This is a step-by-step guide to build an all weather portfolio with stocks, CDs, bonds, and bond funds. The goal is a portfolio of stocks and bonds that will achieve your financial goals—a portfolio that will survive the inevitable turbulent market periods.

This article is a comprehensive step-by-step guide. If you’re not ready for that yet, you might prefer to start with this short overview article: What Makes a Good Investment Portfolio.

Step-by-step instructions to build the all weather portfolio that meets your needs

There is no such thing as a perfect investment portfolio, only the best portfolio for you in your situation. That’s what we’re after. These nine steps will help you plan and build an all weather portfolio:

Time needed: 2 hours

Nine Step Guide To Design and Build an All Weather Portfolio with Stocks and Bonds.

- Set goals. Which goals require money?

- How much money do you need for each?

- When is that money needed?

- Create a realistic saving plan.

- Match broad asset allocations with time horizons for each goal.

- Add your Investment Policy Statement (describes your strategy).

- Choose a mutual fund provider.

- Select low-cost mutual funds that match your strategy.

- Review plan and re-balance annually.

These nine steps are of three types:

- Your personal decisions (Steps 1 – 4).

- Investment strategy decisions (Steps 5 – 6).

- Action-taking (Steps 7 – 9).

The end result has a potentially different allocation of stocks and bonds for every goal—each driven by their time horizon. Yet they share a common set of investments and accounts.

This approach helps you avoid the major pitfalls of unnecessary costs, bad investing behaviors, and the lack of planning. The name, all weather portfolio, implies a plan that you can stick with no matter what the markets are doing.

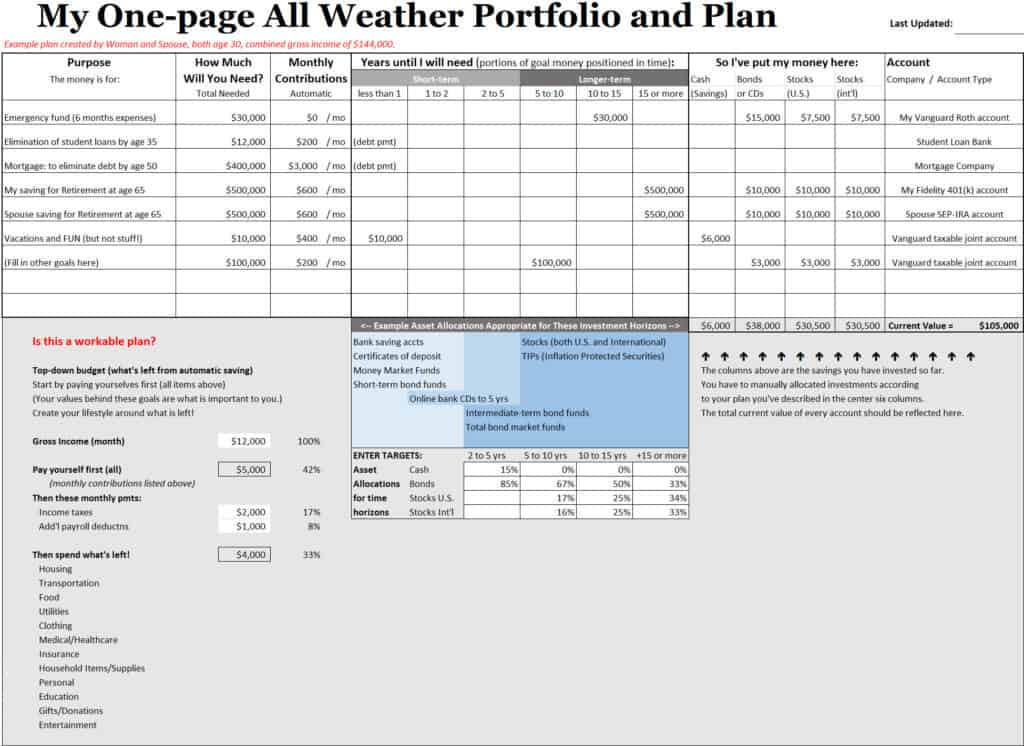

I like to see this all on one side of a sheet of paper—but that is nothing more than personal preference. This comprehensive guide is an educational tool with examples to get you started. Create a plan for all your financial goals with an Excel worksheet you can download (free) and customize. The methodology for developing and managing your investment portfolio uses industry best-practices.

Hopefully you’ll decide you can do this all yourself. But, if you decide you’ll need additional help, this guide will make you a more educated customer so you will pay for only the help you need, and not more.

Make an all weather portfolio to address your biggest investing problems

You will build a plan and learn why a time-proven investing strategy is the best way to achieve your goals. These nine steps will get you there.

The outcome will be simple and give you the highest possible return for your specific situation because you:

- Capture the Market Return at the lowest possible cost with broad diversification using total market index funds.

- Choose an appropriate asset allocation for each of your financial goals to achieve the confidence to stay invested. This is about getting the correct allocation between stocks and bonds and avoid temptations to second-guess your investing decisions.

- Write a plan—no matter how simple—to remind you of your goals and priorities and help keep you on track. It also helps you avoid unnecessary transactions and attempts to “time the market” and predict upcoming short-term changes.

Those 9 steps need to solve two common investor problems:

- you are not capturing your fair share of your investment returns, and

- you lack a simple plan to achieve your financial goals.

Problem 1: You earn far less than the Market (and probably don’t know it).

Problem: most investors earn far less than the Market. Why? More than half the gap is lost to emotion-driven selling. The rest is lost to expenses. This figure shows the dual penalties of costs and investor behavior.1,2

Most investing costs can be easily avoided, and should be. When necessary, investing advice can be purchased at a fair price. But everyone should be aware of where their investments leak away. Some big ones include:

- Wealth management fees

- Fund operating expenses (usually listed as “expense ratio”)

- Hidden costs of mutual funds

- Hidden costs of individual bonds

The other costly penalty is from investor behavior and market timing. It’s hard to keep our emotions from influencing our stock market trading —panic selling after the stock market has taken a plunge, or buying a recent top performer (at a premium) to get in on a good thing.

More subtle behavior problems are when you stop contributing new money in a down market or fail to re-balance because it involves selling something that is growing strong and buying something that is currently out of favor.

Here’s how investing guru Benjamin Graham puts it:3

“The investors’ chief problem—and his worst enemy—is likely to be himself. … In the end, how your investments behave is much less important than how you behave.”

Benjamin Graham

Example: Protect your investments from yourself

Consider Fred, Chuck, and Leslie. They’ve all been faithfully investing 15% of every paycheck.

Fred was aggressive. He chose to invest 100% in stocks, and he wisely chose a broadly diversified low-cost index fund. The stock market began to plummet early in the summer of 2008, and he began worrying. On September 25, presidential candidate John McCain suspended his campaign to fly to Washington, D.C. to address the ominous financial crisis. Fred became afraid that his portfolio was too risky so he traded his 100% stock investment for a more balanced portfolio (60% stocks/40% bonds). It was worth $84,000 that day, down from a peak of $150,000 early that year. It was an emotion-based decision that cost him dearly.

Chuck likes things simple. He hates to stress about financial decisions, so he invested exactly the same amounts on the same days into a balanced fund (60% stocks and 40% bonds). When Fred’s investment was down 44% in late 2008, Chuck’s was down only 31%. He hung on, and despite the ever-present drumbeat of bad news in the news, he never had a bad night’s sleep. His investments were worth $13,000 more than Fred on that sorry day, but have grown to be worth $32,000 more than Fred today (June 2019)—and the difference is growing exponentially.

Simple is nice, but only because doesn’t need the money yet. He has no way to sell some of this fund without selling stocks while they are down. Plus, not everyone has the fortitude of Chuck—confidently holding his balanced fund when it was down 31%. Others might have sold some of their balanced fund for something safer, like Treasury bonds.

Leslie was additionally vulnerable because she had just retired. Her needs for this money were both immediate and long term. Yet, she knew all her short-term needs were covered by the bucket-like categories of an all weather portfolio. In particular, she knew she could easily think of how money for different timeframes was invested.

- 1 to 2 years – cash and bank CDs

- 2 to 5 years – short- and intermediate-term bonds

- 5 to 15 years out – she is conservative with 50% stocks and 50% bonds

- beyond 15 years – her asset allocation stays at 67% stocks + 33% bonds

Seeing how her money is invested for all her short- and long-term goals is psychologically helpful. However, the comfort that knowing that she is ok in all these timeframes might help her stick with the plan, and that is the valuable goal.

We’ll make plans with explicit time horizons like Leslie.

Further, by keeping her stocks and bonds as separate funds she is able to sell bonds and avoid selling stocks during this difficult period.

She achieves a simple, easy-to-understand plan using only three low-cost index funds from her choice of mutual fund companies—a plan that is simply more durable because of the planning process that created it. This results in the confidence to stay the course through market volatility.

Most investors don’t know what they’re missing.

Most investors don’t know they fail to capture the full returns because nobody tells them. Why would any firm tell their client that they are doing worse than the Market? It would either infer that they’ve made bad transaction decisions or that their fund choice was poor.

It’s easier to focus on specific successes and pretend that they can help you to beat the market. They might show their fund doing better than a well-known benchmark like the S&P500—but that would be comparing apples to oranges. The relevant question is: how is the fund doing against a benchmark with the same level of risk? You might attempt to do this with the Morningstar X-ray tool, but it is often a difficult exercise.

Author William Bernstein points out that humans are not-wired to do well at buy and hold investing.4

Learning how to avoid defeating yourself is infinitely more important than knowing how to invest.5

James D. Turner, MD (The Physician Philosopher)

There are very few things that will cost someone more dearly in the world of personal finance than making the “buy high, sell low” mistake.6 A simple low-cost portfolio allows us to stay the course when it is founded in a plan based on your goals and values.

Problem 2: You lack a simple workable plan.

A plan is useful and workable if:

- you understand it

- want to make it work

- can effortlessly remember it at a glance, and

- it will take you where you want to go

Why is a plan important? Because you usually hit what you aim for.

Make it simple. And put it in writing

Your plan almost always needs to be written and, at least for me, it begs to be on one-side of a sheet of paper.

Key Point: It is not permanent. It is useful if it is one of your desired scenarios. You can always change it, or make it a “Plan B”.

The key elements of the plan include your:

- major financial goals you need to save money for.

- realistic saving plan to meet these goals.

- approach to investing (a.k.a. Investment Policy Statement).

- And the marriage of all these with an asset allocation that doesn’t cross your maximum acceptable level of risk-taking.

The old adage still applies:

Failing to plan is to plan to fail.

Put the power of a simple 1-page plan to work for you! You’ll have to learn a few things, but these are the things everyone should be taught in school, but aren’t. It’s not too late. I’ll teach you here.

A simple plan let’s you take control of your finances. I’ll teach you simple rule-of-thumb guidelines and encourage you to do this yourself.

The goal of your all weather portfolio is to decide how much risk you can stand and then assume that risk, but not an ounce more. This is how you will receive the maximum return for you. You will have the fortitude to stick with your plan because each goal in your plan carries the correct amount of risk for when that money is needed.

Example: Reduce financial risk for known spending needs

Sam has another story of being lured into carrying too much investment risk. Growth in the stock market made him think he could retire comfortably. He looked forward to retiring in 2010 and was planning to invest more conservatively then—since he would no longer have an income. Meanwhile, he just wanted to grow that nest egg a little bigger while he could. But the 2008 financial crisis was accompanied with massive layoffs. He got laid off—down-sized, involuntarily retired. His nest egg, that was nearly adequate a year before, was now substantially short of meeting his needs. He tried to get a job for the next two years and eventually just lowered his standard of living to match what he could now afford. It’s not what he had wanted. An all weather portfolio is all about controlling risk so that your short-term needs are well-protected in safe investments.

What is in an investment portfolio?

It is simply all your savings and investments. It includes all your retirement accounts, taxable savings accounts, and real-estate investments.

Key Point: It is the whole portfolio that is important here—not isolated accounts, and not specific investing time horizons.

You make better decisions looking at all your accounts in their entirety—rather than making decisions for each account separately.

- Include all stocks & bonds, but not artwork and other valuables that are not liquid (i.e. not easily sold for full value).

- Include your emergency fund, but you can probably exclude your checkbook account—unless it is holding significantly more than one month’s transactions.

- People have different opinions about whether to include their home and home mortgage. My personal approach has been to not consider my house as an investment asset. This simplification keeps the view of my investments simple and stable which is what I want. Hopefully your house becomes an important asset that you will use and enjoy and may become an important part of your end-of-life medical expenses or estate planning.

An inventory of your current investment portfolio is just one input we’ll use later. First, we need a plan. And we know that sticking to that plan is the hard part for most humans that grapple with both greed and fear.

How is an all weather investment portfolio different?

An all weather portfolio is what we are calling an investment portfolio with special attention to making it easy to stay the course. So, the process of creating it is as important as the result. Elements that help investors to stick with their plans include:

- Making it very personal

- Listing all your important financial goals

- Adopting a saving and investing plan to reach these goals

- Specifying the investing time horizon and risk appropriate for each investing goal

- Creating your personalized investment policy statement

- Using time-proven wisdom to capture investment returns

- Choosing broad diversification at the lowest costs

- Keeping it simple

The investment time horizons—or, when you will need your money—plays a primary role in deciding how much risk you can safely take for each goal.

Your all weather portfolio depicts how much stocks, bonds, or cash for each goal. Experts call this asset allocation. Combining all of these gives you an overall asset allocation, which is always a critical decision. But, building it up from each goal and its investment horizon helps give you confidence. It helps minimize second-guessing and making unnecessary transactions. You can stay the course because your portfolio bears all the risk you want to take for your long-term investing goals, and you’ve removed the risk for savings that you’ll be needing soon.

Growing your investments to meet your needs means continuously adding new savings to your portfolio and not second-guessing your investment strategy.

All-weather portfolios are best with a simple written plan (that you can update and change as life unfolds). But a plan that lives in a drawer doesn’t do the trick. The best plans are kept up-to-date and so simple that you can remember them day-to-day.

Finally, all weather plans strive for the lowest possible costs. That’s because you cannot fully capture the overall stock and bond market returns because of all additional costs. So, while it is ok to pay for the professional advice you might need, these plans are so simple that you should not pay additional wealth management fees that you don’t need.

If you are a do-it-yourselfer (DIYer), then capturing your fair share of Market Returns is as trivial as learning and sticking with the low-cost index funds. If you are not a DIYer—and I know a lot of you absolutely hate dealing with money and investments—then I want you to at least know how to hire the help you need at a fair price.

TIP: Don’t let anyone tell you that achieving the market’s return is average, or mediocre. Or, that with their guidance you are more likely to beat the market. That’s when you should politely say “thank you” and run. We are talking about capturing the Market returns, after costs and without additional risks. It is very easy and possible to do on your own, but the odds fall dramatically when you become attracted to using actively managed funds and wealth managers.

Your all weather portfolio is unique to you

Definition: An all weather portfolio is one that you can stick with regardless of stock-market volatility and depressingly low interest rates. Why would you want to? Because you have correctly chosen the maximum amount of risk that you can tolerate given your plans to use that money. An all-weather portfolio is neither too conservative (i.e. too little growth from too little risk) nor too aggressive (i.e. likely to cause sleepless nights or premature selling).

There is not a single all weather portfolio that applies to everyone. Instead, it refers to the particular portfolio that will best meet your financial goals and when you wish to achieve them. If you had infinite time and were immune to stock market volatility and social persuasion, then you would choose 100% stocks at the lowest possible cost. You don’t, so you shouldn’t.

Your most important investment decisions

What is your most important investment decision?

- Which stocks to buy?

- When to sell?

- Choosing your stock broker?

- How much of your income to save?

- How to allocate your investing between stocks and bonds?

Two of these answers rise to the top.

Key point: Your allocation between stocks and bonds is your most important investment decision.

As you learn how to invest, you’ll discover that your most important decision is the allocation to stocks and bonds in your investment portfolio. But first you have to commit to saving money.

Living below your means and saving a portion of what you earn is even more important than asset allocation for the first half of your career, because small investments are not going to achieve your bigger needs.

Key point: Saving part of every paycheck is your most important habit.

It all starts with saving. Setting aside some of your income to both pay for future years when you’ll have no income plus all other financial goals you may have. Making this a habit is the other important investment decision, because it is totally based on your lifestyle decisions. And, once you are beyond earning enough for subsistence, it is something entirely in your control.

Example: Saving rate more important than investment return

Saving is far more important than your investing rate-of-return for the majority of Americans. That is because most people don’t save very much at all. The dollar amount of investment returns on small amounts is less consequential. This article demonstrates this point for a couple that will need $80,000 per year for living expenses after retirement.

Assume they invest in a stock index fund that gets a total return (dividends and price growth) of 8% per year plus they save and contribute $1,000 into this fund every month. They reach their $1 million goal during year 27. But here’s why I say that saving rate is more important than investing ROI (return on investment):

- Until year 17, their account grows more from their savings (their $1,000 monthly contributions) than from their investment returns.

- Beginning year 18, the contribution from their investment rate of return begins to dominate. Note that it takes nearly two-thirds of the years working towards their goal before this becomes true.

Start your one-page plan and investment portfolio by deciding what your investments need to accomplish.

Step 1: Set goals. Which goals require money?

Choose goals that will bring happiness.

On the surface, it all seems so obvious: We need money to buy the stuff that will make us happy. No, no, and no again. First and foremost, money buys time and autonomy. Secondarily, it buys experiences. Last and least, it buys stuff, and more often than not, the stuff we buy makes us miserable.7

Studies have shown that a higher salary might actually make people happier to some extent, but after some number (between $75,000-$105,000) happiness simply does not increase. Moreover, these studies reveal that it is not material stuff that brings happiness and contentment, but rather experiences.8

James D. Turner, MD, The Physician Philosopher

Getting what you really want.

All your life experiences create for you a good compass that will help you know if you’re on course or off course.

Most people feel lost right about here. “But, I don’t know where I’m going…”

The route Lewis and Clark took to the Pacific Ocean wasn’t a straight line. They had to circumvent mountains, use the rivers, and find supplies. They had a direction. They prepared as best they could. But they didn’t know what they would find.

Life is a quest, after all. A constructive point of view is:

I won’t always know where I’m going—but I can always know whether I’m going in the right direction.

The secret to consuming less and focusing your time and money on those experiences is to have clarity about that direction. Focus on the “Why?”

Personal example: I had no interest in creating financial independence—accumulating money just didn’t grab me. But when I heard Vicki Robin talk about waking up every morning free to spend her time however she chose… WOW, that’s a tremendous value for me! A life-changing moment that I have never forgot.

Here’s the secret takeaway from this guide:

- Use powerful goals that include your values.

- Put them in writing.

- Tell supportive friends.

- Pay yourself first.

What do your investments need to accomplish? What good is money—beyond lifting us from poverty and subsistence living?

Money is a tool that allows us to have the ultimate commodity, which is time. Time to be spent living a meaningful life, however we define that.9

James D. Turner, MD, The Physician Philosopher

Write down goals that you are actively pursuing.

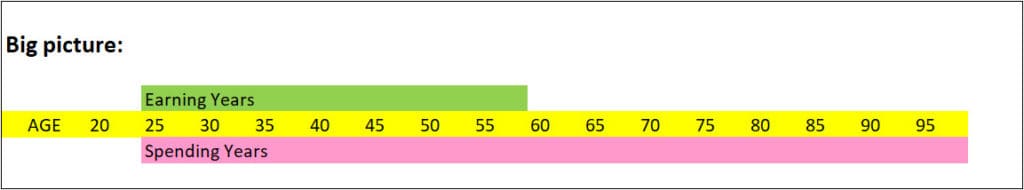

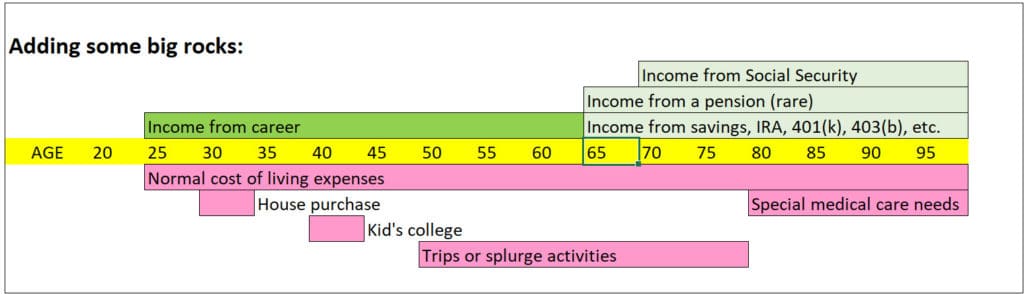

The big picture of financing life is that we typically have 30 years of earning income to pay for 60 years of spending.

Your spending consists of the cost of your lifestyle (you control this!), plus saving and investing for when you will be unemployed in retirement. The big rocks are the identifiable spending that you both need and choose in order to achieve the quality of life and happiness you seek.

Only include goals you are actively pursuing. You can include any financial goal that is important to you, such as paying of debts, saving for a home, taking a vacation, buying into a business, or any other goal that is important to you. Just remember—this isn’t a dream sheet that lists everything you “want to do one day.” These are your actual goals you are working toward.10

Ryan Guina, cashmoneylife.com

Making a simple one-page plan is a huge step towards making a rich and fulfilling life that matches your values. Three important points will help:

First, there is an opportunity to rethink your current lifestyle choices as you identify your bigger goals that will require money. In a wonderful recent book, “How To Think About Money”, authors William J. Bernstein and Jonathan Clements also caution against misguided spending in pursuit of happiness.11

Second, people often want to plan but give-up because they don’t know the future! Don’t get frustrated by what you can’t know. Instead, know that your plan can, and will, change again and again as you encounter new situations. But, a good plan must be realistic and reflect your priorities.

Third, never get hung up with incomplete information. Instead, just write down an assumption and move forward. Improve it later when you have better information. It will start as a rough plan and keep getting better and better.

Are all your goals of equal importance?

It’s no contest. Chronologically, retirement might be our last financial goal, but we should always put it first.12

Jonathan Clements

Travel vacations are nice luxuries, and even paying for your children’s college education, but failing to pay for the last third of your own life (because you will probably no longer be earning an income) can be devastating.

Life happens. The consequences of falling off your plan are not equal for each goal. We all have inevitably periods of unemployment, unplanned spending (e.g. for that car replacement), or other surprises. You can’t have a perfect plan, so don’t even strive for that. There are two main remedies for these natural uncertainties:

- Understand the consequences and your priorities. Having to drive your old car an extra two years is dramatically different than not having enough to be comfortable in retirement. Understanding the relative importance of your goals will help you make good choices. It’s your life. You get to choose your lifestyle and priorities.

- Start early. By starting early, your investments continue to grow while you deal with unplanned gaps of income. This simple video illustrates with an example.

Step 2: How much money will you need for each?

Relax! Just get in the ballpark. Make an estimate and keep moving forward. Keep it simple. Keep everything in today’s dollars.

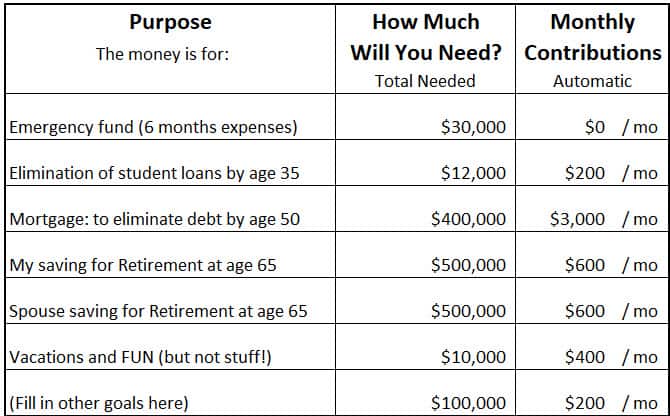

Joan actually has four goals she is saving for, and these are her quick first-guesses about what she needs to save for them:

Retirement

She wants retirement income of $20K/yr plus her Social Security benefit.

She has $200,000, is 46 years old, will need $500,000 in 20 years,

and will get there by saving and investing $625/month.

Down-payment for House purchase

She has $50,000,

will need $50,000 to $100,000 sometime soon,

and will continue to save $500 /month until the purchase.

After the house purchase, her rent payments will become mortgage payments and this monthly saving for the down payment will divert to a capital improvements account.

Annual Splurge trips and vacations

She has $3,000, but wants about $3,000 to $4,000 every year.

She plays to use the money that currently goes towards her student loans.

Elimination of debt

She has no high-interest credit card debt and is paying off her student loans $375 /month. Beginning next year the loan will be paid and those payments will fund her travel vacations.

She is currently saving $625 + $500 + $375 = $1,500 from her monthly paychecks. This is 25% of her gross earnings of $6,000 /month.

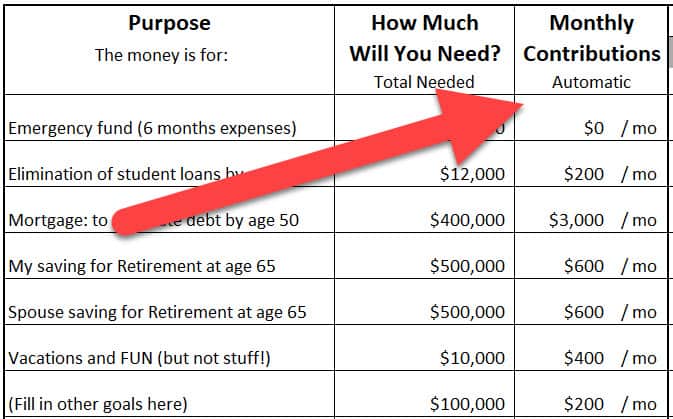

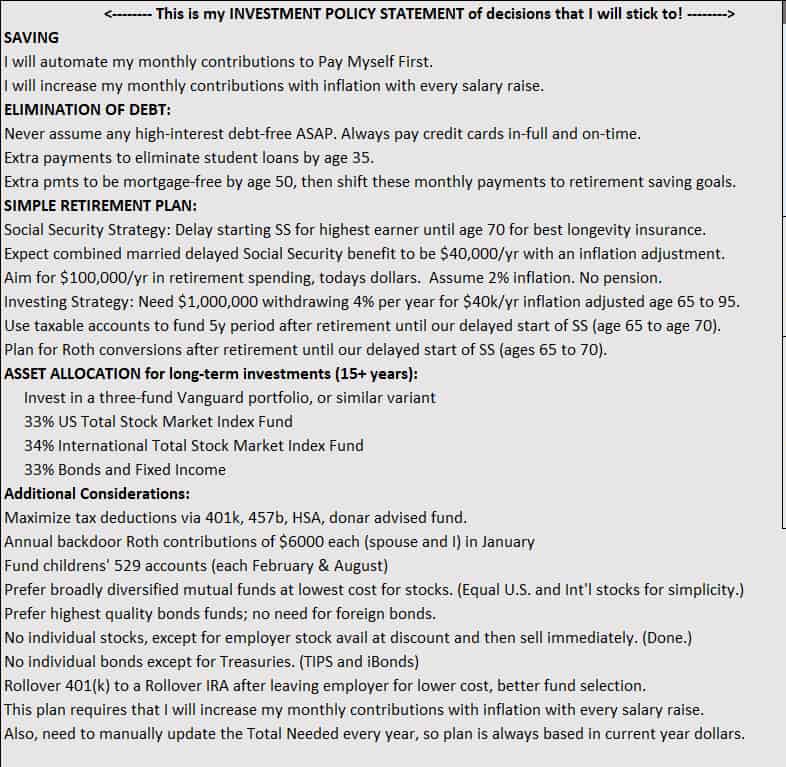

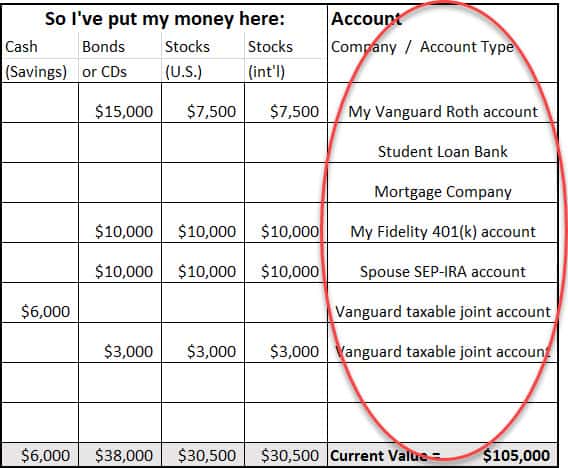

This figure shows you a peek at where we are going. It is a simple 1-page plan that builds an all weather portfolio. This template will shortly be released and available as a PDF here or download the Excel Spreadsheet here.

Your first thoughts should be about goals and monthly contributions. Can you make this work? Are you sure of your priorities? What percentage of your monthly pre-tax earnings do these add up to? What is the implied budget? How much of your saving are you prepared to automate? What are your reservations?

So far, your plan is just work-in-progress. Look at this again after you’ve completed all steps.

A simple retirement plan goes a very long ways!

Financing our retirement is a big challenge. We need to figure out how to pay for a retirement of uncertain length.

On Living Long: If we have young children or a spouse who doesn’t work, our death could cause major financial problems for our family, which is why we need life insurance. But as the kids grow up and leave home, and as we amass more savings, the financial repercussions of our death become less severe. Instead, as we head toward retirement, we have to grapple with the opposite problem. The risk is no longer that we will die and leave our family in the lurch. Instead the big financial risk is that we’ll live longer than we ever imagined—and run out of money before we run out of breadth.13

Jonathan Clements

Further, we don’t know whether our health will end in a cliff, or a 10-year decline requiring expensive nursing home or medical care.

Don’t aim for precision! Instead, start with one plausible scenario and what it would take to make it happen.

“The name of the game is to accumulate around 12 years of living expenses, which combined with Social Security should provide for a reasonable retirement. How did I arrive at 12 years of living expenses? The average person needs to accumulate about twenty-five years of living expenses, and I’m assuming you’ll be getting about half of that from Social Security.”14

William J. Bernstein

Estimate how much you need to save for retirement in 3 steps:

1) Estimate the annual living expenses you will need in retirement

2) Subtract the Social Security or pension benefits you will need in retirement

3) From the result, calculate the nest egg you will require by dividing by your withdrawal rate

TIP: The 4% Withdrawal Rate: this is a good target. A 4% inflation-adjusted wirhdrawal rate, from a portfolio with 2/3 stocks and 1/3 bonds, has a very good probability of lasting for 30 years.15

Example: Couple wants rough estimate of their retirement needs.

- They want $80,000 /yr for living expenses beginning age 65.

- They estimate his Social Security benefit will be $20,000 / yr.

- They estimate her Social Security benefit will be $10,000 / yr.

- They use the guideline that a 4% withdrawal rate can cover about 30 years — or roughly ages 65 through 95.

($80,000 – $20,000 – $10,000) / 4% = $50,000 / 4% = $2,000,000

This is thinking about our future needs in today’s dollars. Forty years of inflation will mean that money will actually cover less than half of our living expenses at that time. We’ll adjust for that in the next section — so far we’re on the right track.

Read Bernstein’s full description of the five hurdles that make the particularly challenging if his book “If You Can”. Because of his generosity, you can get a free copy here (PDF) or order the paperback from Amazon.

Example: Couple delays social security benefit

For many Americans, there is a better solution than relying on early Social Security benefits and then amassing a large nest egg that will last until age 95 or 100, plus allowing for an expensive care in their last years (in a special memory care unit or skilled nursing facility).

The better solution is for one or both in a couple to delay Social Security benefits until age 70. This provides a much larger monthly benefit that includes a cost-of-living adjustment for as long as you live. It is longevity insurance. You get the benefit if you live a long life. The cost of this approach is replacing the Social Security benefit for the five years that you delay starting. This simple example illustrates the math:

- Example: Healthy couple need $100K / yr for living expenses

- The both retire at age 66 and want a plan to age 96

- Using the 4% Rule-of Thumb: they can withdraw an inflation-adjusted 4% per year for thirty years.

- SSA.gov tells them they each get $2500 / month benefit at age 66

which is a combined benefit of $60K / year, or - SSA.gov tells them they can each get $3300 / month benefit starting age 70

which is a combined benefit of about $80K / year.

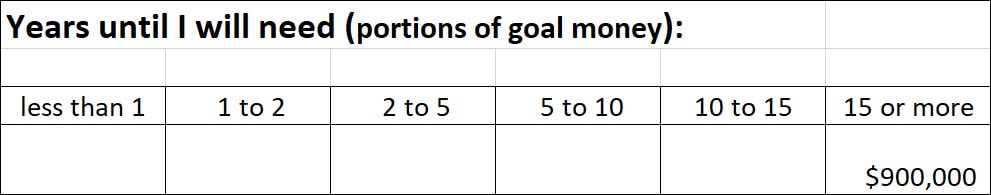

Would their required retirement savings be different if they delay Social Security?

- The nest egg they would need they they start SS at age 66 would be

(100 – 60) / 4% = $1 million for 30 years ages 66 – 96.

Each year they would get $60K from SS plus withdraw an inflation-adjusted $40K from their savings. - But if they delay the start of benefits until age 70, the required nest egg is smaller: (100 – 80) / 4% plus ($100K * 4 delayed years)

= $20K / 4% + $400K = $500K + $400K = $900K nest egg at age 66.- Note: all elements include cost of living adjustments

- Note: The larger SS continues as longevity insurance

- Note: more years to do Roth Conversions (years between retirement and Social Security).

Conclusion: This healthy couple elects to delay starting their Social Security benefits until age 70. Their required nest egg becomes slightly smaller and they are financially more secure in the event of long lives.

TIP: Sign up a ssa.gov and get familiar with your own Social Security benefit, and verify their records of your earning history.

Step 3: When will you need the money?

This refers to your investing timeframe, your investment horizon.

One definition of risk is the uncertainty whether your money will be there when you need it. Eliminate this risk by gradually moving money allocated for a need towards safety as that day approaches — away from the stock market volatility and towards fixed-income (bonds) and then your bank savings account (or a money market fund).

Let’s return to our all weather portfolio planning template and incorporate this concept. This time perspective is necessary so that in later steps you can invest properly for each goal. Later, you will put money you will need this year safely in the bank and invest money you need to grow into riskier investments.

Example: One-time needs and far-away needs

A one-time need is an explicit goal on your plan. Examples might be:

- Events, like saving for a wedding, honeymoon, or travel

- Purchases, like a home, boat, or special musical instrument

- Retirement (or, for aggressive savers, early retirement)

The couple in the previous example, both at age 45, figured they needed $100,000 living expenses for retired ages 66 -69, plus $20,000 /year on top of their delayed Social Security benefits starting at age 70. On their one-page planning sheet their retirement goal looks like this:

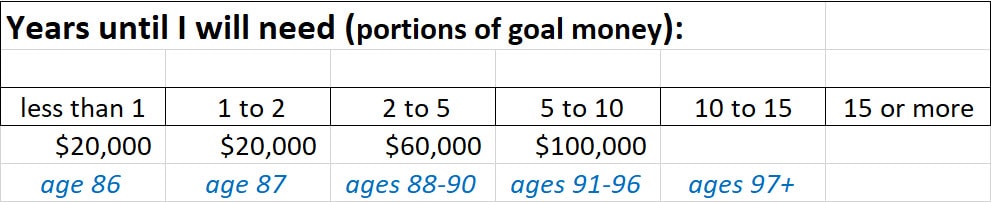

Example: Money needed over multiple years

At age 65, this same couple is particularly vulnerable to a market downturn for the next four years before their Social Security benefits start. has met their retirement saving goal and might summarize their need like this:

At age 85, they might categorize their remaining retirement money needs like this:

The net effect is a gradual shift towards risk-free assets. There is no magic rate to achieve this, but the slow drift avoids the risk of having to do a large stock-to-bond allocation shift at an inconvenient time (e.g. the stock market is in the tank).

Caution from personal experience: You are not in complete control of when you retire. I got downsized before I was 50 and this essentially ended my prime earning years. (Fortunately, by then I had saved plenty.)

Step 4: What savings rate would get you there?

A plan is workable if you have some idea of how much you need for each goal, which goals are most important, how long until you need that money, how much you need to save from every paycheck to achieve each, and you are willing to commit to that plan. It might look something like this:

The open question is whether your savings rate will get you to the amount you need in that timeframe. Our goals that need big money need the growth that comes from investing—the miracle of compound interest. The next important work will be to make some investment choices — we call this asset allocation — to make the portfolio one that you can stick with.

It is never easy. Common mistakes are to:

- ignore the impact of inflation

- overestimate your investment returns

- invest in individual stocks (they have uncompensated risk )

Next, I’ll give you a calculator tool to help estimate your required saving rate for each of your goals.

Estimate your rate of return and your required saving rates

If you want a plan that would support you living on $80,000 per year beginning in 40 years, you really mean $80,000 in today’s dollars—because inflation is likely to make that amount worth less than $36,000 in the future. The best and easiest way to think of everything is in today’s dollars. The adjustment you need to make is to come up with growth estimates for stocks and bonds that are inflation adjusted.

- Without the inflation adjustment, the rates of return

are called normal rates of return. - After inflation is accounted for, the rates of return

are called real rates of return.

Historically: What’s the real average Stock market return?

All the books tell you the average stock market return was around 10 to 12% over the last century. While true, it’s misleading. The much way is to find the “annualized” growth factor and then adjust for inflation. That’s called The Compound Annual Growth Rate (CAGR) and will provide the smooth exponential growth rate representing the total returns over that time period (including dividends). It’s a smaller number, an it doesn’t account for inflation. Adjusted for inflation, the value in today’s dollars drops to 6.53% — and that’s before any costs or fees.16

If you think the future is likely to be similarly excellent for stock holders, then you should use this factor to decide what saving rate will get you to your goal.

Forward-looking: Good long-term real return expectations

William Bernstein emphasizes that nobody can predict short-term market changes, but history aids us in making some good long-term expectations. In his free ebook “If You Can” , Bernstein estimates the real return for these major assets classes:17

- The total U.S. Stock Market: 3.5% / year (real return)

- The total foreign Stock Market: 4.5% / year (real return)

- The total U.S. bond market (mostly Treasuries): 1.4% / yr (real return)

He proposes a 3-fund portfolio evenly divided among these three major asset classes. This would make the return of the portfolio

- The portfolio return would be: 3.1% / year (real return) before any investing costs or fees.

You need to estimate, precisely because you cannot predict the short-term market movements. Nobody can. But you can apply solid judgement about long-term market returns and combine that with what you know about your own risk tolerance.

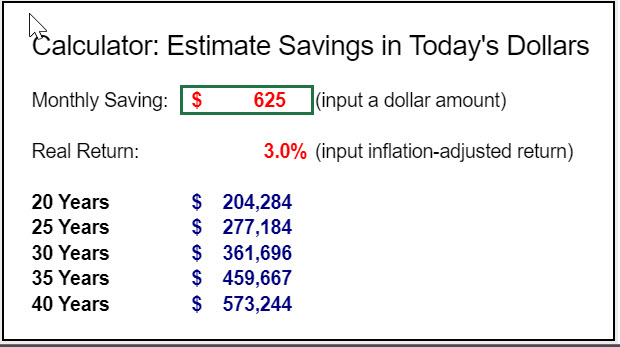

In his example, saving and investing $625 from every monthly paycheck for 40 years will grow to the equivalent of about $573,000 in today’s dollars.

Use this calculator to modify the real return if you have a different view of what you can achieve for your long-term investments and verify that your saving rate is enough to achieve your goals.

Your monthly saving is constantly in today’s dollars. That makes it easy. It means that in ten years you’ll be contributing an inflation-adjusted (larger) amount—in that years’s dollars—that would have the equivalent value in today’s dollars.

Adjust until reasonable

Look at your plan—your goals—and what you value most dearly.

Are you taking care of yourself? Do you pay yourself first? Author David Bach uses this expression to encourage you to spend the first hour of every workday working for your self. One hour of an eight-hour workday would be an easy way to justify saving 1/8 = 12% of your gross pay — for yourself.18

You can do this. You’re richer than you think.

The truth is your ship is right here, right under your feet. You’re standing on the deck. It has already set sail. And you’re the captain.

David Bach

It’s hard to get a plan to work, but it’s not realistic until it is. You could:

- rethink your priorities,

- find ways to save more,

- plan to earn a higher income and dedicate those increases towards enhancing your saving rate.

A workable plan could even start with the plan get yourself on plan. It is having no plan that is a problem. It is never too late to start.

Don’t budget—make it automatic.

There’s a trick to make this work.19

If you have to write a check every week to make your savings plan work, it just won’t happen… It’s human nature. The idea of a personal budget sounds sensible, in theory, but in the real world, it doesn’t work… Cause they’re no fun, that’s why!

David Bach

Even the government wants to make this work for you, so they set up a pretax retirement account called a 401(k). There are other types, too—IRA, self-employment plan (SEP) IRA, and so forth… but they all boil down to the same thing: a place where you can pay yourself first, automatically, before your income is taxed.

If your savings all add up to a manageable amount and these goals reflect your priorities, then you can set up automated investing and, rather than detail budgeting, you simply spend what is left.

TIP: With automatic payroll deductions, you never see (and never miss) that money you are saving. You save first and spend what is left. That is way simpler than budgeting! and accomplishes the goals you’ve established for yourself.

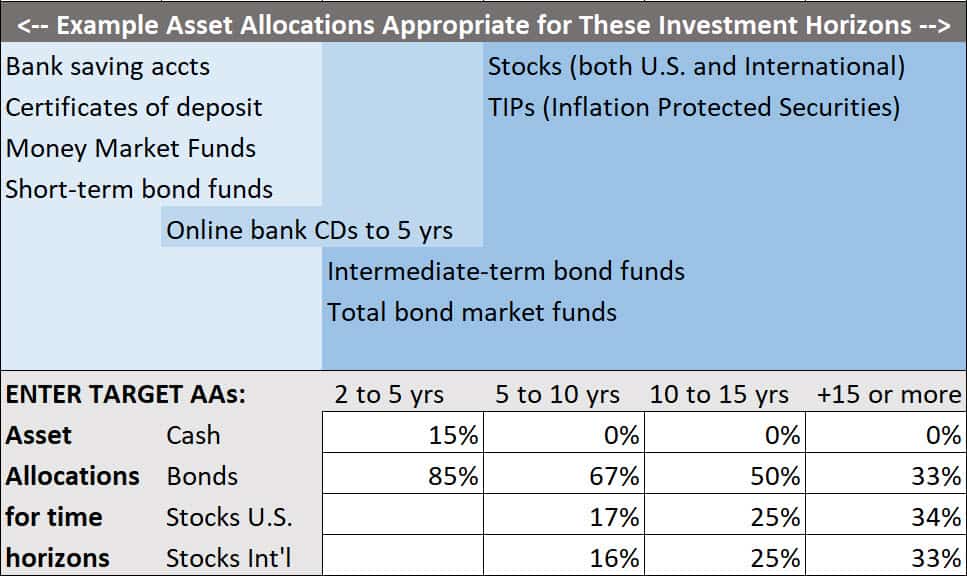

Step 5: Match broad asset allocations with investment time horizon for each goal.

Earlier, in Step 3, you saw how the one-page planning template suggests some reasonable types of investments appropriate for each time horizon.

You might know the guideline: Own your age in bonds. This results in a gradual and increasingly conservative allocation to bonds, bond funds, certificates of deposit, money market funds, and other fixed income securities, as you age. The 1-page template for planning your all-weather portfolio accomplishes a similar reduction in risk as you age but the asset allocation is driven by your needs and investing horizons for each goal rather than solely by age.

By matching your stocks/bonds allocation more closely with your needs, rather than simply your age, you might have more conviction to stick with your plan when the markets get stormy.

Long investing horizons use stock market

The stock market provides greater returns at the cost of greater volatility. It’s your best choice for growth towards your long-term goals.

This planning template is based on a 3-fund portfolio model comprised of risky assets (stocks) and riskfree assets (cash, CDs, bond funds), with a separate asset allocation for each goal.

The default long-term portfolio is the three-fund portfolio with equal weightings (67% in total stock market index funds):

- 1/3 – Total U.S. Stocks Market Index Fund

- 1/3 – Total International Stock Market Index Fund

- 1/3 – Total U.S. Bond Market Index Fund (mostly gvmt bonds)

If you are young with solid employment, you might consider a more aggressive allocation for your long-term goals with 80% in total stock market index funds and 20% in U.S. bond index fund.

Have an alternate way to create your portfolio? That’s fine. There’s nothing wrong with looking at all your money as one big account, even though there are different goals. This uses one asset allocation for each goal, but lots of people don’t. Many roads to Rome.

Separating investing horizons into categories (or buckets) helps people who don’t have a basis for deciding whether to

- own their age in bonds,

- own your age minus 10,

- own you age minus 20

- or any other rationale for making the important stock/bonds allocation.

Hopefully, this process of using the time horizon is comforting way to know that all goals are safe and secure, and you have every incentive to not tinker with your investments.

Whether you use a rule-of-thumb guideline, a risk tolerance questionaire, or investing horizons for each goal is much less important than choosing a method and then sticking with it.

Short investing horizons need the safety of fixed-income investments (e.g. bonds and money markets)

The default planning template gradually incorporates more stocks over years 5 to 15. You can change this. It’s an Excel spreadsheet.

When your investment horizon is short, use a money market or a savings account when you need to use the money soon. Online banks often have better interest rates and you can set up electronic transfers of money to your checking account for convenience. These type of accounts don’t fluctuate with the stock market or interest rates. They are FDIC-insured, or nearly as safe.

Planning with investment horizons does not require precision, and you can always change them later. Instead, strive for realistic scenarios that you could select. Time is what helps you achieve some of these goals, so if you cannot make the first pass work, consider contributing less each month and taking longer to save towards your goals. Use placeholder estimates for when you will retire, how long you might live, etc.

TIP: Any plan is better than no plan. If you revisit it every year, I guarantee it will get better with time.

An all weather portfolio is the right mix and lowest cost

An all weather portfolio is simply this: broadly diversified stocks, high-quality bonds and cash—in the right proportion and the lowest possible costs.

This guide puts the label of all weather portfolio on the portfolio that best meets all of your risk and return objectives—and these vary with your various financial goals and their time-frames. The best portfolio has the highest return for as much risk as you can stick with, and not an ounce more. It attempts to avoid the dual penalties of costs and investor behavior.

Step 6: Incorporate a simple Investment Policy Statement (IPS)

Write an investment policy statement to add the strategy to the goals and investing time horizons. A quick analogy will help you grasp what your investment policy statement is.

Analogy: An IPS is like preparing for a mountain climb.

Imagine this: your lifelong goal is to climb Mt. Grande. Tomorrow is your attempt. Eating well will be necessary. Your current activity is buying breakfast food for your friends climbing together.

Further, imagine the grocery store. There are six super-friendly salespeople on the cereal isle, another six in the meat section, another six in dairy, and another six in the produce area. All get paid on commission. All are opinionated and can be very compelling.

It helps to know what you want. The easiest way to get past these 24 salespeople is to have a short shopping list that reminds you what the team agreed they need:

- Old fashioned rolled oats

- Eggs

- Bacon

- Fresh Fruit

That’s what an Investment Policy Statement (IPS) is—a short reminder of what to buy so that you don’t come home with fancy packaging and prepared foods that you don’t want or need to fuel your mountain climb ahead.

I like to see everything at a glance. I also want to show you that an IPS doesn’t need to be complicated. You can learn more about creating your Investment Policy Statement, and see IPS examples from others, at these links.

Benefits of an Investment Policy Statement

The whole idea of a simple written policy of your investment goals and objectives, is to help you stay on track regardless of what the markets are doing.

A trillion dollar industry thrives on making investors believe investing is complicated—too complicated to manage without their help. Having a written Investment Policy Statement will save you a lot of time, money, and energy.

When you are investing every month, you want this to be a routine process. Your ISP will act as a guide to follow regardless of what is happening in the stock markets or other current events. You simply refer to the guidelines you previously created, and follow the steps you already decided you would take.

Separate your decision making from your action taking

With investing, this means you don’t need to recreate the wheel each time you make a contribution to your 401k, IRA, or brokerage account. You don’t need to sit through half an hour of stock analysis of portfolio balancing before deciding to buy a stock or mutual fund. You have already made your decisions. Your IPS is there to follow.

Rayn Guina, cashmoneylife.com

But here is the key: You should separate these two actions. The best time to make decisions is when you have a clear mind and aren’t under any pressure. Trying to couple investment research and analysis when you are trying to make an investment decision often leads to overwhelm. Take the time to document your Investment Policy Statement and the heavy lifting is already done. You just need to take action and adjust accordingly.20

Solidify your strategy

Not only do you want to separate your decision making from your action taking, you want to solidify your strategy into one you can stick to—your lifelong plan. I will tell you the essence and introduce you to world renown experts so you can hear this advice from them directly (in videos). It is straight forward and simple—but not easy, because humans are vulnerable to noise from media, and marketing pressures from the financial services industry.

But word to the wise: that industry wants to move some of your money into their wallets and it might take you some time to recognize that the essence is actually as simple as I portray here. In short, I will be describing what others might call:

- Boglehead investing, or

- Low-cost Index fund investing, or

- Passive investing, or

- Buy-and-hold strategies (when this refers to low-cost total market index funds)

Equally important, is that you know it is not:

- Picking individual stocks

- Actively managed mutual funds / hedge funds

- Speculating in commodities or precious metals

- FOREX (currency trading)

- Cryptocurrencies

John Bogle gives us a colorful way to achieve broad diversification. The solution is both simple and low-cost:

Don’t look for the needle in the haystack. Buy the whole haystack.21

John C. Bogle

Asset classes to invest in (and which to avoid)

- U.S. Total Stock Market

- International Total Stock Market

- Treasury Bonds, TIPS

- Only highest quality U.S. Corporate Bonds

You can accomplish this with one fund, or two funds, or many funds. But, my favorite approach is to use three funds for these advantages. Step 8 lists some specific example funds to consider at Vanguard, Fidelity, and Schwab.

Asset allocation targets

The stocks/bonds ratio is the biggest factor that determines your expected return. But this ratio also determines your risk, or portfolio volatility. Accept all the risk you can bear, but not more. Because your goal is to buy and hold—no second-guessing.

A greater expected return requires greater investment risk, but the opposite is not true. There are many ways you can take greater investment risk and not be compensated for it.

If you seek the greatest return for unit of risk, you will choose the Market Portfolio. If your investment horizon requires something more conservative, then mix this with a risk-free alternative.

A simple approach for 15+ years out would be equal weightings of U.S. stocks, International stocks, and U.S. bonds (1/3, 1/3, 1/3). This would be easy to keep balanced because differences are visible at a glance.

For 10 to 15 years out, you might pull this in to equal weighting of stocks and bonds, or (1/4, 1/4, 1/2).

Investments for 5 to 10 years out should have even less exposure to stocks, maybe (1/6, 1/6, 2/3).

Investments for money needed within 5 years should not have any stock market risk.

No universal best asset allocation

There is no universally best asset allocation. The idea of a best asset allocation for all investors was called The All Weather Portfolio by Ray Dalio and made famous by Tony Robbins. In this guest post by Kathryn Cicoletti, she kindly dismisses this idea, emphasizing that there is no such thing as Portfolio Nirvana.

No speculating in gold or other non-productive assets

What about alternative investments, like Gold and Commodities? Nope. Here’s how Jonathan Clements (personal finance writer, Wall Street Journal) puts it:

I would argue that most investors do not need alternative investments. I mean, the reason you buy alternative investments more than anything, is to provide something that will do well when stocks don’t. But we already have an asset that we know is going to perform well when stocks don’t and that is high quality bonds. If you want great long-term returns, you put your money in the stock market. If you worry about what’s going to happen when stocks turn lower, you include some bonds, it’s as simple as that. And the easiest way to get those, that exposure is with low cost index funds so that you capture as much of the markets return as possible.22

Jonathan Clements interviewed by Jim Dahle in podcast 105

John Bogle and Warren Buffett both distinguish investing in businesses from speculating in gold or other non-productive assets.

What about real estate? Sometimes. Note that the total market already has an allocation to real estate through the publicly traded companies like Public Storage. And if you own your own home, then you have additional exposure to this asset class. Some people like even more exposure by using it as a productive asset for rental income or farming.

Tax considerations and types of accounts to use

Most of your short-term goals you may use a simple taxable account, sometimes called a brokerage account.

Now, nobody actually calls it a “taxable account”. But that’s what any brokerage or mutual fund account is that isn’t in some type of retirement plan (Roth, IRA, 401k, etc.).

For your retirement goals you have two additional choices: tax-deferred accounts (like IRA, 401k, 403b, etc.) where you defer paying income taxes on money you invest until you eventually withdraw it in retirement. This is a benefit for most people because they avoid paying the high tax rate during their peak earning years and then pay in retirement when their tax bracket is lower.

The other retirement choice is a Roth IRA which is a tax-free account. Here you earn income, pay taxes on that income, and then invest the balance into your account that will be forever tax free. This is an ideal investment during years your tax bracket is less than you peak-earning years.

Get familiar with tax costs because you can control them. I find this order of prioritizing your investing helpful:

- Repay Debt (especially high-interest debt)

- 401(k) Employer Match

- Roth IRA if still early in career; not at peak earning

- Health Savings Account (HSA)

- Max your 401(k), or 403(b), etc.

- Save in taxable brokerage account

Employer tax-deferred retirement programs vary widely. If there is a company match for your contribution, you should at least take advantage of that. Sometimes, there are few good fund choices (actively managed or high expense-ratio), but use those. If the only low-cost index fund in your 401k is the S&P500, then use that and plan to improve it in a Rollover IRA after you change jobs or retire.

Step 7: Choose a mutual fund provider.

It’s in your best interest to move towards lowest cost and the fewest number of accounts. Firms are in one of these general categories:

- A mutual fund company (e.g. Vanguard or Fidelity)

- A discount brokerage firm (e.g. Schwab)

- A full service brokerage firm.

Vanguard and TIAA-CREF rise to the top because they have outstanding products based on a not-or-profit model.23

Fidelity is an excellent choice but you must be judicious to select their low-cost index funds–which I consider to be equivalent to Vanguard. Their website and customer service are both superb.

A full service brokerage firm might seem like an attractive choice since they will offer you a plan. This is generally not your best choice because of the cost. A better path would be to get a professional plan and pay for just that, not continue to pay an ongoing percentage of your wealth. Advice only. Further, these firms are usually not “fiduciary” firms, which means that they are not obligated to make decisions in your best interest. The typical conflict of interest results in them recommending funds that give them a commission either directly or indirectly. A.G. Edwards is an example of one of these many firms.

Don’t confuse a salesman with a financial advisor. Most of these do not have “fiduciary” responsibility, meaning they are not obligated to make decisions that are in your best interest. If they are recommending investments for you, there are many incentives at work. They earn money in commissions and other hidden ways, over and above what you pay them.

Further, they make investing appear far more complicated than it is—which makes you feel small and powerless and that you need and are grateful for their ongoing advice.

I encourage you to seek the help that you need, pay a fair amount for unbiased advice, but then make the investments yourself. Cut the extra fees. Take control of your finances. Know what you are investing in why.

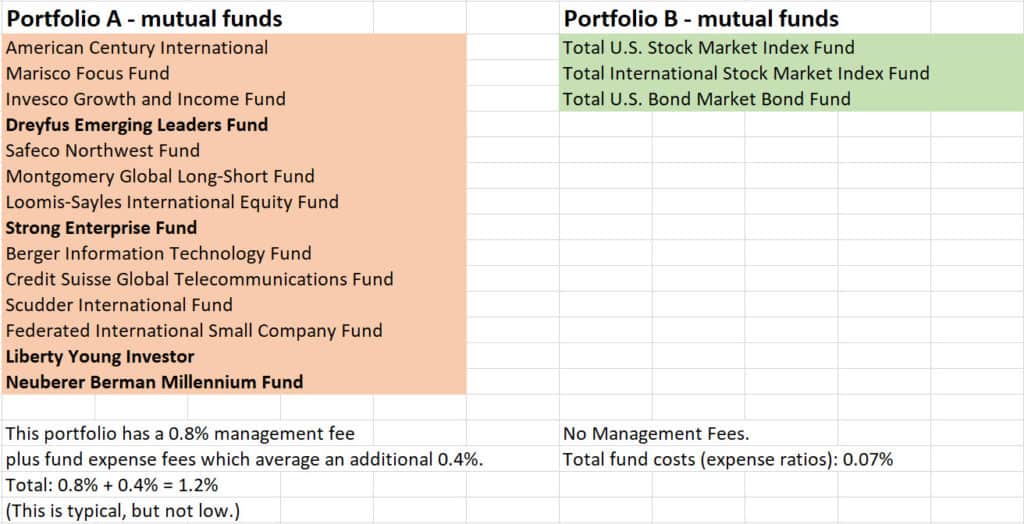

Consider these two portfolios in Figure 13. Portfolio A comes from a Schwab advertisement. Portfolio B is what this guide is advocating.

Portfolio A might be an example of how a wealth manager invests your money. Ask yourself:

- What do you actually own? The fund names, designed with some marketing intent, include an Enterprise Fund, an Emerging Leaders Fund, a Young Investor Fund, and a Millennium Fund.

- How much is in stocks? What kind of stocks?

- Do the funds overlap?

- Are they U.S.? or foreign?

- How much is in bonds? What kind of bonds?

- What are the management fees? And the annual fund costs?

As it turns out, the funds in Portfolio A all had spectacular prior year performance (appealing to our greed) and all came crashing down the following year.24 Yesterday’s winners are often tomorrow’s losers.

Portfolio B might is an example of a 3-fund portfolio which attempts to fully capture the market return at rock-bottom costs and a bond portion to control the amount of investment risk to match the investor’s situation.

- You know at a glance exactly what you own (the total market).

- It took you only a minute to verify that these funds are the lowest possible cost.

- You know at a glance the bond fund and you only need to learn about it once.

Is it not obvious which path puts you in control of your investments?

Consolidate accounts, banks, and brokerage houses

Spreading your money around with various banks and brokerage houses can happen over time. It makes life more difficult, and that robs you of time you could spend on more fulfilling things. Make sure you have a solid justification if your portfolio includes more than one brokerage with excellent mutual funds and one bank for depositing checks and paying bills.

The one-page planning template reminds you whether you need to work on simplifying.

TIP: It is false to think that you are safer to spread your investments among different brokers companies. You are making life difficult for yourself

- Managing the accounts becomes much more difficult because you cannot see the overview.

- Taxes become more difficult because you have entries from every fund at every account at every brokerage.

- Investing is more expensive if you have additional transaction costs, additional account fees, and higher fund costs when you don’t have enough for their most advantageous rates.

- Eventually, sorry to say, every one of us will reach the stage where we cannot handle our financial matters and need to rely on help. Simplify now and make the transition to your future easy as well.

Vanguard – whenever I help friends and family I get them to use Vanguard. When there are reasons they cannot, then I always suggest using Vanguard’s fund costs as the benchmark cost (expense ratio) for what to strive for.

Fidelity – I think equally highly of Fidelity as long as you stick to their low cost index funds. Don’t be overly swayed by the fact that Fidelity is advertising no cost mutual funds now (although those are probably the ones you will want). Their customer service is outstanding and they have a lot of local offices you can visit for face-to-face service.

Consider advantages to roll over 401k to traditional IRA accounts.

Avoid splintered accounts left over from prior employer programs. Keep in mind that when you leave, you can either keep that account or “roll it over” to one at Vanguard, Fidelity, or another place you might choose–and there are some very good advantages for you to do that.

Employer retirement programs like 401k programs vary widely in quality. By design, they offer a limited number of choices to employees, and the fund selection ranges from excellent to awful. Sometimes there are additional annual administrative charges.

If you change employers, or retire, then you have the ability to convert (or “roll”) this into a regular self-managed Individual Retirement Account (IRA).

Important point: this is something they do for you. For instance, if you want to roll over your 401(k) to Fidelity, Fidelity will handle all of the paperwork for you. It must be done this way so that it maintains its tax advantaged status and does not prematurely become a taxable event for you. It is very easy. You sign their form which gives them permission to do this, and how you want the money invested when it arrives.

Author Mike Piper (I highly recommend his books and blog articles) explains the reasons why it’s usually preferable to roll over, some situations when it is not, plus how and where to do it:25

- Advantages of rolling 401(k) to a Rollover IRA:

- Better fund choices in an IRA

- Lower fees in an IRA

- Roth 401(k) Rollover to avoid required minimum distributions (RMDs)

- Special considerations to maintain your 401(k) program:

- Retiring early?

- Planning a Roth conversion?

- Your 401(k) includes employer stock?

Step 8: Select low cost investments to fulfill your asset allocation.

This is easy, unless your 401k (or similar) doesn’t have these basic building block funds. And if not, you should probably use the closest funds they do offer.

Diversification is important in investing because it leads to the greatest returns for the risk. The three fund portfolio we have alluded to in this guide includes the total U.S. stock market, some exposure to the total international stock market, and then a fixed-income portion.

Diversification is not important in the fixed-income portion if you stay with U.S. Treasuries and FDIC-insured investments. This portion of your portfolio is for safety and stability, and you cannot get safer than that.

Ticker symbols for appropriate index funds from several major fund families:

- Vanguard: VTSMX, VGTSX, VBMFX

- Fidelity: FSTMX, FSGDX, FBIDX

- Schwab: SWTSX, SWISX, SWLBX

- TIAA-CREF: TINRX, TRIEX, TRILX

Types of funds: mutual funds and ETFs.

An ETF is a basket of stocks, just like a mutual fund, but you trade it like a stock. That means you buy/sell it at an auction and the price can move minute to minute. There is no advantage to this. In fact, there is usually a trading cost and this makes it a poor choice if you are investing from every paycheck.

For occasional buy-and-hold purchases ETFs are fine. Vanguard is unique in that they have ETFs that are exactly the same as their mutual fund versions. Since I don’t make monthly transactions, and I prefer a Vanguard fund to the Fidelity mutual fund offerings, I can simply buy the Vanguard ETF from my Fidelity account.

If your money is at a different firm, you can access Vanguard ETFs (e.g., VTI, VXUS, and BND, or the equivalents).

If you do need to consider owning an ETF, the liquidity of the fund is an added consideration. The best advice is to only consider the large ones. They should have more than $100 million in assets and an average daily trading volume in excess of $5 million.26

Occasionally I need to rebalance my stocks and bonds. This is particularly easy if you can do it within a tax-deferred account (so it doesn’t become a taxable event) by merely exchanging one mutual fund for the equivalent value of another.

Three fund portfolios

The goal is broad diversification at the lowest possible costs. This is efficiently done with several low-cost index funds. When you add the objective of simplicity, many settle on a three-fund portfolio:

Advantages of the three-fund index portfolio27

- Diversification. Over 10,000 world-wide securities.

- Contains every style and cap-size.

- Very low cost.

- Very tax-efficient.

- No manager risk.

- No style drift.

- No overlap.

- Low turnover.

- Avoids “front running.”

- Easy to rebalance.

- Never under-performs the market (less worry).

- Mathematically certain to out-perform most investors.

- Simplicity

— Taylor Larimore, co-author, The Boglehead’s Guide to the Three-Fund Portfolio

This all weather portfolio isn’t a magical construct, it is simply an additional planning process, or tool, to help you avoid the dual penalties of cost and behavior. At the end of the day, you might have arrived at the same desired portfolio from a different direction.

Some might prefer a handful of low-cost index funds. Others choose the simplicity of an all-in-one fund.

A three- or four-fund portfolio involves a do-it-yourself aspect that makes it more complicated than using an all-in-one fund. For example, because different assets grow at different rates, any investor who chooses a do-it-yourself approach needs to “rebalance” occasionally — perhaps annually — in order to maintain the desired percentage mix.

Balanced & Target Date Funds

There are single, all-in-one, “funds of funds” that are intended to be used as an investor’s whole portfolio. Vanguard funds in this category include the Target Retirement funds, the LifeStrategy funds.

All-in-one wins for simplicity and they are a good way to get started. Since a key goal is to keep you from tinkering with your portfolio, this deserves some serious consideration.

But, ultimately, with 3 or more funds you get these additional (albeit small) advantages:

- Improved tax efficiency for taxable investors by placing each fund in its best location (i.e. account type)

- Direct control over allocation percentages

- Independence from small management changes (as to the stocks and bonds included)

- Availability of slightly-lower-cost Admiral shares in the individual funds, but not the Target Retirement or LifeStrategy funds

- Additional surgical opportunities for tax loss harvesting -with three or more funds.

- There is no extra fund-of-fund fees at Vanguard, but some other firms do charge a fund acquisition fee.

- Unnecessary cost for the fixed-income portion.

Costs Matter

The last point is an important one for me. Larry Swedroe is a widely respected bond expert whose point-of-view is that portfolio should keep all the risk on the stocks side. The bond side should the highest quality safe investments, like FDIC-insured certificates of deposit, U.S. Treasury Bonds, and Treasury Inflation-Protected Securities (TIPS). It is easy to keep the cost of this portion of your portfolio either zero, or nearly zero.

To illustrate the problem, consider an all-in-one portfolio that might be 50% stocks and 50% bonds with a annual expense of ER=1% (high, but industry average). You could consider the stock side of that portfolio really costing 2% since you can purchase the high-quality investments independently at little to no cost. That would be a pretty high price to pay for the convenience of the fund doing the rebalancing.28

My advice? Don’t hesitate to get started. Inside your tax advantaged account you can always migrate from an all-in-one fund to something more efficient after you’ve made some progress towards your goal.

Step 9: Review plan and rebalance annually

All along I have emphasized that you can change your plan. Life happens! Goals change. Having a workable plan today gives you freedom to change your plans tomorrow. In business people call this scenario planning. The scenario you have in mind may not happen, but you’ll be prepared for something equally exciting.

Rebalance to control risk

Stocks usually outperform bonds. That’s because stocks are riskier and have higher expected returns. This growth changes your stocks/bonds ratio in the direction of more risky. To stay on your risk target you might need to occasionally re-balance. In this case, you would sell some of the stocks to buy more bonds. This is relatively easy because it feels like you are cashing some of your winners to buy more of something that is relatively stable.

Periodically stocks tumble and the value of you stocks/bonds is below your target. Again it’s simple. You sell some of your bonds to buy more stocks. If you don’t have a plan to remind you to do this, you emotions will get in the way. It might feel like throwing good money after bad. I believe your one-page plan will bolster your discipline.

A recession produces an opportunity to sell excess bonds to buy stocks when they are cheap. (That’s how you should think about it. It is emotionally difficult to buy stocks after they have suffered tremendously.)

One of the benefits of tax-advantaged retirement accounts is that you can rebalance within one of those accounts to avoid any tax consequences.

TIP: A great way to minimize the need to rebalance is to focus new money in whichever is below target.

The general idea is to rebalance when it exceeds your target by significant limits—say, when your target allocation is off by 5% or more.

Some people prefer to just make it part of an annual habit. Early January works for a lot of people because they are just beginning to pull their information for their taxes. You birthday would work just as well.

Automatic Investing

The secret to becoming a millionaire is powerfully simple: Make your financial plan automatic. This is one of those magical habits that works. You’ll thank yourself for doing this!

Rick Ferri perhaps echos what I think is the consensus view that the best chance of success comes from taking the thinking out of it:

Regarding your portfolio, make it simple, make it automated, and just let it do its thing. Don’t touch it. That’s the best financial advice I can give. Simplicity, automation, hibernation.29

Rick Ferri, author, from WCI podcast #109 on 6/6/2019

David Bach drives this home in a vivid way and his mantra:

Pay Yourself First!

David Bach, author Automatic Millionaire

David Bach has written many books that drive this point home: work the first hour of an 8 hour day for yourself and your personal goals and priorities. One hour equates to 1/8th of your time, or 12.5% of your pre-tax earnings. Start there. Start today. If you have any hesitation, run to the library and grab any of his books.

The best way to set up an automatic investment plan is to set up a payroll deduction to transfer the funds each pay period direct to your IRA account.

Alternatively, ask your employer to provide automatic direct deposit of your paycheck into your bank account. Then, virtually any brokerage that offers IRAs is equipped to handle the automatic investment for you.

Simply Google “Automatic investing Vanguard”, or where you choose, and follow their simple step-by-step instructions.

Decide accounting method for taxable accounts.

The first time you sell a fund from a taxable account, you must commit to an accounting method.

- Average (typically the default method)

- First In First Out (FIFO)

- Lot Method for taxable account (my recommendation!). This allows you to sell any specific lot that you purchased. Your brokerage will keep track of those purchases and you simply tag which ones you wish to sell. That give you maximum flexibility to minimize your taxes due this year by deferring more into the future.

Time for action!

Thanks for reading this long article. I truly hope it helps you

make your dreams come true.

Now it is time for action!

Will you have the future you want?

Or, the future that happens to you by default?

Notes:

1. John C. Bogle, The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Market Returns (Hoboken, N.J: John Wiley & Sons, 2007), pg. 51; John C. Bogle, The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns, 10th anniversary edition, updated & revised (Hoboken, NJ: Wiley, 2017), pg. 75.↩

2. “In the 25 Years Leading up to His 2007 Book, John Bogle Reports the Market Return Was 12.3%, the Average Fund Return 10.,” n.d.↩

3. Benjamin Graham and Jason Zweig, The Intelligent Investor: A Book of Practical Counsel, Rev. ed (New York: HarperBusiness Essentials, 2003), pg. xiii.↩

4. “The Four Pillars of Investing with Bill Bernstein, MD – Podcast #107,” The White Coat Investor – Investing & Personal Finance for Doctors, May 23, 2019, https://www.whitecoatinvestor.com/four-pillars-of-investing-bill-bernstein-md-podcast-107/.↩

5. James D. Turner, “The Most Important Thing About Investing,” The Physician Philosopher (blog), June 12, 2019, https://thephysicianphilosopher.com/2019/06/12/pyschology-of-investing/.↩

6. Turner.↩

7. Jonathan Clements and William J Bernstein, How to Think about Money, 2016, pg. 2.↩

8. “The Real Secret To Financial Success – The Physician Philosopher,” accessed July 8, 2019, https://thephysicianphilosopher.com/2018/09/24/contentment/.↩

9. ThePhysicianPhilosopher, “How To Teach Kids About Money: The Ultimate Guide,” The Physician Philosopher (blog), October 22, 2018, https://thephysicianphilosopher.com/2018/10/22/how-to-teach-kids-about-money/.↩

10. Ryan Guina, “Investment Policy Statement – How to Write a Rock-Solid IPS,” accessed July 5, 2019, https://cashmoneylife.com/write-investment-policy-statement/.↩

11. Clements and Bernstein, How to Think about Money, pg. 3.↩

12. Clements and Bernstein, pg. 101.↩

13. Clements and Bernstein, pg. 60.↩

14. William J Bernstein, If You Can: How Millennials Can Get Rich Slowly (Portland, Oregon: William J. Berstein, 2014), pg. 8.↩

15. “Trinity Study Update – Bogleheads,” accessed July 8, 2019, https://www.bogleheads.org/wiki/Trinity_study_update.↩

16. “Wait, What’s the Real Average Stock Market Return?,” Club Thrifty, August 10, 2016, https://clubthrifty.com/average-stock-market-return/.↩

17. Bernstein, If You Can.↩

18. David Bach and John David Mann, The Latte Factor: Why You Don’t Have to Be Rich to Live Rich (New York: Atria Books, 2019), pg. 29.↩

19. Bach and Mann, pg. 49-51.↩

20. Guina, “Investment Policy Statement – How to Write a Rock-Solid IPS.”↩

21. Bogle, The Little Book of Common Sense Investing, 2017, pg. 121.↩

22. “How to Think About Money with Jonathan Clements – Podcast #105,” The White Coat Investor – Investing & Personal Finance for Doctors, May 9, 2019, https://www.whitecoatinvestor.com/how-to-think-about-money-with-jonathan-clements-podcast-105/.↩

23. David F. Swensen, Unconventional Success: A Fundamental Approach to Personal Investment (New York: Free Press, 2005), pg. 345.↩

24. Swensen, pg. 171.↩

25. “401k Rollover: Roll Over a 401k to an IRA — Oblivious Investor,” accessed July 8, 2019, https://obliviousinvestor.com/should-i-rollover-my-401k-into-an-ira/.↩

26. LARRY. GROGAN SWEDROE KEVIN, Your Complete Guide to a Successful and Secure Retirement. (Place of publication not identified: HARRIMAN House Publishing, 2019), pg. 265.↩

27. Taylor Larimore, The Bogleheads’ Guide to the Three-Fund Portfolio: How a Simple Portfolio of Three Total Market Index Funds Outperforms Most Investors with Less Risk (Hoboken, New Jersey: John Wiley & Sons, Inc, 2018).↩

28. SWEDROE, Your Complete Guide to a Successful and Secure Retirement., pg. 115.↩

29. “Passive Investing and Financial Advisory Fees with Rick Ferri – Podcast #109,” The White Coat Investor – Investing & Personal Finance for Doctors, June 6, 2019, https://www.whitecoatinvestor.com/rick-ferri-podcast-109/.↩