This article recommends the best investment books based on lessons you need to learn next. Your goal should be to become a knowledgeable investor. With that, most people can manage their own investments and be smart about hiring specialized help when needed. Few people need advanced expertise.

This post helps you discover the lesson you may want to learn next. For instance, most of my readers are advanced-beginners and might consider phrases like:

“I try to pick a few winners—like Warren Buffett does.”

“I choose only no-load five star funds, so I know I own the best funds at the lowest cost.”

When someone says phrases like these, it suggests what they need to learn next. So click on the phrases in the table I provide to link to suggestions about what to learn next, book suggestions and web resources.

Let me know if this works for you. Leave me a comment at the bottom of this page.

A premise of this website is that most people should manage their own investments and just need to learn some simple fundamentals. The reason is so you minimize investing expenses and remain knowledgeable. Both are very important. But if you truly understand the consequences of advisor fees (this is uncommon), using an investment advisor can sometimes be the right decision for you. Even for those that want professional help, knowing some basic principles will help you recognize and hire a competent adviser. The key is to get educated! It’s not hard.

Ordinary investors, which are 99% of us, need a strategy of extreme diversification. This strategy is to own a piece of all businesses at the lowest possible cost. Note that professional investors and some entrepreneurs have a different strategy: they seek returns that are substantially greater than the market and can afford the greater risks. They hope to achieve this by concentrating on very few investments which they attempt to understand thoroughly. Their strategy is not appropriate for most people because the expected returns are not commensurate with the high risk.

Table: Links to the Best Investment Books for Ordinary Investors

Click a phrase that you identify with:

Knowledge Level

About 40% of us are just starting

Click one for suggestions about what to learn next!

What investors getting started should learn first:

“I rarely have extra money to invest.”

“I’ve never thought about funding retirement.”

“I’m not interested in investing. Really.”

Knowledge Level

Another 30% of us are Wishful thinkers

Click one for suggestions about what to learn next!

Click a phrase for resource suggestions for advanced-beginners:

“I try to pick a few winners—like Warren Buffett does.”

“To me, ‘speculating’ and ‘investing’ seem like the same thing.”

“I love lottery tickets and Las Vegas. It’s fun, and someday I might win enough to retire.”

“I watch the news and read the money magazines to choose the best funds.”

“I can’t resist the siren song of Wall Street: “Let us help you beat the market.”

“I choose only no-load five star funds, so I know I own the best funds at the lowest cost.”

“I pay my CPA 1% to manage my investments.”

“I pay a firm a few percent to have their full breadth of financial services.”

“I can’t predict my earnings, my retirement, or when I’ll die. So I don’t have a plan.”

Knowledge Level

Perhaps 20% of us are Knowledgeable

Click one for suggestions about what to learn next!

Links to resource suggestions for intermediate level investors:

“I only pay for the financial services I need, and on a fee-for-service basis.”

“I ‘pay myself first’ and invest from every paycheck.”

“I use my rebate credit cards and charge things AND pay them off monthly!”

“I don’t think frugal is a four letter word.”

Asked: “What did the Market do today?” You reply, “I don’t know and I don’t care.”

“I know what an asset allocation plan is.”

“I know where to put my investments for maximum tax benefits.”

Knowledge Level

Wise ≈ 8% of us

Click one for suggestions about what to learn next!

Links to resource suggestions for advanced investors:

“I don’t moan and groan at every downward dip of the market.”

“I’m not overwhelmed by zillions of different mutual fund choices.”

“I can explain why passive funds beat actively-managed funds.”

“I am dismayed at the amount of ‘financial porn’ and ‘get-rich-quick’ schemes.

Knowledge Level

Admit it, 1% of us are Obsessive!

Click one for suggestions about what to learn next!

Links to resource suggestions for experts:

If someone says “Index”, the first thing I think of isn’t that thing at the back of a book.

I hear about Monte Carlo and I think “simulation”.

Best Investment Books for When You Are You Just Starting:

It’s normal to start adult life as a complete novice. Not only is common sense personal finance not taught in our schools, but it is usually not learned at home either. Worse, common sense wisdom is obscured by the HUGE financial services industry that wants to sell you something. You’re best defense is to Start With A Sound Financial Lifestyle, and then learn to recognize common sense wisdom amidst all the noise and clutter in the market. The concepts are simple but you’ll be vastly better off if you learn them for yourself so you don’t have to rely on hired-help being both competent and putting your interests first.

The main lessons you need to learn first are to live below your means and to save regularly. Retirement should be the last thing on the minds of our young adults as they set about building their lives. That said, you will get old and it is irresponsible to not save for that time—just as it is irresponsible not to carry health insurance or auto insurance. Many of our dreams can come true with the help of those savings invested wisely. Here are some good books that are helpful to get novice investors started:

Your Money Or Your Life, Vicki Robin and Joe Dominguez, 2008. This book is about transforming your relationship with money and achieving financial independence. Vicki Robin has since become a wonderful spokesperson for frugal, sustainable lifestyles and taught me important, liberating concepts that I have incorporated into my life and for this reason I highly recommend this book! On the other hand, this book is about extreme budgeting which you might skip over if it’s not for you. But if you’re not saving 15% of your gross earnings, then maybe it is for you!

On My Own Two Feet, Manisha Thakor and Sharon Kedar, 2007. All of America needs to master the basics of personal finance and investing, and these authors aim particularly at young women. But, no young man should hesitate to read this book and master the same concepts! It’s a short easy read.

The Wealthy Barber: Everyone’s Commonsense Guide to Becoming Financially Independent, David Chilton. A fun book with a fictional barber shows how to take control of your finances, and slowly, steadily achieve financial independence on nothing more than an average salary.

The Millionaire Next Door: The Surprising Secrets of America’s Wealthy, Stanley and Danko, Most of the truly wealthy are not conspicuous consumers, but are most likely your neighbors who live below their means, allocate funds to build wealth, choose their occupation wisely, etc. Again the message that almost everyone can accumulate wealth, if they are disciplined enough.

The Only Investment Guide You’ll Ever Need, Andrew Tobias. This is the book that first grabbed me. It’s been updated many times. I’m particularly fond of the chapter titled: A Penny Saved Is Two Pennies Earned.

The New Coffeehouse Investor, Bill Schulteis. This easy to read in one sitting. It drives home the necessity of investing and the importance of index funds. It’s wonderfully simple in plain English.

Smart and Simple Strategies for Busy People, Jane Bryant Quinn. The best ideas are simple, low in cost, and easy to use. In this case, they are also sophisticated and smart but most of us don’t want to get bogged down with all that. Also check out her classic bestseller, Making the Most of Your Money.

30-Minute Money Solutions, Christine Benz. Here’s a nice guidebook to help you get on track. This is a well-written practical book that will hep you get organized piece by piece, a little at a time, and before you know it—you’ll have control of your finances!

Best Investment Books for when You Can’t Recognize Wishful Thinking

The financial services industry is persuasive, so the main lessons beginner investors need to learn is why many common beliefs are based on wishful thinking and to replace those ideas with time-proven wisdom. Consider whether you’re tempted to agree with any of these comments and then the easy-to-read books that shine light on these topics.

Did you choose this descriptive comment?

I try to pick a few winners—like Warren Buffett does.

Warren Buffett believes that the way for professionals to beat the market in a substantial way is to identify a few companies that are likely to excel in a big way, become an owner and then help the management team make that happen. That’s very different than ordinary investors trying to pick stocks. In fact, he believes that virtually all ordinary investors would be better off with broadly diversified index funds at the lowest possible cost.

So if you are not a professional investor, I suggest that you hear this advice directly from Warren Buffett (find video link here) and then take steps to understand why he recommends index funds with very low cost. You can watch my videos about why and how to diversify (Rule#3 and Rule#4), read the paperback version, or consider these books I very highly recommend:

The Little Book of Common Sense Investing, John Bogle. One of my absolute favorites because it is so short and to the point with crystal clear rock solid advice.

The Random Walk Guide To Investing, Burton G. Malkiel. Another favorite because it is short, clear, and easy-to-read.

Think, Act, and Invest Like Warren Buffett, by Larry Swedroe. I recommend this new book by Larry Swedroe over my prior favorite of his (The Only … Winning Investment Strategy) because it is shorter and more current. It’s very readable. Highly Recommended! Here’s my short video book review.

Other suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

To me, ‘speculating’ and ‘investing’ seem like the same thing.

Both Warren Buffett (see prior comment) and John Bogle promote investing to own a slice of all businesses—all of which combine creativity and hard work to create something of value. John Bogle labels people who engage in market timing, and who buy and sell options and derivative contracts, as speculators. They are trying to make money (or limit losses) on random price movements. We have a bias against speculating as a sound investment strategy. Instead of “buying puts” to hedge against declines in stock prices, we recommend a stable asset allocation and re-balancing approach where a decline in stock prices creates an opportunity to re-balance and buy more stocks when they are on sale. Try to understand what they are saying so you don’t get hung-up on the semantics of these words.

Watch my video about investment risk (Rule#3), the paperback version, or consider these books I highly recommend:

The Random Walk Guide To Investing, by Burton Malkiel. This Princeton professor became famous from a bestseller book that I’ve listed intermediate level. This one is a wonderful place to start because he distills this time-tested wisdom into ten rules that are easy to understand and remember.

The Only Investment Guide You’ll Ever Need, by Andrew Tobias. This is the book that first grabbed me. It’s been updated many times.

The Clash of the Cultures: Investment vs Speculation, by John Bogle. If you are interested in investing then you will find this book interesting because it shows change in historical context as well as bold prescriptive remedies. It’s not for beginners or casual investors.

Other suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I love lottery tickets and Las Vegas. It’s fun, and someday I might win enough to retire.

We all recognize blatant gambling. Simple math tells us that it is a loser’s game for the gambler, and a winner’s game for the casino (or fundraiser).

What you might need to learn is that stock picking is gambling. For every winner there is a loser—each believing that they were trading on a better forecast of future profits. What John C. Bogle so eloquently tells us is that if there were no costs involved, all stock trading would be a zero-sum gain. Combined, the winners cancel losers and the result is the total stock market. But since there are costs involved (stock broker fees and mutual fund expenses), picking stocks or stock funds is also a loser’s game. Investors (like gamblers) lose. And the giant financial services industry (like casinos) win.

I suggest you watch my video about timing the market (Rule#5), the paperback version, or one of these books that I highly recommend:

Think, Act, and Invest Like Warren Buffett, by Larry Swedroe. I recommend this new book by Larry Swedroe over my prior favorite of his (The Only … Winning Investment Strategy) because it is shorter and more current. It’s very readable. Highly Recommended! Here’s my short video book review.

The New Coffeehouse Investor, by Bill Schulteis. This easy to read in one sitting. It drives home the necessity of investing and the importance of index funds. It’s wonderfully simple in plain English.

How A Second Grader Beats Wall Street, Allan Roth. Author uses conversations with his son as the device to debunk myths and teach common sense investing principles in a way that we can all understand. This book is for ages 20 to 50 by an author who is a very respected financial planner.

Other suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I watch the news and read the money magazines to choose the best funds.

It’s a natural instinct to seek advice from authoritative-sounding sources. But consider this to become grounded. First, if anybody had credible information about what would outperform would they earn more money dispensing that information by a newsletter or TV-show, or by investing themselves with that advantageous information? (answer: the latter) Second, if the information was valid and people invested from it, would the advantage remain valid (answer: no). Lastly, are you clear about how each of these players actually do make money? (answer: TV by attracting an audience for advertisements, newsletters and magazines by selling subscriptions, brokers by commissions, fund companies by their fund expenses, etc.) Can you see when their interests are not aligned with yours? This is just a warning to be cautious, and the best way is to become knowledgeable.

Watch my video about sticking to your plan (Rule#10), or the paperback version. But since you regularly reflect on your investments, also consider reading a worthy blog and treating yourself to a good investment book every year. I suggest you consider these:

Think, Act, and Invest Like Warren Buffett, by Larry Swedroe. I recommend this new book by Larry Swedroe over my prior favorite of his (The Only … Winning Investment Strategy) because it is shorter and more current. It’s very readable. Highly Recommended! Here’s my short video book review.

Web/Blog: I’ve been following Mike Piper’s blog, Oblivious Investor, for over a year. He’s got a knack for taking the complexity out of investing and the wisdom to help his readers understand the alternatives and implications of common investment decisions.

Web/Blog: While The White Coat Investor blog purports to aim medical practitioners, it’s full of wisdom for all of us. Highly recommended.

Other suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I can’t resist the siren song of Wall Street: “Let us help you beat the market.”

Actually, there are many forms of this sweet song: “We don’t need to choose the winners, just eliminate the obvious losers.” Or: “You don’t want to be average do you?” Or: “Look at the outstanding returns before you consider the relatively small price.” It must be a sweet song to many millions because they have made the financial services industry simply enormous. However John C. Bogle, champion of ordinary investors, shows that in this industry it’s not “you get what you pay for” but quite the opposite.

The cleanest way to stay clear of trouble is to learn what constitutes a good mutual fund, and to be crystal clear how everybody makes money. I’m all for everyone making money and happy to pay for advice that has value, but I’m not at all happy about “being sold” by somebody who has a vested interest in selling something. Do this: check with a dis-interested party—somebody who gets paid only for service provided. You’ll find that the common sense investing wisdom on this website (inspired by Jack Bogle) prevails when self-interest is removed from the messages you are bombarded with daily. The wisdom is not unique to this website, but is is often obscured by the noise of people trying to sell you something.

Watch my video about how to choose a good mutual fund (Rule#6), the paperback version, or consider one of these books I highly recommend:

Think, Act, and Invest Like Warren Buffett, by Larry Swedroe. I recommend this new book by Larry Swedroe over my prior favorite of his (The Only … Winning Investment Strategy) because it is shorter and more current. It’s very readable. Highly Recommended! Here’s my short video book review.

The Little Book of Common Sense Investing, by John C. Bogle. I had an opportunity to ask Jack (author) to sign any of his books (I have them all) and I chose this one. It’s compelling, simple, short.

Common Sense on Mutual Funds, by John C. Bogle. This is a fully updated tenth anniversary edition with much commentary about what has changed in the past decade, but still its core is the timeless fundamentals of investing that apply in any type of market.

Other suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I choose only no-load five-star funds, so I know I own the best funds at the lowest cost.

You are on the right track! No-load funds do not charge a sales commission. They are now common so there is no reason to buy funds that have sales loads or commissions. But don’t make the mistake of stopping there. There are additional recurring fees for every fund to cover their operating expenses. All else being equal, these fees are the best predictors of fund performance—low cost funds eventually outperform their more expensive actively-managed rivals. So you need to find and compare these fees. Very often they are labeled with the odd name “expense ratio”. Vanguard is famous for having excellent funds for very low cost, so you can compare whatever you are considering with them.

Finally, while we can rely on ratings for many of our purchases, the star system fails us for rating investment funds because it relies on recent performance. And if you believe (as you should) that past performance does not guarantee future performance, then you will not only understand why recent winners will be rated highly but why index funds won’t. Index funds will never outperform the market—because they are the market, by definition. Four and five star ratings are tempting, but you should simply ignore them.

Now some will argue that a one-star rating often is useful for identifying funds with additional problems, which may be true, but you are better off not looking at actively managed funds and sticking to the big broadly-diversified total stock market funds (both US and international) with very low cost. You can have a very smart portfolio with only three funds: US total stock market + International total stock market + Very high quality bonds. The more important decision is getting the ratio of stocks to bonds correct and then sticking to that.

Watch my video about using index funds when possible (Rule#6), the paperback version, or consider one of these books I highly recommend:

The Bogleheads’ Guide to Investing, Larimore, Lindauer, LeBoeuf, and Bogle. Friends of John Bogle put together a guide simply to support Bogle’s mission by teaching others how to get the best long-term return on their investment dollars. It’s also a good introduction to this amazing site: Bogleheads.org.

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing, Burton Malkiel. This is his best-seller. It’s brilliant, and very readable. He updates this frequently and I recently bought the tenth edition. Highly recommended!

The Investor’s Manifesto: Preparing for Prosperity, Armageddon, and Everything in Between, William J. Bernstein. Another brilliant book by a bestselling author, well known for understandable insights about how to manage wealth wisely.

Other suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I pay my CPA 1% to manage my investments.

Heck, what’s 1%—right? Small number. Worth it? Well, think of it this way: if your investments only earn 1% that year, that’s half your earnings. Remember: that 1% comes off the top and you get the rest. Worse, they get their cut even when the market is down for the year!

I think you will make much better decisions if you think of it in term of actual dollars. Say you have a $100,000 portfolio that is half stocks and half bonds. In ten years you will have given your CPA $10,000 (1% x $100,000 x 10 years).

Are you ok with that? That’s a huge portion of what you will have earned. And for what? To suggest which mutual funds to own? Stay tuned–I’m about to tell you that for free! Meanwhile, I suggest that you learn why you simply want to own broadly-diversified mutual funds at the lowest possible cost.

Now, if you want some advice regarding how much to put in stocks, and how much to put in bonds, just pay for that specific advice—typically $180/hour. Revisit this advice in ten years, or if something major changes in your life. (Yes, you should rebalance every year but that is simple arithmetic and I have trouble understanding why you would hire somebody to do this for you.)

Watch my video about the importance of low cost when possible (Rule#7), the paperback version, or consider one of these books I highly recommend:

Think, Act, and Invest Like Warren Buffett, by Larry Swedroe. I recommend this new book by Larry Swedroe over my prior favorite of his (The Only … Winning Investment Strategy) because it is shorter and more current. It’s very readable. Highly Recommended! Here’s my short video book review.

The Four Pillars of Investing, Dr. William J. Bernstein. This best-selling author approaches the topic in this book from four perspectives of investing: theory, history, psychology, and the business of investing—then discusses how to combine this into an investment strategy. I was ready for the first edition of this book when it came out in 2002 and it motivated me to get my finances in better order.

Smart and Simple Strategies for Busy People, Jane Bryant Quinn. The best ideas are simple, low in cost, and easy to use. In this case, they are also sophisticated and smart but most of us don’t want to get bogged down with all that. Also check out her classic bestseller, Making the Most of Your Money.

Other suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I pay a firm a few percent to have their full breadth of financial services.

My reading of this comment is that a big firm has impressed you with their keen insight which you think is worth buying. Further, their elaborate seminars, webinars, newsletters, office furnishings, and managers’ yachts all suggest to you that they know how to pick investments and that you’ll be able to achieve the same. Unless, that is, their wealth comes from clients instead of superior market intelligence.

Watch my video about the importance of low cost when possible (Rule#7), the paperback version, or consider The Four Pillars of Investing, by Dr. William J. Bernstein. This best-selling author approaches the topic in this book from four perspectives of investing: theory, history, psychology, and the business of investing—then discusses how to combine this into an investment strategy. I was ready for the first edition of this book when it came out in 2002 and it motivated me to get my finances in better order.

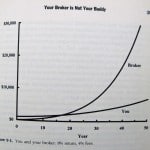

A small leak will sink a great ship. Author William Bernstein drives home the importance of minimizing these costs (click chart on right), in which it is hypothetically assumed that you and your broker can both earn 8% per year, but that he takes 4% of your portfolio each year, leaving you with a 4% return. Meanwhile, he can invest his commissions at 8%. After 17 years, he has accumulated more than you have, and after 28 years, he has twice a much. (from p. 199 in The Four Pillars of Investing, chapter titled “Your Broker is Not Your Buddy”).

Other suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I can’t predict my earnings, my retirement, or when I’ll die. So I don’t have a plan.

Life happens. Most (all?) of it is unplanned, but you do get to point yourself in a direction. Most of your life you cannot plan. I do believe that living every day to the fullest requires being able to articulate goals or scenarios that seem interesting to you. Dare to dream.

Some might be willing to fritter away their money at the cost of working most of their lives and then living off Social Security. Others like to save for fantastic vacations, or retire comfortably, or other dreams. You decide. All I’m suggesting is that you have a much better chance of maximizing your happiness if you can imagine potential future scenarios that might be interesting to you. Write them down, and your chances improve further. Update it whenever you want (when something changes, or you change your mind). The chances that your life will match your plan is low. A personal investment plan merely creates options—it enables dreams.

Suggestions: get familiar with how much of what you earn each you you save, with how much savings you’ll need if you retire at age 65,…

Watch my video about how to develop a workable plan (Rule#1), the paperback version, or consider one of these books I highly recommend:

Smart and Simple Strategies for Busy People, by Jane Bryant Quinn. The best ideas are simple, low in cost, and easy to use. In this case, they are also sophisticated and smart but most of us don’t want to get bogged down with all that. Also check out her classic bestseller, Making the Most of Your Money.

30-Minute Money Solutions, by Christine Benz. Here’s a nice guidebook to help you get on track. This is a well-written practical book that will hep you get organized piece by piece, a little at a time, and before you know it—you’ll have control of your finances!

The Only Investment Guide You’ll Ever Need, by Andrew Tobias. This is the book that first grabbed me. It’s been updated many times. I’m particularly fond of the chapter titled: A Penny Saved Is Two Pennies Earned.

Other suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Best Investment Books for Knowledgeable Investors

Knowledgeable investors have learned the simplicity of common sense investing wisdom, but they also recognize that it is not easy to “stay the course”. They also know where to turn for answers when inevitable questions arise. The links below will lead you to the books and websites they trust.

Did you choose this descriptive comment?

I only pay for the financial services I need, and on a fee-for-service basis.

Yea! It’s perfectly fair to ask for help and to pay for valuable services. Just be calibrated. For instance, getting your oil checked and changed is critical to your car’s health. It’s smarter to pay $50 per oil change than 0.1% of your wealth per year. Right? Be just as smart about your investments.

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I “pay myself first” and with an automatic investment from every paycheck.

Yea! You use the time-proven secret to saving—automatic investing. It turns out that you don’t miss what you never see. Still takes a little discipline, but it’s a whole lot easier this way!

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I use my rebate credit cards to charge things AND pay them off monthly!

Yea! For undisciplined consumers, the credit card is their own worst enemy—an invitation to painless impulse buying. This quickly spirals out of control if you fall to the temptation of not paying the bill in-full and on-time, every single month. The cost of failing to do so is huge. But if you have the discipline to be responsible with your credit card, then it turns out that credit cards can be your friend. It doesn’t take much work to get a free card that will give you a 2% discount on everything you do need to buy.

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I don’t think frugal is a four letter word.

It helps if you can see the reward for being frugal and saving, and the reward is different for everyone. For me, the reward was to no longer need to work after age 50. I wake up every day and invest my time and energy into whatever I please (like helping you make your dreams come true with advice via this website). That’s a simplification, but I am proudly frugal. It has opened up many options for me that would not be available if I had been (frivolous) with money.

I was deeply moved when Vicki Robin showed how freeing it is to be both frugal and non-judgmental. If you get immense pleasure from an overseas vacation—spend it on that. If you get immense pleasure from a mink coat—spend it on that. The key point is to be able to get maximum happiness from what you trade your life-energy for (i.e. the energy you invest in a job to earn that money).

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I know what an asset allocation plan is.

Yea! I think we all grew up learning “don’t put all your eggs in one basket”. Asset allocation is all about carrying the appropriate amount of risk (your ratio of stocks to bonds) and spreading around your risk factors.

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

Asked: “What did the Market do today?” You reply, “I don’t know and I don’t care.”

The stock market goes up and down. This really doesn’t matter if you are not pulling money out for one of your goals. And money you are pulling out for short-term goals should have been shifted to low-risk bonds or CDs unless it comes from a periodic re-balancing.

Congratulations also, because you are not trying to outsmart the market. Timing these short-term market swings is speculating, gambling—and you know better.

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Best Investment Books for Wise Investors

Wise investors are well-read, knowledgeable, and current. They don’t need suggestions from me, but you might find their comments interesting. And you might find the books and resources aimed at that level valuable for delving into a topic of interest.

Did you choose this descriptive comment?

I know where to put my investments for maximum tax benefits!

Bravo! We know that wise investors work hard to shave off 1% of investing expenses—because that goes right into their pockets. A 4% return becomes a 5% return without taking any more risk! So we wouldn’t expect you would ignore the fact that bonds get taxed more heavily in taxable accounts than do stocks. Keep your stocks and bonds in the correct type of accounts to further increase your return without taking any additional stock market risk.

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I don’t moan and groan at every downward dip of the market.

Hooray! Isn’t it a better day when you don’t see and respond to this kind of noise? You’ll feel terrific when you simply don’t care—not out of ignorance, but from the confidence of being a long-term investor with a simple plan.

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I’m not overwhelmed by zillions of different mutual fund choices.

Outstanding! A wise investor can be happy with three good mutual funds—and if you can already name them, congratulations, you’ve arrived! A beginning investor can be happy with one good mutual fund. The fact that there are zillions of choices is merely a consequence of there being a demand for them. Uninformed investors WANT to buy yesterday’s winners believing that they too will enjoy that success. Many many people make a living selling the recent winners, and discretely hide the recent losers. Because remember: the winners+losers together make up the very market they are compared with.

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I can explain why passive funds beat actively-managed funds.

Excellent! Note, this statement does not mention “index funds” which is fine, because a fund doesn’t *have* to be an index fund to be low cost—but that’s the general rule. Index funds are also known as “passively managed” funds in that there are no expensive fund managers betting on particular sectors and market timing to achieve superior performance. Being a passively managed fund is merely the tactic for achieving low cost and a consistent investing style.

This is a milestone of confidence. Because we are somehow wired to expect that we can achieve better than average returns without additional risk. Many people that think that average market returns are bad are conflating it with their own investor returns—which are generally poor for a number of common mistakes related to lacking knowledge and having poor discipline. But the average market return (that these poor investors failed to capture) was an average of 10% last century—seemed pretty damn good to me!

Similarly, we are somehow wired to thing that we can pay smart people to achieve above market returns (for any given level of risk) and that these higher returns will pay for the additional costs. Plenty of research debunks this! See authors Bogle, Swedroe, and Ferri to get introduced to the arguments in favor of passive investing.

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Did you choose this descriptive comment?

I am dismayed at the amount of “financial porn” and get-rich-quick schemes.

Wow! You’ve even used a term coined by Emmy-winning Jane Bryant Quinn who is an American personal-finance writer. This comes at you from everywhere, in many forms: Jim Cramer’s television show “Mad Money”, “Best Funds of the Year” at the checkout counter, dedicated television channels like CNBC, newsletters, and even our mutual fund providers trying to serve you by giving people what they (mistakenly) want.

Keep it up! Consider reading a good book each year. Links to suggestions: Starting, Beginner, Intermediate, Advanced, Expert

Confessions from Obsessive Investors

For some, investing—even within the bounds of common sense that we focus on—is a source of entertainment and community. Happily, many of these people are very generous about sharing their wisdom and helping others onto the path of sensible investing. These are comments they’d identify with… 😉

Did you choose this descriptive comment?

If someone says Index, the first thing I think of isn’t that thing at the back of a book.

OK. That may be beyond the pail. But this year on the popular television show Jeopardy, not a single contestant was able to answer the clue which called for a response of “What is an index fund?” It is part of all of our basic financial foundations to know about investing via low-cost broadly diversified index funds. It is simply unacceptable to be an adult and not to know, because this is the building block care of your portfolio. But, if you don’t think first of an index at the back of a book, well you are an obsessive investor. Get a life. 😉

Did you choose this descriptive comment?

I hear about Monte Carlo and I think “simulation”.

A Monte Carlo simulation applies hundreds of potential future scenarios against your investment decisions to see how you are likely to fare from a statistical perspective. It provides an answer to the question: What is the probability that I will outlive my savings if I live to so-and-so age.

Did you choose this descriptive comment?

I know my funds’ benchmarks.

This is among the details that most of us don’t need to know. But, there is a fundamental concept that we should all learn that is important: you judge an index fund against the benchmark portfolio (or index) that it mimics. Because once you understand this, you are ready to understand how you might be bamboozled.

For instance, if I said XYZ Fund outperformed the S&P 500 you should not be interested unless XYZ Fund is an S&P 500 index fund, in which case it would indicate a problem because ideally it wants to match the performance, not lead or lag. More often someone might cherry-pick a fund that recently outperformed the S&P 500—say Joe’s Small Cap Value Fund—in which case you would certainly hope that it outperforms the S&P 500 in the long-term because you carry more risk with small company stocks. The more appropriate benchmark would be a Small Cap Value Index Fund because it would have comparable risk.

Did you choose this descriptive comment?

I have the expense ratios of my mutual funds memorized.

I might be guilty of this one. Because once you get it in your head that “you can keep what you don’t give away” as operating expenses (or, “expense ratio”), then it can become a game to set up your investments to really minimize this. I don’t suggest this game, although it is entirely a healthy and wholesome one. Keep in mind that you can have an outstanding investment portfolio with only three funds.

Did you choose this descriptive comment?

I attend Boglehead conventions.

That is obsessive—but also wonderful. Please look for me and say hello. 🙂

Bogleheads is a term that thousands endearingly call themselves to honor John C. Bogle, a lifelong champion for ordinary investors and the founder of The Vanguard Group. Bogleheads originally called themselves Vanguard Diehards. They poked fun at themselves in a forum thread titled “You MIGHT BE a … IF“. If you find this funny (as I do), then you’re a Boglehead.

Footnotes:

(1) Listen to Warren Buffett yourself. Skip to the 1:12 mark of the following online video

http://www.youtube.com/watch?v=P-PobeU4Ox0

Hi,Rick, I gave your common sense investing book copies as gift to my relatives and friends in india, they are very excited by reading and learning from your video,s ,but keep asking me how they can get vanguard index funds in india ,as iother indian index funds are charging 1.89% for a simple nifty index funds compared to sir john c. bogle vanguard index funds with er as low as 0.07% to 0.18%?? any idea when vanguard will include indian bogleheads as john c. bogle and your book are in highest demand jhere ,bec. of a coming bull phase due to new prime minister shri Modi who is very growth and reform oriented created a mass optimism in stock market.

I cannot comment about investing in India, but I do wish to point out that Bogleheads are not associated with Vanguard. Rather, they are a self-organized bunch of individuals (open to all!) who all share an admiration for a man who has spent his life trying to help the average investor get a “fair shake.” I also will admit that I share such admiration, but not just of Mr. Bogle, but of this very large collection of individuals—many of whom are very generous sharing their time and wisdom, often anonymously.

I hope someday I will get to visit India and visit the an Indian chapter of the Bogleheads, and hopefully meet you. 🙂

Hi Rick,

Thanks for the wonderful articles. I live in Northern CA, San Jose, and I’m trying to find the Bogelhead group here locally. Do you have a contact person here and can you tell me when the next National Boglehead Conference will be held and the location. Thanks a bunch, Craig

Thanks Craig. Here’s a list of local chapters, although not all are very active.

http://www.bogleheads.org/forum/viewtopic.php?f=9&t=778

Alternatively, you might consider attending the national meeting and meeting many wonderful people. This will be in Philadelphia this October. Here is the announcement:

http://www.bogleheads.org/forum/viewtopic.php?f=10&t=111986

All the best to you!

Rick