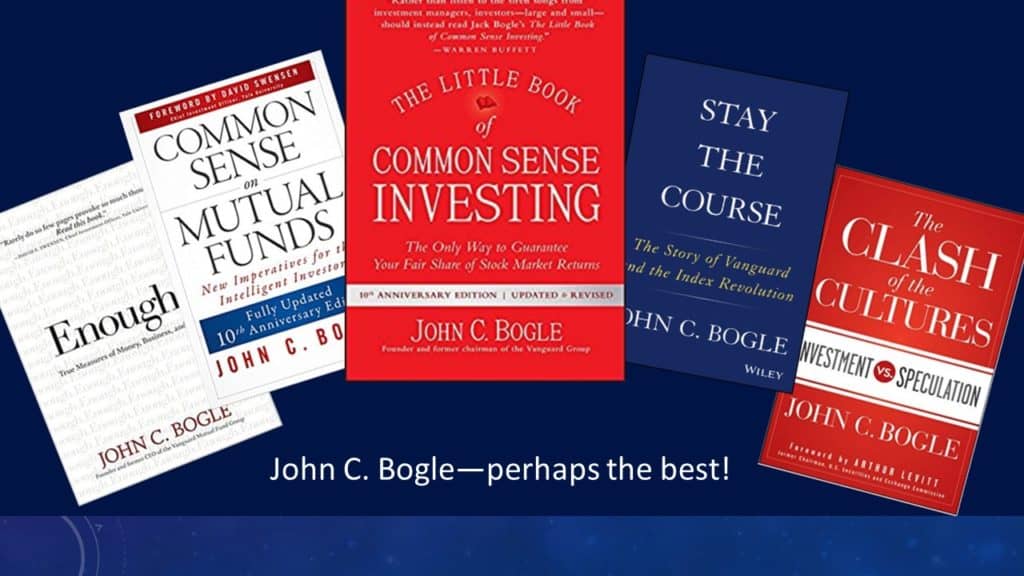

John C. Bogle died in January 2019. Anyone interested to learn about investing needs to understand what he spent his life trying to teach us. Please read my tribute to him and learn and why he is on my short list of personal heroes. He is also a brilliant writer. He can reduce complexity to simple. I’ve collected some beautiful quotes from his books and speeches for you to enjoy. Below I’ll highlight five important books that he wrote.

The Little Book of Common Sense Investing

All books by John Bogle are brilliant, but I do have a favorite: The Little Book of Common Sense Investing. It is wisdom boiled down to the essence and decorated with smiles and wry humor. This book is readable by everyone.

This 10th Anniversary Edition was updated and revised in October 2017.

Common Sense on Mutual Funds

The second book by John Bogle is commonly highlighted as one of his best: Common Sense on Mutual Funds. It may very well be the best book about mutual funds—which is important from the man who invented the index fund and founded The Vanguard Group—but I’d recommend it to the DIY investors that are trying to improve and learn a more.

This 10th Anniversary Edition updated Dec 2009.

Enough: True Measures of Money, Business, and Life

I consider frugality a virtue. So when I heard that Jack was publishing a book titled Enough., I thought I had found an alter-ego. Jack does very thoughtfully consider what “enough” actually means, but in a much bigger way. Let me list the ten chapter titles to show you.

- MONEY

- Too Much Cost, Not Enough Value

- Too Much speculation, Not Enough Investment

- Too Much Complexity, Not Enough Simplicity

- BUSINESS

- Too Much Counting, Not Enough Trust

- Too Much Busines Conduct, Not Enough Professional Conduct

- Too Much Salesmanship, Not Enough Stewardship

- Too Much Management, Not Enough leadership

- LIFE

- Too Much focus on things, Not Enought Focus on Commitment

- Too Many Twenty-FIrst Century Values, Not Enough Eighteenth Century Values

- Too Much “Success,” Not Enough Character

This is a great book by John Bogle. It takes a giant to live the life he did. He stood for so much. His contribution was huge. Bogle is both brilliant and persuasive, and his ability to get to the heart of these topics is one of his greatest gifts. So much wisdom. So eloquently stated. He writes for all of us. This is another book that recommend to everyone.

The Clash of Cultures

The three books by John Bogle listed above reveal the depth of this man. He loved investing and what investing can do.

He marvels at the miracles possible when corporations and their owners and managers jointly pursue long-term shareholder return… And yet when he sees the corridors of fiance and investment turned into a den of speculation and greed, he does not hold his tongue…

There are many villains in this book: auditors, regulators, politicians, rating agencies, the Securities and Exchange Commission (which I led), the Federal Reserve, sell-side analysts, and the media. And their collective (as well as individual) sins have one primary victim: investors.

Arthur Levitt, in the Foreword to this book

This book is not a guide for ordinary investors like the first two I listed above. This is more a living history of the character of our financial system. He says, “We must understand what went wrong in finance in order to take the necessary steps toward building a better system.” The themes throughout all his books become familiar—pressing that “we again honor the standard of fiduciary duty that once largely prevailed among the trustees of Other People’s Money.”

Stay The Course

This was John’s last book. I do not own this book but I include it in this list because it tells the story of Vanguard’s history–which is a fascinating story. This is a tribute to his accomplishments.