You may also like: Buffett: ‘Gold is a speculative investment!’ (video)

Answer:

John Bogle urges you not to invest in gold because it is a speculative investment—a gamble that somebody will pay you more than you bought it for. “Gold is not an investment at all!” he says.

Warren Buffett doesn’t believe gold is a good investment because it is a non-productive asset. It doesn’t do anything, other than shine. When you invest in stocks you invest in companies striving to create value for their customers, and in the process create some profit for themselves.

People that are sold the idea that gold is the ultimate safe investment (and a hedge against inflation?) are overlooking Treasury Bonds and FDIC-insured CDs as the safest investment of all because they are backed by the full faith and credit of the United States government.

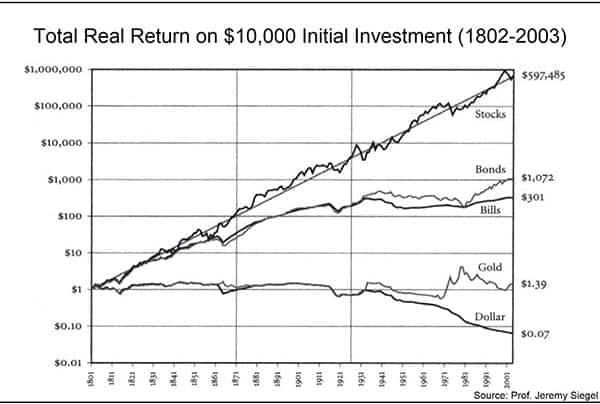

Over the arc of time (more than a century!), gold has done poorly as an investment. I’ve included this chart to illustrate that a productive assets (stocks) run circles around non-productive assets (gold). An astute investor will look at this chart and wonder why the y shouldn’t always be 100% invested in equities (stocks). One answer is that stocks are too risky.

My best advice is to learn the basics about how bonds work. Learn why short-term bonds are less risky than long-term bonds. Learn to choose bonds that have duration (a financial term) longer than when you’ll need that money. My book describes how to build an all-weather portfolio including CDs, Bonds, and Bond Funds—even during low and rising interest rates.

When you invest in bonds you are loaning your money for an agreed rate of return, so here too the bond issuer is working to create value so as to pay these interest payments.

People are also sold gold as a “hedge against inflation”, but there is little evidence that the value of gold will increase with inflation. It turns out that stocks and, of course, TIPS are better for inflation protection. If people lose faith in other assets, they turn to gold. Whether or not this is rational is controversial at the very least.

If you are interested in alternatives, a good book I remember is Larry Swedroe’s book The Only Guide to Alternative Investments You’ll Ever Need: The Good, the Flawed, the Bad, and the Ugly.