Stay the course — meaning, continue doing something until it is finished or until you achieve something you have planned to do. This is also a famous John Bogle mantra because so many investors make terrible decisions based on emotions. Stick to your plan! Invest for the long-term. These videos help you stay the course because it’s easier to block out the noise once you realize there is time-proven wisdom and places to learn more—without being subjected to somebody trying to sell you something. This is the last of the Ten Rules of Investing For Beginners.

Next steps:

- Watch next video in this series: The ABCs of Common Sense Investing

- Download cheat sheet Ten Simple Rules to Common Sense Investing,

a printable 1-page PDF summarizes Boglehead Investing. - Take a free course: Common Sense Investing,

or Where Should I Put Money?

Read the transcript for Stay The Course

Here’s where it gets difficult for most of us — in fact, very difficult. Author Mike Piper deftly summarizes our predicament as follows.(1)

Intuitively, we understand the importance of sticking to our plan. Yet “we’re constantly receiving conflicting messages about how to be successful investors. For example, the mutual fund industry tells us that:

• Professionals have the best chance of picking stocks that will outperform, and

• A mutual fund that has outperformed the market in the past is likely to outperform the market in the future.

“At the same time, the discount brokerage firms are telling us that:

• Picking stocks on your own is easy! And,

• with up-to-the-minute information, you can time the market successfully.

“Meanwhile, the mainstream financial media is bombarding us with a third group of messages:

• Like: you can improve your performance by picking hot funds (particularly, those mentioned in their show or magazine), and

• If you watch the news enough and listen to enough economists/market analysts, you have a good chance of predicting the next market move.

“So whom should we believe? Each of those sources seems like they should know what they’re talking about.

“The reality is that the primary goal of each of those parties is not to provide us with quality information, but rather to persuade us to consume their products (just like any other business). So we must tune them out and turn instead to unbiased sources of information (like academic studies). When we do, we encounter a few findings that have been confirmed time and again:

• Within each category of mutual funds, expenses are the best predictor of future performance.(2)

• Any investor–even a full-time professional–is unlikely to be able to reliably outperform the market.(3)

• and, Reliably predicting short-term market moves is impossible.(4)

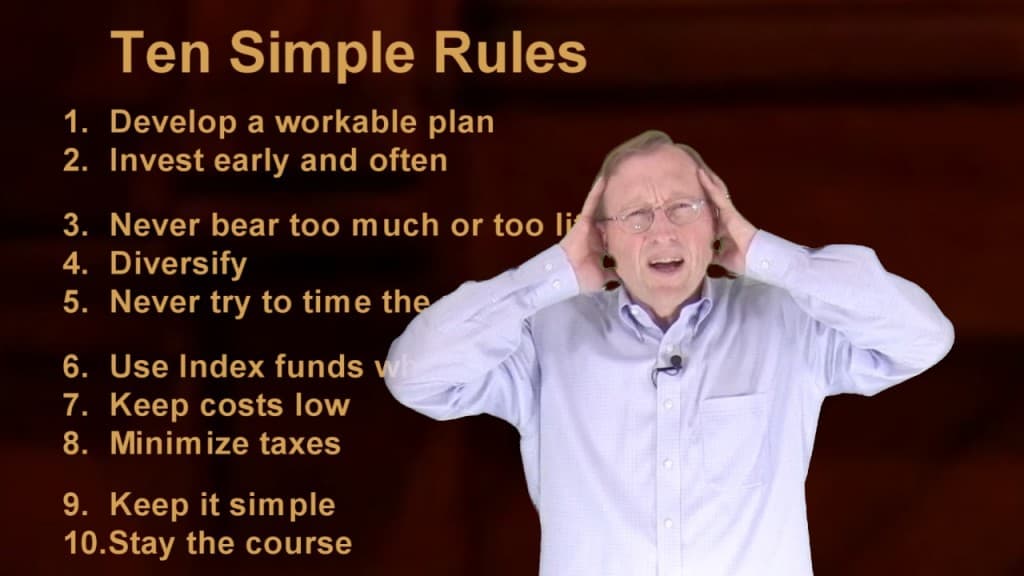

And those facts lead us to this simple common-sense investment strategy:

1. Develop a workable plan

2. Start saving now, not later. Time is your friend when you use the wondrous growth power of compound interest.

3. Own the appropriate amount of bonds. It is the ratio of stocks to bonds that controls your risk. This is far more important than which specific funds you choose.

4. Diversify, and hold on to your investments for as long as you possibly can before selling them.

5. Never try to time the market.

6. Use index funds when possible.

7. Keep all costs low, not just sales costs, but the recurring expense ratio, and hidden tax consequences.

8. Taxes are a very big cost that you can minimize, or defer.

9. Keep it simple.

10. And hardest of all: Stick To Your Plan!

“Stay the course” means that once you’ve chosen your portfolio, only sell to rebalance and maintain your risk level. Never sell based on greed or fear.

Imagine that you wake up tomorrow morning and the stock market is down 50% due to some huge global problem, like a nuclear war in the middle east, what will you do? If the answer is “sell” when it is down 50% then you have too much in stocks. You are carrying too much risk.

A written Investment Policy Statement helps you rebalance in a market drop. Everyone is different. Not everyone can be cool in the line of fire. But knowing your limitations ahead of time and being able to admit them and select an appropriate level of risk and a plan that you can stick with is a wonderful pursuit of self knowledge.(5)

You can do this! Now when you get a question, and you will, you can turn to the Boglehead wiki. The Bogleheads have endearingly named themselves after John C. Bogle, the great champion of common sense investing. You can look him up. Or, you can find answers to common questions, or books that are worth reading. And if you can’t find your answer you can always anonymously ask the Bogleheads discussion board — a group of friendly people that are amazingly generous with helpful feedback (to people with genuine questions).

Tune out the noise. Stick to these ten simple guidelines. Investing is just a small piece of fully living your life, but it’s an important piece. It enables you to reach some of your most valued dreams.

Find other explanatory videos, smart tips, and links to useful resources at FinancingLife.org.

Related articles:

- Must-read guide: Smart Investing for Beginners

- Video overview of Intro: Ten Rules of Investing for Beginners

- Step 1: Develop a workable plan.

- Step 2: Start saving early.

- Step 3: Choose appropriate investment risk.

- Video overview of Step 4: Diversify.

- Video overview of Step 5: Never try to time the market.

- Video overview of Step 6: Use index funds when possible.

- Video overview of Step 7: Keep costs low.

- Video overview of Step 8: Maximize after-tax returns.

- Video overview of Step 9: Keep it simple.

- Video overview of Step 10: Stay the course.

- Video overview of The ABCs of Common Sense Investing

- Must-read guide: How To Build An All Weather Portfolio With Stocks and Bonds

- Courses at: FinancingLife Academy

Footnotes and Video Production Credits for Rule #10: Stay The Course

(1) Excerpts from chapter 12 (pp. 98-100) of

Investing Made Simple by Mike Piper, and used with permission.

(2) See video and transcript for Rule#7: Keep Costs Low.

(3) See video and transcript for Rule #6: Use Index Funds When Possible.

(4) See video and transcript for Rule#5: Never try to time the market.

(5) Also inspired by a well-worded posting by jidina80 on the bogleheads.org forum.

The opening/closing music “Because” is by David Modica from his Stillness and Movement album, published and licensed by www.Magnatune.com.

Small excerpts from the following television commercials, shows and web sites: Merrill Lynch, Fidelity, eTrade, ScottTrade, Jim Cramer on MadMoney, CNBC, and AMAproduction.

Keyboard sounds from Bjornredtail under a Creative Commons Sampling Plus 1.0 License.

Mouse click sounds from Nirmatara under a Creative Commons Sampling Plus 1.0 License.

The closing photo “Trees in the Fog” is by Yann Richard under the terms of the Creative Commons BY 2.5 license.

This video may be freely shared under the terms of this Creative Commons License BY-NC-SA 3.0.

Video copyright 2009-2019 Rick Van Ness. Some rights reserved.

————————————————————————–

What’s your learning style? Would you prefer a book?

- to learn at your own pace?

- to mark with notes?

- to use as reference?

- to give as a gift?

- or, even just to support this non-profit educational website (thanks!)

Take a closer look at the paperback book.