investors (often in defined contribution plans – see note 8), Mr. Bogle assumes no such distribution costs for index funds.

Tax Inefficiency

If a hypothetical portfolio had zero transactions during a year, then it would have no capital gains that investors would be required to report on their income taxes and the fund costs in this category would be zero. Similarly, note that if you hold any fund in a tax-advantaged account like an IRA or 401(k), there are no annual tax costs from stock trading within the portfolio. But now consider the typical actively managed account with 100% turnover creating short-term capital gains (from stocks held less than 12 months). And remember that long-term capital gains are taxed at 15% while short-term capital gains can be taxed at over twice that. This creates an additional cost for funds held in taxable accounts and the gap between active- and passive funds (i.e. index funds) widens even further.

These costs are easy to understand but difficult to calculate precisely, so Mr. Bogle measures them indirectly by using pretax and after-tax returns provided by Morningstar for the 10-year period ending in 2013. Over this period the returns for actively managed large-cap blend funds lost an additional 0.75% to taxes if investors held them in taxable accounts; the broad market index fund lost about 0.3% to taxes in these accounts.(9)

Investor Behavior

Finally, the last cost that most investors are blind to: their own counterproductive behavior.(10) The truth is that ordinary investors don’t come close to capturing the returns that the market generously provides. But this final component is easily revealed by comparing their actual personal returns to the index returns for the same market, or risk. (Don’t compare your small company mutual fund with the S&P 500 index—they have different risks and different expected returns.) The difference between your actual return and the theoretical return is the sum of all the factors described in Bogle’s analysis. Savvy investors know this and invest in broadly diversified low-cost index funds, and hold those funds for the long-term.

Throughout his career, Mr. Bogle has pointed to losses by investors succumbing to greed and fear. The record clearly shows that mutual fund investors are too often tempted to add to their equity holdings when markets are rising, to withdraw their investments when markets tumble, and to move into funds that have performed well in the recently past only to revert to the the mean (or below) thereafter. Such counterproductive investor behavior proves to be another advantage for index fund investors that buy-and-hold for the long term.

Perhaps you know people that “got out of the market” before the 2016 presidential election because of uncertainty and anxiety? I do. And when I hear this I think two things:

- This person actually thinks they can time the market. (Hint: nobody can. And if they could they would charge more than they are worth in fees.) And,

- This person probably doesn’t own the correct mix of stocks and bonds for their particular situation.

How Small Costs Are Really Big Numbers

Many of you started reading this article thinking your fees were “only 1 percent”, and perhaps some of you thought this is reasonable. In his recent book, The Index Revolution, Charles Ellis shows you shows you a better way to think about those fees—as a percentage of annual returns.(11)

Take a look from a different perspective and you’ll never again think…that fees can be fairly described as “only 1 percent.” Since you already have your assets, the right way to quantify investment fees is not as a percentage of the assets you have, but as a percentage of the returns that the investment manager produces. This simple first step into reality changes fees from a low “only 1 percent” to (assuming the consensus of 7 percent future returns on equities) a substantial 14 percent. This surely warrants deleting the four-letter word ‘only’.

But that’s just where he begins. The real leap of insight involves the whole idea that actively managed funds cost more because they are can supposedly earn an incremental return above index funds. If they could consistently generate returns 1.1% better than the similar index fund, then they would wholly be worth, say, an incremental 1.0% in annual fees. Then there is the but stunning reality is that most actively managed mutual funds fail to keep up with index funds that match those active funds’ chosen benchmarks. The problem gets worse as the time period gets longer.

Since all investors can invest via index funds…the true cost of active investing is the incremental fee above indexing as a percentage of the incremental return above indexing. … Actually the grim reality in markets all around the world is that a majority of active managers, after fees, fall short of the index they chose as their target to beat, so for those managers, incremental fees as a percentage of incremental returns are over 100 percent–or infinity.

Your Investment Returns

Your Asset Mix (% stocks and % bonds) Affects Your Expected Returns

Bernstein’s example (the default values in the opening calculator) assumes both you and your broker portfolios are 100% stocks. But prudent investors own a percentage of bonds to achieve the overall level of risk that is appropriate to their specific situations. The stock market is risky because it is very volatile. Owning an appropriate amount of bonds is the ballast to a successful portfolio—one where you don’t need to sell during a falling stock market. Fees are even more destructive to safer (less risky) portfolios—because the same fees are subtracted from smaller expected returns.

Expected returns are proportional to risk. Stocks are riskier than bonds, so including bonds will make the expected return of your overall portfolio lower.

High fees virtually eliminate small returns. Demonstrate this to yourself. Type a 4.5% return into the calculator above. Table 1 shows how “your broker” (in the multi-party sense) still accumulates more of your money than you do in approximately 18 years, but your own investment grows less than inflation. It’s important to reduce all your investment costs and to use your IRA, 401(k), or other tax-advantaged accounts to capture much more of the market returns. After all, you take the investment risk so you deserve the return.

To reiterate this point: you give away a bigger portion of your earnings when your expected returns are smaller.

Our allocation to bonds is how we control our overall investment risk. Warning: here comes a plug. A lot of people do not understand bonds; yet they understand CD’s (certificate of deposit from your bank). I wrote a book to show everyone how bonds are both simple and vital to every portfolio. The proceeds of the book sales help to finance my not-for-profit educational website. The book is only available on Amazon. Find it here: Why Bother With Bonds: A Guide To Build An All-Weather Portfolio Including CDs, Bonds, and Bond funds—Even During Low Interest Rates by Rick Van Ness.

Real Returns Are Returns Adjusted For Inflation

Fees get subtracted first. Investors just get to enjoy what remains after costs. Inflation is the other big factor. We need to think in terms of real, or inflation-adjusted dollars, because that’s what we will use for our future spending. Inflation shrinks all returns by the amount of inflation while fees remain constant.

Future Investment Returns

Let’s return to the calculator at the top of this page. Mr. Bogle’s work has given you reasons to adjust your Total Costs, your all-inclusive costs of investing, either up or down. But what about future market returns?

William Bernstein gives us a good answer in his very short (and highly recommended) book If You Can.(12)

He writes:

While it’s impossible to estimate the returns of the stock or bond markets tomorrow, or even next year, it’s actually not too difficult to estimate them in the very long term. First, government bonds. The 30-year U.S. Treasury bond, as of this writing, yields around 3.6%. This is a pretty good estimate of its return over the next 30 years. But this is a nominal return, and recall I just told you that you want to think in real, inflation-adjusted terms. Well, the Treasury also offers a 30-year inflation-protected security (TIPS), that currently has a real 1.4% yield and return of real principal, both of which rise over time with inflation. So the expected real return of the 30-year bond is . . . 1.4%.

Stocks are only slightly more complicated. Domestic stocks currently yield a dividend of around 2%, foreign stocks around 3%. This is a real yield, since historically the real dividend payout increases at around 1.5% per year. Since the stock price should increase roughly in line with this growth in dividends, the real return of stocks should be the sum of the current yield and the growth rate—that is, for domestic stocks, the 2% yield plus the 1.5% growth rate , or 3.5%, and for foreign stocks, about 4.5% (the 3% dividend plus the 1.5% dividend growth).

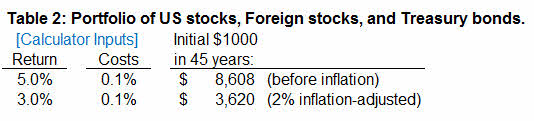

Thus, a portfolio that is two-thirds stocks and one third bonds should have a long-term expected real return of around 3% and this is also where the suggested 15% savings rate for someone who starts saving at age 25 comes from.

Table 2 shows a responsible broadly diversified portfolio using low-cost index funds and both taxable and tax-advantaged accounts. This portfolio has a nominal return of 5% and a real return of 3%. There are no advisor fees included here but many people may need such advice. Avoid annual fees and seek knowledgeable unbiased professionals with a fixed hourly fee as needed to get you oriented. I strongly urge you to take strides to learn the investing basics yourself. There are many resources to steer you, including my website FinancingLife.org. Also start with William Bernstein’s short and free book If You Can. We investors can’t control inflation, but we can control costs and investment risk.

Conclusion

The hidden costs of mutual fund investing are greater than most investors recognize. I urge you to learn about these costs in your portfolio. The numeric details aren’t important, but recognizing their existence, magnitude, and consequence is. In the short term these costs may appear reasonable, but over the long run they become immensely damaging to your returns. Or, in John Bogle’s eloquent words:

“Do not allow the tyranny of compounding costs to overwhelm the magic of compounding returns.”

Get the professional advice that you need, but pay it the same way you pay for doctors, lawyers, architects, and all other professionals in your life: a fixed fee for just the service you need at that time but not more. Don’t believe that this is complicated. It’s not! Learn about other ways that you can get the investment advice. Don’t get your advice from your broker. That’s a bit like asking your barber if you need a haircut, only far more consequential. He has a vested interest in this.

Strive to educate yourself. Your goal is to recognize the difference between things you are sold and things you want or need to buy. An easy way to learn is to just get started. There are ten simple rules to common sense investing. Start by learning them. Strive to understand them. It’s very likely that by the time you can recognize a good financial adviser from a bad one, you may no longer need one, or perhaps hardly need one.

Please share your thoughts in the comments below.

Footnotes

(1) But don’t take my word for it. Listen to Warren Buffett tell you this on YouTube here. Or, read it from John Bogle in my favorite of all investing books (on page 189) The Little Book of Common Sense Investing.

(2) Bernstein, William, The Four Pillars of Investing, The McGraw-Hill Companies, Inc., 2002, p.199.

(3) Bogle, John C., Little Book of Common Sense Investing, John Wiley & Sons, Inc., 2007, p.37.

(4) Kinnel, Russel, Mutual Fund Expense Ratio Trends, Morningstar, June 2014.

(5) Kinnel, Russel, How Expense Ratios and Star Ratings Predict Success, Morningstar, Inc., Aug 9, 2010.

(6) Bogle, John C., The Arithmetic of “All-In” Investment Expenses, Financial Analysts Journal, Volume 70, Number 1, 2014, CFA Institute.

(7) Bernicke, Ty A., The Real Cost Of Owning A Mutual Fund, Forbes, April 4, 2011.

In the cost summary for taxable accounts, Mr. Bericke identified: Expense Ratio 0.90%, Transaction Costs 1.44%, Cash Drag 0.83%, and Tax Cost 1.00%. He cites a range of 0.25% to 2.5% for additional Advisory Fees. If we use Mr. Bogle’s logic and settle on 0.5% for these Sales Charges, and Counterproductive Investor Behavior of 1.20%, the total becomes 4.67%.

(8) Companies negotiate defined contribution plans, like a 401(k), with a sponsoring company (think Fidelity or Vanguard) and that sponsoring company provides the fund menu that employees select from. Employees generally make their investment allocations on their own and so Mr. Bogle includes no distribution costs for these funds.

(9) Bogle, John C., The Arithmetic of “All-In” Investment Expenses, Financial Analysts Journal, Volume 70, Number 1, CFA Institute, 2014,Table 2 on page 6.

(10) Mr. Bogle uses 1.2% for active investors. That’s a conservative estimate, well below the 1.9% lag realized on the 15 years ending 2013. This also assumes index investors the required discipline to buy and hold.

(11) Ellis, Charles, The Index Revolution, Wiley, 2016, pp 103-122.

(12) Bernstein, William, If You Can, (or, click here for his free PDF version)

Would you like to support this site?

Thank you for supporting my website through your Amazon purchases.

I just wanted to say a big thank you to all of you who make Amazon purchases through the links on FinancingLife.org. It really does help to support the software and web hosting charges for the site and doesn’t add any extra cost to your purchase. Just click on this link and search for your product on Amazon’s Homepage and that’s all there is to do.

Thank you for supporting my website by purchasing my books.

I also thank the many of you who have purchased and commented on my books, both Common Sense Investing and Why Bother With Bonds. These book revenues also go towards the direct costs of my not-for-profit educational website FinancingLife.org.